Canada cut immigration and rents fell

The solution to Australia’s rental crisis is being played out in real time in Canada.

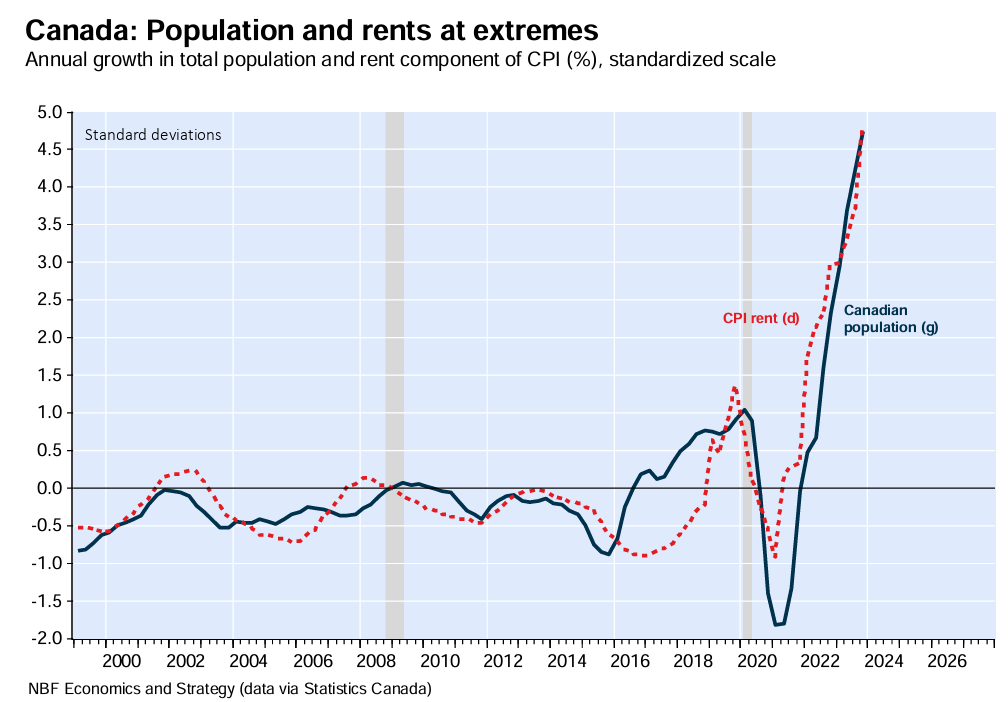

Rents in Canada soared to a record high in response to the country’s largest immigration influx in history.

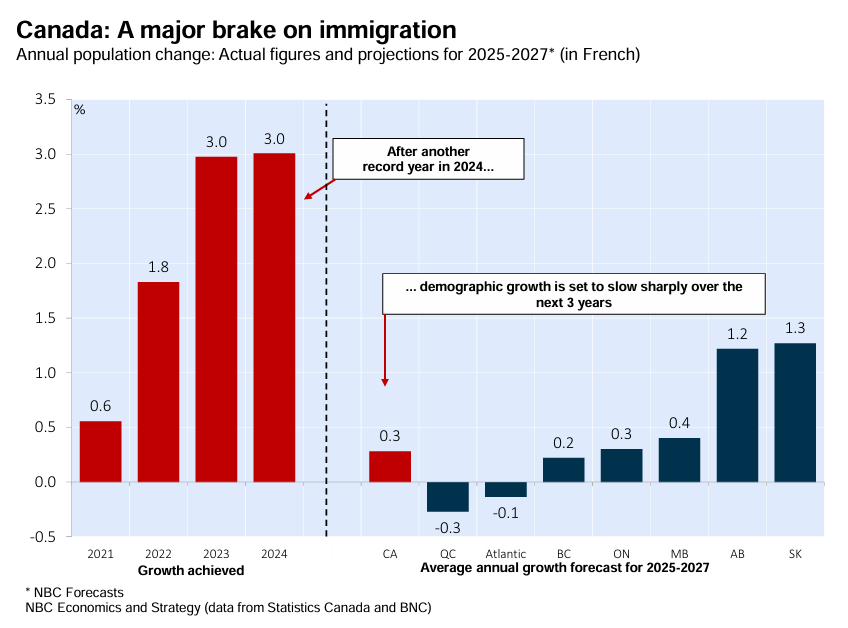

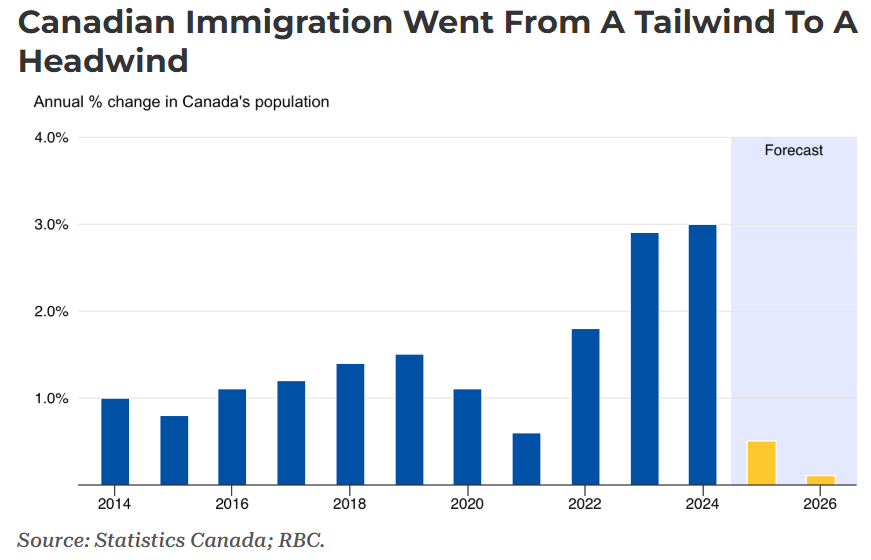

Last year, the Canadian government imposed a three-year pause on population growth to relieve the strains on housing and infrastructure.

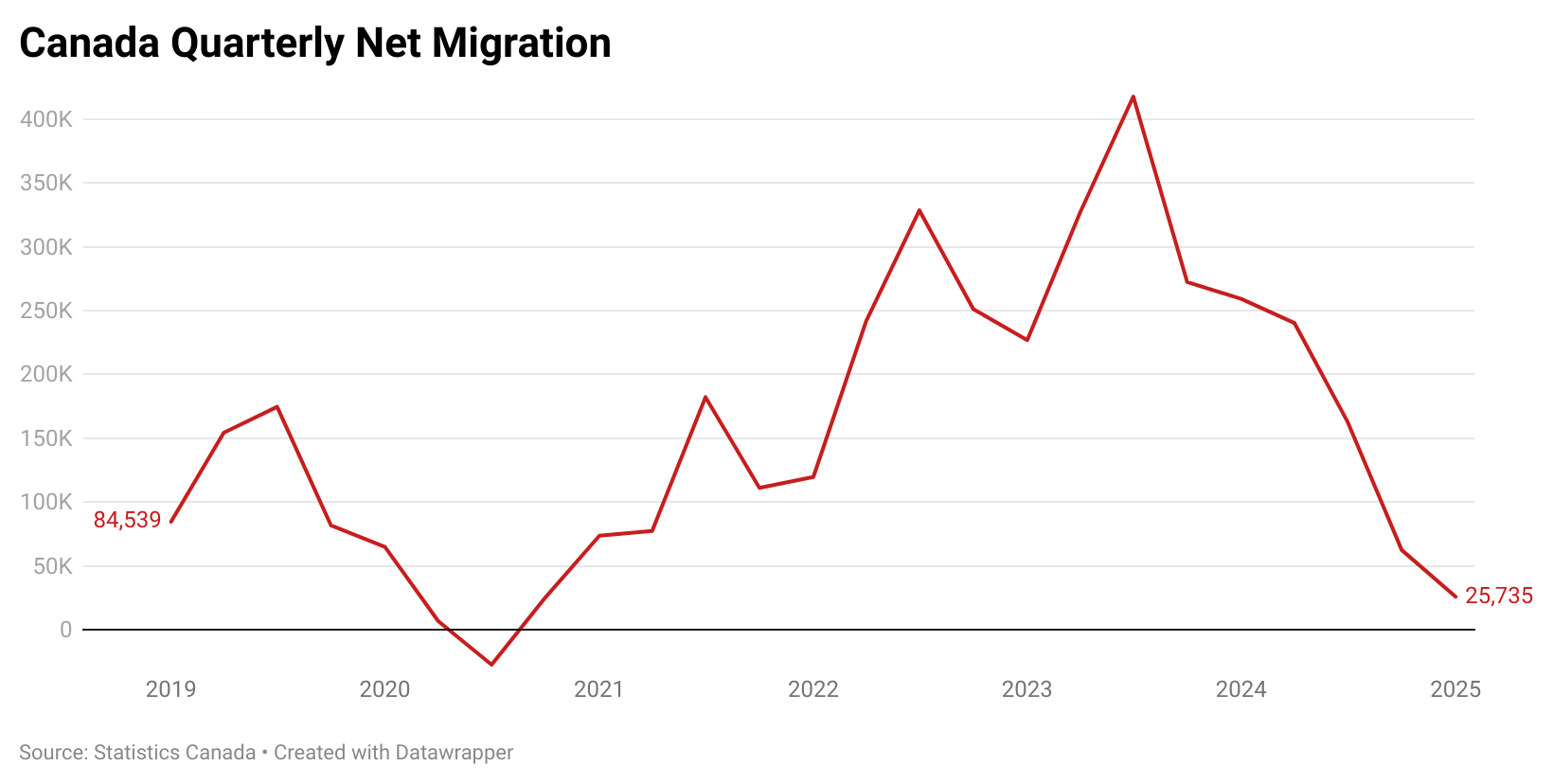

In the March quarter of 2025, almost 210,000 temporary migrants left Canada or transitioned to permanent residency, demonstrating the effectiveness of the plan.

Canada’s net migration has decreased by more than 90% from its peak in 2023. Net migration has plummeted by more than two-thirds since its final pre-pandemic reading in the same quarter.

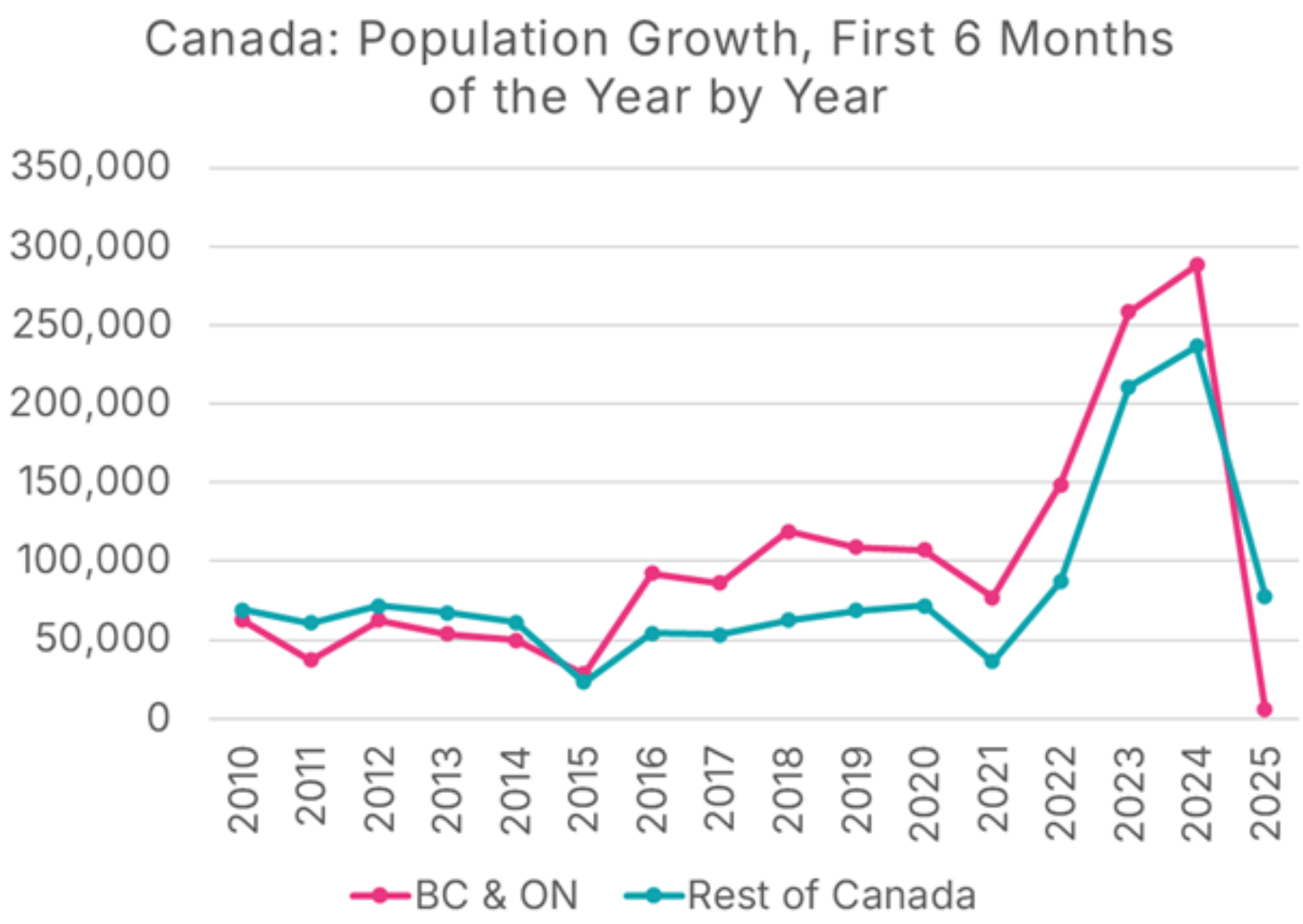

British Columbia, home to Vancouver, and Ontario, home to Toronto, have led the decline in Canadian population growth, as illustrated below.

The sharp decline in immigration and population growth has driven rents down across Canada.

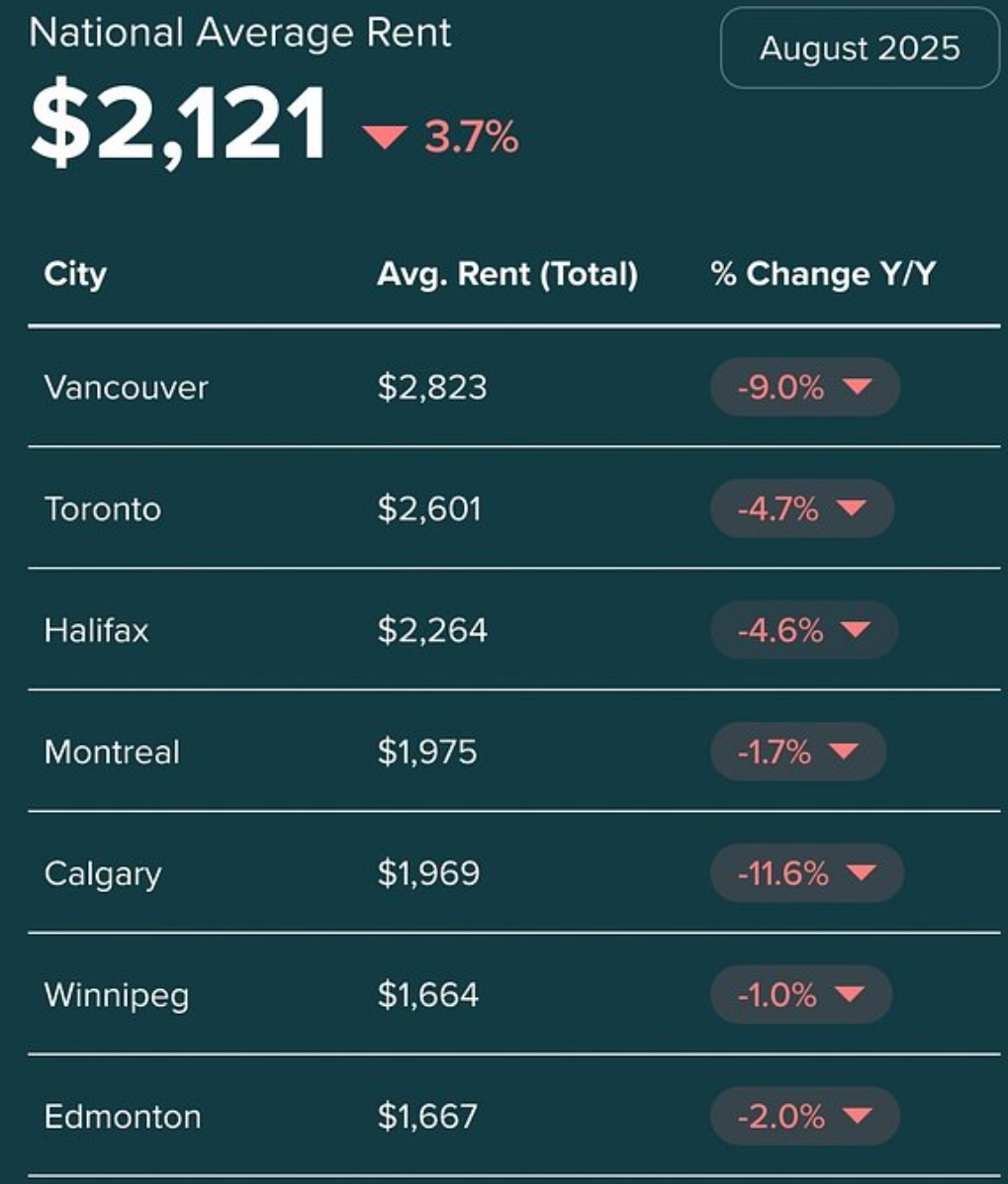

The latest National Rent Report from Rentals.ca and Urbanation shows that asking rents in Canada fell for 11th consecutive month in August, led by Vancouver and Toronto:

Source: Rentals.ca and Urbanation

Canada’s largest bank BMO also stated last month that rents should continue to fall as “stricter immigration targets continue to slow population growth and limit new household formations”.

BMO also noted separately that immigration has transformed from a tailwind to headwind for the housing market.

The key takeaway for Australian policymakers is that if they genuinely want to ‘solve’ the rental crisis, they should emulate Canada and slash immigration levels.

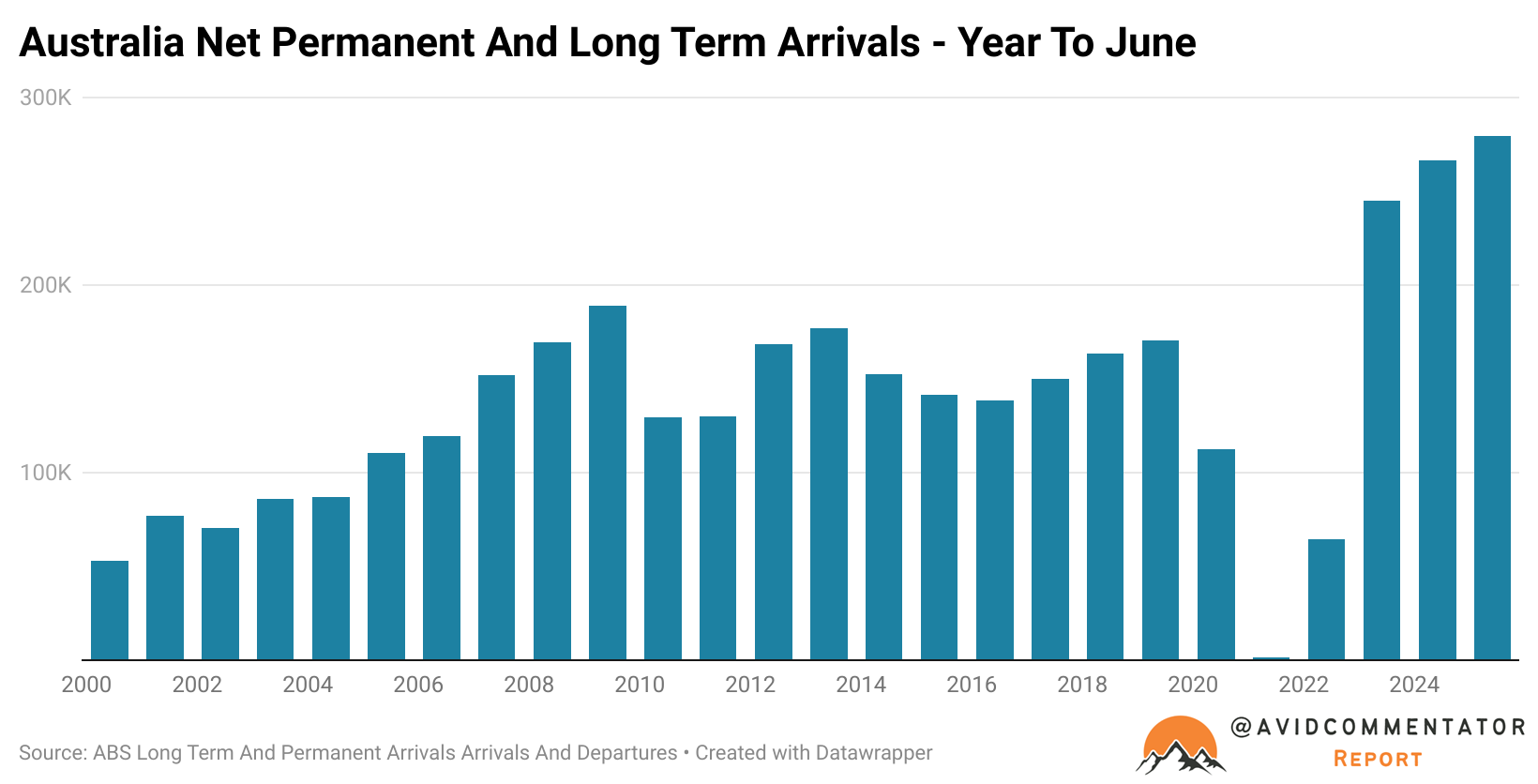

Unfortunately, Australia has taken the opposite approach, maintaining the throttle on immigration.

The Albanese government recently increased the international student planning level by 25,000 for 2026 and eased some English-language requirements.

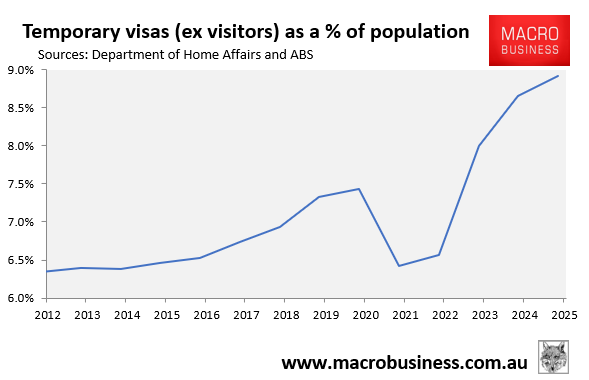

As a result, Australia’s international student and temporary visa numbers, which are already the highest in the advanced world relative to its population, will undoubtedly rise.

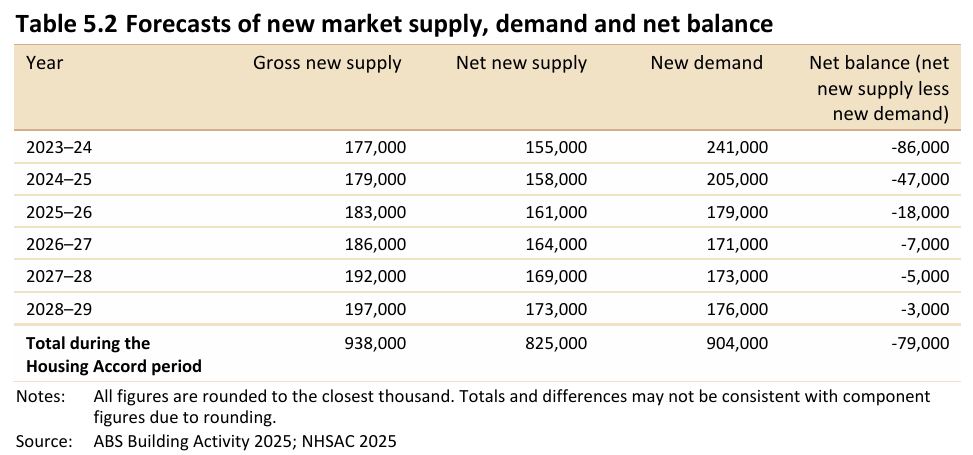

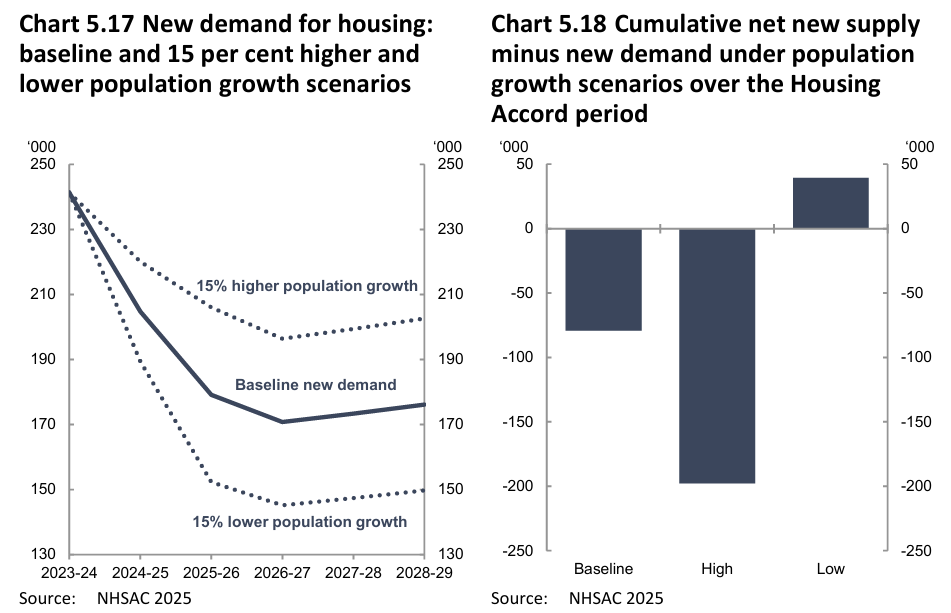

Australia’s rental crisis will also worsen as population demand continues to outstrip supply. This point was explicitly made by the National Housing Supply and Affordability Council (NHSAC), which forecast that new net housing supply will remain below population demand over the five years to 2028–29, resulting in an additional cumulative undersupply of 79,000 homes.

NHSAC warned that ongoing strong population growth relative to supply will push up rents and lead to more homelessness and overcrowding.

“The excess of new demand relative to new supply over the Housing Accord period will worsen the existing undersupply of housing in the system and add to affordability pressures”, NHSAC said.

“Rental housing will remain scarce for households across the income spectrum as the vacancy rate remains below its historic average”.

“A lowered vacancy rate will absorb some of the unmet demand, and some will add to the homeless population. Some may be absorbed by suboptimal types of shelter not captured by traditional measures of the housing stock, such as caravan parks, hotels and emergency shelters. Most will be absorbed by households not forming that otherwise would have, resulting in larger households and more instances of overcrowding”, NHSAC warned.

However, NSAC’s sensitivity analysis projected a surplus of 40,000 homes after five years if population growth is just 15% less than forecast.

The solution to Australia’s housing crisis is staring policymakers in the face: follow Canada’s lead and significantly cut immigration.