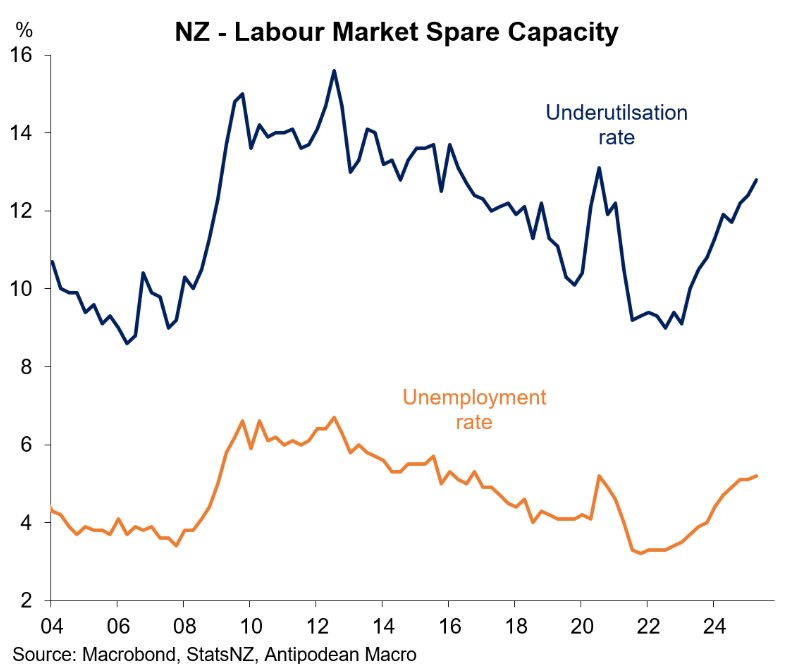

The latest official labour force survey showed that New Zealand’s unemployment rate lifted to 5.2% in Q2 2025, the highest rate since Q4 2016.

New Zealand’s underutilisation rate, which combines unemployment and underemployment, also surged, indicating a significant surplus capacity in the labour market.

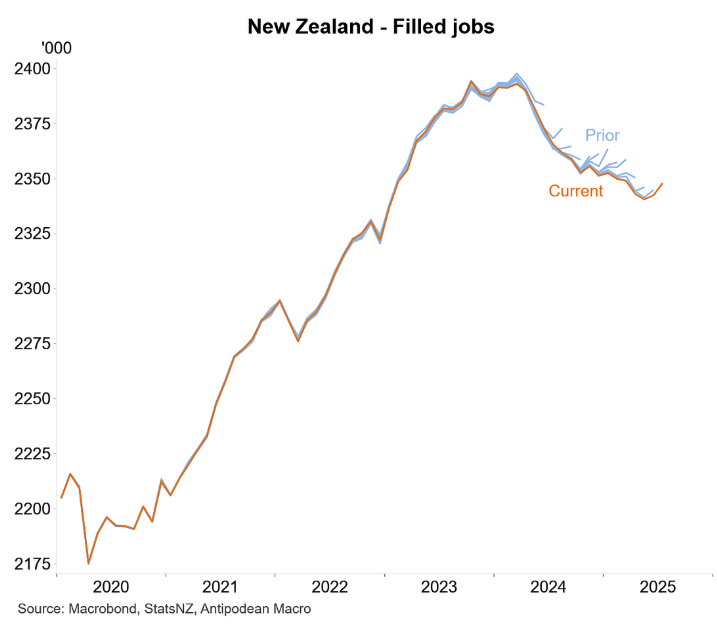

On Thursday, Statistics New Zealand released its filled jobs survey, which rose by 0.2% in July, stronger than expected.

However, as illustrated below by Justin Fabo from Antipodean Macro, prior outcomes continue to be revised down:

Employment was down 0.2% in the three months to July, with the level of employment also down 0.7% annually.

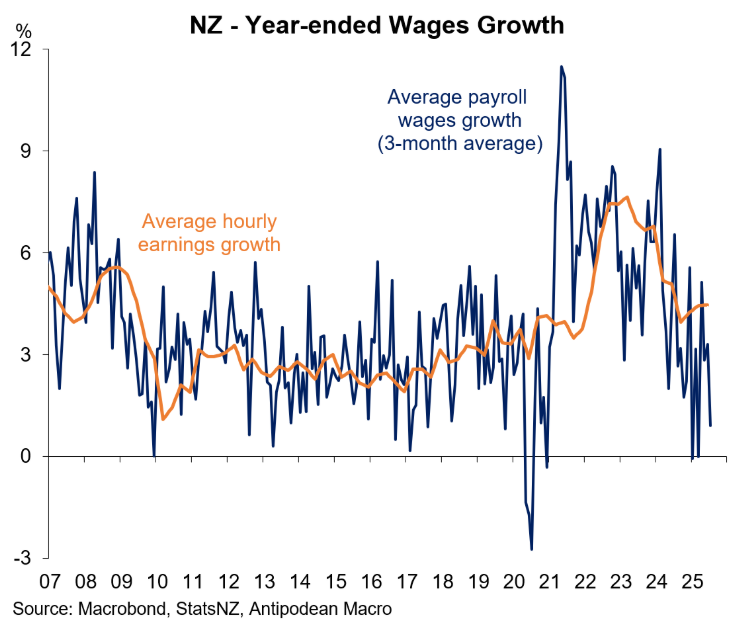

Wage growth in New Zealand has also collapsed, reflecting the surplus of jobs:

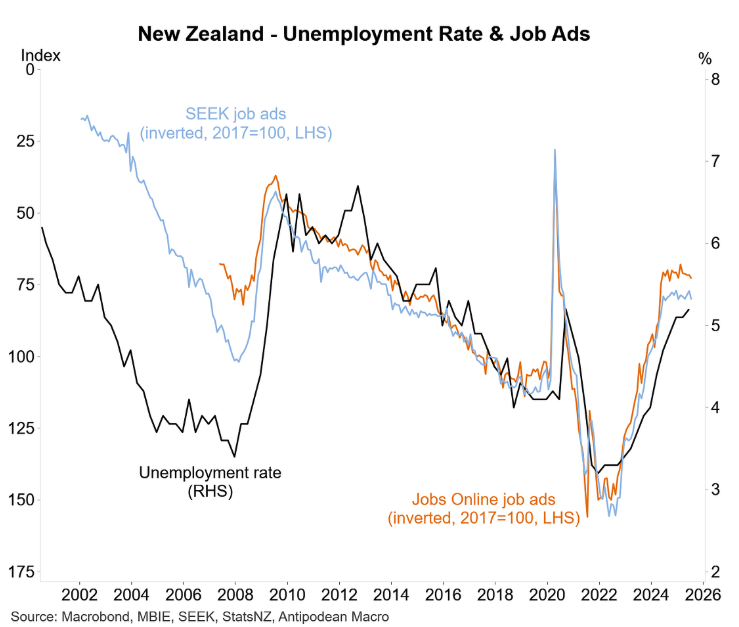

Meanwhile, job ads have fallen sharply from their post-pandemic peak but have stabilised in recent months:

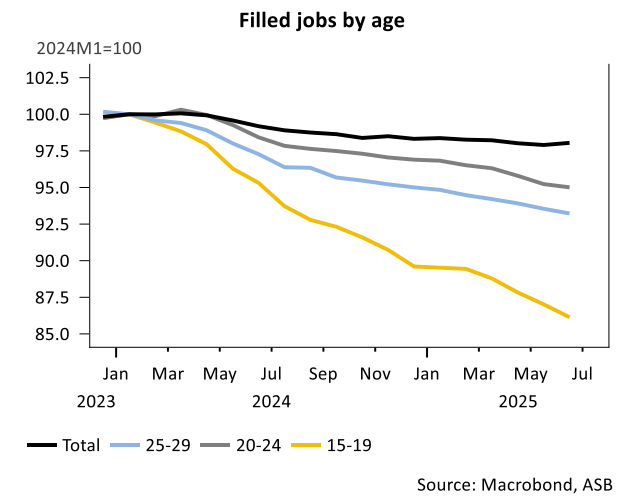

As illustrated below by major bank ASB, New Zealand’s youth continue to bear the brunt of job losses.

Heavy annual falls were still evident for the 15-19 age bracket (-8.5% annually), with hiring down 3.2% annually for those aged 20-24 and down 3.4% annually for the 25-29 age group.

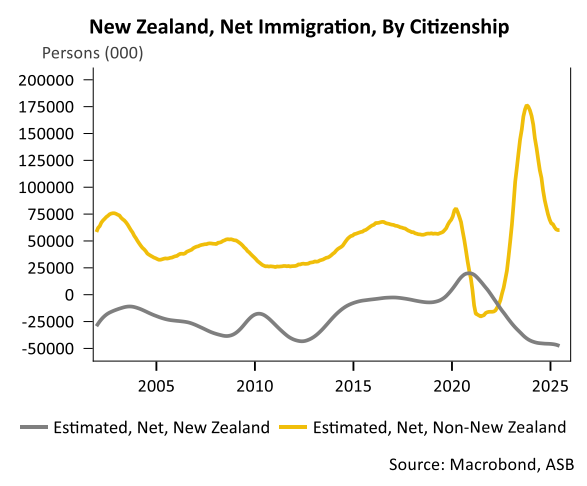

Young Kiwis are contending with soggy labour demand from employers at the same time as large numbers of mostly young migrants continue to flood into New Zealand, led by arrivals from India:

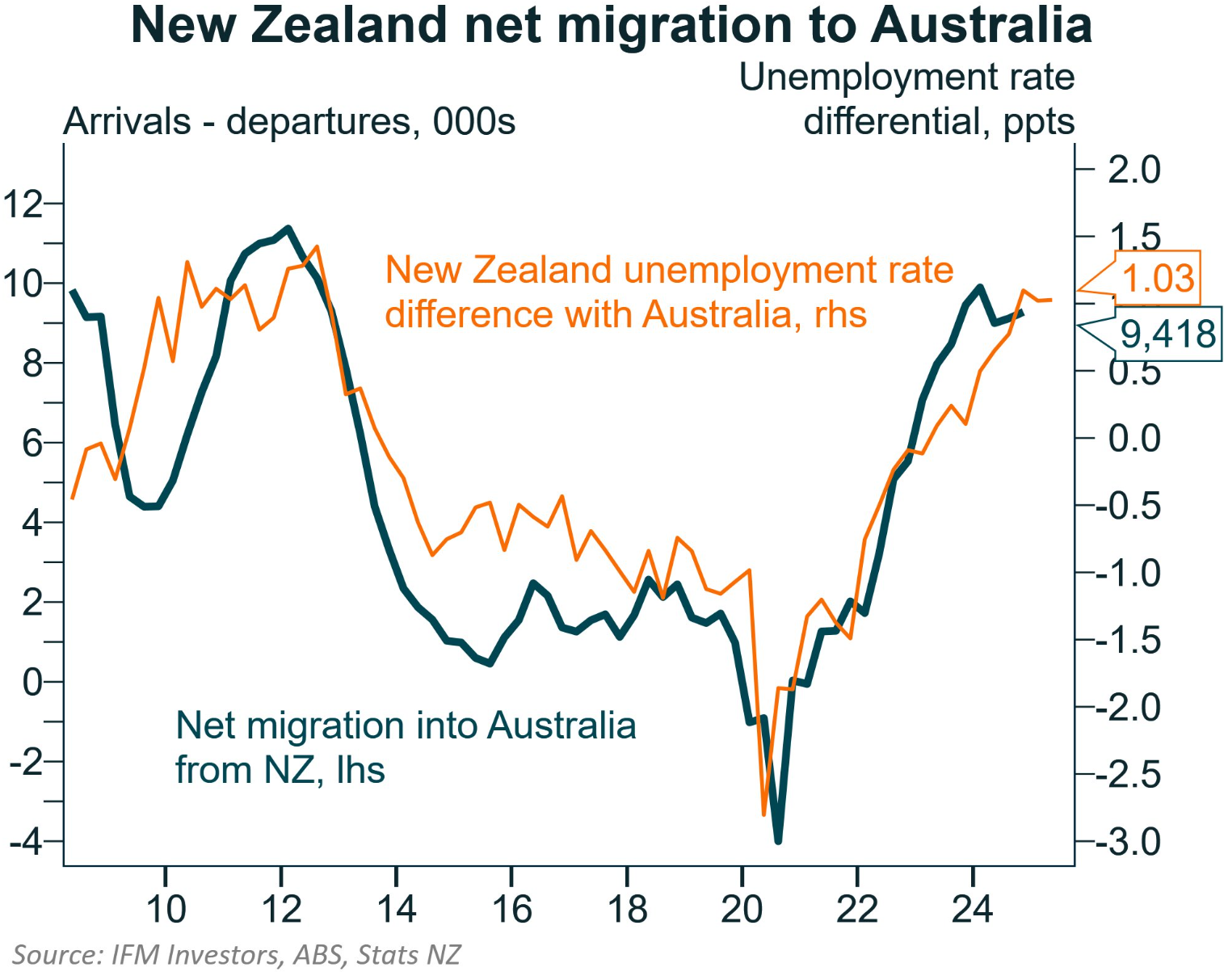

As a result, New Zealand is experiencing a large outflow of citizens to Australia, where job prospects are significantly brighter:

The one area where New Zealand offers greater hope to young residents is housing.

Unlike Australia, New Zealand house prices have fallen heavily from their post-pandemic peak and are tracking at around late 2019 levels in real terms:

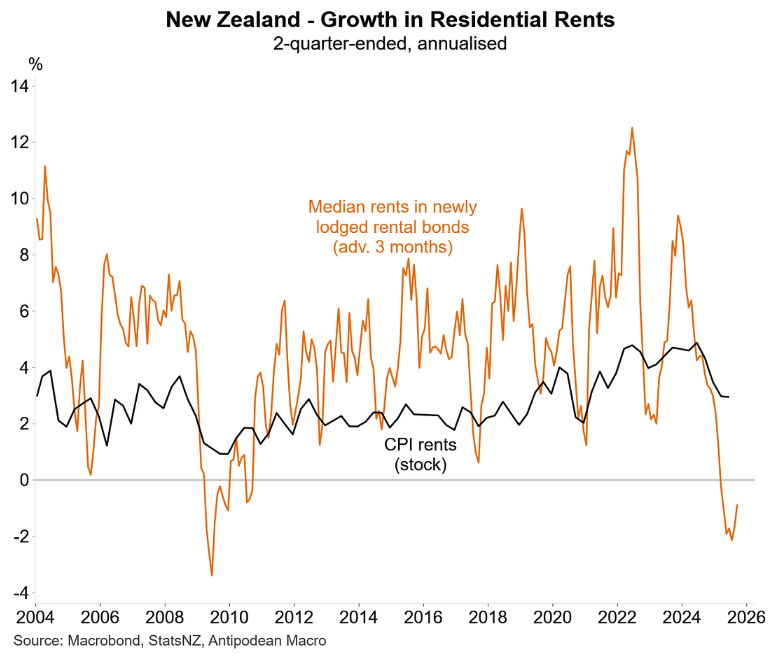

Rents as measured by newly lodged rental bonds have also fallen in New Zealand:

Superior housing affordability should logically make New Zealand increasingly attractive to younger cohorts and should eventually help stem the loss of Kiwis to Australia.