Wednesday’s monthly CPI indicator from the Australian Bureau of Statistics (ABS) printed significantly below expectations.

The headline CPI was only 2.4%, below market expectations of 2.5% and below the midpoint of the Reserve Bank of Australia’s (RBA) 2-3% target band.

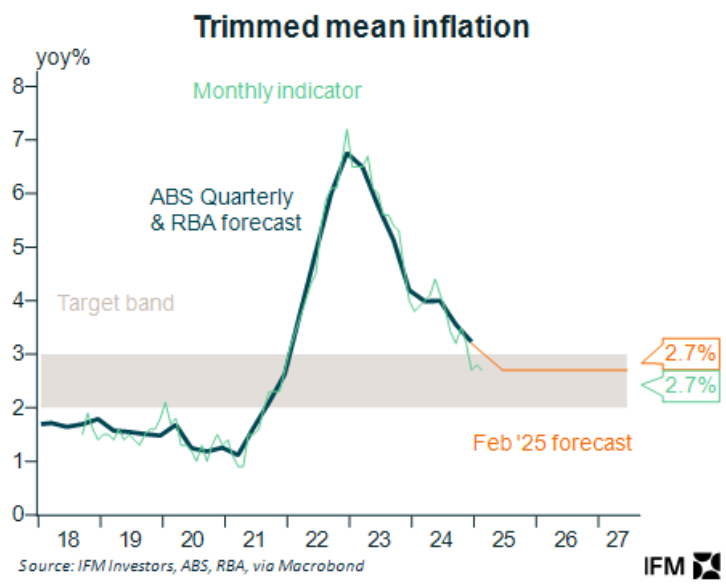

The underlying measure, trimmed mean inflation, also fell to 2.7% and is now well within the RBA’s 2% to 3% target band.

The following chart from Alex Joiner from IFM Investors plots the trimmed means CPI indicator against the RBA’s forecast.

As you can see, inflation is falling faster than projected by the RBA, increasing the likelihood of another interest rate cut at next week’s monetary board meeting.

That being said, the monthly CPI gauge does not carry the same weight as the official quarterly figure, which won’t be released until later in April. The monthly trimmed mean inflation gauge was also below the quarterly trimmed mean in Q4 2024.

Still, January and February are what we have to go on for the quarter so far, and those readings are moving in the right direction.

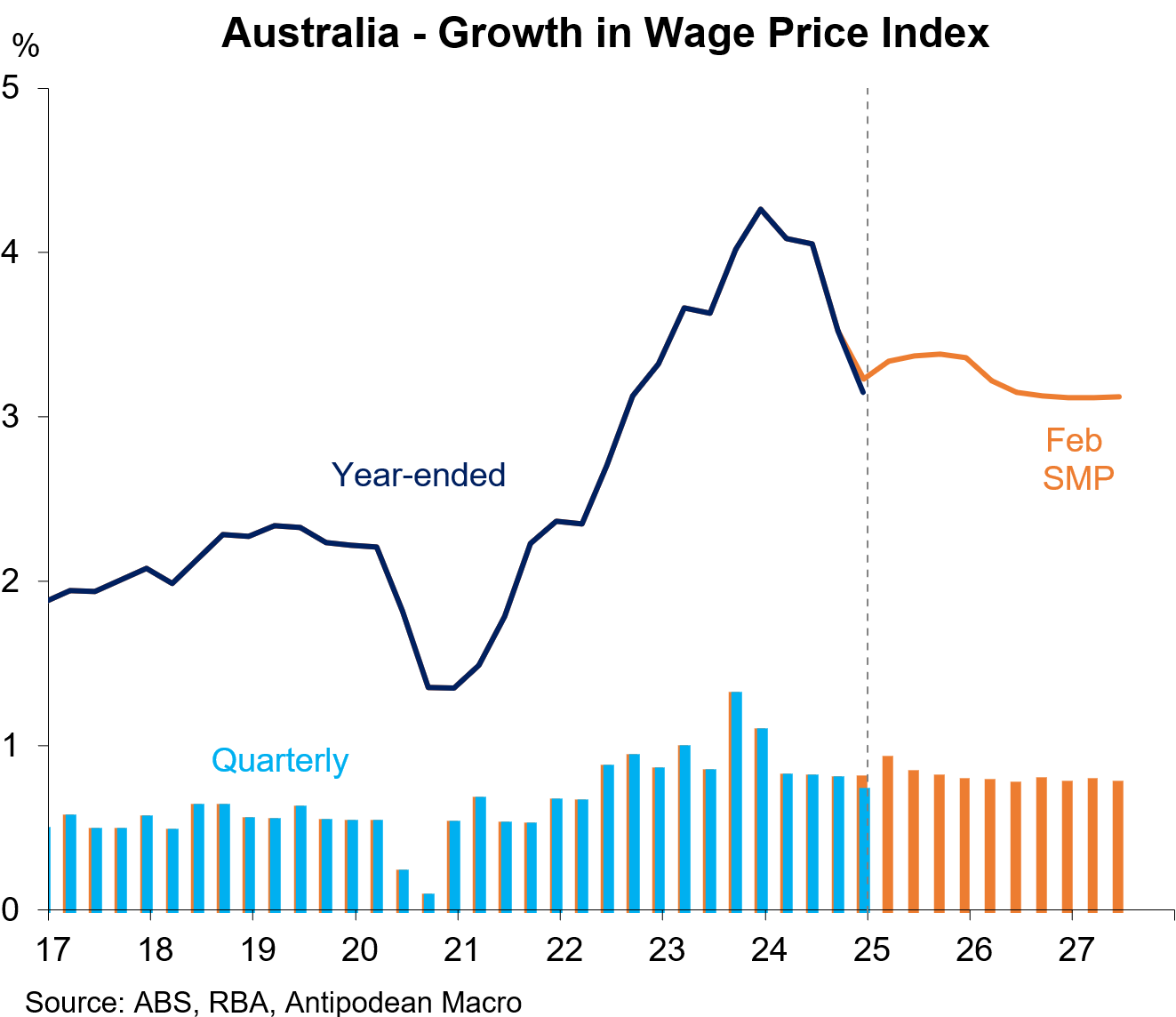

There is enough justification here to permit the RBA to cut rates next week, especially in light of last week’s labour market shocker, and weaker-than-forecast wage growth.

Even so, I expect the RBA to remain on hold and wait for confirmation from the official Q1 inflation print later in April before making its next move.

Westpac chief economist Luci Ellis agrees, noting today that, “the RBA was too hawkish in its rhetoric last month to consider a cut at this meeting”.

“The Board made clear that last month’s cut did not foreshadow more. Cutting again at the April meeting would therefore be damaging to its credibility”.

Instead, Westpac expects the next cut to arrive at the May meeting.