Belinda Allen, CBA’s Head of Australian Economics, believes that the probability of further rate cuts has slimmed amid stronger domestic economic data and stubborn inflationary pressures.

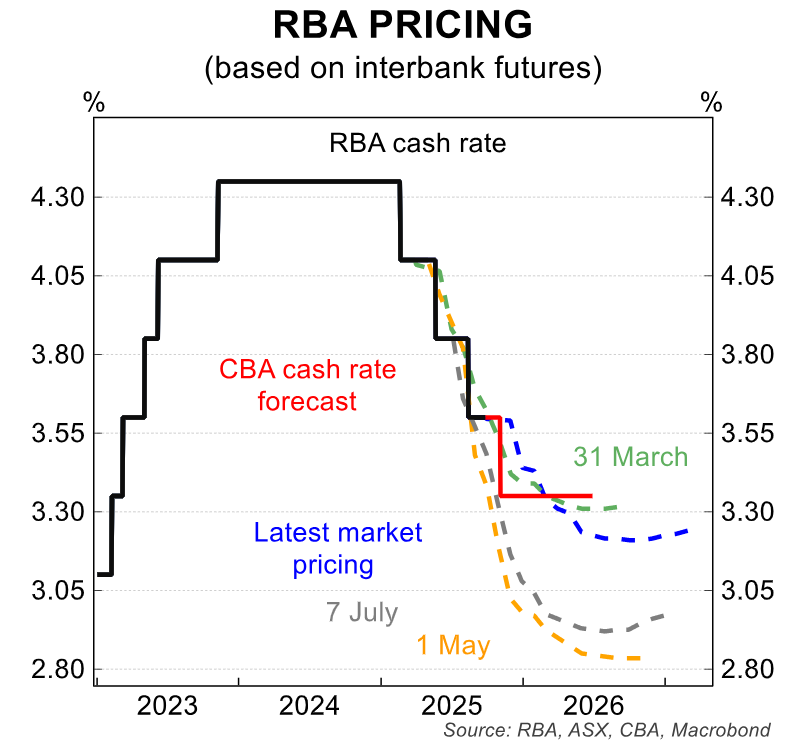

Markets are effectively pricing no chance of a cut in September following the stronger August CPI indicator. November market pricing has also shifted from a 70% probability to around 50%.

Allen argues that “the flow of data since the August meeting has affirmed a cyclical upswing is underway in the economy”.

This upswing was acknowledged on Monday by RBA governor Michele Bullock, who told the House of Representatives Standing Committee on Economics that “since the August meeting, domestic data have been broadly in line with our expectations, or, if anything, slightly stronger”.

This followed Bullock’s comments earlier in the month where she noted that private sector growth is “a little stronger than we thought it would be” and that “if it keeps going, then there may not be many interest rate declines left to come”.

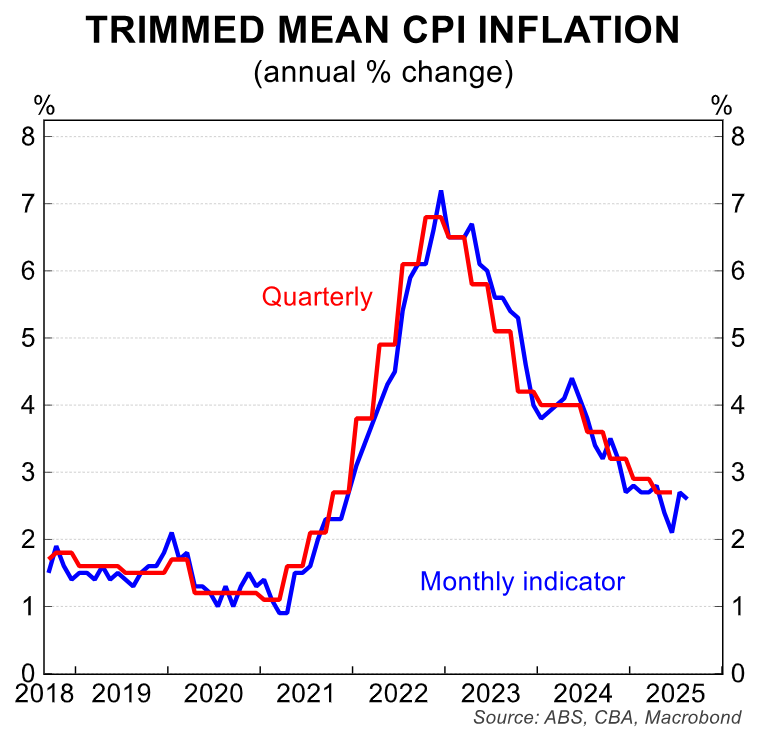

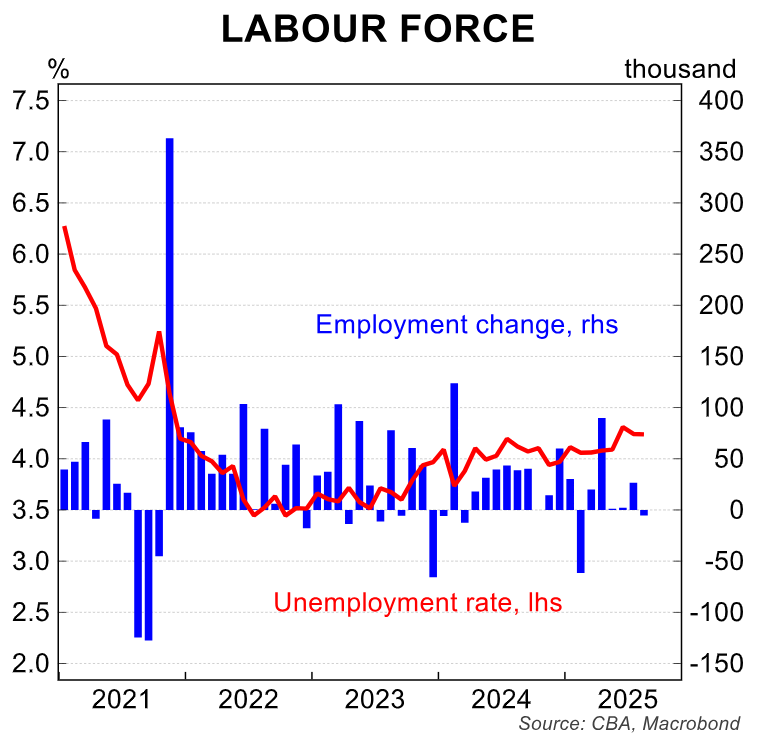

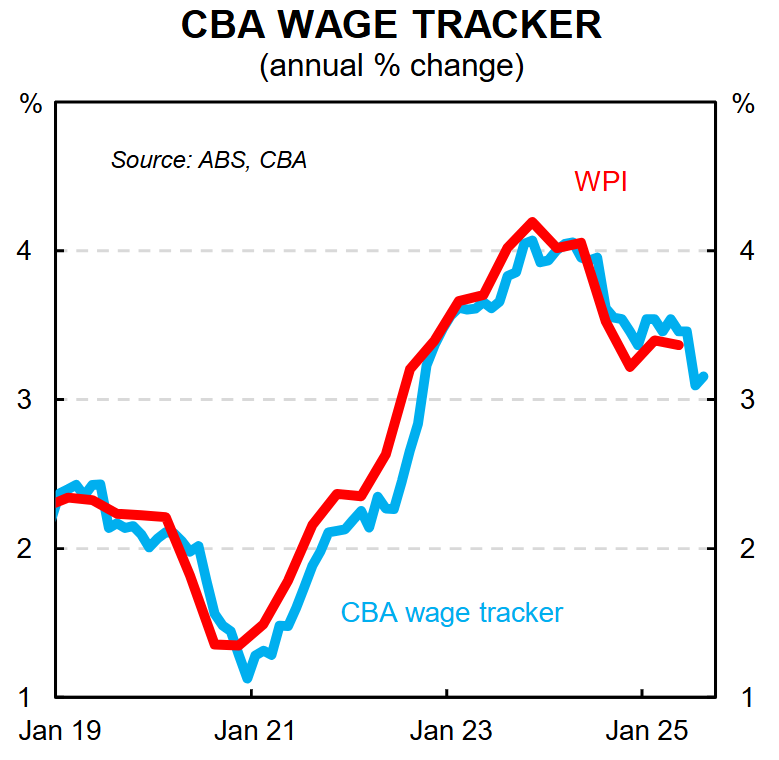

However, “there is real tension building in the data flow”, argues Allen. “The August CPI indicates material upside risks to Q3 inflation, a cyclical upswing in the activity data is also clear but there are signs of softer employment and moderating wages growth”, Allen says.

“Softness in employment growth has become a feature. The last three months has seen employment gains of 23k, compared to 111k the prior three months. The unemployment rate though has held steady at ~4.2%”.

“Our CBA wages tracker also shows a clear moderation in wages growth. The tension between the RBA’s two goals of inflation and full employment could escalate if the monthly CPI gives us the right steer for the quarterly print”, Allen argues.

In light of the data, CBA has forecast only one further 0.25% rate cut in November and a terminal cash rate of 3.35%.

However, the timing of the next rate cut will hinge on the outcome of the Q3 CPI, which the RBA forecast will print at 0.6% for the trimmed mean for the quarter.

“A 0.7%/qtr outcome would see annual trimmed mean inflation sit at 2.6% and should see the RBA cut the cash rate”, Allen argues. “A 0.8%/qtr outcome would see the annual rate of trimmed mean CPI remain unchanged at 2.7% and would make the November decision also dependent on the other flow of data, but would very much be a line ball decision”.

“A 0.9%/qtr outcome would see the annual trimmed mean rate of inflation lift to 2.8% and would be expected to see the RBA leave the cash rate on hold”.

This uncertainty is why the market has ascribed only a 50% probability of a rate cut in November.