The Q1 national accounts, released earlier this month, showed that the private sector economy remains locked in recession.

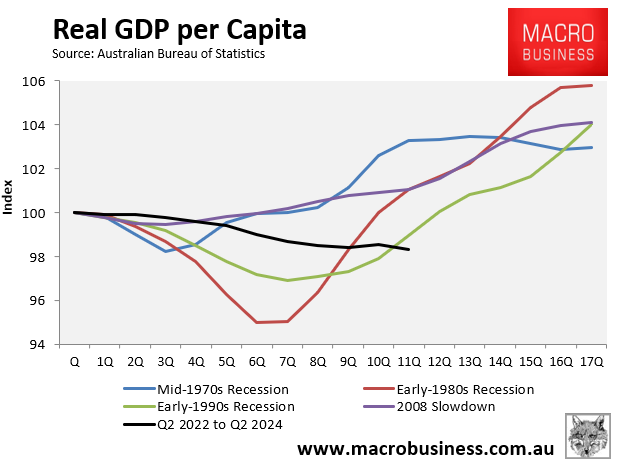

Australia’s per capita GDP declined by 0.2% over the quarter, the ninth decline in 12 quarters.

It was also the longest (but not deepest) decline in GDP per capita in modern recorded history.

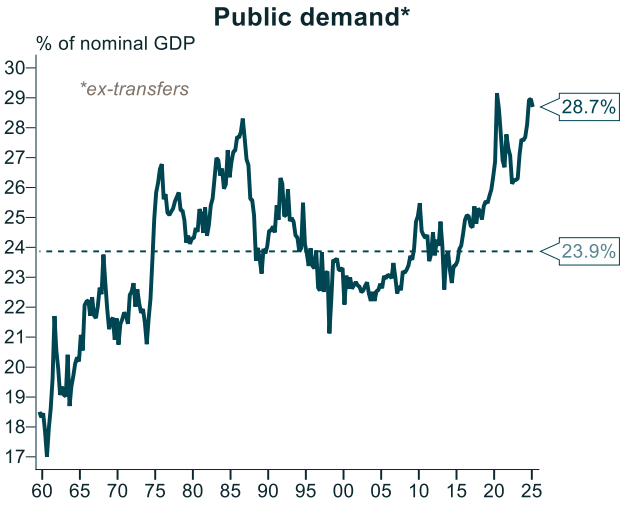

The decline in per capita GDP comes despite record public spending, suggesting that the private (market) sector has been hit especially hard.

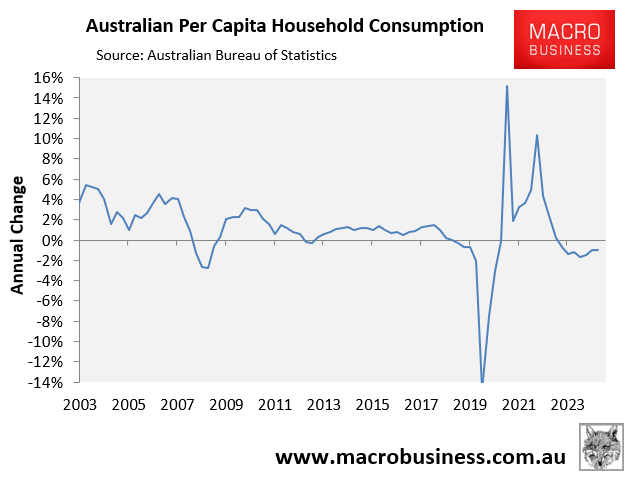

Indeed, real per capita household consumption has fallen for eight straight quarters in annual terms.

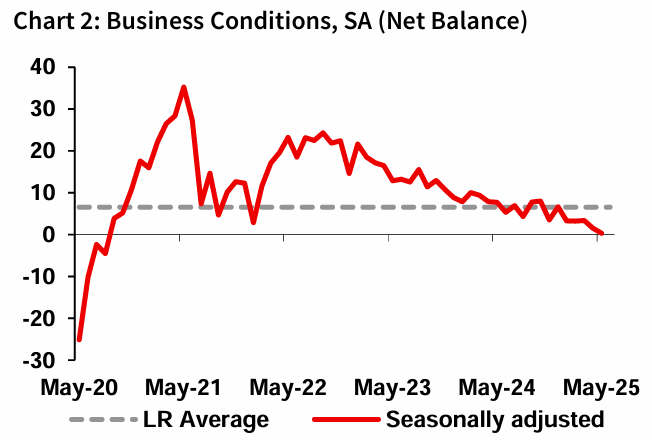

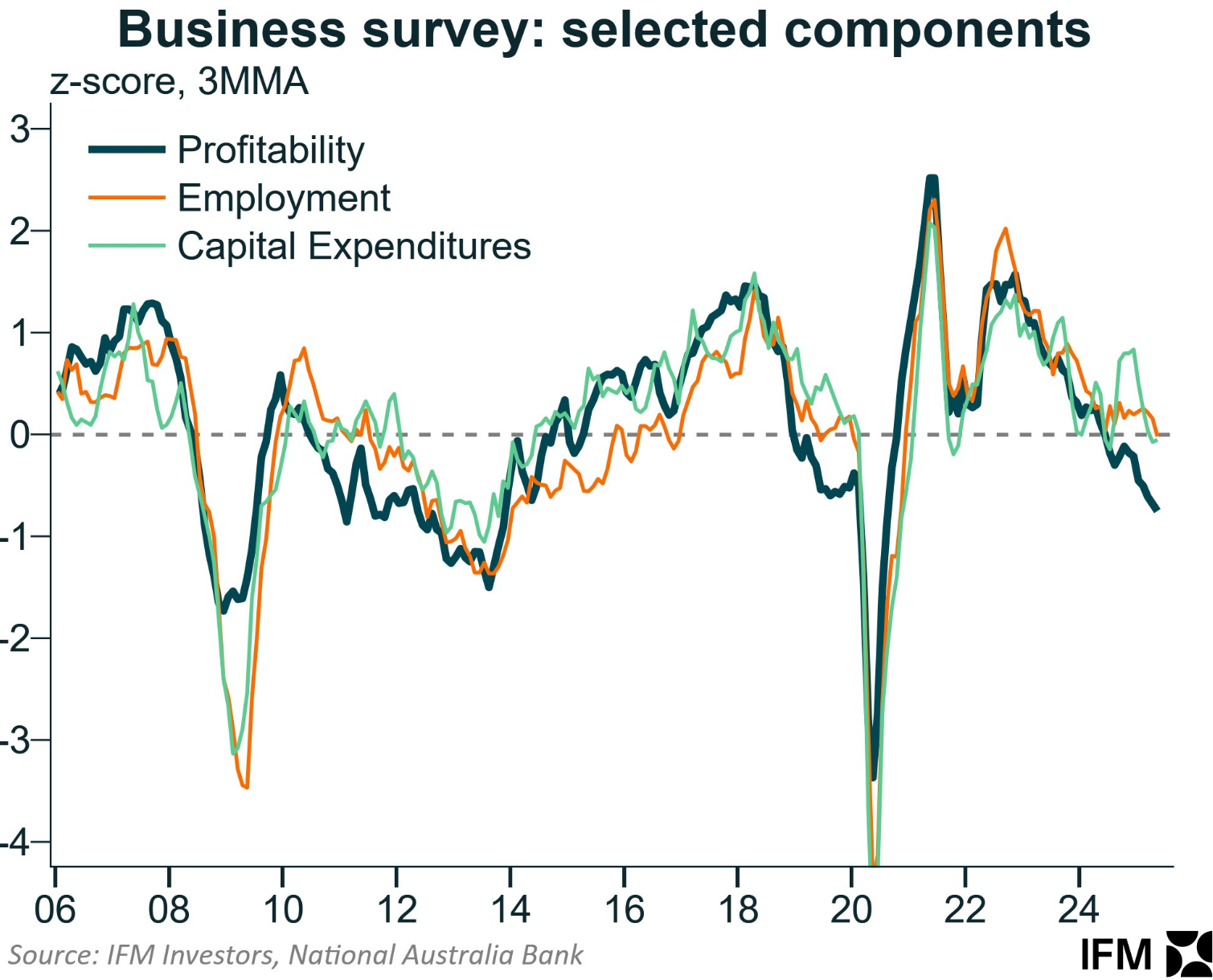

More timely indicators also suggest that the business sector is experiencing recessionary conditions.

This month’s NAB business survey revealed that business conditions have deteriorated:

In May, Australian businesses reported the lowest business conditions—a composite measure of firms’ reported trading conditions, employment, and profitability—since 2014, excluding the pandemic.

As highlighted below by Alex Joiner from IFM Investors, profitability has collapsed, resulting in lower employment and capital spending.

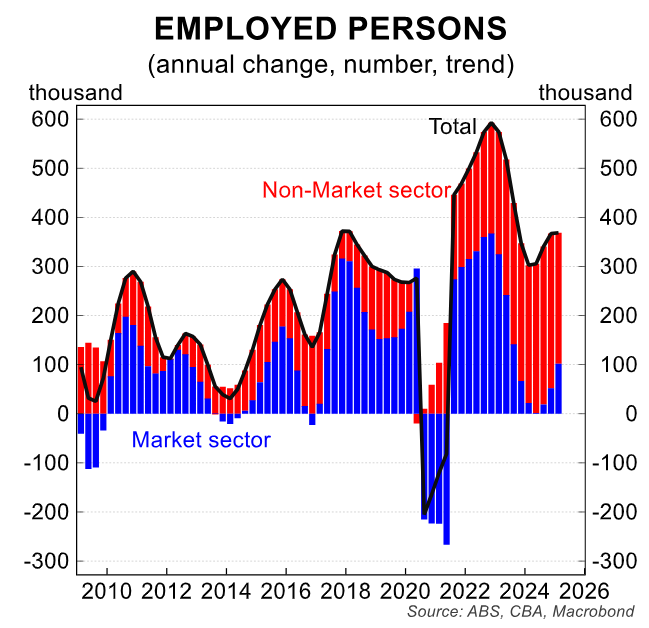

The private sector weakness extends to the Labour market.

Last week, CBA produced the following chart showing that around 60% of filled jobs since the pandemic have come from the non-market sector. Over the past two years, that figure has risen to around 80%.

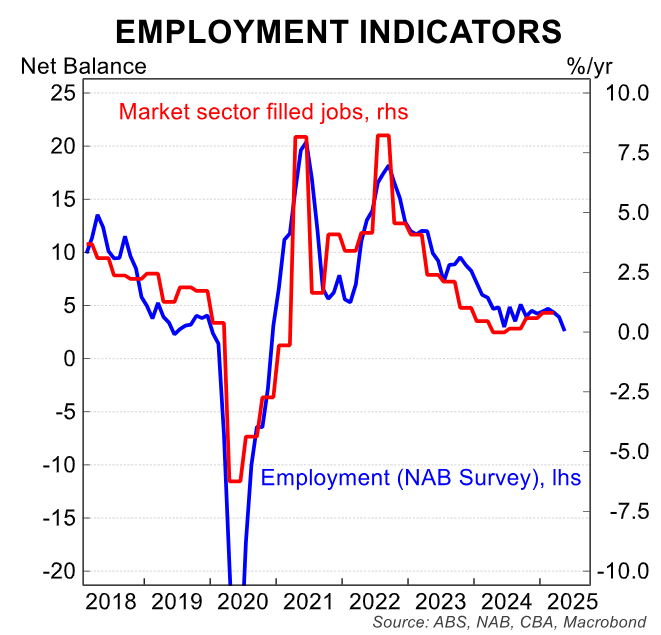

The NAB survey on employment intentions has also fallen to a cyclical low. As shown below by CBA, this indicator has a strong relationship with market sector filled jobs.

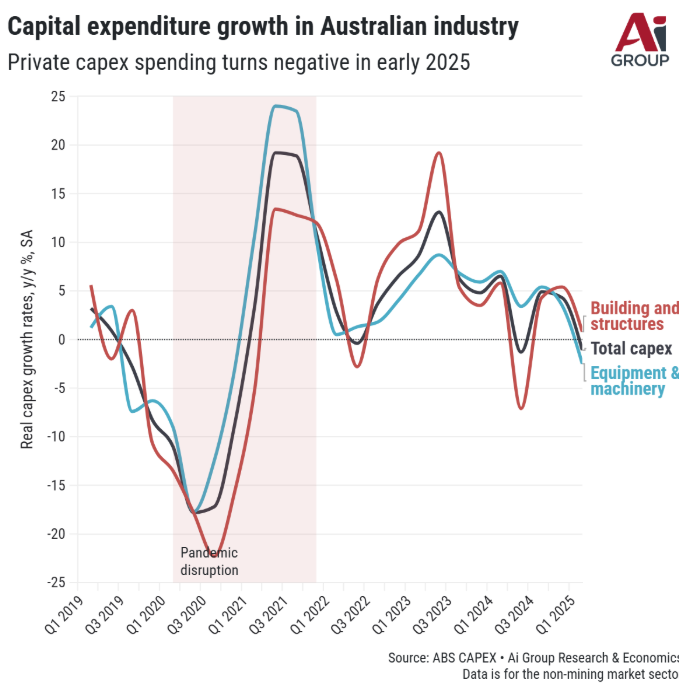

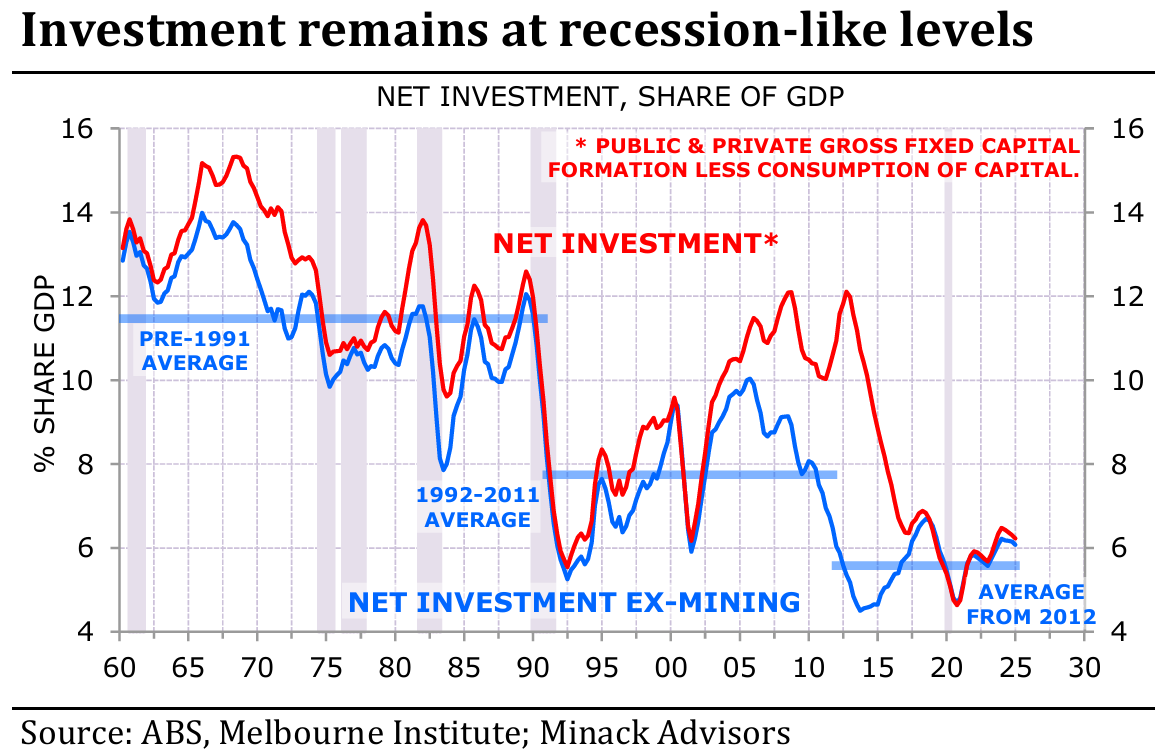

In my opinion, the slump in private business investment is especially concerning.

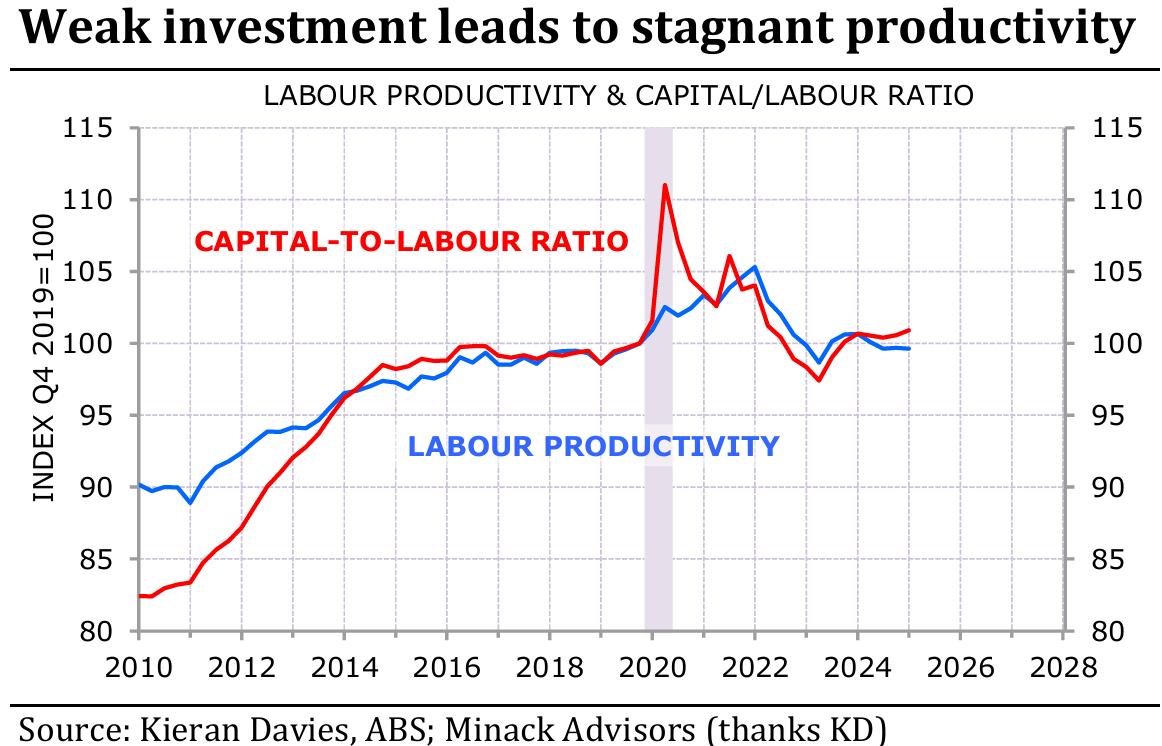

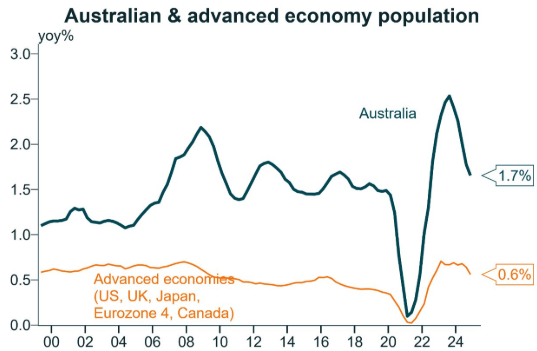

This month’s seminal analysis by respected independent economist Gerard Minack showed that “low investment and fast population growth prevent capital deepening and productivity growth. The result is stagnant real incomes and falling per capita GDP”.

With Australia’s net investment tracking at recessionary levels while the population continues to grow rapidly, Australia has experienced “capital shallowing” and diminishing productivity growth.

The end result is that Australia has a low-productivity “zombie” economy that is only growing due to internationally high population growth and government spending.

Source: Alex Joiner (IFM Investors)

The private sector and per capita economies are stagnant, and the slump in private investments suggests this trend is unlikely to change in the near future.