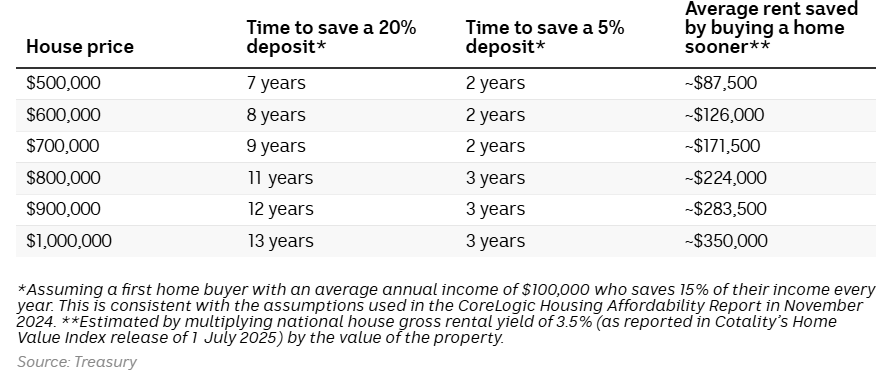

The Albanese government announced that it will bring forward its 5% home deposit scheme for first home buyers by three months.

Under the scheme, the government will guarantee 15% of the purchase price so that applicants can avoid paying lenders’ mortgage insurance.

Previous income limits on eligibility will be removed from October, whereas the scheme’s property price caps will also be lifted from $900,000 to $1.5 million in Sydney, from $800,000 to $950,000 in Melbourne, and from $700,000 to $1 million in Brisbane, with similar lifts across the rest of the country.

The Australian Treasury estimates that an extra 20,000 guarantees will be issued in the first year after uncapping the scheme.

Treasury predicts 70,000 homes will be bought through the scheme in the next 12 months and claims the scheme will only increase home values by around half a percent after six years.

“We want to help young people and first home buyers achieve the dream of home ownership sooner. Bringing the start date of our 5% deposit scheme forward will do just that”, Prime Minister Anthony Albanese said in a statement.

The Treasury’s 0.5% price impact after six years is ridiculously low. Combined with the Reserve Bank of Australia’s rate cuts, the policy is likely to place significant upward pressure on prices.

History has shown that these types of demand-side ‘affordability’ policies never work. They end up getting capitalised into larger mortgages and higher home prices, thus rendering them self-defeating from an affordability perspective.

“It doesn’t solve Australia’s housing challenges”, AMP deputy chief economist Diana Mousina said. “Generally, boosts to first home buyers, such as grants and loans, are inflationary for house prices”.

“You’ll benefit if you’re lucky and get in before prices start going up. But you’ll lose out if you get in after they’ve already started rising”, Mousina said.

Independent economist Saul Eslake agreed that the policy would help push home prices higher.

“It’s not a coincidence that the home ownership rate peaked at the first census after the introduction of the first homeowner grant scheme [in 1966] and has been going down ever since, except for people over 65”, he said.

Independent property analyst Cameron Kusher summed up the merits of the policy with the following Tweet:

Imagine being a Professor of Economics going into politics and having to support this policy knowing that it is just going to drive home prices higher and put taxpayer money at risk in the event of a downturn? https://t.co/60dXpWlg78

— Cameron Kusher (@cmkusher) August 25, 2025

The average dwelling in Australia is currently valued at more than $1 million. The last thing the housing market needs is more policy stimulus.

If the Albanese government genuinely cared about housing affordability, it would take the pressure off rents and prices by slashing immigration.

Instead, Labor has expanded the student visa intake by 25,000 and watered down English-language standards.

As a result, population demand will forever run ahead of supply, worsening housing affordability.