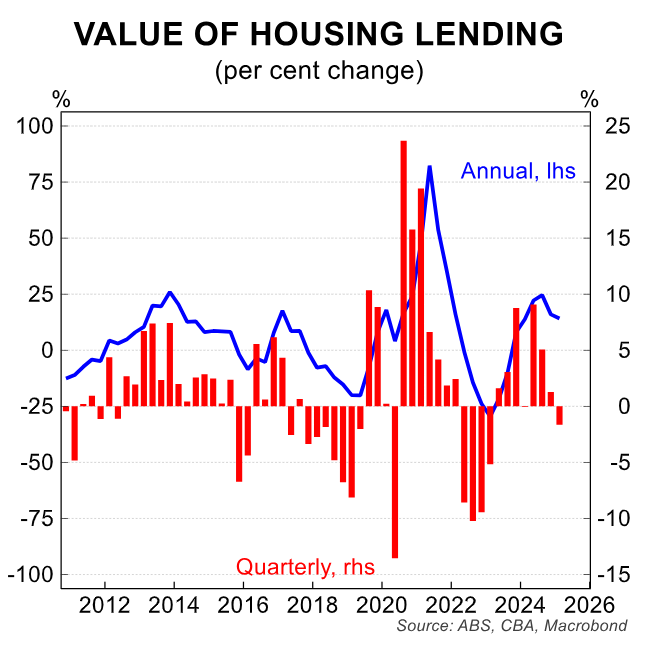

The Australian Bureau of Statistics (ABS) released housing finance data for Q1 2025 showing that the value of new housing lending declined by 1.6% in Q1, taking the rate of annual growth down to 14.2%.

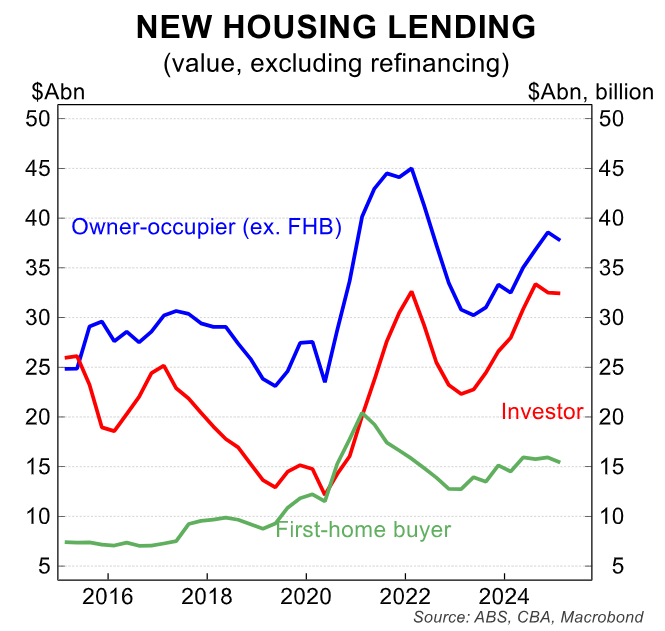

This was the first quarterly decrease since Q1 23, driven by a fall in lending to owner occupiers (-2.6%/qtr) and investors (-0.3%/qtr), with first home buyer lending also declining by 3.2%/qtr.

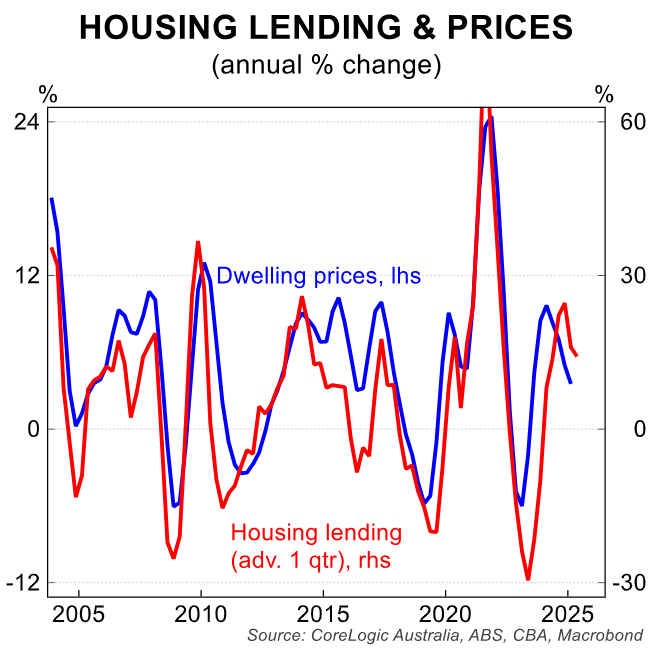

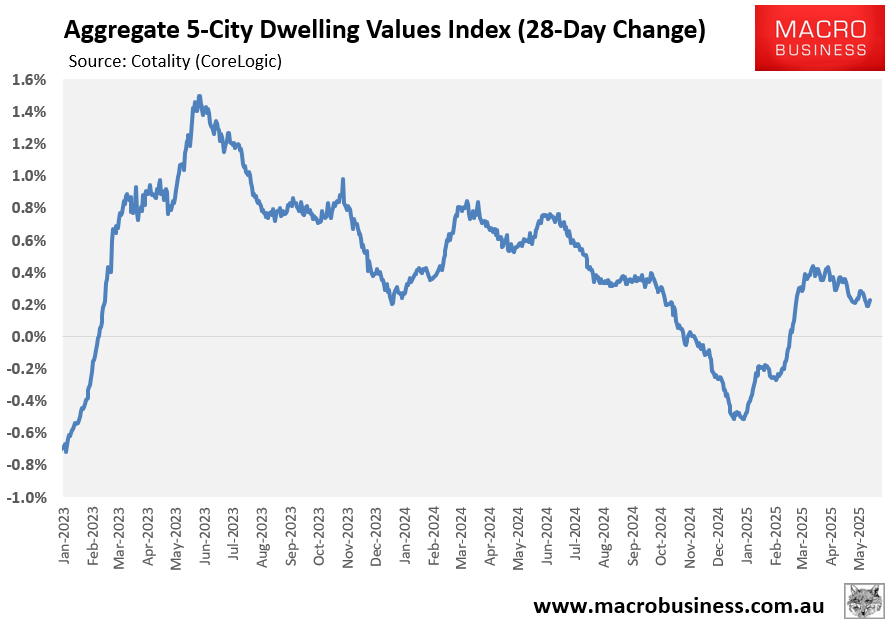

As illustrated below by CBA, the slowing of mortgage lending is being reflected in prices, where growth has also moderated.

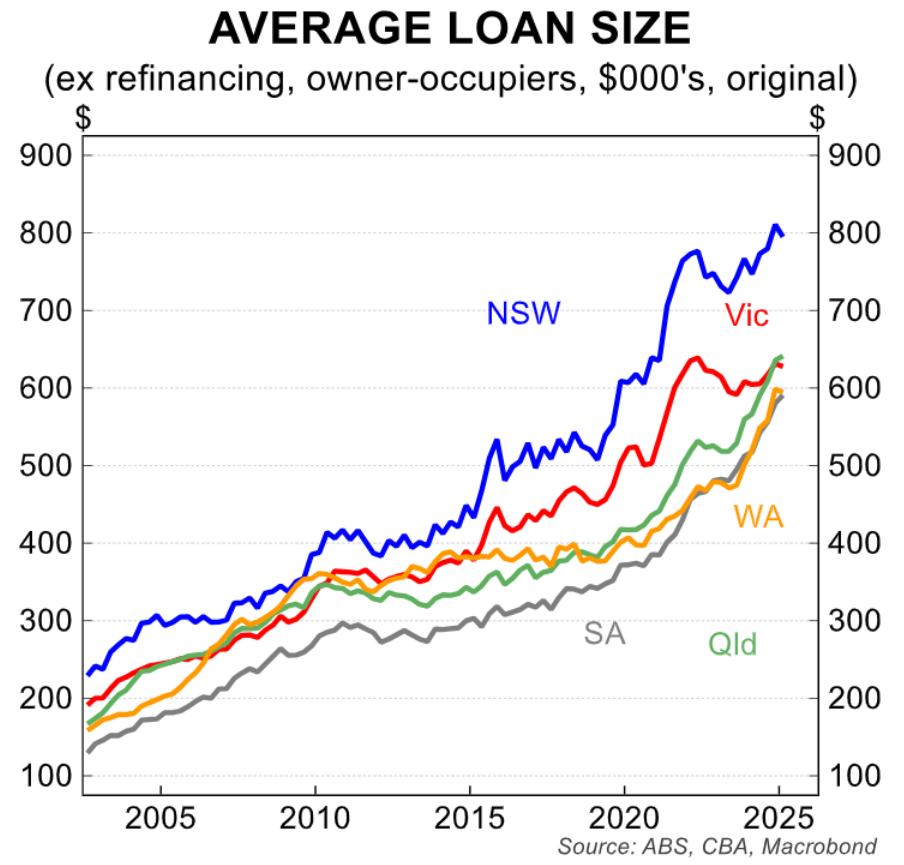

As a result, average loan sizes declined from their Q4 2024 peak.

The latest data from Cotality’s (formerly CoreLogic’s) daily dwelling values index shows that the rate of growth across the 5-city aggregate has halved from the recent peak in March following the RBA’s February interest rate cut.

Westpac noted that Australia’s housing upturn has “lost much of its momentum”:

“Overall, the picture in early 2025 is of a housing upturn that has lost considerable momentum”.

“While the RBA’s February rate cut generated some positive response, particularly in the softer Sydney and Melbourne markets, turnover has been soft with moderating price growth in the previously strong ‘middle-sized’ capital cities of Brisbane, Adelaide, and Perth also a prominent feature”.

“The weakness in construction related loans is also of note, suggesting the lift in dwelling approvals in recent months is likely to fade”.

“All up, the picture is of a housing upturn that has lost much of its momentum and a sector that may continue to lack direction near term”.

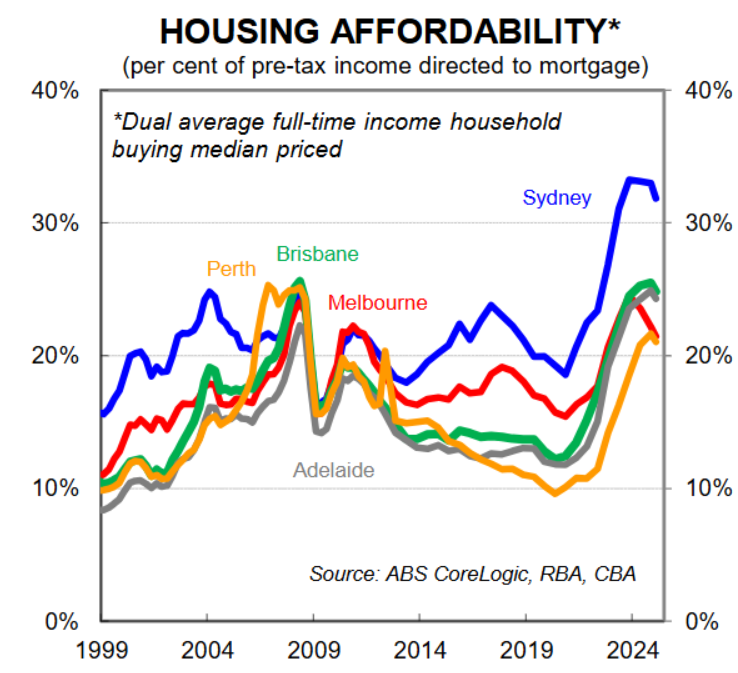

One of the major barriers working against an upturn is Australia’s poor housing affordability, illustrated below by CBA:

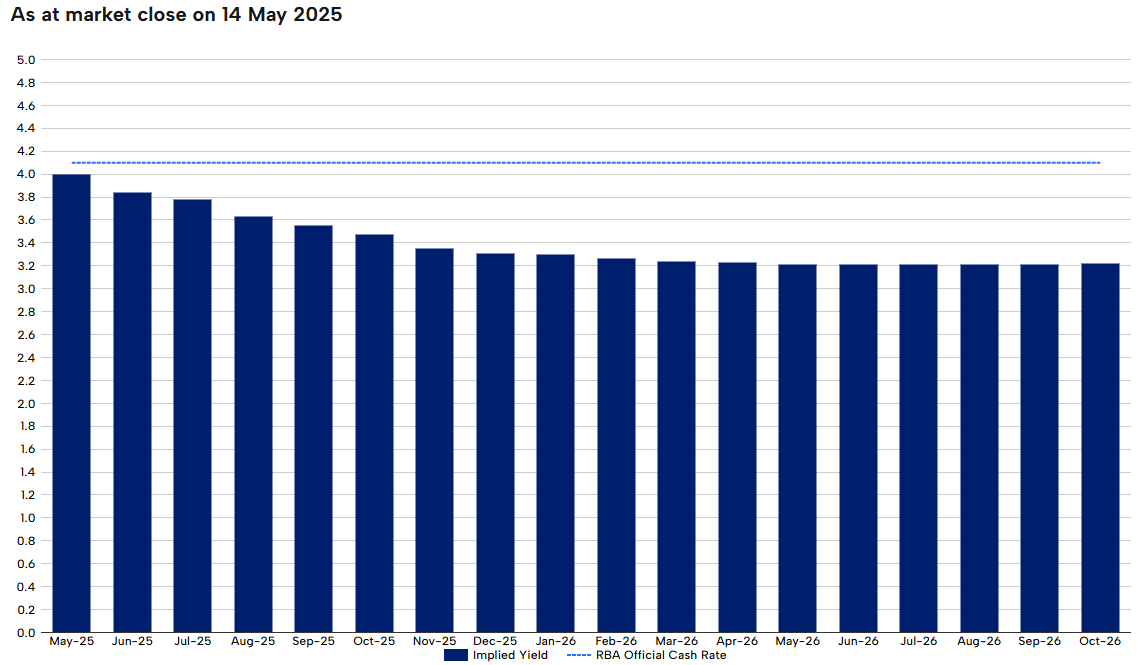

Financial markets are now tipping three more rate cuts this year, which will improve mortgage affordability and capacity to pay, providing stimulus to prices.

Labor’s 5% deposit scheme for all first home buyers will then kick off on 1 January 2026, further stimulating the housing market.