Australia’s economy has become overly reliant on public sector spending (not to mention high immigration) to grow the economy.

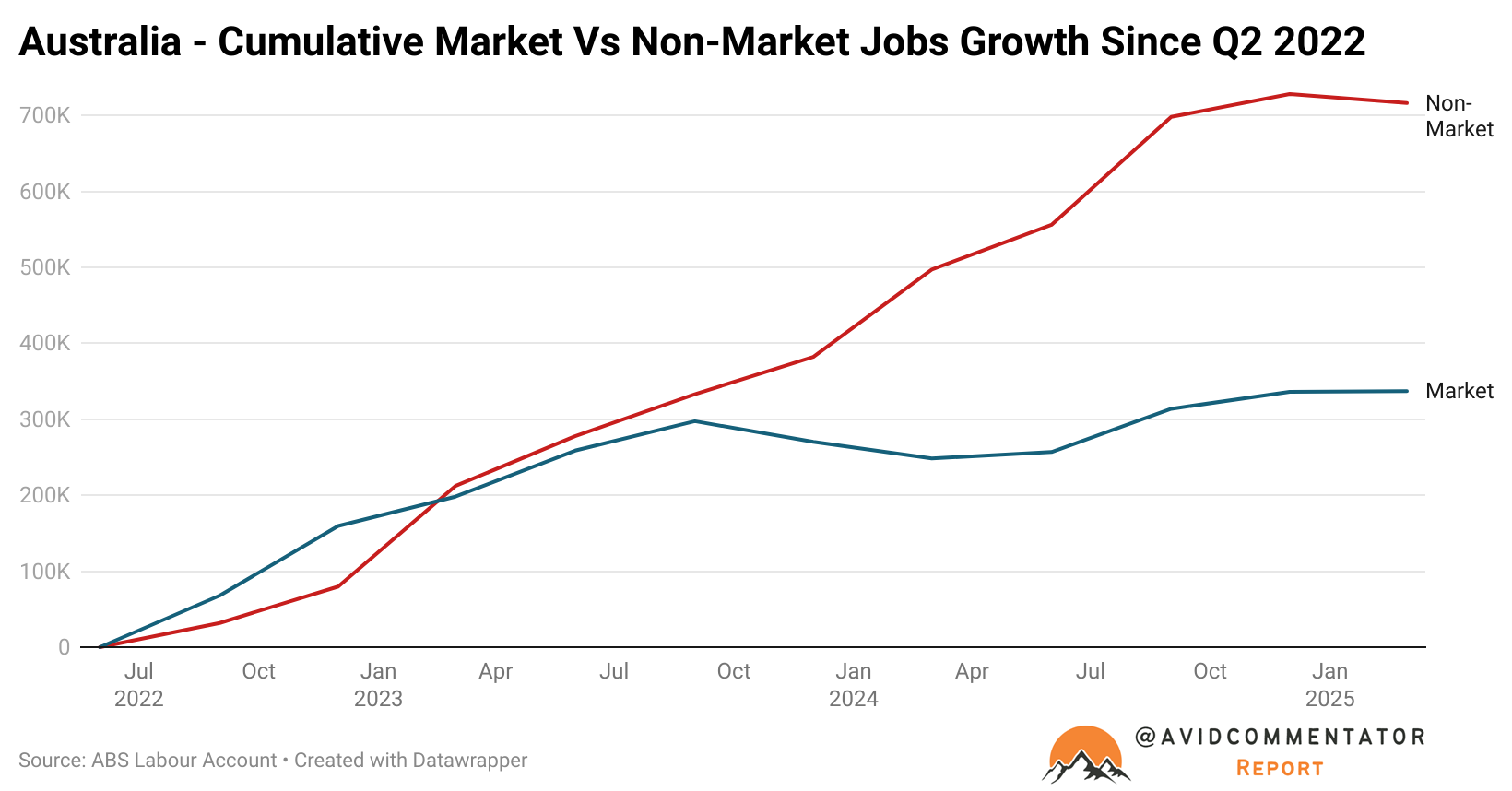

Consider the following facts. Since the COVID-19 pandemic began, around 60% of Australia’s job growth has come from the non-market (effectively government-funded) sector of public administration and safety, education, healthcare, and social assistance.

Over the past two years, just over 80% of job creation has come from the non-market sector, much of this related to the NDIS.

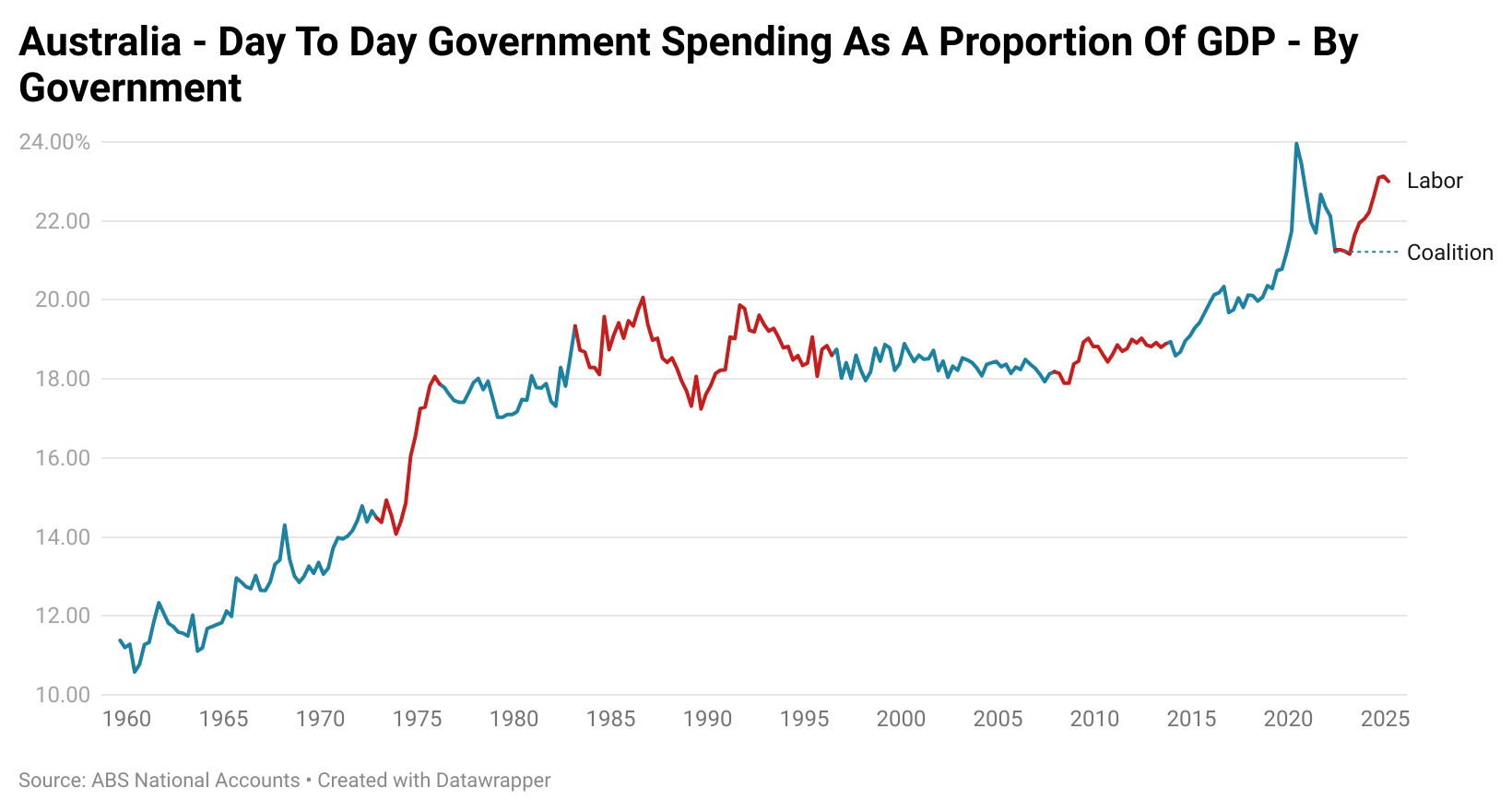

As illustrated below by Tarric Brooker, day-to-day government spending (i.e., excluding infrastructure spending) surged to record highs during the pandemic and has remained there.

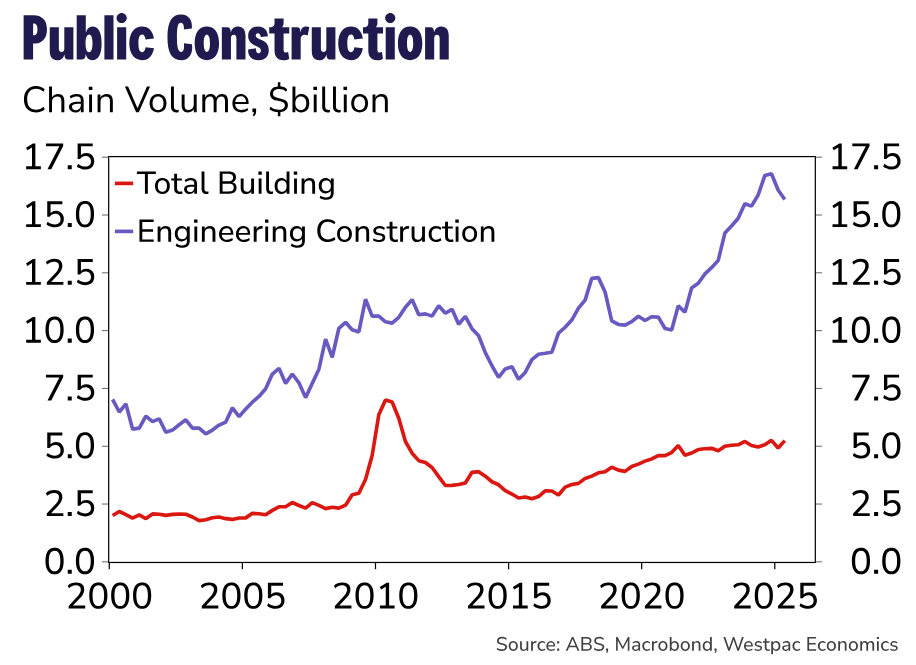

Australia’s infrastructure spending has also become government driven.

As illustrated below by Westpac, over the past three years, “the public sector has made an outsized contribution to growth in construction activity—total construction work done has increased by around 20% since Q1 2021, with half of this driven by the public sector, even though the sector only accounts for around 25% of total activity”:

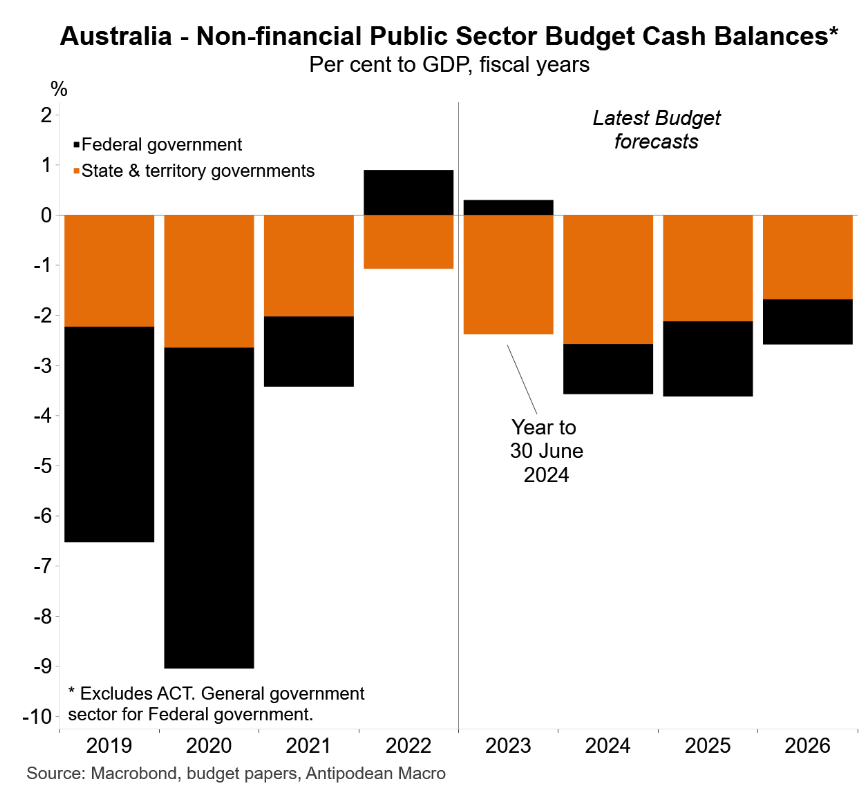

The risks for the economy are obvious. With state and federal governments facing a decade of budget deficits and rising net debt, there will be immense pressure to cut back on government spending, including the bureaucracy, services, and infrastructure.

However, doing so will also remove what has been the nation’s primary generator of ‘jobs and growth’ since the pandemic.

In the unlikely event that the government does cut back heavily on immigration, it would remove the economy’s other major growth driver (although this should improve GDP on a per capita basis).

The underlying problem is that Australia’s economy is moribund with few genuine private sector drivers.

Dumb government policy has sentenced Australians to a low productivity growth future amidst an endless flood of low-skilled, capital-diluting immigration, soaring energy costs, and bureaucratic waste.