Cotality (formerly CoreLogic) has published its daily dwelling value index for 31 May, which covers Australia’s five major city housing markets.

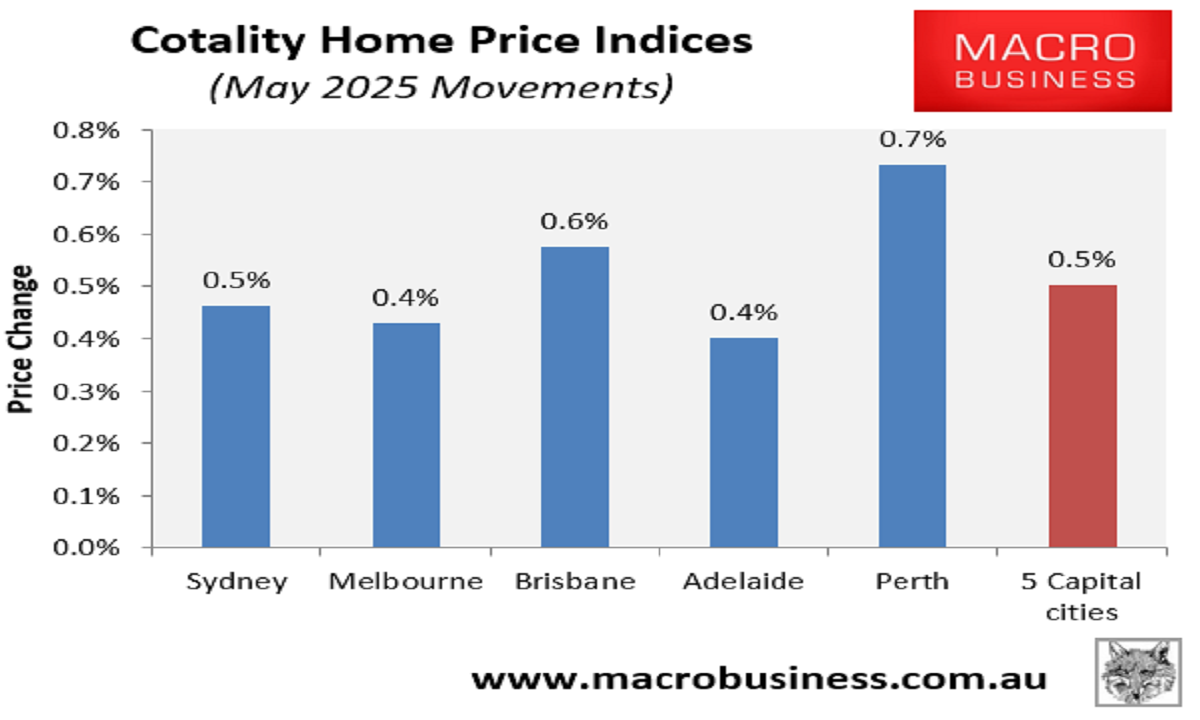

Dwelling values rose by 0.5% in May at the aggregate 5-city level, with all major markets recording solid increases:

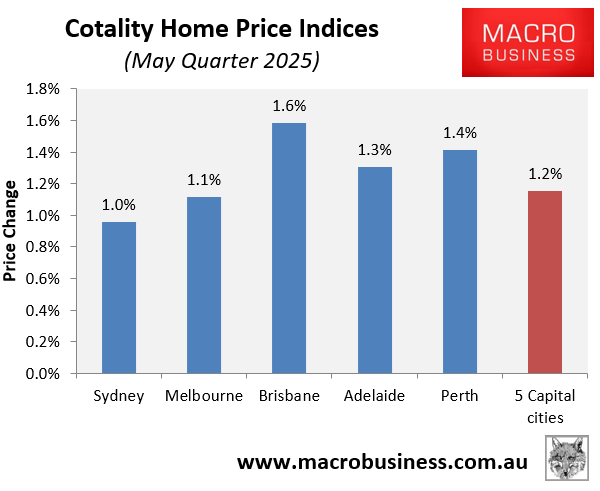

Over the May quarter, dwelling values rose by 1.2%, with Brisbane (1.6%) leading the way, followed by Perth (1.4%) and Adelaide (1.3%). Melbourne (1.1%) and Sydney (1.0%) recorded slower growth:

While the quarterly pace of growth remained modest at 1.2%, prices have accelerated.

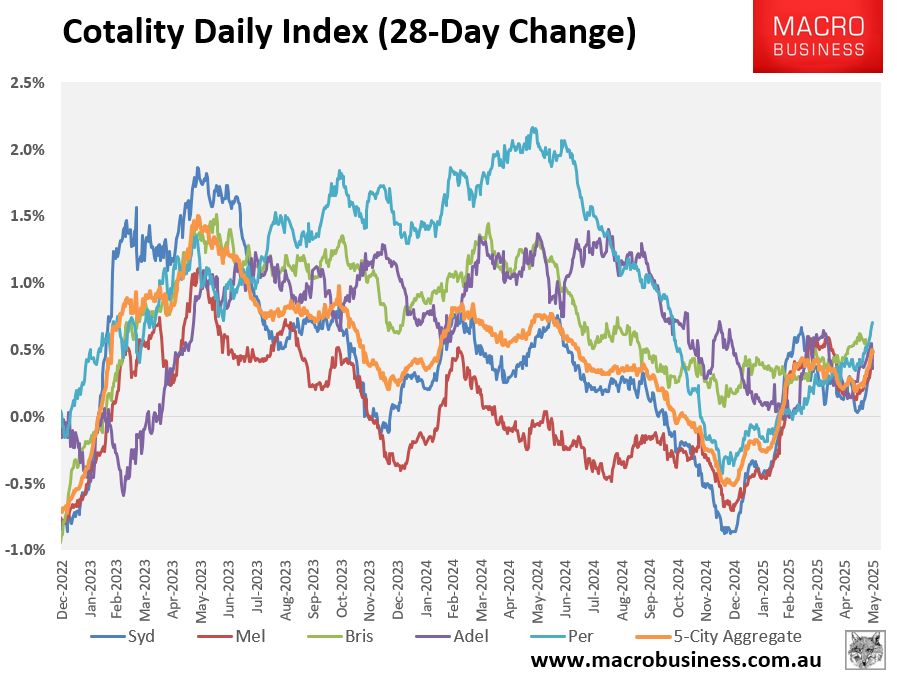

The following chart plots Cotality’s daily dwelling values index on a rolling 28-day basis. You can see the sharp acceleration in growth across the various markets in May in anticipation of the RBA’s 0.25% rate cut:

The rebound in dwelling value growth is especially obvious when we focus on Sydney and Melbourne:

The price rebound has been matched in the auction market, which has recorded its highest clearance rate since mid-2024 across the combined capital cities:

As shown above, auction clearance rates typically mirror price growth.

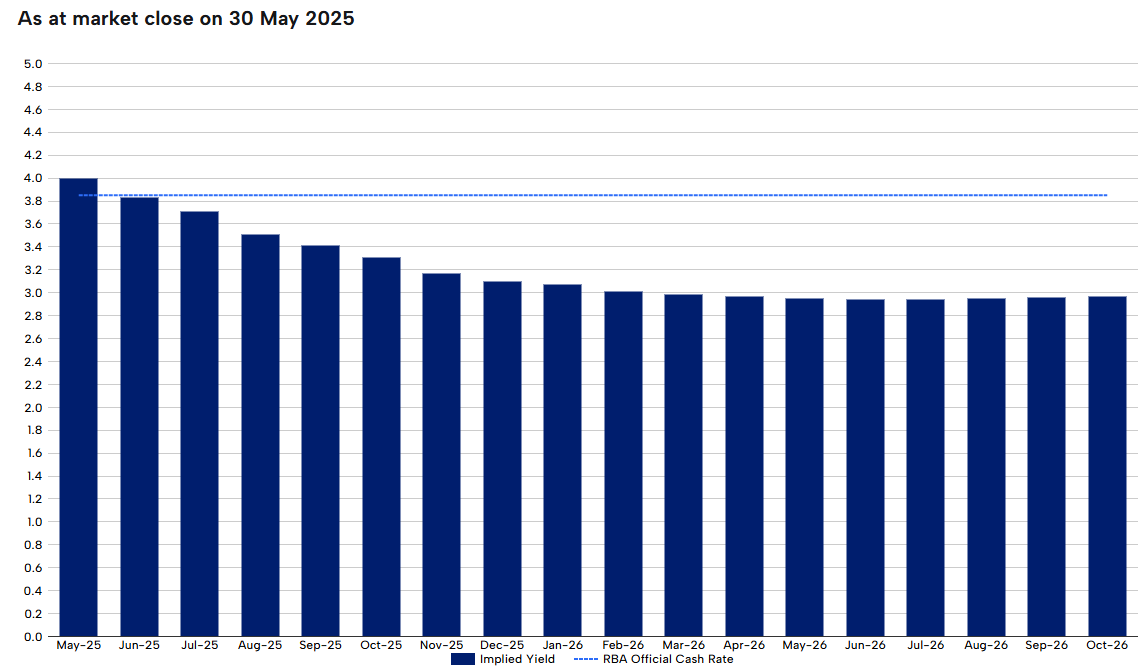

The latest pricing from the futures market tips another three 0.25% rate cuts this year, which would lower the official cash rate to 3.10%.

If these rate cuts come to fruition, they would stimulate buyer demand and propel home prices higher.

The Albanese government’s 5% deposit scheme for first home buyers is then scheduled to take effect from 1 January 2026, which will further lift demand and prices.

Interest rate cuts and Labor’s 5% deposit scheme for first home buyers will ignite another upswing in Australian home prices.