The Rudd/Gillard Labor government made the disastrous decision in the early 2010s to authorise LNG exports from Gladstone, Queensland, without forcing gas producers to first serve the domestic market.

As a result of this policy blunder, East Coast Australia became the only gas exporting jurisdiction in the world without a domestic gas reservation policy. We also pay the highest gas costs in the world among gas-exporting countries.

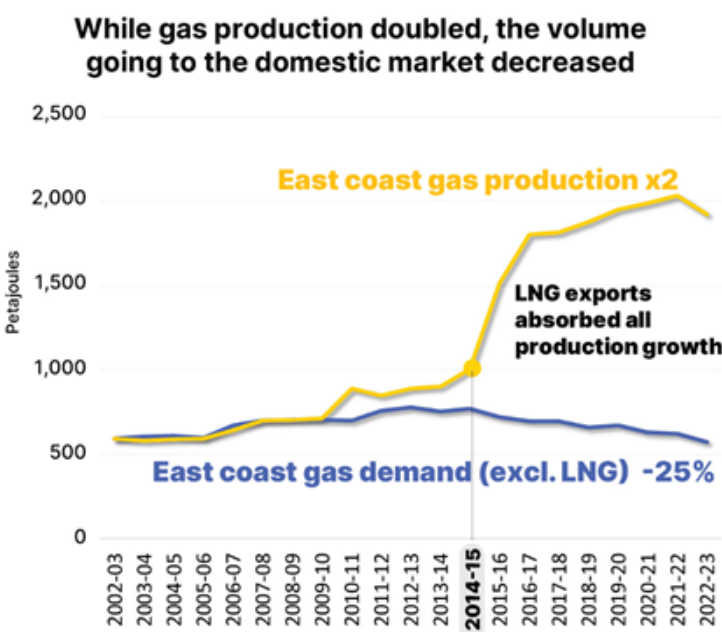

Despite tripling gas output on the East Coast since the LNG terminals opened in 2015, 25% less gas has been delivered to the domestic market.

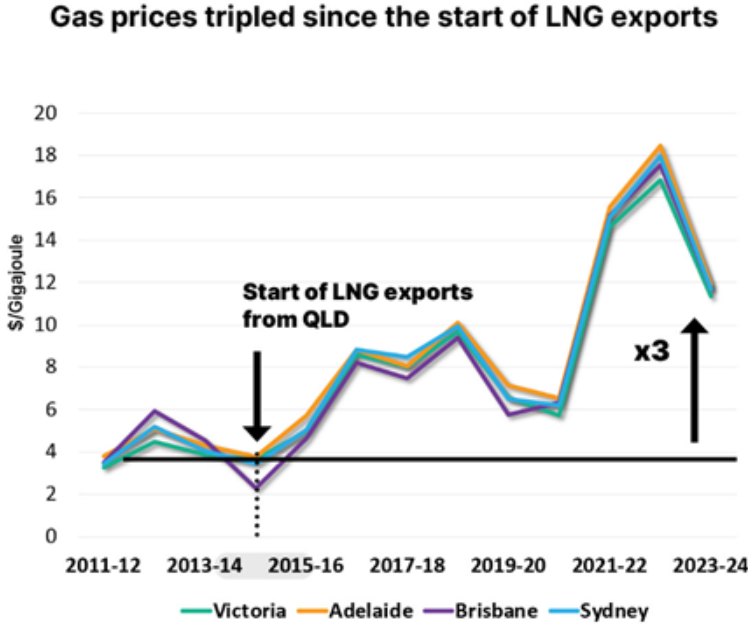

As a result, East Coast gas prices have tripled since LNG exports began.

The rise in gas costs has also pushed up electricity prices, as gas is a crucial marginal price setter in the wholesale market.

During the recent election campaign, the Coalition committed to establishing an East Coast reservation policy by imposing export levies on uncontracted gas.

The Coalition vowed to reduce the East Coast gas price to less than $10 per gigajoule.

The alternative scenario includes no reservation, liquefied natural gas (LNG) imports, and an import parity East Coast gas price of up to $20.

The Coalition also committed to investing $1 billion in a Critical Gas Infrastructure Fund to increase gas pipeline and storage capacity.

Labor’s Resources Minister, Madeline King, called the Coalition’s gas reservation program a “thought bubble”.

Prime Minister Anthony Albanese recently asserted that the Coalition’s excellent gas reservation policy was “plucked out of a Coco Pops packet”.

These remarks imply that Labor’s electoral triumph had ended the possibility of reservation.

As a result, while nearly three-quarters of East Coast gas is exported to Asia (mostly to China), East Coast Australians face the real prospect of having to import LNG, which will drive gas and electricity prices even higher, increasing inflation and shifting more manufacturing offshore.

Energy Idiocy Strikes Home:

This week, we experienced the full force of Australia’s gas foolishness.

Petroleum Australia reported that Australia Pacific LNG (APLNG), the country’s largest liquefied natural gas exporter on the East Coast (partly owned by Origin), has agreed to a significant price reduction under its flagship 7.6 million tonne per year deal with China’s Sinopec.

The price drop comes after a thorough evaluation of the long-term contract, which runs until 2035 and would cost APLNG around $2 billion in lost revenue.

The price decrease is in response to a potential global supply glut caused by an increase in new, low-cost supply, notably from Qatar, which is already increasing competition and driving down contract prices around the world.

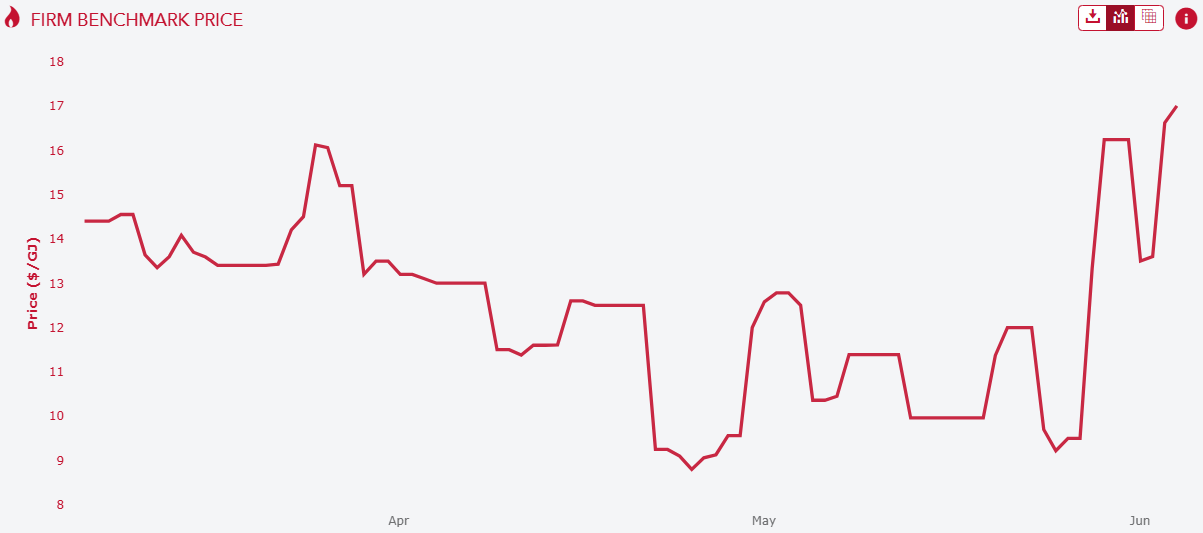

The IEEFA forecasts that the new contract price might be as low as $13.50 per gigajoule.

When the price decrease was announced, Australia’s spot East Coast gas price was $16.24 per gigajoule and it has since climbed to around $17.

Local contract prices are approximately $14 per gigajoule.

As a result, despite liquefaction and shipping expenses of $2–3 per gigajoule, Australian East Coast gas will be cheaper in China than in Australia.

It also follows reports that Japan and China are receiving more Australian gas than they require and are re-exporting it into third markets for profit.

The obvious question is, why are Australians being deprived of gas and compelled to pay more than the Asian countries to which we sell it? Why aren’t Australians being looked after first?

Meanwhile, an Abu Dhabi-led group announced this week an $18.7 billion acquisition bid for gas giant Santos, which operates two LNG export trains from Gladstone.

Losing crucial national energy assets to the Middle East is the last thing Australians require. Such a move would solidify Australia’s status as a territory open to foreign exploitation, where the interests of locals are subordinated.

The Australian government should respond in kind by instituting an East Coast domestic gas reservation policy and/or levies on gas exports from Gladstone.

Australia’s gas belongs to Australians. Our interests must come first.

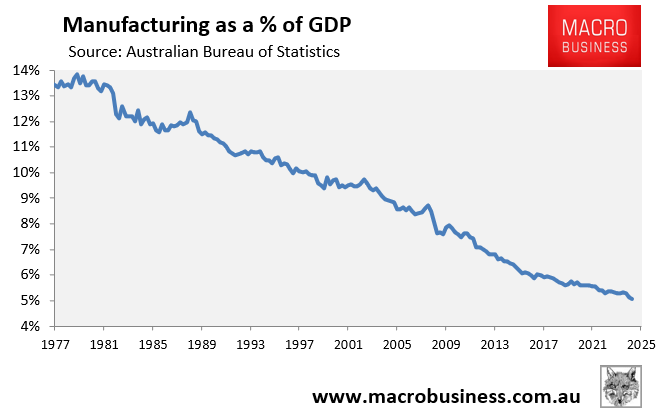

Without reservation and/or export levies, energy inflation will rise, cost-of-living pressures will increase, and Australia’s economy will continue to deindustrialise and the manufacturing sector ceases to exist.

Without action, Australia’s economy is facing an energy-driven apocalypse.

I discussed these issues in detail on this week’s Treasury of Common Sense on Radio 2GB/4BC.