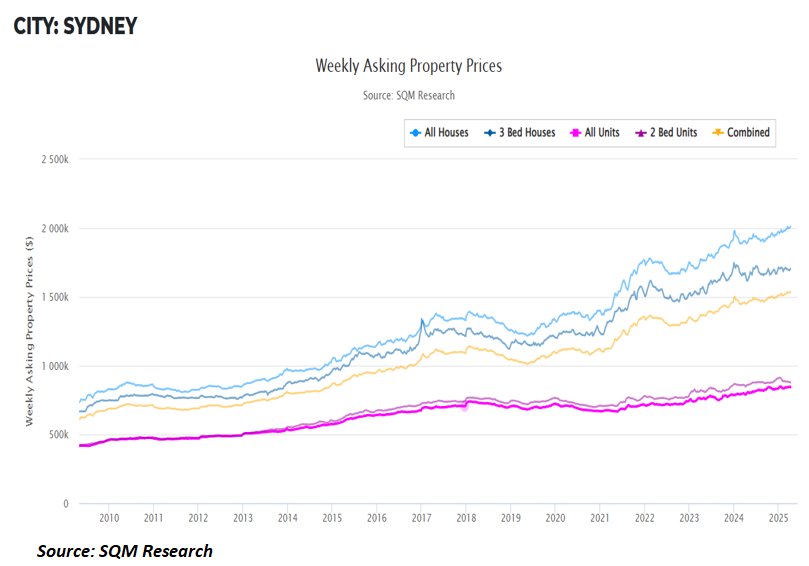

According to SQM Research, Sydney’s median asking price for houses crossed over $2 million for the first time last week, hitting $2,012,000 on 15 April.

SQM Research managing director Louis Christopher confirmed on Twitter (X) that the median asking price incorporates Greater Sydney, including the Blue Mountains and Central Coast.

SQM Research’s methodology paper notes that it “tracks the vendor’s expectations of asking prices”, which has proven “to be an accurate leading indicator of the direction in which house prices are likely to move, going forward”.

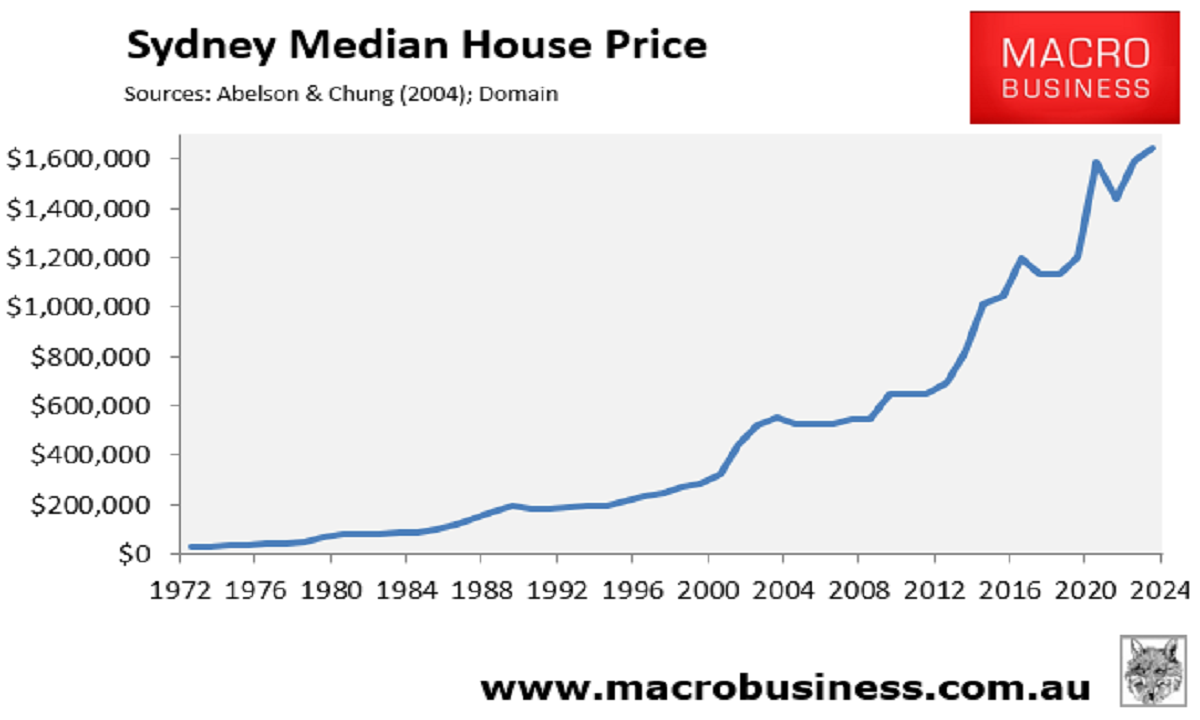

According to Domain, the actual median sold price for Sydney houses was a record $1,645,400 in Q4 2024.

Given the rise in asking prices this year, Sydney’s median house price should continue to rise to new heights.

A perfect storm is brewing for Sydney home values.

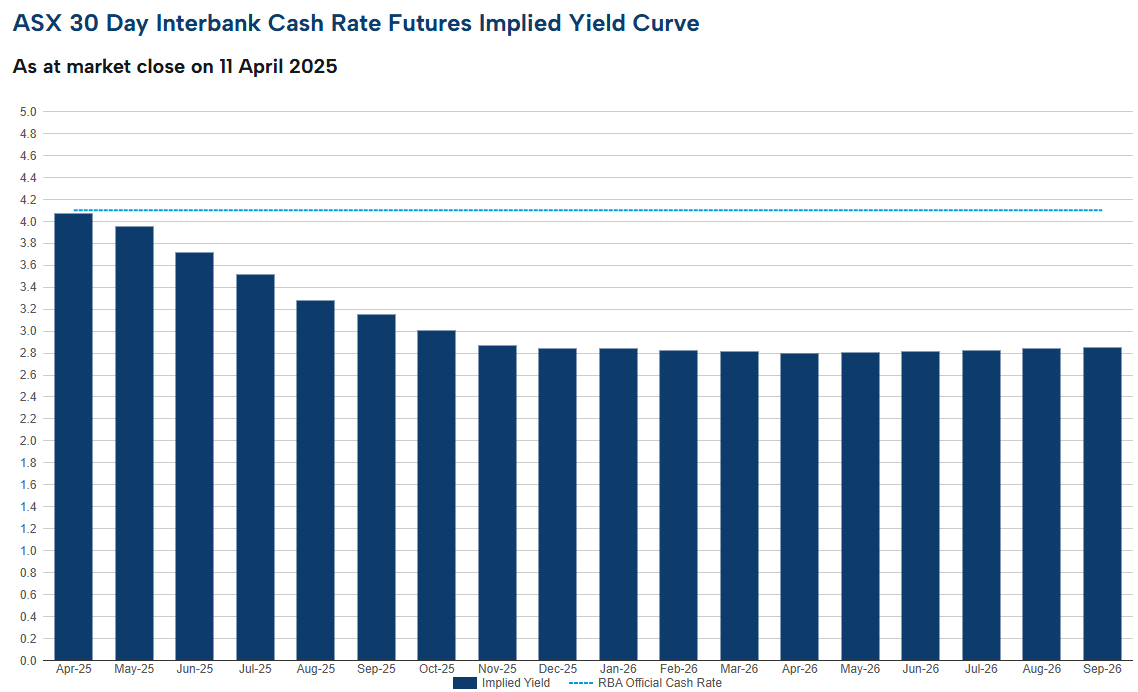

Financial markets are tipping five more rate cuts from the RBA this year, which would take the official cash rate down to 2.85% by year’s end.

The Albanese government, if reelected, has also promised to pour a bucket of mortgage fuel on the housing bonfire via its universal 5% housing deposit guarantee for first home buyers.

Under Labor’s policy, every first home buyer will be eligible to purchase a home with only a 5% deposit from 1 January 2026. The government will guarantee up to 15% of the loan value, thereby eliminating the need for lenders’ mortgage insurance, which currently costs the average purchaser around $23,000.

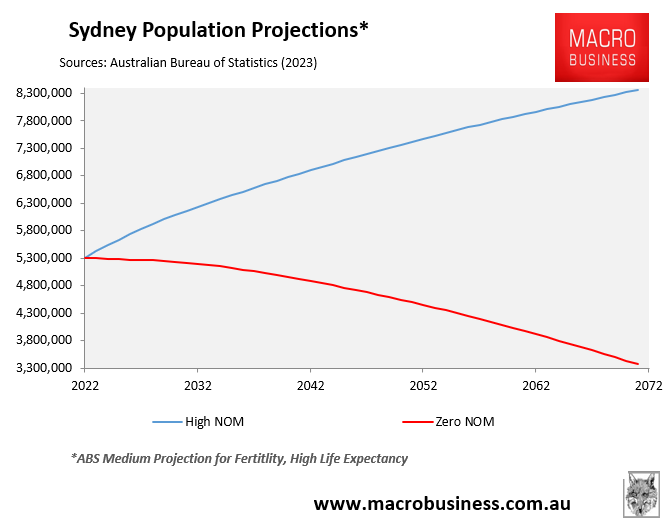

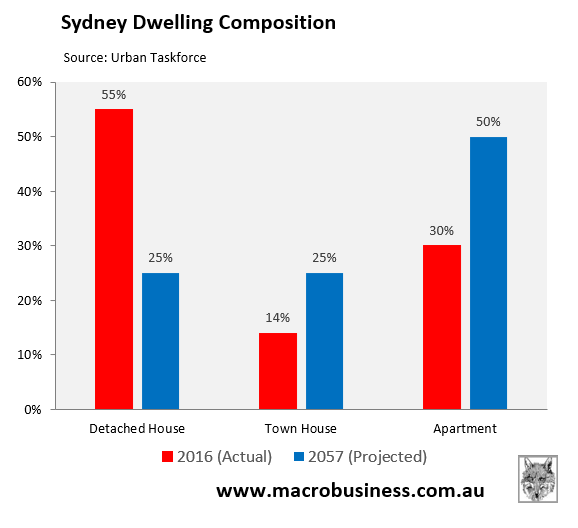

Longer-term projections indicate that Sydney’s population will surpass 8 million by the 2060s due to high net overseas migration.

As Sydney densifies to accommodate its ballooning population, single detached housing will become increasingly scarce, replaced by apartments, which will drive up its value.

In short, asinine government policy will continue to drive Sydney home prices higher, wrecking affordability and liveability.

Young Sydneysiders will continue to leave the city, replaced by endless waves of overseas migrants.