A better superannuation solution

Australia’s superannuation system is too costly and inequitable.

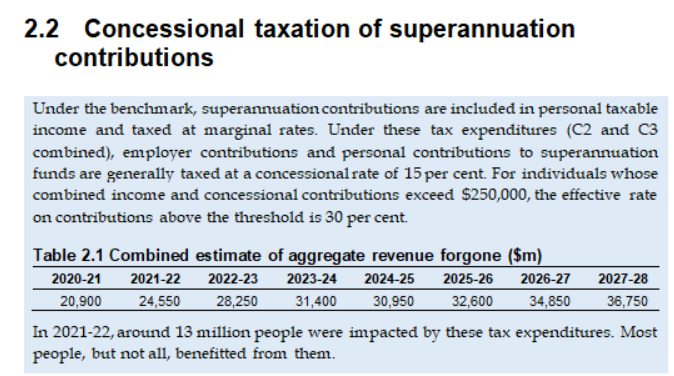

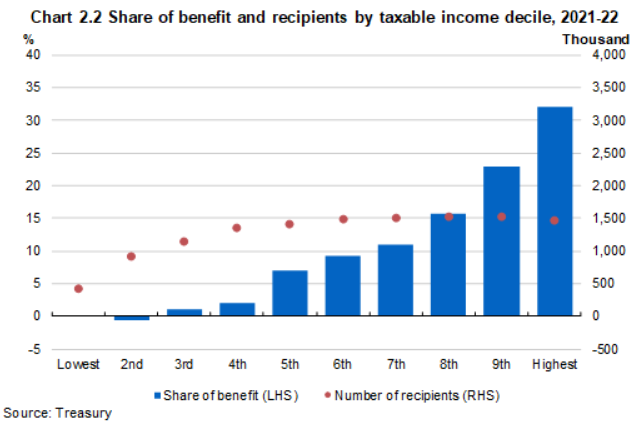

The Australian Treasury estimated total superannuation tax expenditures at around $60 billion in 2024–25, with contribution concessions being the most expensive at $37 billion, growing to $36,750 billion by 2027–28.

Most of these concessions go to high-income earners, as illustrated below.

In 2021-22, 91% of the benefit went to people with above median income, and 32% of the benefit went to people in the top income decile”, noted the Treasury.

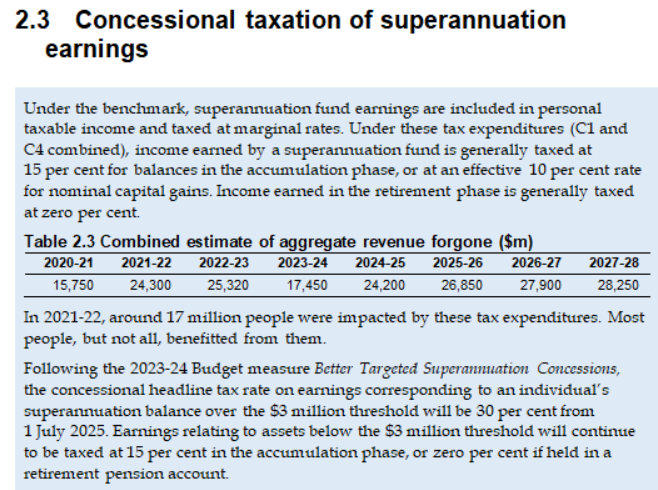

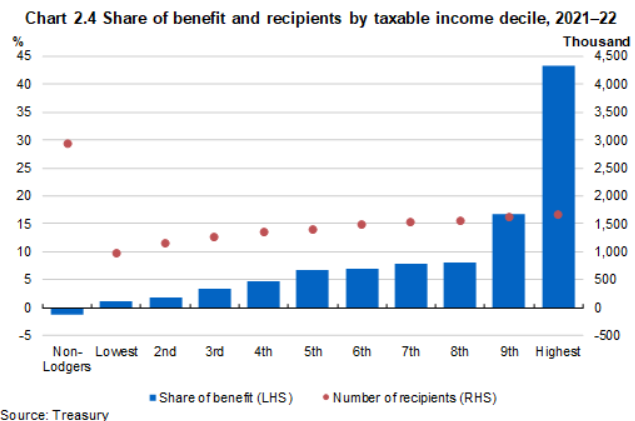

Superannuation tax expenditures related to the concessional taxation of earnings were also estimated at $24,200 billion in 2024–25, rising to $28,250 billion in 2027–28.

These concessions also overwhelmingly flow to high-income earners.

“In 2021–22, people with above-median income received 83% of the benefit from the concessional taxation of superannuation earnings, with those in the top taxable income decile received 43% of the benefit”, noted the Treasury.

Amid the growing cost and inequity of the superannuation system, the Albanese government proposes taxing people on their unrealised gains from any assets held in their superannuation accounts, beginning with those with a balance of $3 million or more and without indexation.

This proposal has been met with stiff opposition from industry superannuation funds, self-managed funds, investors, business leaders, and even former trade unionists.

The most noteworthy pushback has come from former RBA governor Philip Lowe and former Treasury secretary Ken Henry.

Lowe suggested that Labor should reconsider the policy.

“I am a supporter of good public policy design, but I am not convinced this is an example of it”, Lowe told The Australian.

“We should be exploring other ways to adjust the concessional tax rates on high super balances”.

Ken Henry questioned why Labor did not adopt the 2010 Henry Tax Review’s recommendations to make the super system fairer and more sustainable.

“It’s understandable the government would want a more equitable tax treatment of superannuation but to do that you do not need to tax unrealised capital gains”, Henry said.

“There are other options and these are outlined in our review from 15 years ago”.

The Australian’s Robert Gottliebsen suggested that instead of taxing unrealised gains, Labor should go back to the original plan of Treasurer Jim Chalmers of simply doubling the tax on income derived from superannuation balances above $3 million.

“The Treasurer, the cabinet and the caucus can still become ALP and community heroes if they go back to the original Chalmers plan—a 30% tax on the income derived from superannuation balances above $3 million—double the current 15% rate on all funds”, Gottliebsen wrote.

“The second 15% tax would be taxed in exactly the same way as the first 15% tax, which would continue to apply to all superannuation members”.

Gottliebsen argued that most young and middle-aged Australians who aspire to success would likely accept that tax as fair.

Gottliebsen’s alternative is simple, fair, and would improve the sustainability of the superannuation system and federal budget.

Another alternative is to adopt the recommendation from the Henry Tax Review to replace the 15% flat tax on superannuation contributions and earnings with a flat 15% deduction from one’s marginal tax rate.

If a superannuant’s income were $220,000, then for every $1 contributed, the superannuant would be taxed at their marginal tax rate (47%) less 15%, giving them a superannuation contributions tax of 32%.

If a poorer superannuant earning $30,000 contributed, they would be taxed at their marginal tax rate (18%) less 15%, giving them a superannuation contributions tax of just 3%.

This simple policy change would make superannuation taxes progressive and more equitable, saving the federal budget billions in lost revenue.

Regardless, the Albanese government should dump its proposed unrealised superannuation tax and replace it with a simple alternative, like the abovementioned options.