Cotality has released alarming data showing that Australia’s rental market is tightening fast.

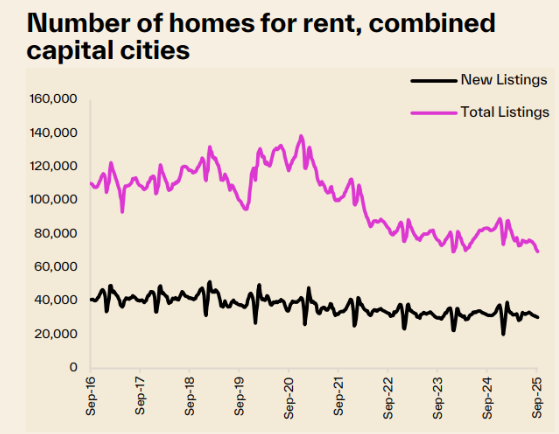

The following chart from Cotality shows that the total number of rental listings has fallen back to a historic low across the combined capital cities, tracking at about half the level of the early pandemic peak:

Source: Cotality

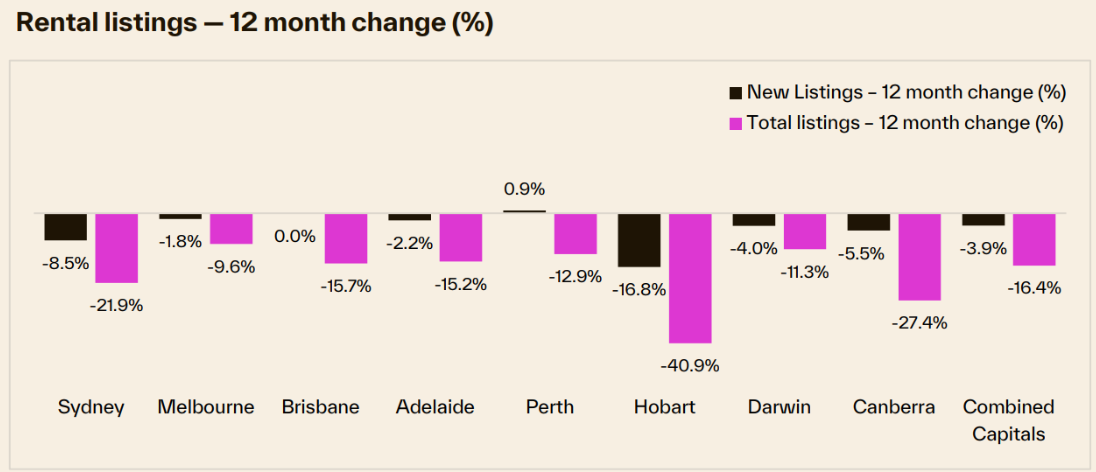

The following chart from Cotality shows that the total number of listings has fallen by 16.4% over the past year across the combined capital cities, with all markets tightening:

Source: Cotality

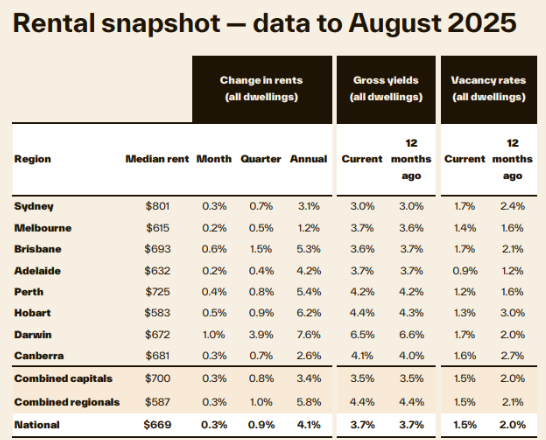

The decline in listings matches the corresponding fall in vacancy rates, which tightened to an equal record low of 1.5% in August across the combined capital cities, down from 2.0% at the same time in 2024.

Source: Cotality

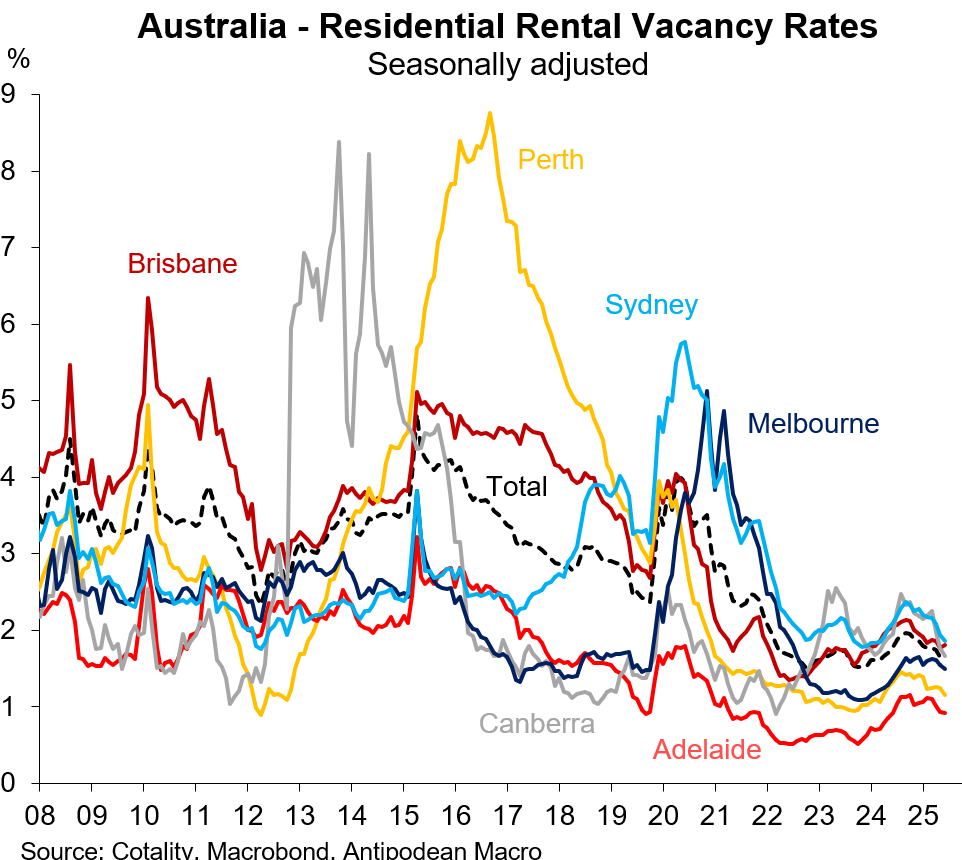

The following chart from Justin Fabo from Antipodean Macro plots Cotality’s rental vacancy rates as a time series and shows the re-tightening experienced this year.

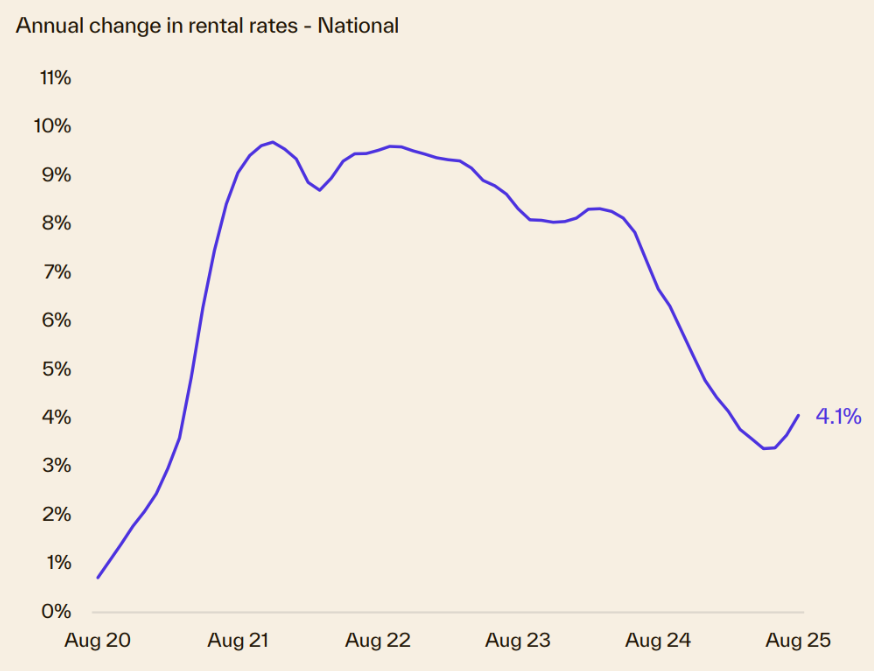

Meanwhile, Cotality has recorded a resurgence of rental growth, with the annual rate of growth in national rents ticking higher for the second consecutive month in August, with rents up 4.1% over the year.

Source: Cotality

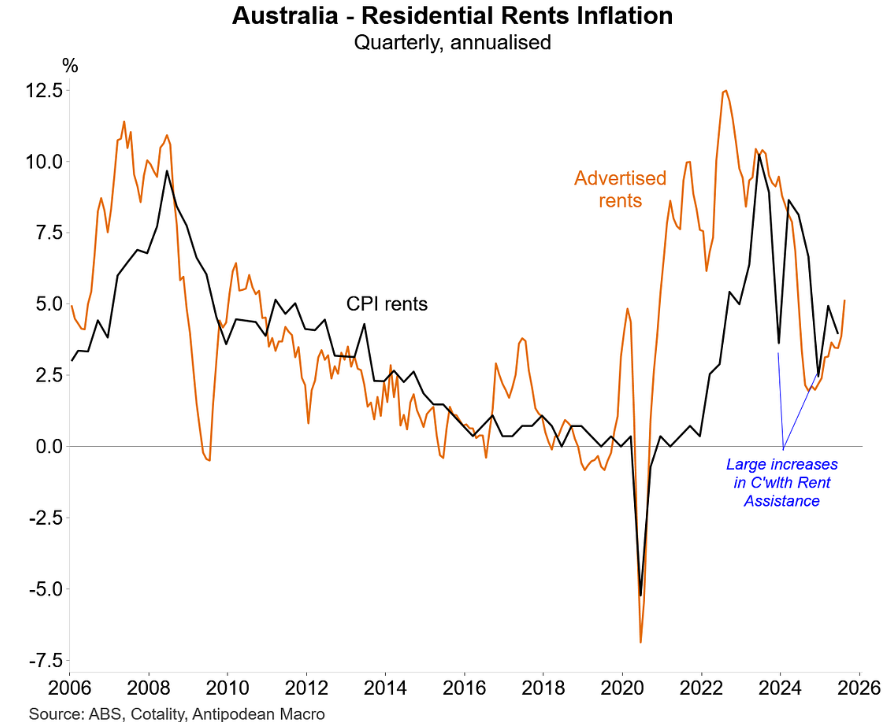

The following chhart from Justin Fabo, which tracks rental growth on a quarterly basis, shows a marked uptick:

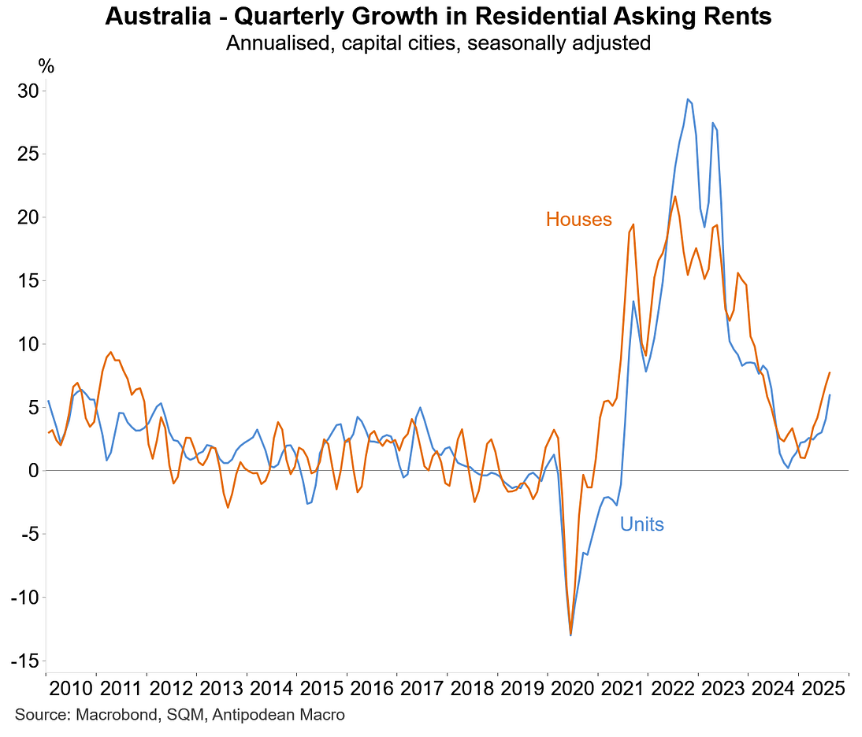

SQM Research’s rental series shows a similar tightening of rental vacancies alongside a marked pick-up in rental growth:

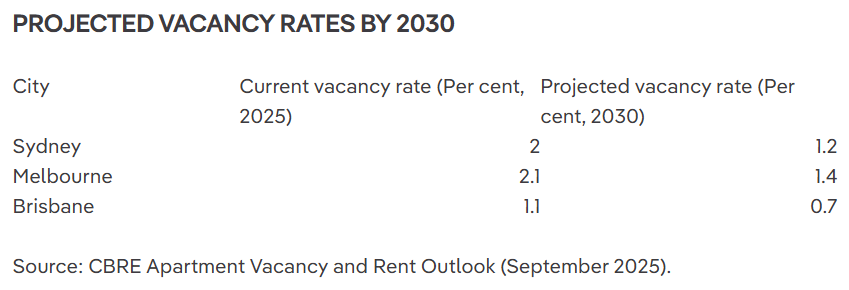

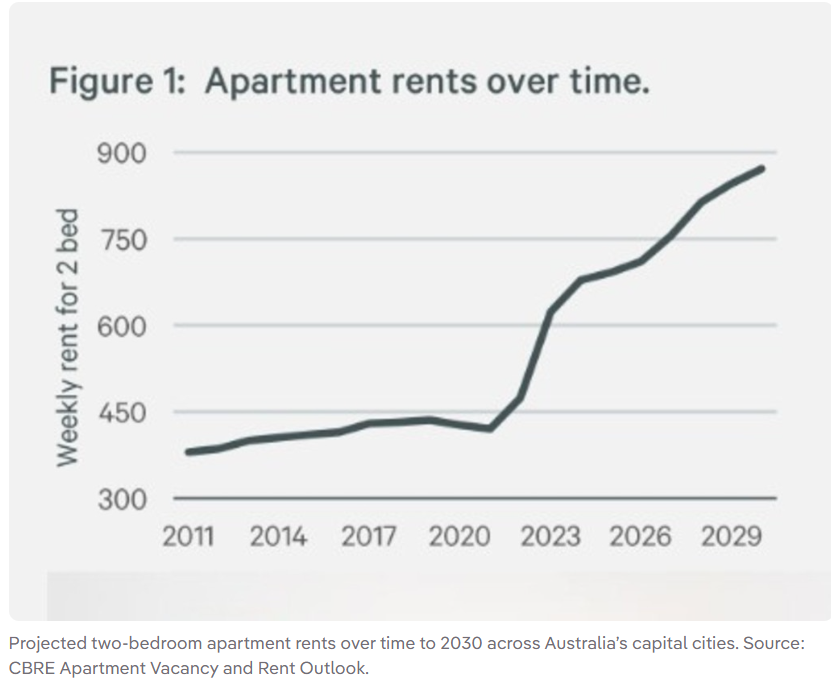

CBRE’s latest Apartment Vacancy and Rent Outlook, which was released last week, forecasts that population demand will exceed supply over the next five years.

As a result, the national capital city vacancy rate is forecast by CBRE to fall to a record low 1.1% by 2030, down from 1.8% in 2025.

Apartment rents are also projected by CBRE to soar over the next five years:

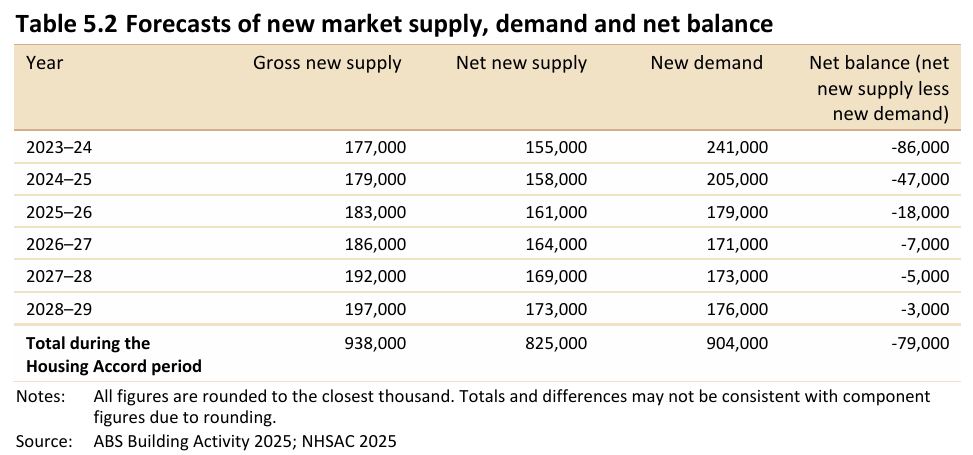

CBRE’s forecasts of a worsening rental crisis are similar to those of the National Housing Supply and Affordability Council (NHSAC), which forecasts that new housing supply will remain below population demand over the five years to 2028–29, resulting in an additional cumulative undersupply of 79,000 homes.

NHSAC warned that ongoing strong immigration relative to supply will place upward pressure on rents and result in more homelessness and overcrowding.

Overall, the data paints a grim picture for Australian renters who face tightening conditions as immigration demand continues to overwhelm supply.