Australia is experiencing a generational housing shortage, exacerbated by historically high immigration-driven population growth and a sluggish housing supply.

A meeting of the national cabinet in August 2023 agreed on a National Housing Accord, which aims to build 1.2 million new homes between July 1, 2024, and July 1, 2029.

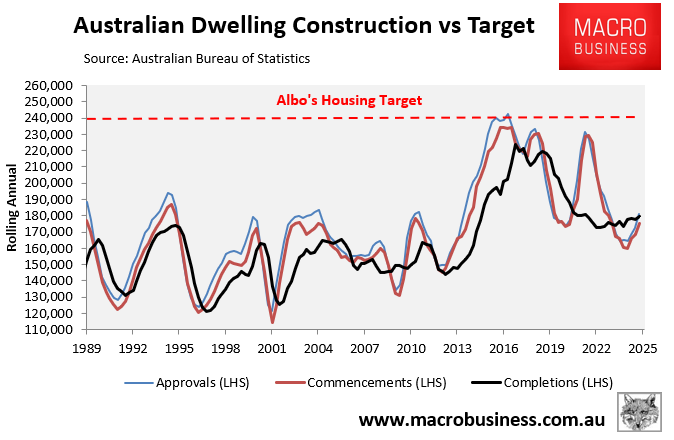

This 1.2 million target requires 240,000 homes to be constructed annually, which is approximately 7% higher than the record single-year construction of 223,600 reached in 2017.

Over the past week, the ABS has released data on dwelling approvals, commencements, and completions, each of which shows that construction rates are tracking well below target.

As illustrated in the following chart, annual approvals, commencements, and completions are tracking around one quarter below the 240,000 construction target.

Over the first three quarters of the Housing Accord, which commenced on 1 July 2024, the number of completions is tracking 46,000 (26%) behind the 180,000 required to meet the construction target.

There are several reasons for the sluggish supply response, including the following factors:

- Construction costs have risen by more than 40% since the start of the pandemic, pricing new builds above what buyers can afford to pay.

- The current official cash rate of 3.85% is significantly higher than the 1.5% cash rate on offer when construction rates boomed in 2017. Moreover, the cash rate is not expected to decline significantly this cycle.

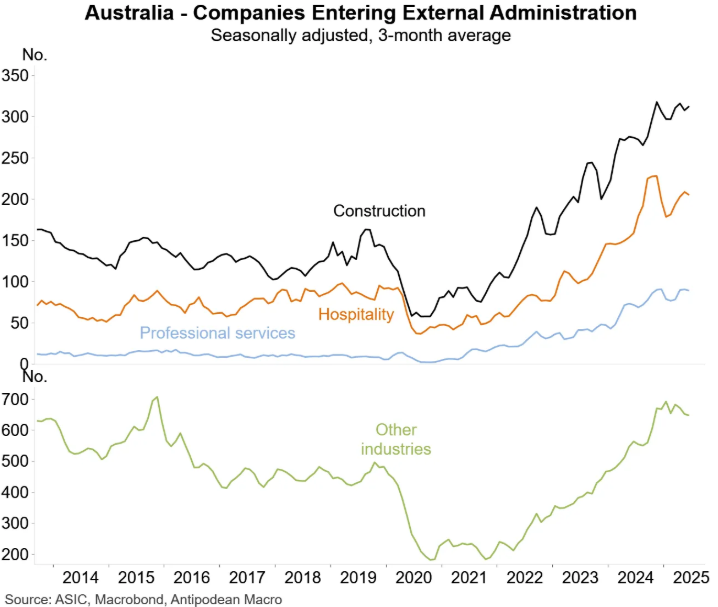

- Record numbers of builders have gone bust, reducing capacity across the homebuilding industry.

- Builders are competing with infrastructure and energy projects for scarce construction labour.

This week, we received data highlighting the stiff headwinds facing the homebuilding sector.

The Australian Securities and Investments Commission (ASIC) reported that construction insolvencies increased from 2,977 in FY24 to 3,595 in FY25, representing a 21% rise.

The following chart, courtesy of Justin Fabo from Antipodean Macro, plots the surge in construction sector insolvencies over the past several years.

“It’s been a difficult few years for businesses in the industry, but hopefully the worst is now behind us”, Master Builders Australia chief executive Denita Wawn said in response to the data.

Part of the reason for the squeeze on margins is that construction costs continue to rise, albeit at a slower rate.

Cotality’s latest Cordell Construction Cost Index, released this week, showed that construction costs rose 0.5% in Q2 2025, picking up slightly from a 0.4% rise in Q1 2025.

Cotality’s research director, Tim Lawless, noted that while the increase in costs was half the pre-pandemic decade average of 1%, he said that builders will continue to struggle with feasibility assessments amid high material and labour costs.

“With the cost of building a new home continuing to rise, the (government’s) stretch target of building 1.2 million new homes by July 2029 is looking harder and harder”, Lawless said.

Ultimately, the costs of supplying homes are too expensive due to exorbitant land and construction costs. As a result, homes are priced above what buyers can afford, while builders are unable to make a profit.

With these conditions in place, the National Housing Accord’s target of building 1.2 million homes over five years has no realistic chance of being met.