Victoria’s finances are in a dire state.

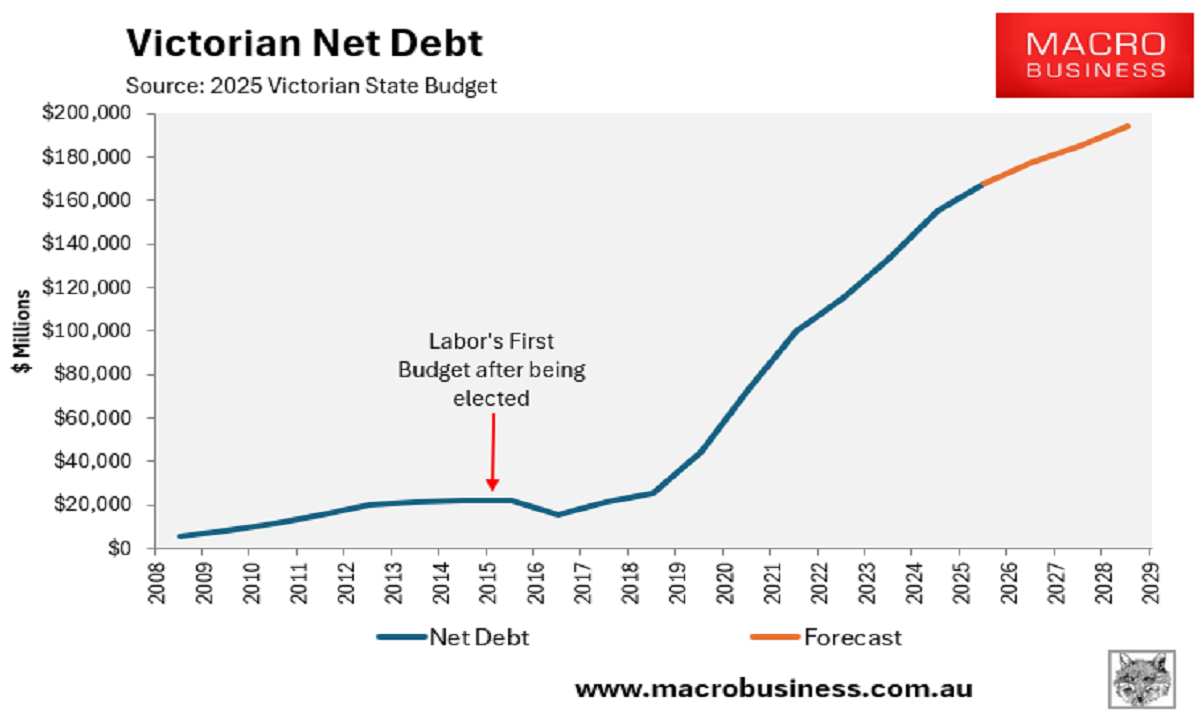

Victoria’s net debt was only $22.3 billion when the Labor government presented its first state budget in 2015. It has now risen to $155.5 billion and is expected to reach $194 billion by 2028-29, according to budget projections.

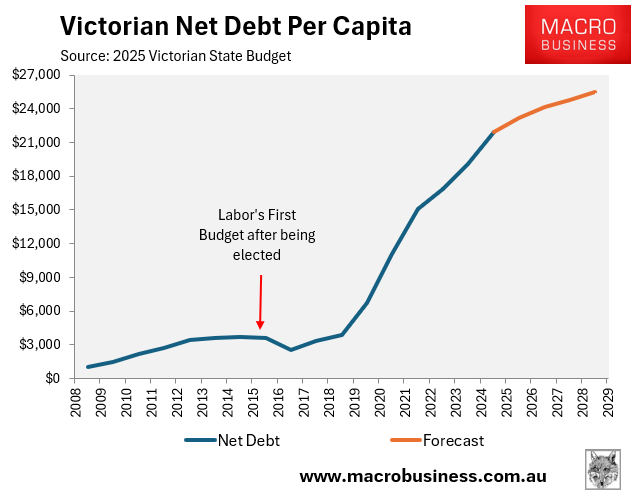

Victorian net debt per capita was under $3,600 in Labor’s inaugural budget. It has since climbed to $21,900 and is expected to reach $25,500 by 2028-29.

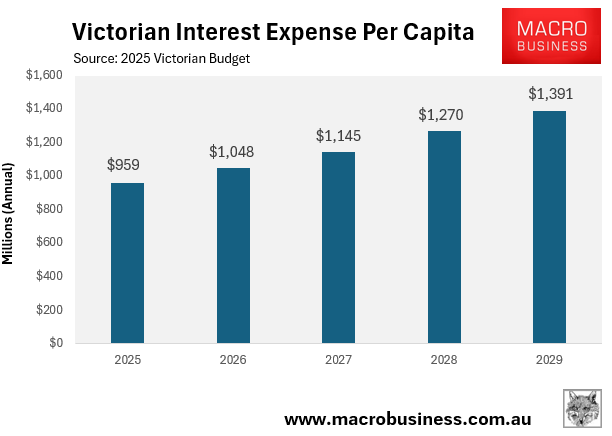

Victoria presently pays $6.8 billion in annual interest expenses. By 2028-29, Victoria’s interest bill is expected to reach $10.6 billion.

Per capita, Victoria’s yearly interest expense is expected to climb from $959 in 2024-25 to $1,391 in 2028-29.

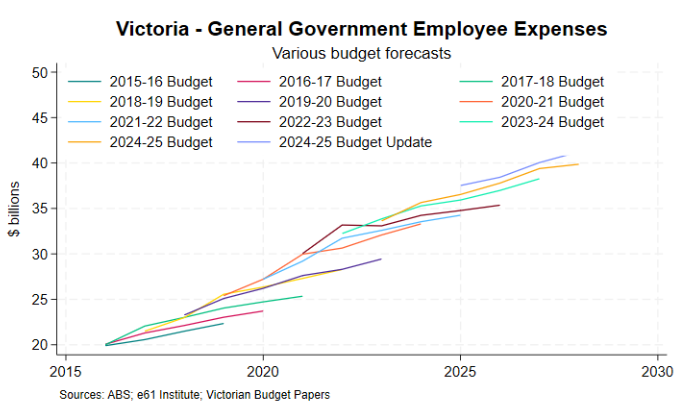

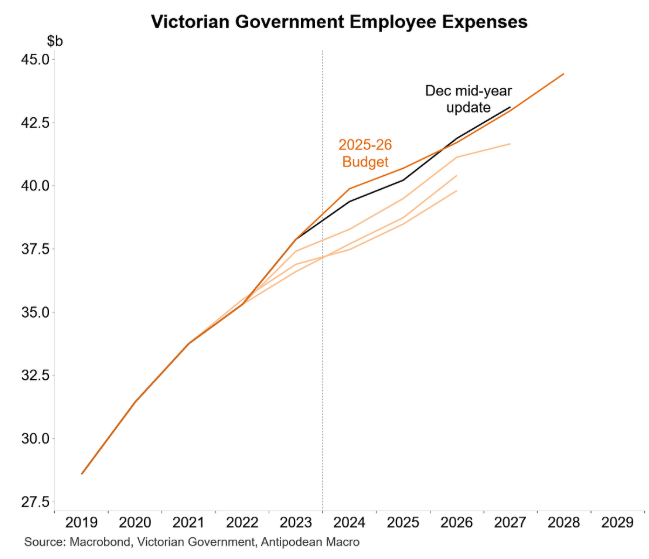

A major reason why Victoria’s budget is in such a precarious position is because of the blowout in public servant wage expenses, which have regularly exceeded budget projections.

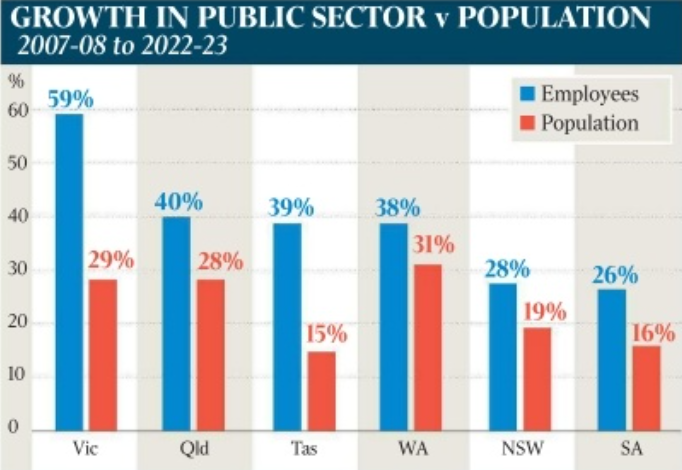

Wages are the state’s single largest expense. In the 15 years preceding 2022-23, Victoria’s public sector headcount expanded by 59%, exceeding the state’s population growth of 29%.

Source: The Australian

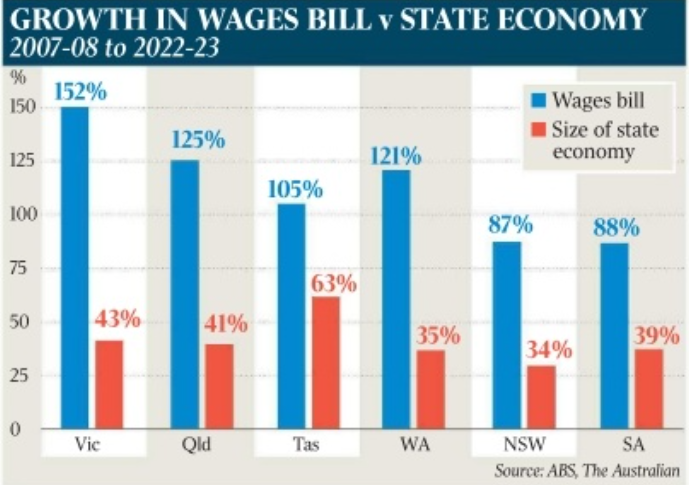

Over the same 15-year period, the state’s public servant wage bill increased by 152%, exceeding all other Australian states.

Source: The Australian

Victoria’s wage bill was $19.5 billion in the financial year 2014–15. According to the latest state budget, employee expenses will rise to around $44 billion by 2028-29.

To make matters worse, the majority of large projects in Victoria have far surpassed their timetables and budgeted costs.

For example, a recent analysis by the Victorian Auditor-General’s Office indicated that the costs of 113 significant projects have risen by $11 billion since last year.

Almost half (53%) of the 113 large projects reviewed by the Auditor-General’s Office had an increase in total planned investment.

Victoria already has the lowest credit rating in the nation (AA).

The major credit rating agencies, S&P, Moody’s, and Fitch, have threatened to downgrade Victoria if it does not manage its debt. This would boost the state’s already soaring interest cost.

For example, a 0.25 bp rise in Victoria’s average interest rate would increase interest payments by $26.4 million in 2029. A 100 bp rise would increase interest payments by around $100 million.

Alarmingly, the Victorian Treasury has not bothered to model the impact of a ratings downgrade on the state’s interest expenses and economy.

Parliamentary hearings into the Victorian budget got underway on Tuesday, with Department of Treasury and Finance secretary Chris Barrett admitting that the impact of a credit rating downgrade has not been modelled.

The department has only assessed the budgetary impact of a 100 basis point rise in interest rates.

Victorian Treasurer Jaclyn Symes will travel to the US this week to meet with ratings agencies, including representatives from Moody’s on Friday.

No doubt, Symes will assure S&P and Moody’s that Victoria’s debt situation is under control to avert another ratings downgrade.

I discussed these issues in an interview with Jacqui Felgate at Radio 3AW: