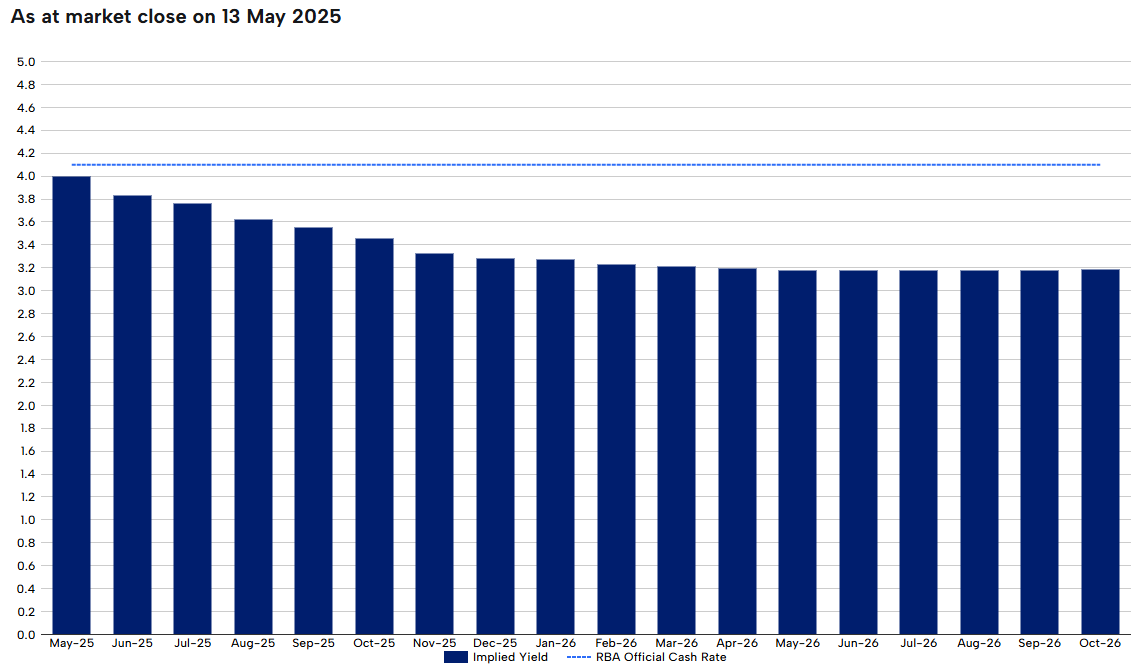

A few weeks back, amid the turmoil of the Trump Administration’s “Liberation Day” tariffs, the futures market was pricing five more rate cuts this year.

Earlier this week, the US and China agreed to massively reduce tariffs for 90 days while they negotiate a longer-term deal. US tariffs will be lowered to 30% (from 145%) and China’s to 10% (from 125%).

CBA estimates that the US effective tariff rate on imports from China is now 41%, down from 155%.

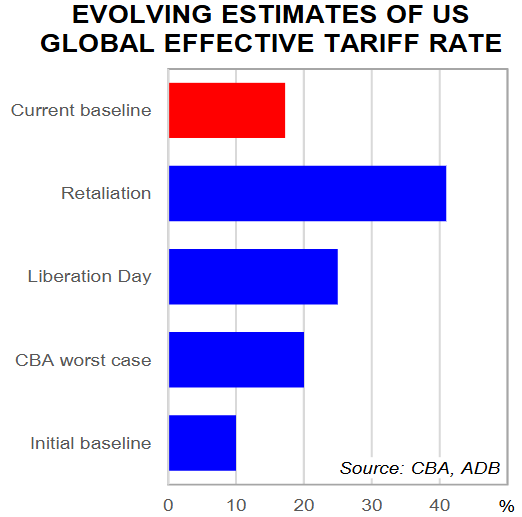

CBA’s estimate of the US global effective tariff rate is now 17% compared to 21% assumed in its recent global economic growth update.

Financial markets viewed the 90-day tariff reduction as a sign that ‘peak tariff’ has past. As a result, futures markets are now tipping only three more 0.25% interest rate cuts this year from the RBA:

As illustrated below by Alex Joiner from IFM Investors, interest rate futures markets are inherently skittish and regularly change their forecasts.

Futures markets are now aligned with CBA and Westpac, which have also forecast three more rate cuts this year.

NAB remains the outlier, tipping four rate cuts by Q3 2025, 2.85% by year’s end before reaching 2.60% in February 2026.

Clearly, external events will play a significant role in the outcome.