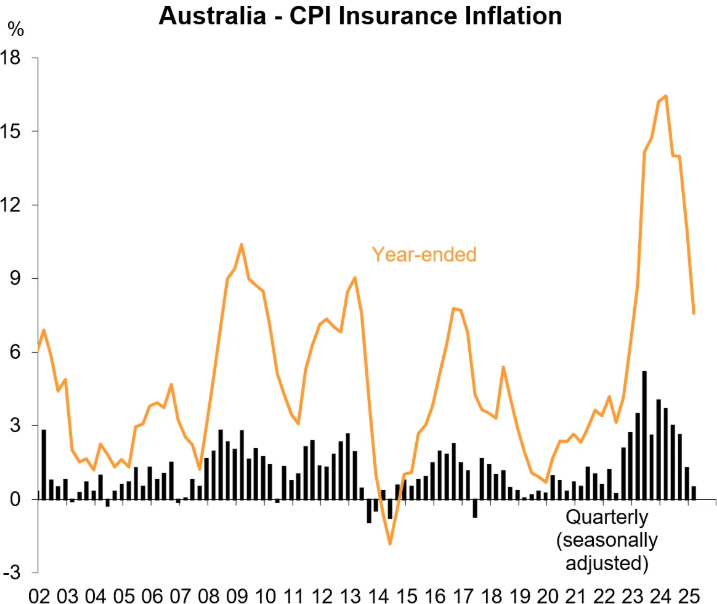

The Climate Council claims that Australians are paying $30 billion more on insurance than they were a decade ago, while premiums have risen at more than twice the average rate of inflation over that time.

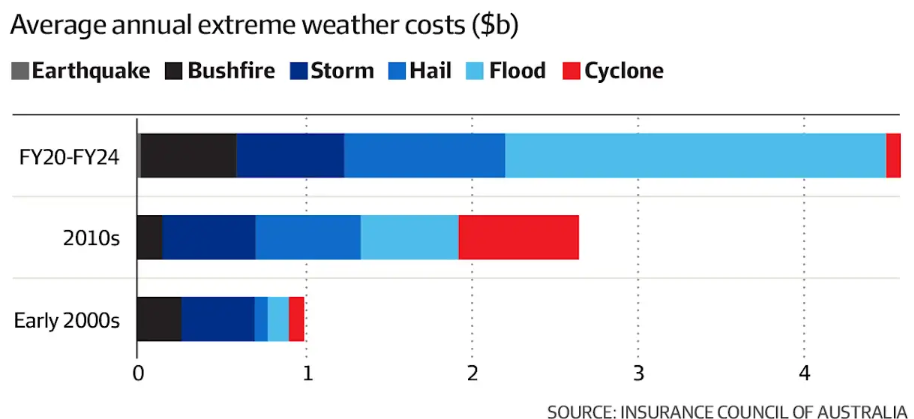

Insurance companies have incurred losses averaging $4.5 billion a year over the past five years due to extreme weather events, which is a 67% increase compared to previous years, with around half of the payouts resulting from flood damage.

The Insurance Council of Australia stated in a recent report that 225,000 Australian homes face a 2% to 5% chance of flooding each year, but only 23% of those homes have flood coverage, compared to 60% across the country.

The Actuaries Institute also estimates that 12% of households are facing insurance affordability stress, which is defined as when home insurance premiums exceed four week’s income.

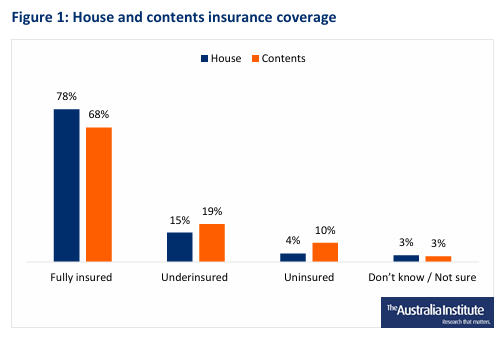

The above claims align with recent research from The Australia Institute (TAI), which showed that 1 in 5 Australian homes are either uninsured (4%) or underinsured (15%).

TAI warned that struggling, uninsured families would lose three-quarters of their wealth if their home were destroyed.

The following chart from Justin Fabo from Antipodean Macro shows that insurance premiums have soared, although the rate of inflation has eased:

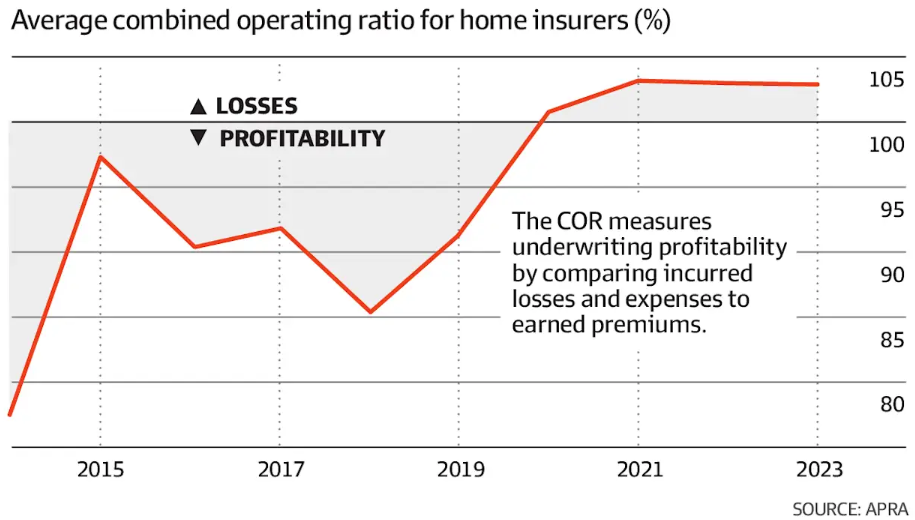

However, despite the strong rise in premiums, Australian insurers have made underwriting losses on home insurance policies across the market.

Rising insurance premiums have been a notable contributor to Australia’s cost-of-living crisis. They have also placed upward pressure on CPI inflation.