The Australian dollar has rallied strongly against the US dollar after hitting a two-year low following the announcement of President Trump’s “Liberation Day” tariffs.

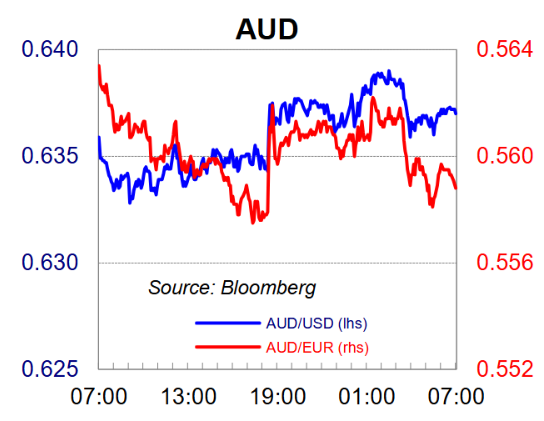

The Australian dollar has rebounded to 0.64 US cents, effectively returning to its pre-tariff announcement level.

The rebound partly reflects weakness in the US dollar against all currencies as the Greenback flirted with two year lows, and investors favoured other havens.

For example, the Euro rose from US$1.1350 to as high as US$1.1413 and was near US$1.1400 at the US close.The Japanese yen eased initially to 142.90 yen per US dollar before rallying to JPY 141.60 and was near JPY 141.80 at the US close.

As a result, the Australian dollar remains down heavily against the Euro.

The US dollar is being negatively impacted by two main factors:

- The perceived loss of US economic exceptionalism, with recent data suggesting the economy is not travelling nearly as strongly as it was late last year.

- The messy implementation of the Liberation Day tariffs, which has dented confidence in the US dollar as a reserve currency.

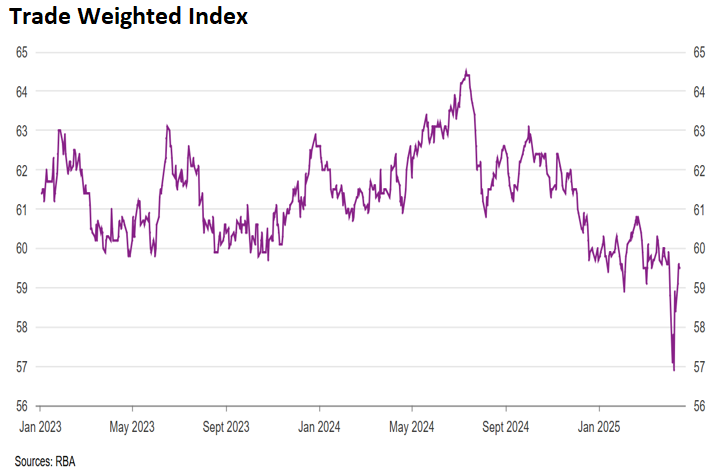

Even so, the trade-weighted index (TWI), which measures the value of the Australian dollar relative to its most important trading partners, has also bounced, albeit by less than against the US Dollar.

China has a significant impact on the Australian dollar TWI, with the Chinese yuan accounting for 29.5% of the total weighting, well exceeding the second-placed US dollar (11.3%) and the third-placed Japanese yen (10.1%).

As a result, the Trump administration’s harsh 145% tariffs on China (with the exception of electronics like smartphones and computers) are expected to have a significant impact on the Australian dollar going forward.