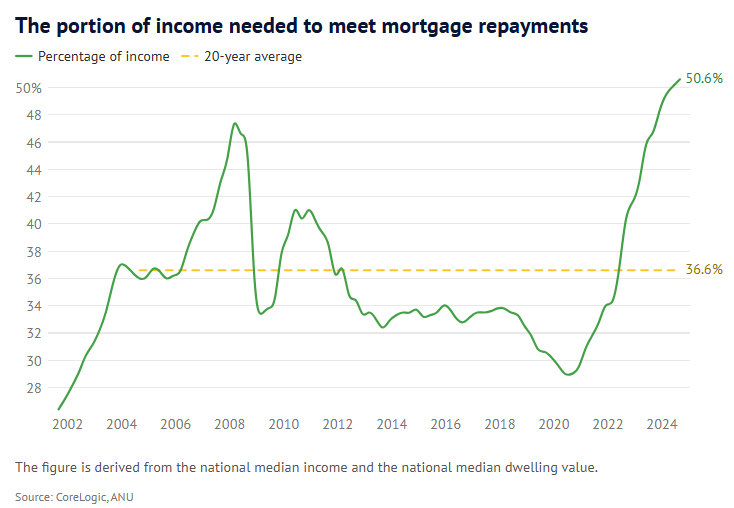

At the end of 2024, Australians required a record share of household income to make mortgage repayments on a median-priced home.

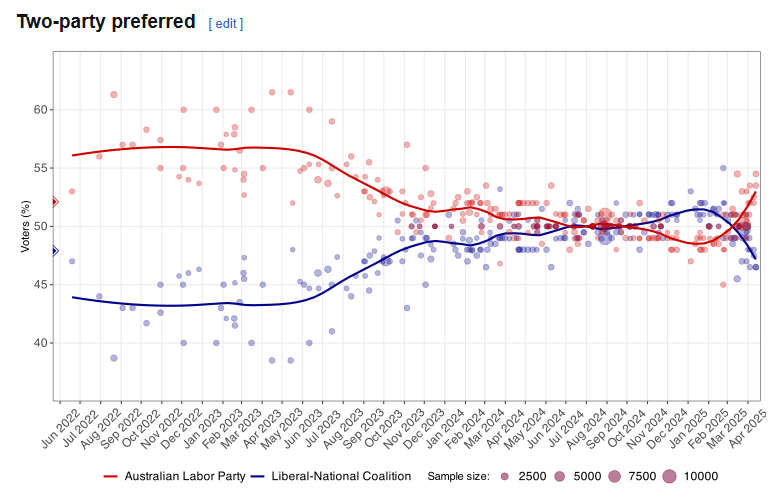

Based on the latest opinion polls, Labor looks certain to win the upcoming election.

When Labor is reelected, it is committed to leveraging Australian taxpayers into the housing bubble.

Consider the following policy announcements from Labor.

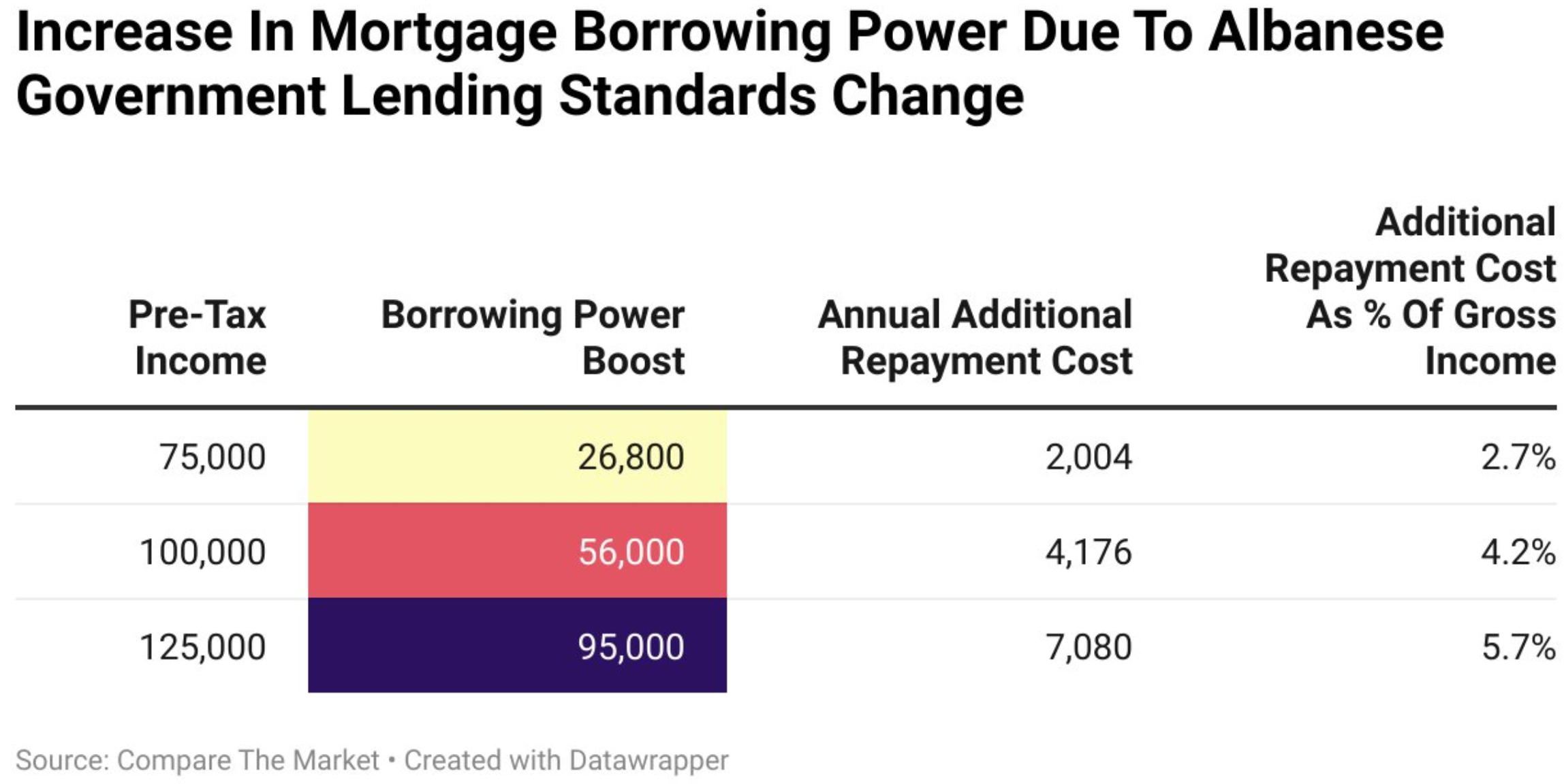

First, Labor Treasurer Jim Chalmers announced in February that Australia’s financial authorities would be required to relax home lending standards for millions of Australians with student loans.

The reforms will exempt a borrower’s student debts from mortgage serviceability calculations if the bank feels the borrower will repay them in the near future.

According to Compare the Market, the changes would allow a tertiary-educated single professional earning $125,000 to borrow an additional $95,900.

Someone earning $100,000 will have an increased borrowing capability of $56,000, while someone earning $75,000 can borrow an additional $26,800.

Second, Labor pledged to broaden its ‘Help to Buy’ shared equity scheme, increasing the income and price thresholds for eligible properties.

Income caps will be lifted to $100,000 for individuals and $160,000 for couples and single parents.

Property price caps will also be lifted to reflect the average prices in each state and territory.

Help to Buy offers first homebuyers 30% of the purchase price of an existing property or 40% of the buying price of a new home.

The buyer only needs to contribute a 2% deposit, and the scheme is open to 10,000 spots each year.

Finally, Labor over the weekend promised to introduce what is effectively a state-sponsored subprime mortgage scheme.

Labor will enable all first home buyers to purchase housing with only a 5% deposit, with the government guaranteeing 15% of the mortgage.

Labor’s housing policies will pull more buyers into the market, which will boost demand and drive up house prices.

Housing will become structurally less affordable as more money competes for the same number of homes, leading to an increase in prices.

Ultimately, Australia has a housing crisis because its home prices are among the highest in the world relative to incomes, we have some of the most indebted households in the world, and tenants are spending a record share of their incomes on rents.

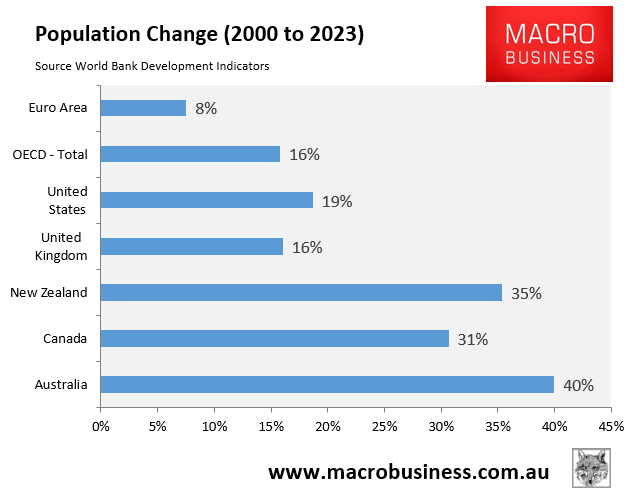

A key reason why house prices and rents are so expensive is that we have grown the population excessively via immigration, and demand has far exceeded supply.

The Coalition’s policies are equally inflationary and would also make the housing situation worse.

Both sides are intent on blowing a bigger housing bubble, fueled by household debt and taxpayer subsidies.