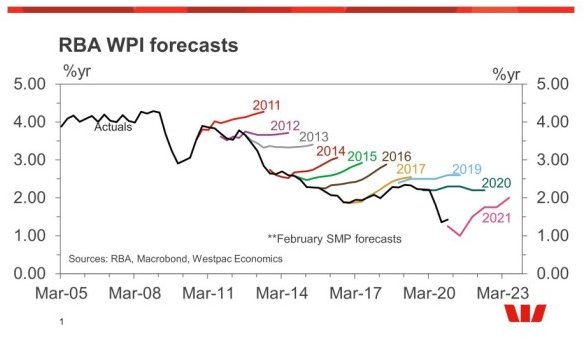

The Reserve Bank of Australia (RBA) is famously bad at forecasting Australian wage growth.

For the past 15 years, the RBA’s Statement of Monetary Policy (SoMP) has routinely forecast stronger wage growth than has occurred.

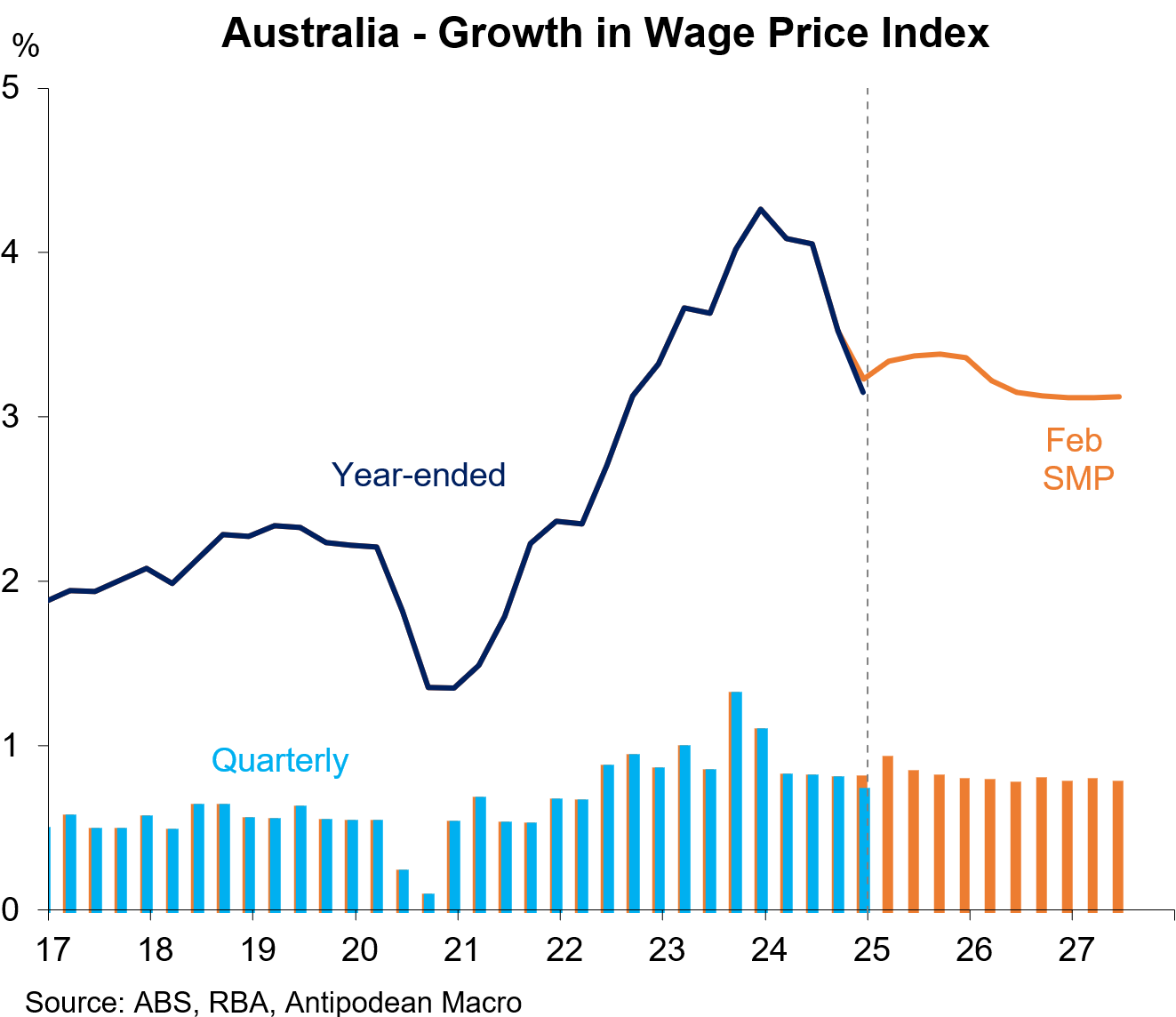

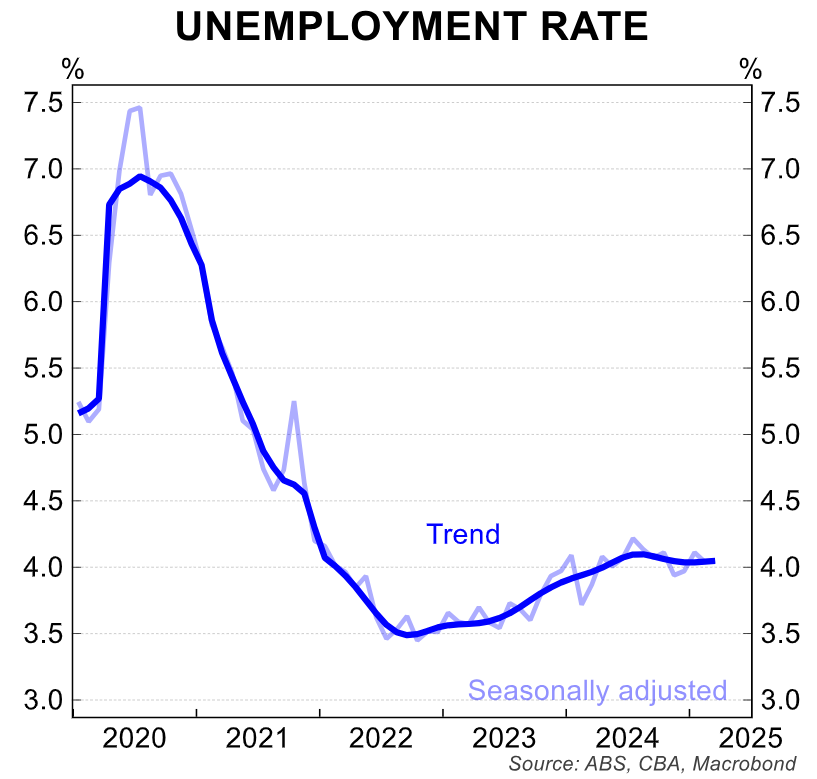

The RBA continues to make the same mistakes, with Australian wage growth falling more than projected despite the nation’s low trend unemployment rate of 4.0%.

The RBA remains overly optimistic about wage growth partly because its “non-accelerating-inflation rate of unemployment,” or NAIRU, is too high at 4.5%.

The NAIRU, or “full employment”, is the highest level of employment that is consistent with keeping inflation within the RBA’s 2% to 3% target.

As a result, with a trend unemployment rate of 4.0%, wage growth should be increasing rather than falling.

In his latest note on last week’s March labour force release from the Australian Bureau of Statistics (ABS), CBA’s head of Australian economics, Gareth Aird, argued that the “NAIRU is likely to be ~4.0% (i.e. essentially the current level of the unemployment rate)”.

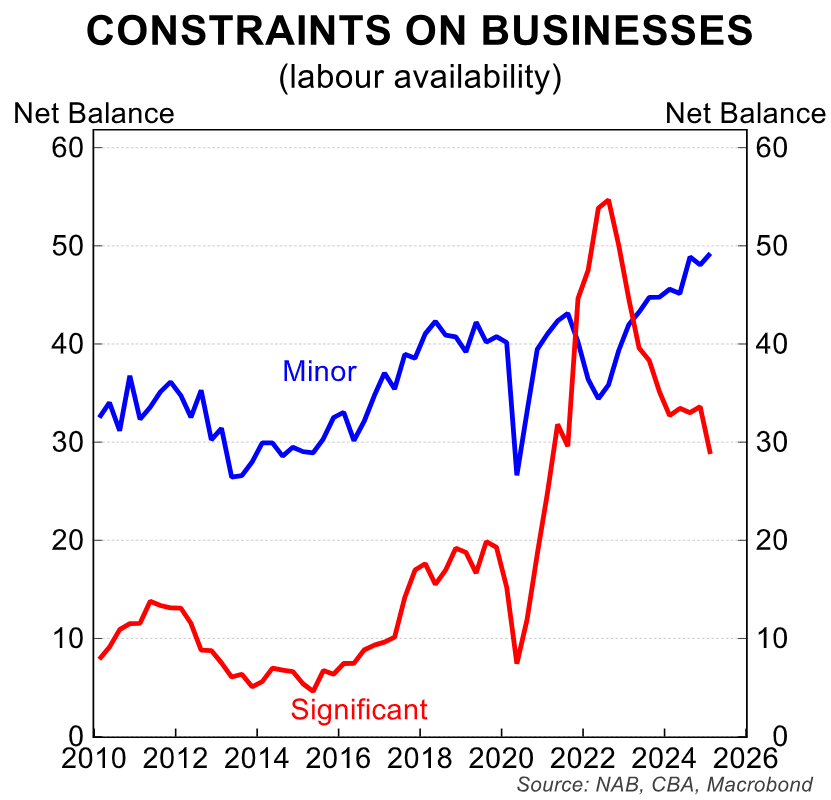

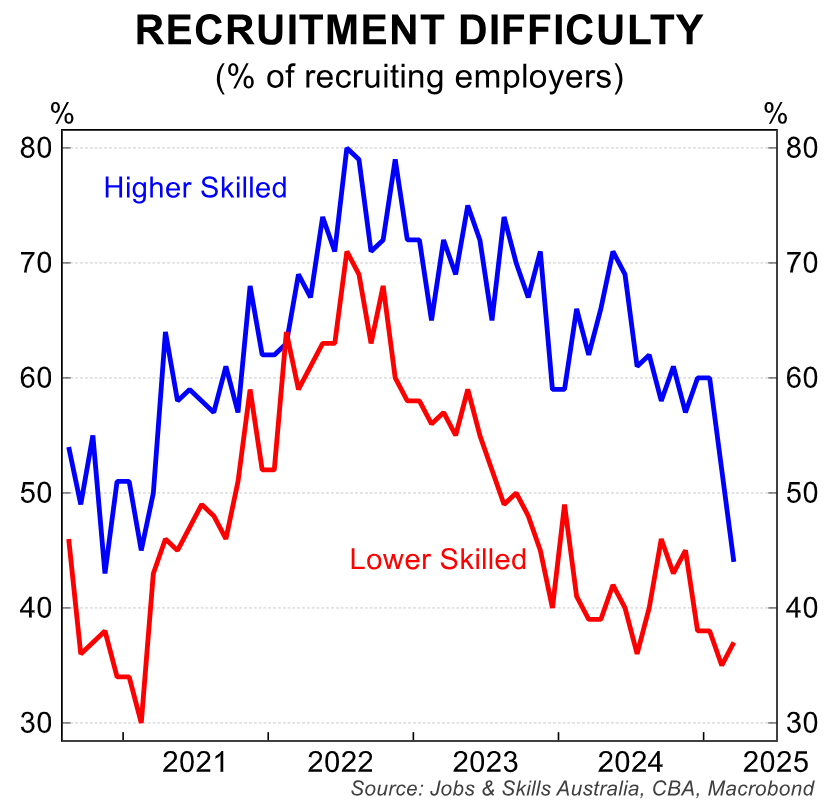

Aird points to other measures suggesting that the labour market is softening despite the reported 4.0% trend unemployment rate. These include the Q1 25 quarterly NAB business survey, released on Thursday, which “indicates labour as a significant constraint on output fell notably in the quarter”.

“This outcome isconsistent with slowing private sector wages growth”, Aird noted.

Moreover, while the level of labour as a significant constraint on output “is still comfortably above the five-year pre-pandemic period”, Aird notes that “wages growth was simply too low over that period and unemployment was too high. Inflation was below the RBA’s target band”.

“If we are correct on our estimate of NAIRU, then Australia will be able to run a lower unemployment rate than is currently assumed by the RBA, that is consistent with inflation sustainability around the mid-point of the target band”, Aird argued.

“Ultimately, inflation and wages outcomes from here will help to settle the conjecture around what level of unemployment Australia can run that is consistent with the inflation target”.

The Q1 2025 CPI data will be released on 30 April, followed by the Q1 2025 wage price index on 14 May 2025. Both will arrive before the next monetary policy meeting on 20 May.

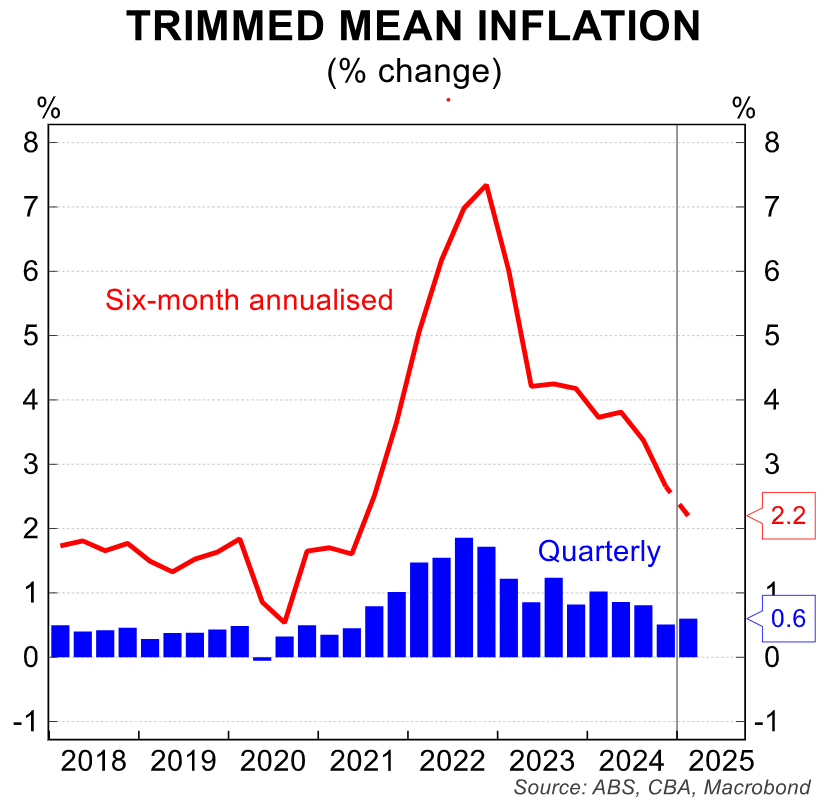

CBA expects Q1 trimmed mean (underlying) inflation to slow to 0.6%, with the six-month annualised rate slowing to 2.2%—well within the RBA’s target band of 2% to 3%.

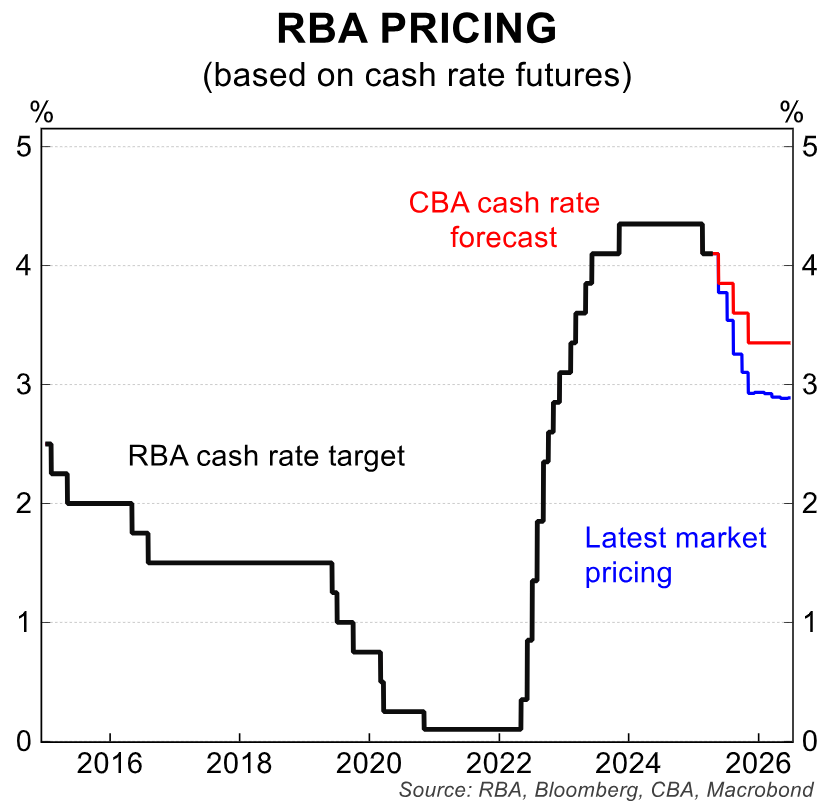

As a result, CBA expects the RBA to cut the official cash rate by 0.25% at its May meeting, followed by two more rate cuts this year.

Financial markets are more dovish, tipping the equivalent of five 0.25% rate cuts by the end of this year.