On Monday, I spoke to Ben Davis on Brisbane Radio 4BC Mornings to unpack the housing policies announced by Labor and the Coalition over the weekend.

I described these as “some of the worst policy making I’ve seen in my 47 years of life”.

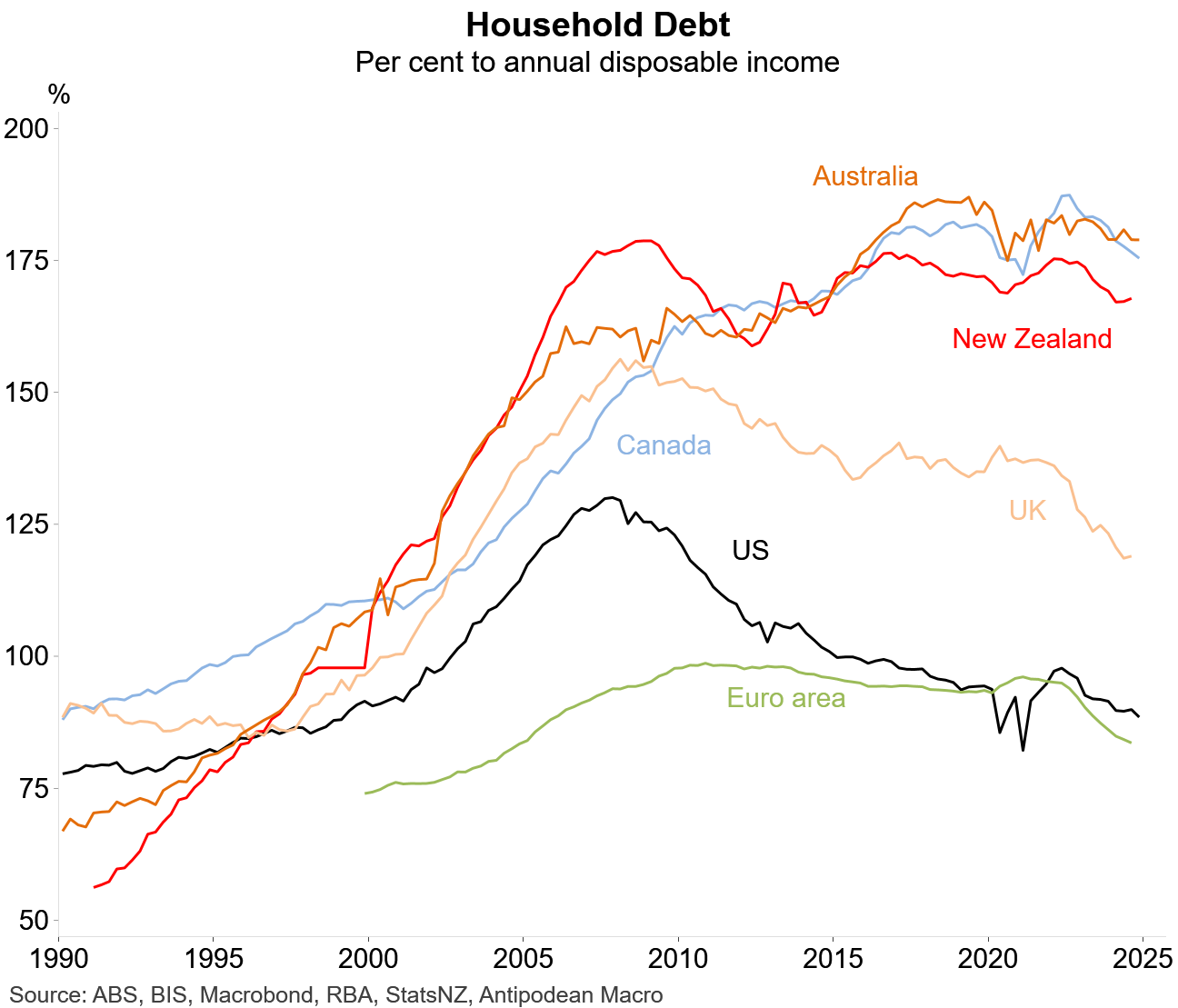

I added that Australian “households are among the most indebted in the world, and we’ve got both sides of government basically pouring fuel on the housing bonfire through these demand-side policies that are just going to send prices higher, and mean that Australians are going to take out larger mortgages and become even more indebted”.

Below are key highlights from the interview.

Edited Transcript:

Both sides’ policies are deplorable. These are some of the worst policies I’ve seen in my 47 years of life.

Australia already has some of the most expensive housing in the world. Our households are among the most indebted in the world. Yet both sides have committed to pouring fuel on the housing bonfire through these demand-side policies that are just going to send prices higher.

Australians are going to take out larger mortgages and become even more indebted. And taxpayers will be on the hook. Both sides are intent on blowing the biggest housing bubble in the world. It is crazy.

First of all, we’ve got the Albanese government, which has effectively announced a state-sponsored subprime mortgage scheme. Labor has promised to allow all first home buyers to purchase a home with only a 5% deposit.

Under the current system, they need a 20% deposit. They can get a lower deposit if they take out lender’s mortgage insurance. But under Labor’s scheme, all first home buyers will be able to buy with a 5% deposit because the government, i.e., taxpayers, will guarantee the other 15%.

Labor’s policy will effectively pull more buyers into the market. This will result in an increase in their borrowing capacity, which in turn will boost demand and drive up house prices.

Labor’s policy will make housing structurally less affordable because prices will go up. We will have more money chasing the same number of homes, which means that prices will go up.

We have seen this play out since the turn of the century, with first home buyer grants and all these other things. Governments have continually introduced demand-side policies and all they’ve ended up doing is pushing prices higher, with Australians taking out bigger mortgage debts.

The housing affordability situation has continued to get worse because prices kept rising further away from incomes.

The Coalition’s policy is a bit different, but it is also equally stupid.

The Coalition wants to make mortgages tax deductible on interest paid on the first $650,000 for first home buyers who purchase new homes.

Under the Coalition’s policy, all first home buyers earning up to $175,000 for a single or $250,000 if you’re a couple will be able to effectively negatively gear their owner occupied new home purchase.

The Coalition’s policy is better than Labor’s in one respect: it only applies to new homes. So it should at least boost supply a bit.

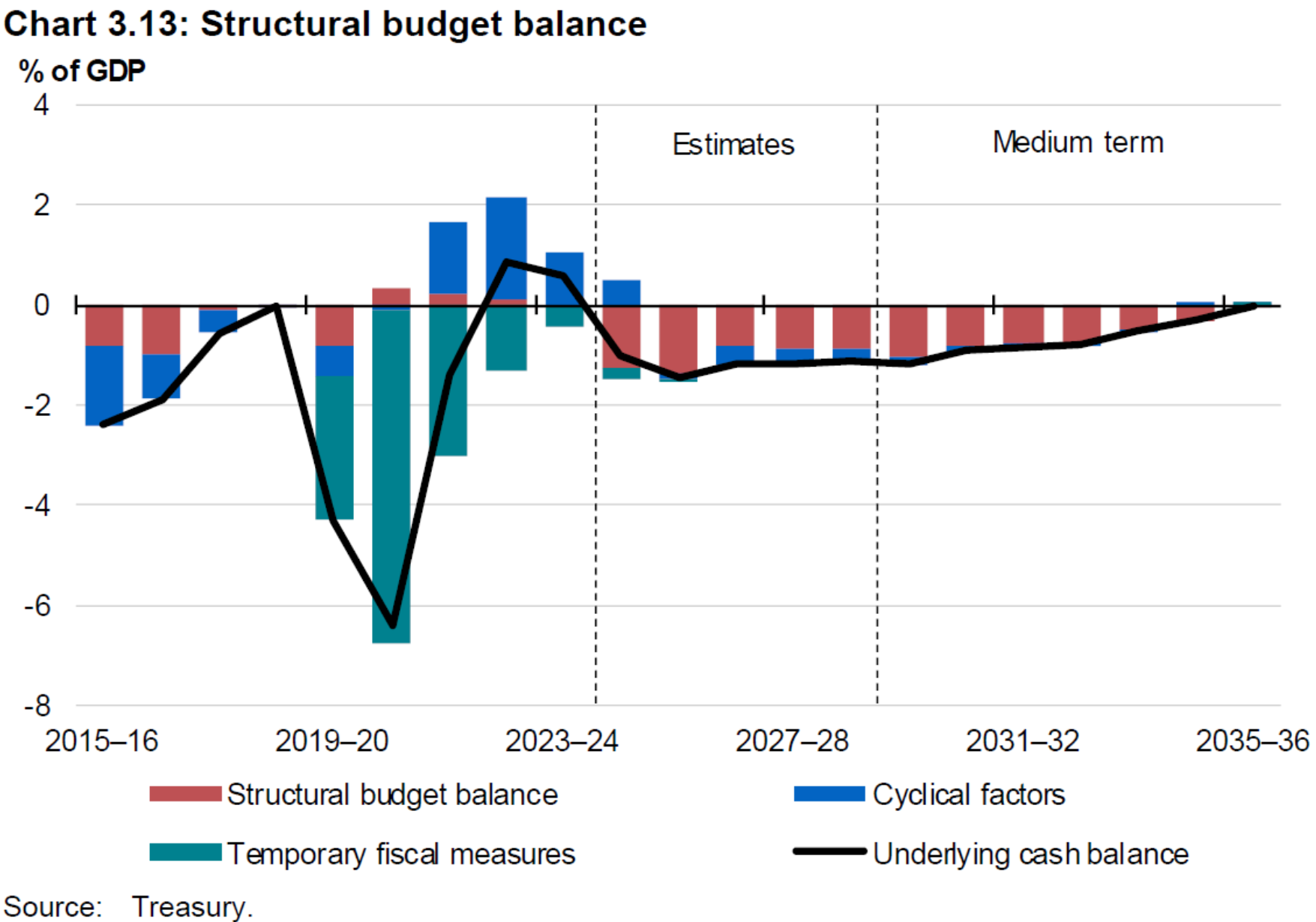

But the Coalition’s policy is worse from a budget sustainability perspective because the federal budget is projected to be in deficit for the next decade.

The Coalition’s policy is effectively going to strip more tax revenue out of the system, and it is going to mean that Australia runs a bigger budget deficit.

It is also regressive and inequitable because the more that you earn, the bigger your tax break. It will hand out bigger tax breaks to higher-income earners.

The Coalition estimated that a first home buyer earning $120,000 a year with a $650,000 mortgage would save around $12,000 a year in their tax. That’s obviously $12,000 a year that the government won’t get in income tax.

So, the Coalition’s policy is going to blow a bigger hole in the budget and it is going to push up new home prices because we are going to have all this extra demand.

It will push up the price of new housing because developers are going to add it to the price they charge. You are going to have more demand bidding up new housing estates where we have limited supply, a lack of builders, and the costs of construction have risen 40% since the start of the pandemic.

Adding more demand is going to inflate new home prices. So, we will probably get a few more homes built but they are going to cost more, and that will be inflationary for the whole housing market.

Both parties are contributing to the housing crisis by increasing demand, which will ultimately lead to inflation in home prices. They are going to lead to Australians carrying bigger mortgages than they otherwise would. The federal budget is also going to be in a worse position.

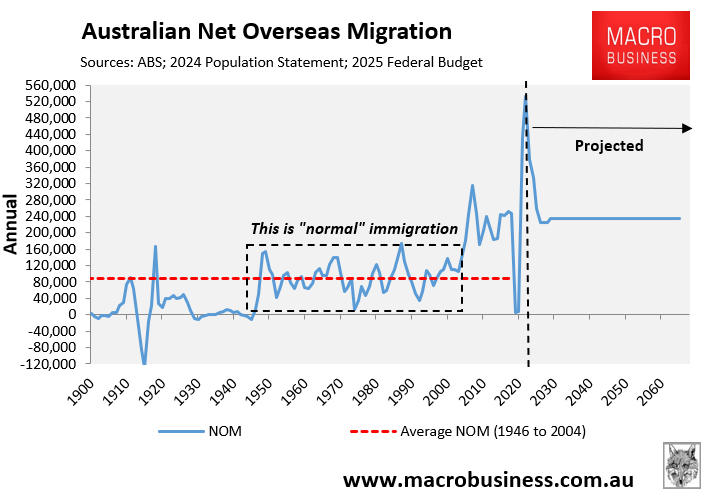

Both are stupid policies. They are all about boosting demand, which ultimately ends up being capitalised into higher prices when really the optimal solution here is to significantly cut immigration.

If you cut immigration, you take demand out of the market. You will lower rents. It is better for first home buyers because they will be spending less on rent while saving for a home deposit, which means they can save up quicker.

Lower immigration would also put downward pressure on the cost of houses.

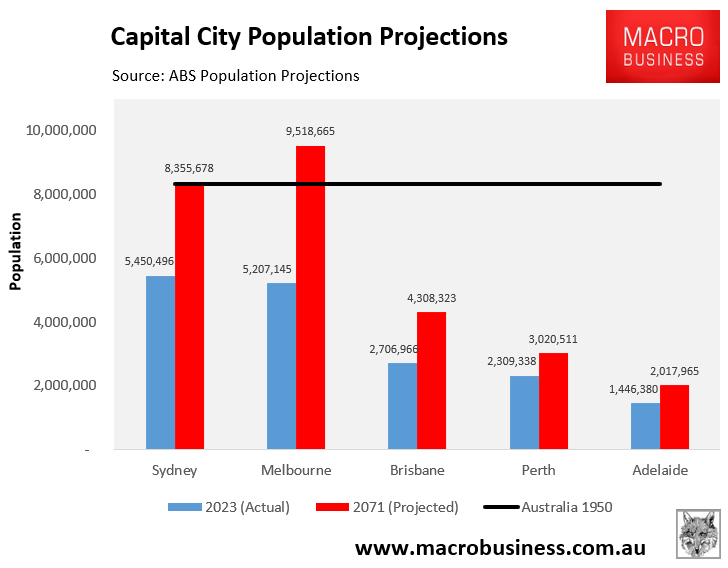

Ultimately, lower immigration is what Australians want. They don’t want high levels of immigration. They don’t want our cities to keep growing in size and becoming megacities. They don’t want future Australians to have to live in high-rise shoebox apartments.

But neither side is properly tackling the immigration problem. The Coalition is better than Labor. But neither side is bothering to attack the problem at the source, which is why we have a housing shortage.

The federal government keeps growing the population a lot faster through immigration than we can build homes. Instead of reducing immigration and demand, they have committed to pouring taxpayer fuel onto the housing bonfire.

It is crazy policy from both sides.