The Australian Bureau of Statistics (ABS) released data on permanent and long-term arrivals for the month of April.

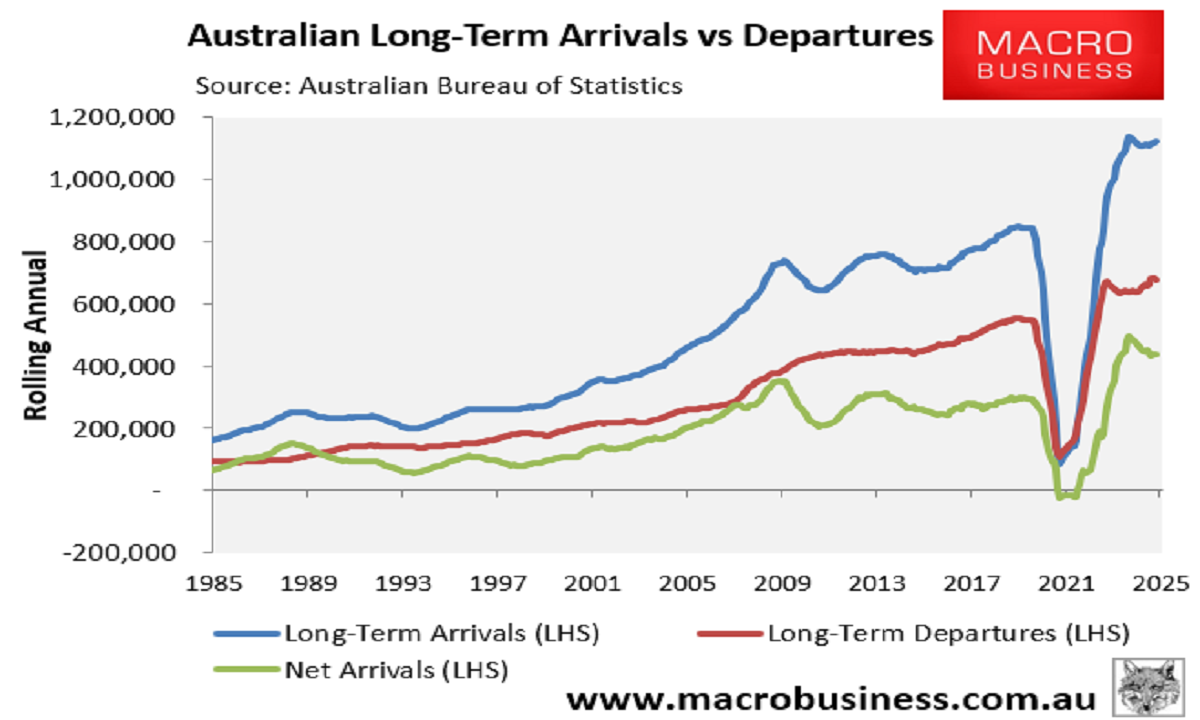

There were 1,119,910 permanent and long-term arrivals in the year to April, offset by 679,580 departures, with both tracking at close to a record high.

As a result, there were 440,330 net permanent and long-term arrivals in the year to April, down from a peak of 498,270 in February 2024.

The following table shows that the net number of permanent and long-term arrivals accelerated in the first four months of 2025, with 212,660 net arrivals recorded by the ABS:

The number of net arrivals over the first four months of 2025 is only slightly below last year’s peak of 216,810 and well ahead of 2023 (176,780) and 2019 (135,910).

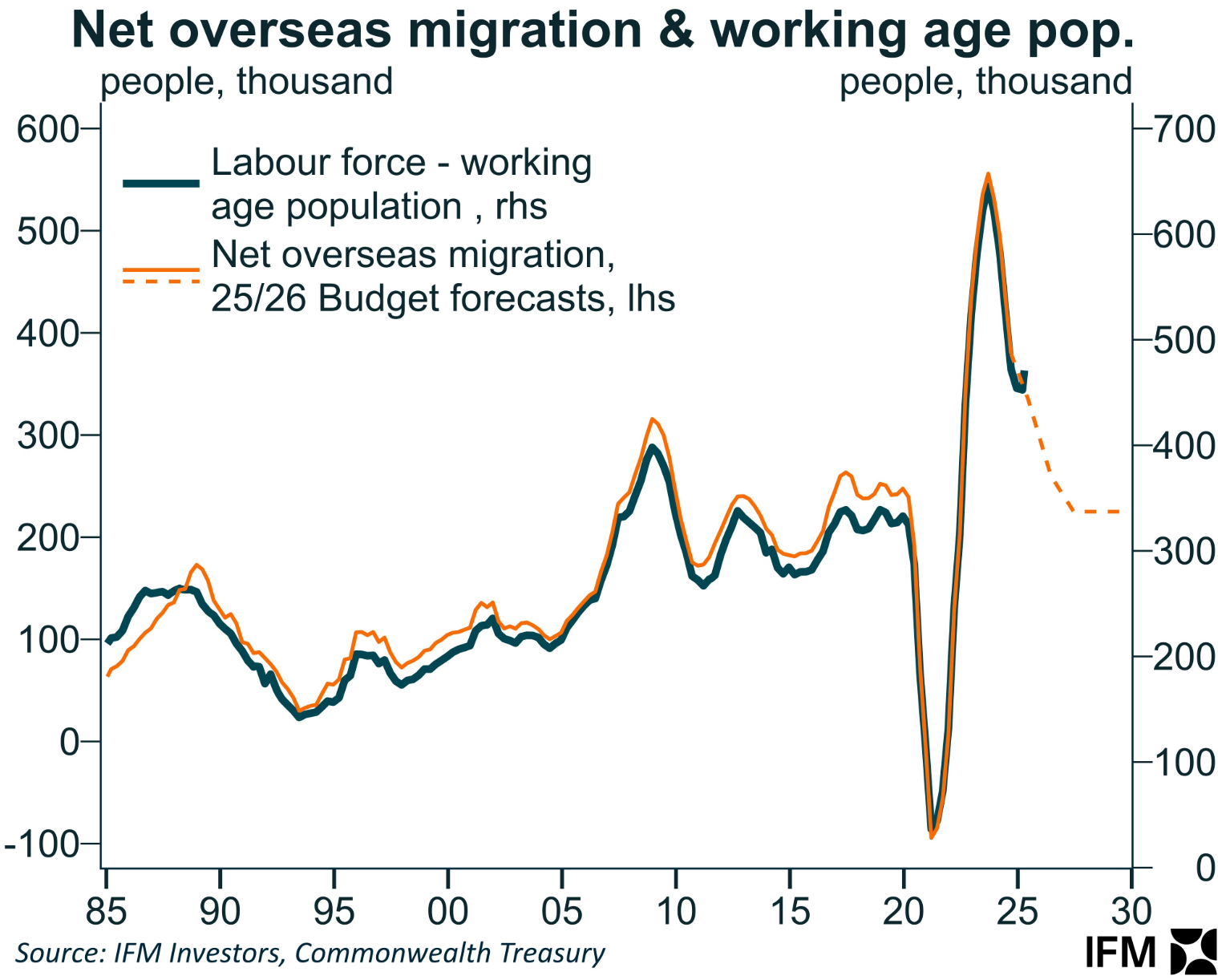

The next chart plots annual net permanent and long-term arrivals against the official quarterly net overseas migration (NOM), which are current to September 2024.

As you can see, both series generally track each other closely but have diverged recently.

Indeed, Justin Fabo from Antipodean Macro shows that the bounce in net permanent and long-term arrivals over the first four months suggests that NOM will also rebound.

However, Fabo cautions that the same bounce occurred in 2022 and 2024 and was not reflected in the official quarterly NOM.

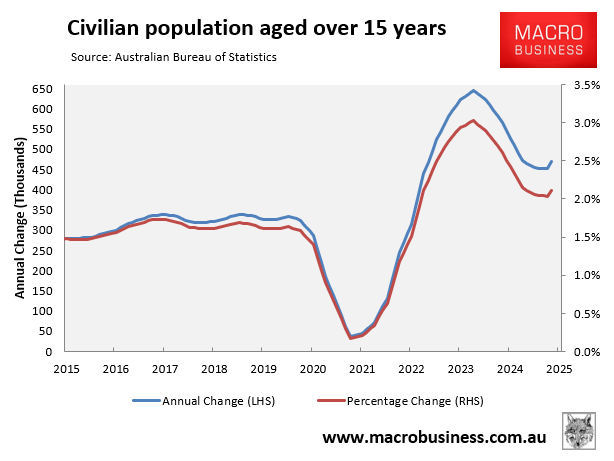

That said, the civilian population figures contained in the monthly labour force survey have also bounced:

Alex Joiner from IFM Investors showed that this rebound in civilian population casts doubt on the federal budget’s forecasts for net overseas migration.

Whatever the case, Australia’s NOM remains excessive and is the primary driver of the nation’s housing shortage.

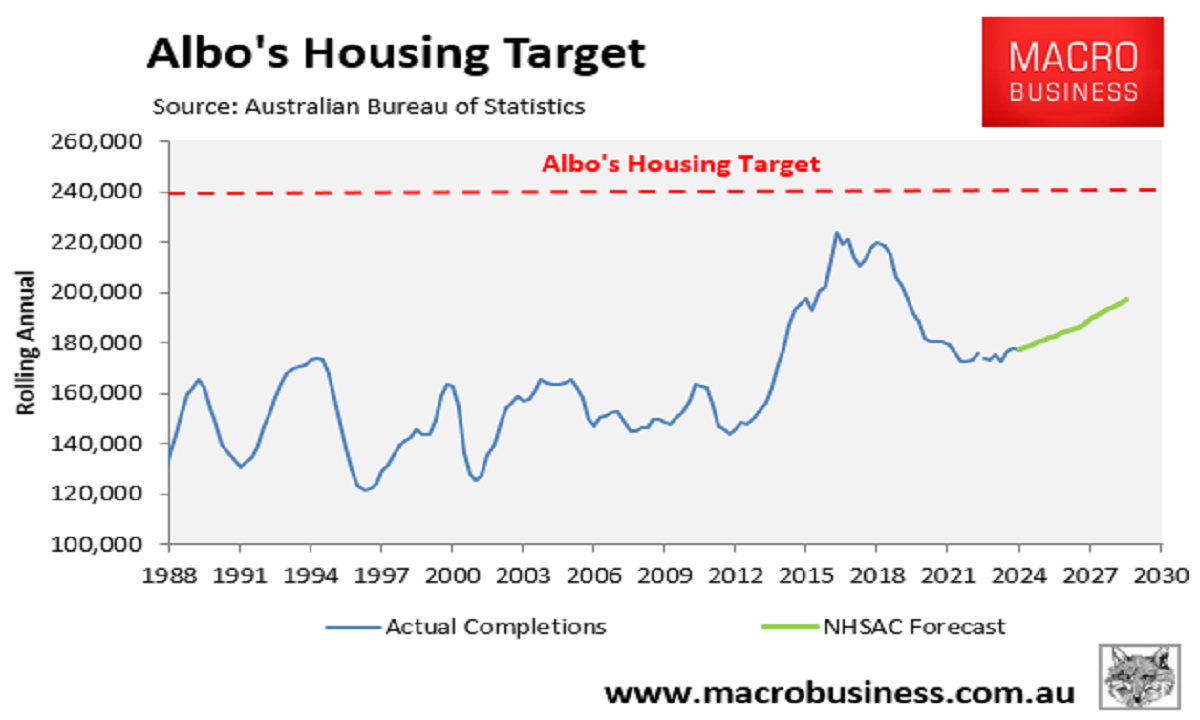

The reality was revealed in the National Housing Supply and Affordability Council’s (NHSAC) most recent projections.

NHSAC projected that Australia’s housing construction will stay considerably below the Albanese government’s annual target of 240,000 dwellings.

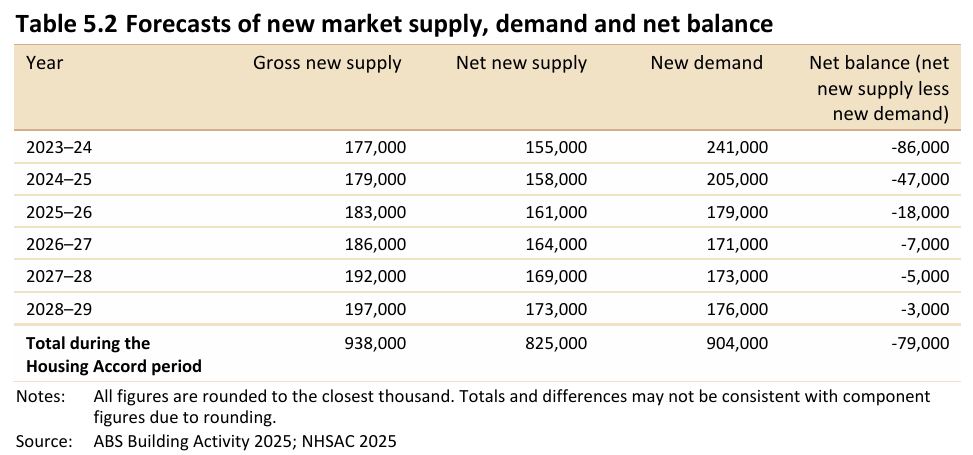

And because population growth (read immigration) is expected to stay historically high, Australia’s housing shortfall will deteriorate by 79,000 homes over the next five years:

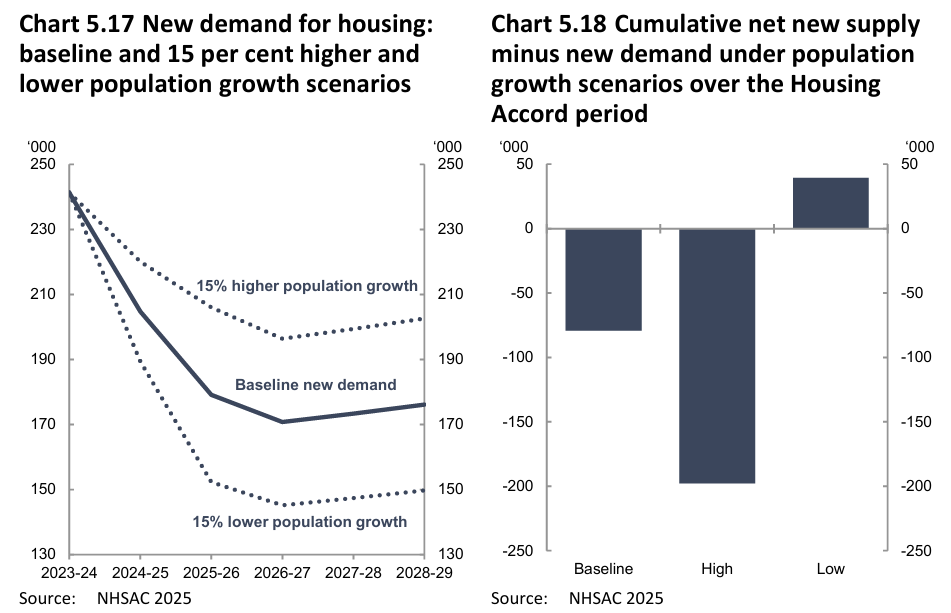

But here’s the catch. According to NHSAC’s sensitivity analysis, if Australia’s population grows by just 15% less than expected over the next five years, the country’s anticipated 79,000 shortage would become a 40,000 surplus:

NHSAC’s projections prove that the number one solution to Australia’s housing crisis is to manage demand through a sensible, sustainable immigration program that is well below the nation’s capacity to build housing and infrastructure.