The following chart from Alex Joiner from IFM Investors shows how average Australian mortgage sizes have chased home prices higher.

There is an element of ‘chicken and egg’ on display here. Higher home prices require borrowers to take out larger mortgages, whereas people taking out bigger mortgages bid prices higher.

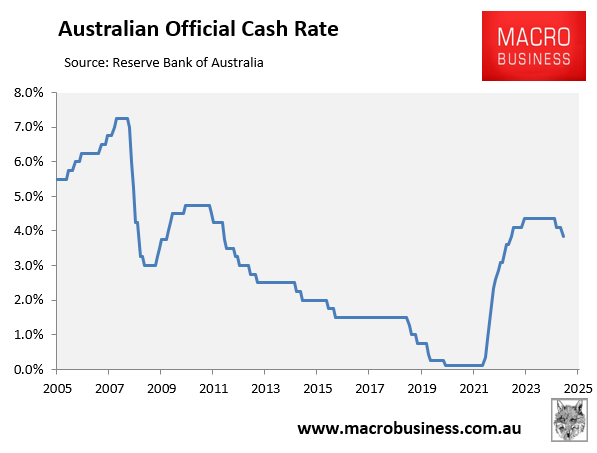

Higher home prices combined with bigger mortgages explain why scheduled mortgage repayments are tracking at a record high relative to incomes even though the official cash rate is well below the 2007-08 peak and the amount spent on interest is lower.

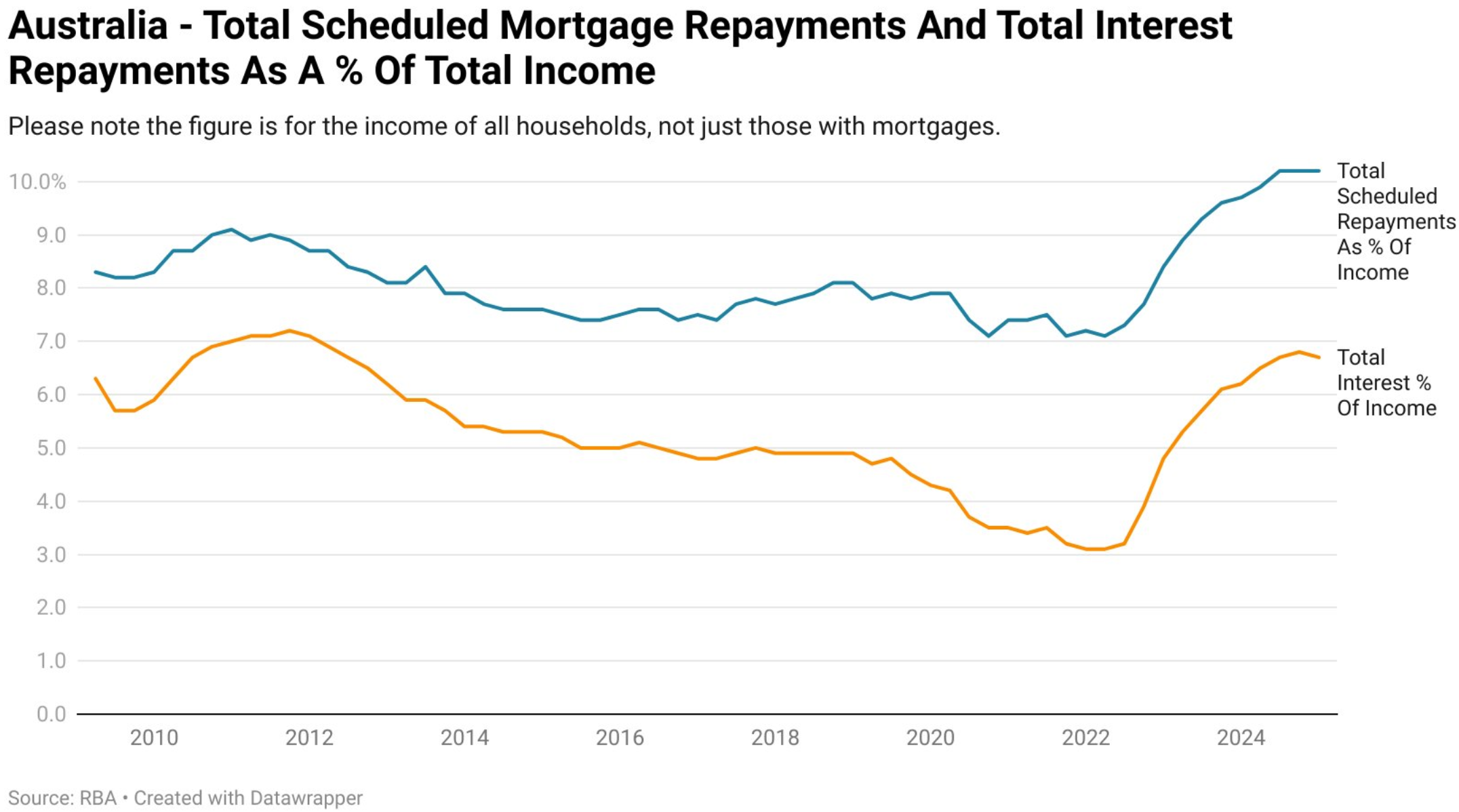

The following chart from independent economist Tarric Brooker paints the picture:

“Australian mortgage repayments as a proportion of total aggregate household income are at an all time high”, Brooker wrote on Twitter (X).

“However, the proportion of income dedicated to interest repayments is still below 2011 levels”.

“In short, lower rates, but larger debts and higher principal repayments”.

Brooker’s chart uses RBA data up to Q1 2025 and therefore captures only the RBA’s first 0.25% rate cut in February.

Total scheduled repayments to household disposable income were an equal record high of 10.2% in Q1 2025, above the Q4 2010 peak of 9.1%.

However, mortgage interest repayments as a share of household income were 6.7% in Q1 2025, below the peak of 7.2% in Q3 2011.

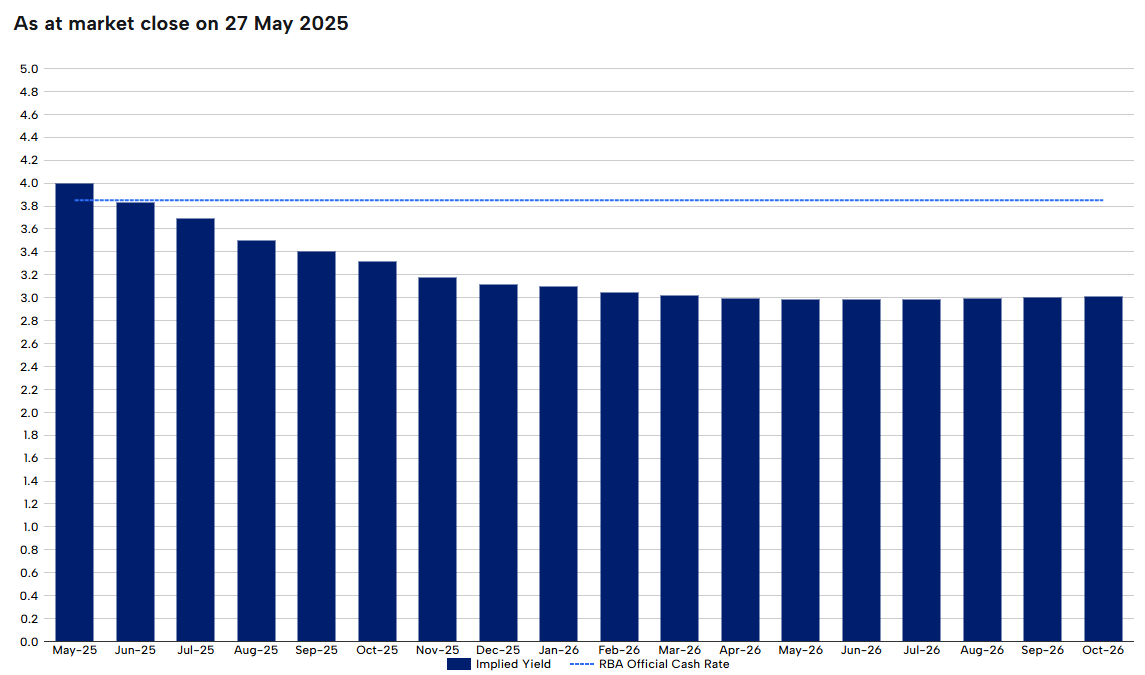

The RBA cut the official cash rate by 0.25% last week. The futures market also expects the RBA to cut rates a further three times in 2025, to 3.10% at year’s end.

These cuts, assuming they come to fruition, will significantly reduce the share of income spent on interest and overall mortgage repayments.

The longer-term worry is that lower interest rates and the federal government’s stimulatory policies (e.g., 5% deposits for first home buyers) are capitalised into bigger mortgages, higher prices, and larger principal repayments. That is, an extrapolation of Alex Joiner’s first chart above.

This is why demand-side stimulus always ends up being self-defeating from a housing affordability perspective.