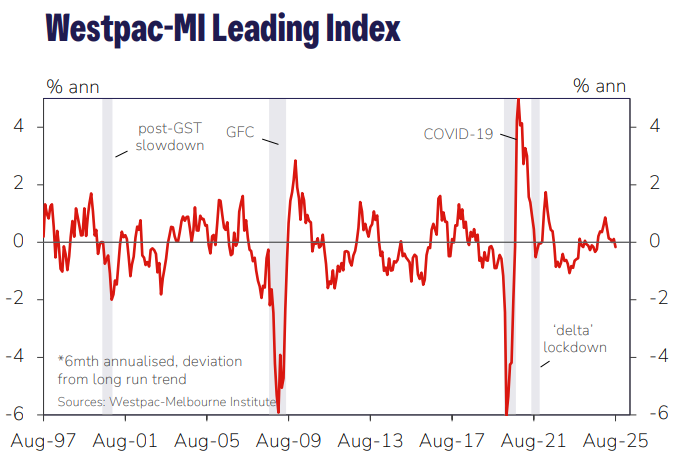

After this month’s stronger-than-expected June quarter national accounts release, which saw the economy grow by 0.6% over the quarter (faster than consensus and the RBA’s forecasts), Westpac’s leading index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, has stalled.

The six-month annualised growth rate in the Westpac–Melbourne Institute Leading Index dropped back to –0.16% in August from +0.11% in July.

It was the first below-trend reading since September 2024, suggesting that momentum is proving hard to sustain.

“While the weakness is not overly concerning it marks a clear softening from the above-trend momentum that was evident earlier in the year”, Westpac Head of Australian Macro-Forecasting, Matthew Hassan, wrote.

“The pattern is broadly consistent with the economy slowing again after a relatively firm performance in the June quarter. Westpac expects the Australian economy to grow by 1.9% this year, an improvement on the 1.3% gain in 2024 but still slightly below trend. Growth is expected to return to a trend pace in 2026”.

Hassan notes that nearly all components have contributed to moderation over last six months, namely:

- the Westpac–Melbourne Institute Consumer Unemployment Expectations Index (contributing –0.34ppts to the weakening)

- commodity prices, measured in AUD terms (–0.25ppts)

- the Westpac–Melbourne Institute Consumer Expectations Index (–0.22ppts)

- dwelling approvals (–0.19ppts).

The only improved contribution since February has come from the 10% rally in the S&P/ASX200.

Unlike CBA, Westpac is tipping a further three RBA rate cuts—one in November followed by two next year.

“Westpac expects the dataflow to gradually confirm that temporary one-off factors have been at play with underlying trends still consistent with benign inflation and slow growth in demand”, Hassan wrote.

“Indeed, the latest Leading Index update is already pointing to sluggish growth momentum across the wider economy”.