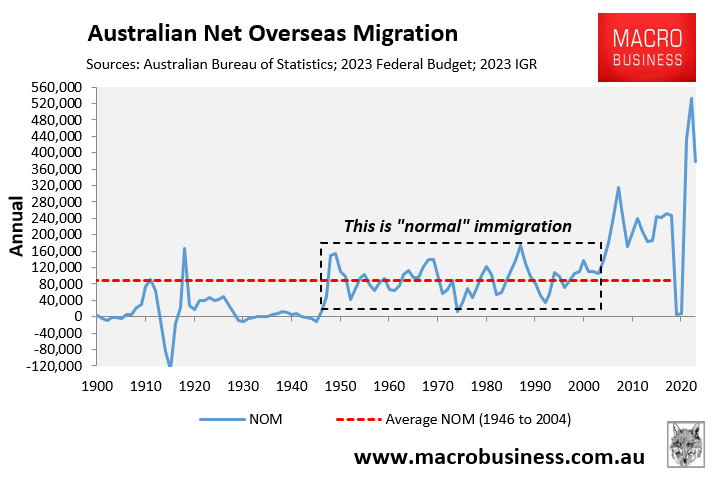

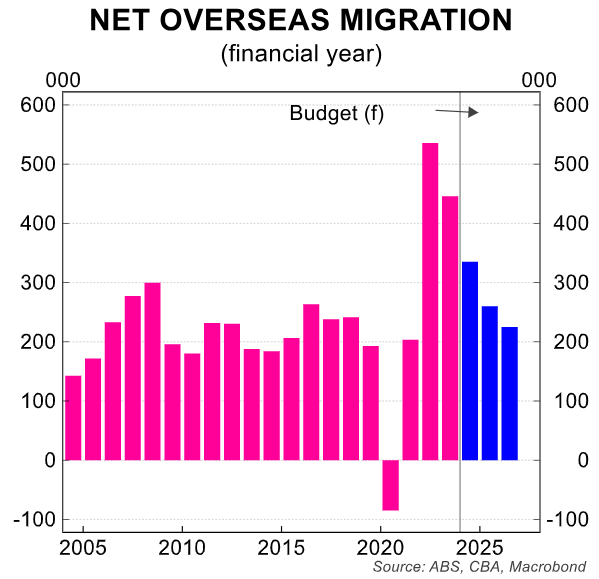

The first term of the Albanese government saw net overseas migration to Australia surge to a record high.

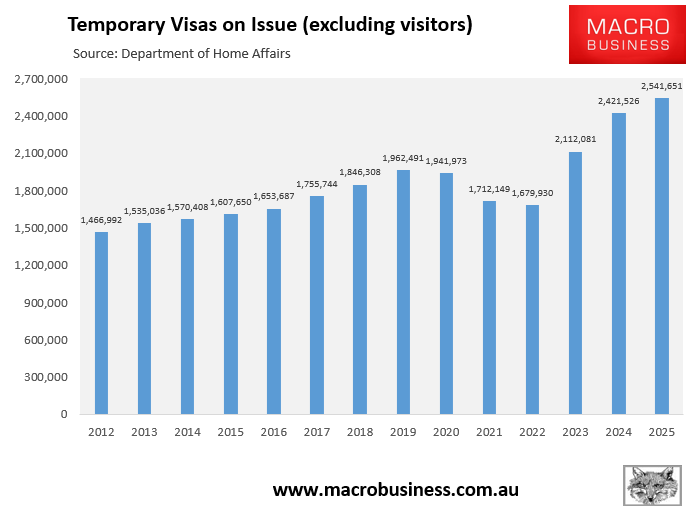

It also saw temporary visa numbers balloon nearly 500,000 higher than the pre-pandemic peak:

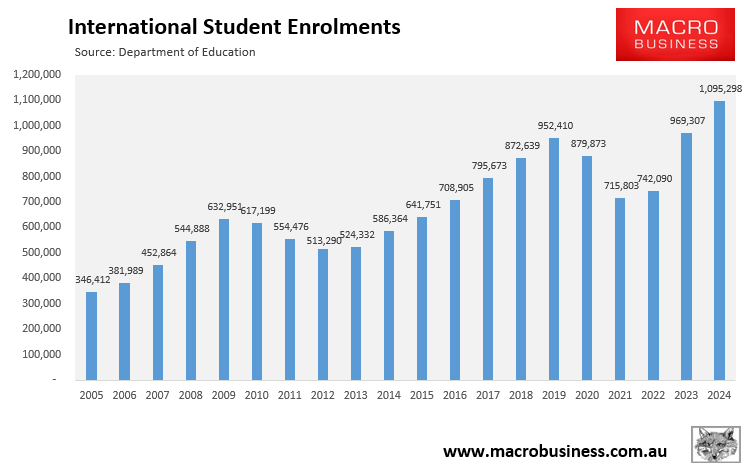

Total international student enrolments also hit a record high of nearly 1.1 million at the end of 2024, nearly 250,000 higher than the pre-pandemic peak.

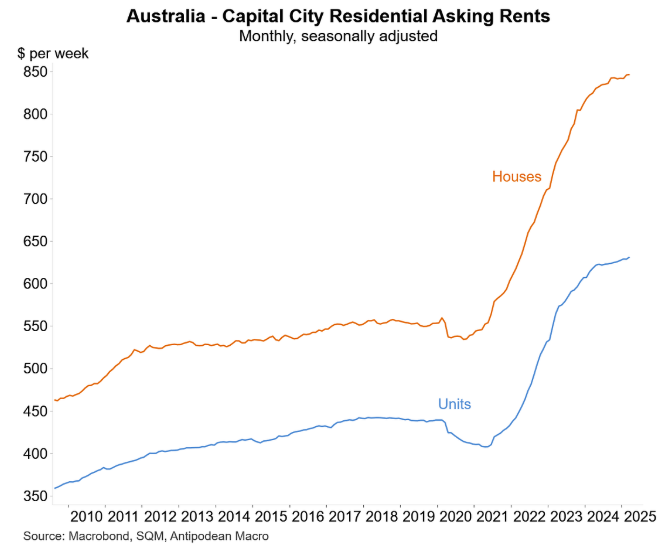

As a result, rents surged as vacancy rates fell to a historic low.

The Albanese government claims that it will bring migration back to “sustainable” levels, in part by stemming the flow of international students into Australia.

However, Indian students and migration agents contradict this view. The following video created by Frank Chung at News.com.au shows various students and migration agents celebrating Labor’s election victory as a green light to immigration.

It also shows Labor MP Andrew Charlton dancing and celebrating with Indian Labor supporters. Last year, Charlton also endorsed the Hindu festival of Diwali being recognised as a public holiday in Australia.

“It’s big, big news for all international students, which means more chances, more work rights, better support are on the way”, one man said in a viral clip shared on Twitter (X).

“So if you are planning to stay or study in Australia, this is your moment, OK? Just tighten your seatbelts and consider Australia for your future. Congratulations”.

“No more $5000 international student visa fees, no more international student visa cut each year, no more international student visa issues”, another man said. “It’s great news for everybody”.

The Indian community and migration agents know that the Albanese Labor government is a soft touch on immigration.