Australia’s property obsession is slowly strangling the nation’s economy.

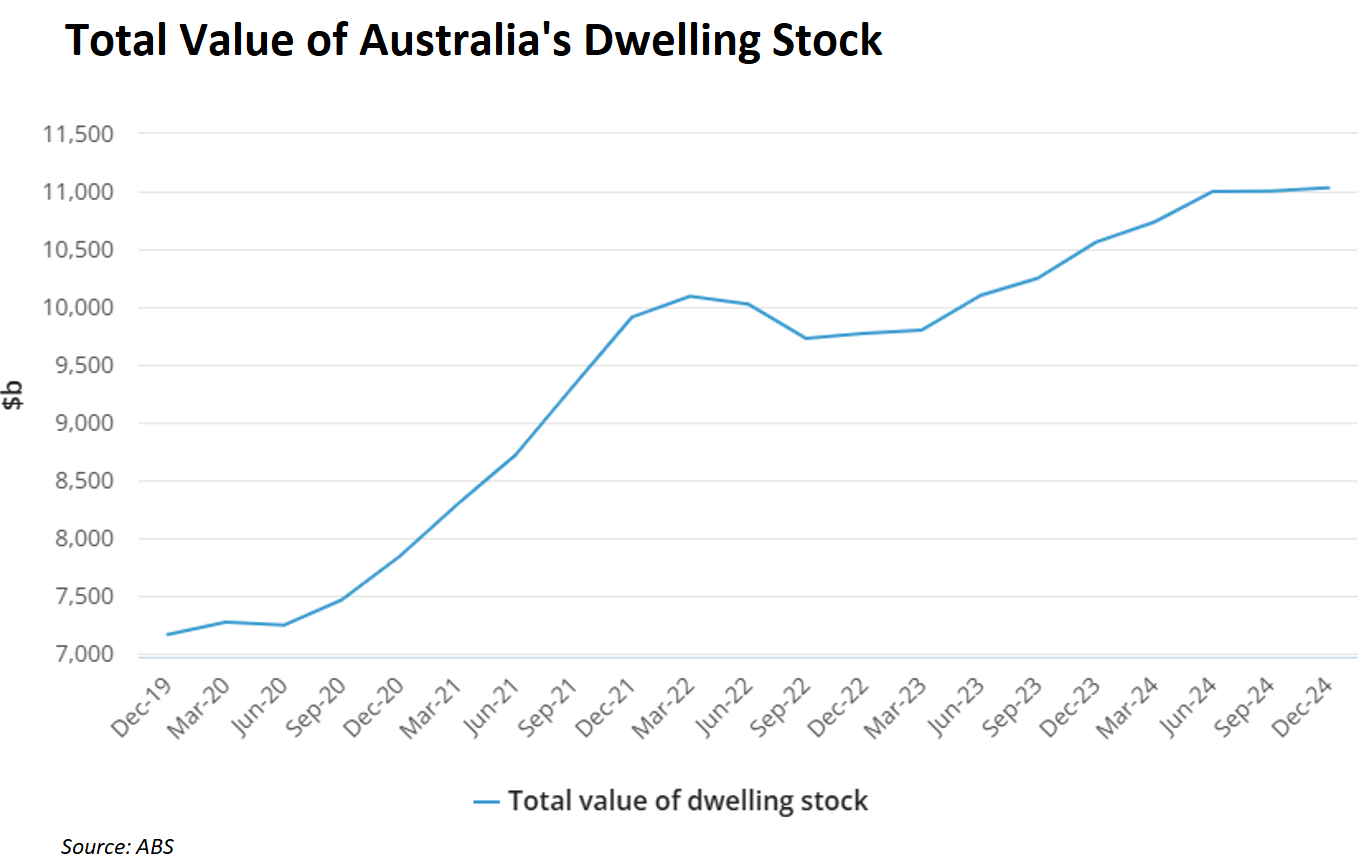

According to the Australian Bureau of Statistics (ABS), the total value of Australia’s housing stock reached a record high of $11,032.2 billion at the end of 2024, with the average home valued at $976,800.

CoreLogic’s latest monthly chart pack valued Australia’s housing stock at $11.3 trillion as of the end of March 2025, with the average home valued at exactly $1 million.

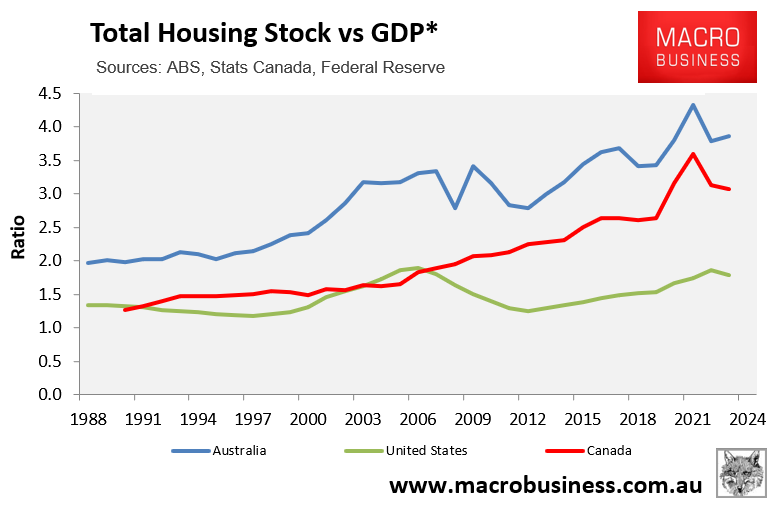

The value of Australia’s housing market relative to its economy is among the highest in the world, more than doubling the United States.

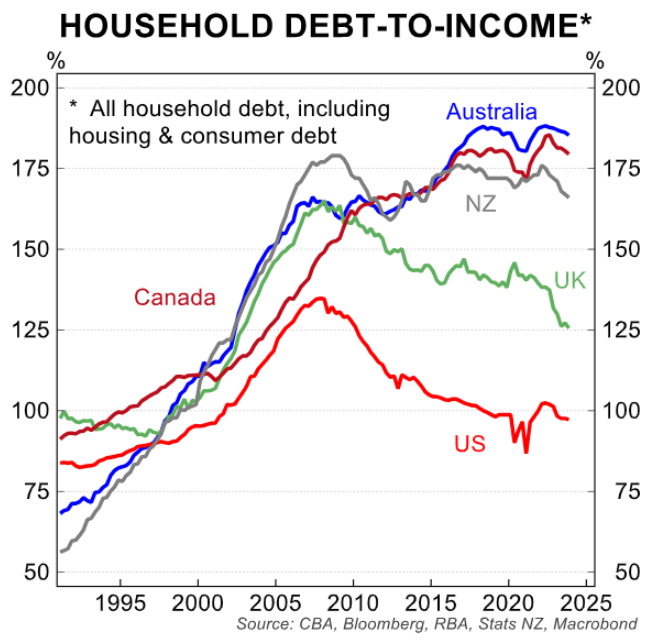

The surge in Australian home values has been fueled by mortgage debt, forever chasing higher home prices.

Australian households carry some of the world’s largest debt loads, driven overwhelmingly by mortgage lending.

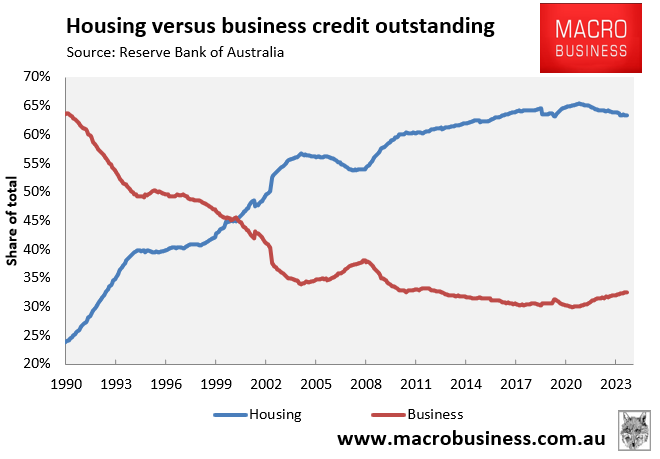

Australia’s banks have transformed into giant building societies focused on mortgage lending to the detriment of productive businesses.

In 1990, nearly two-thirds of bank lending was for businesses, and only around one-quarter of the lending went to mortgages.

Thirty-five years later, the shares have flipped around, with nearly two-thirds of bank lending for mortgages versus only one-third for businesses.

AustralianSuper chief executive Paul Schroder summed up the situation nicely at last month’s 2025 AFR Business Summit.

Schroder argued that Australia’s obsession with housing is sucking capital from the productive economy and has become an enormous drain on the nation’s productivity.

“All we’ve done is pour all of this money into houses, which has deprived the economy of heaps and heaps of productive capital”, Schroder said.

“We’ve got all this money in domestic houses and we’re not backing business, we’re not creating new things, we’re not driving productivity”…

“I think the big, burning productivity and cost of living problem is housing. I think we keep underestimating how worrying housing is”.

This election campaign has seen both sides promise to leverage the national balance sheet to pour more fuel on the housing bonfire.

Labor’s promise to enable all first home buyers to purchase a home with a 5% deposit, with the government (taxpayers) guaranteeing 15% of the borrowers’ mortgage, is essentially a state-sponsored subprime mortgage scheme.

Labor has also announced that mortgage lenders would no longer need to consider student debts in mortgage serviceability calculations.

The Coalition’s announcements are equally inflationary for home prices, namely:

- Allowing first home buyers to access super savings for a housing deposit.

- Tax deductible first home buyer mortgages for new homes.

Regardless of which side wins the upcoming election, their policies will dramatically increase borrowing capacity and pull more buyers into the market. As a result, they will dramatically increase household debt and home prices and suck more of the nation’s capital into non-productive housing.

In summary, Australia has sold its soul for a housing bubble.

I discussed these issues in detail in last week’s 90-minute interview podcast with Martin North from Digital Finance Analytics.