Wednesday’s monthly inflation gauge from the Australian Bureau of Statistics (ABS) revealed that housing inflation is falling fast, helping to lower trimmed mean inflation.

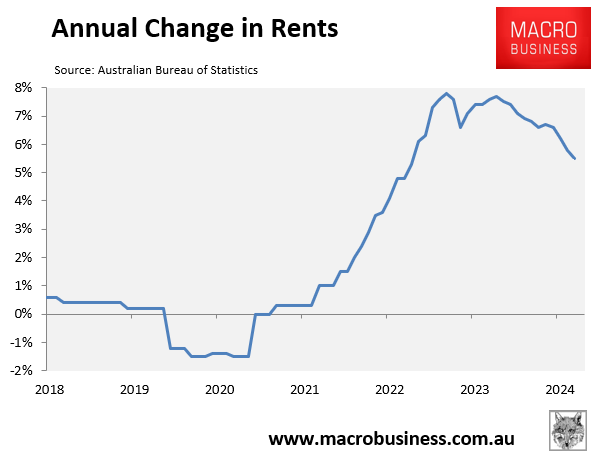

The annual CPI rental inflation rate declined to 5.5% in February 2025. This was down from the August 2023 peak of 7.8% and the lowest reading since March 2023:

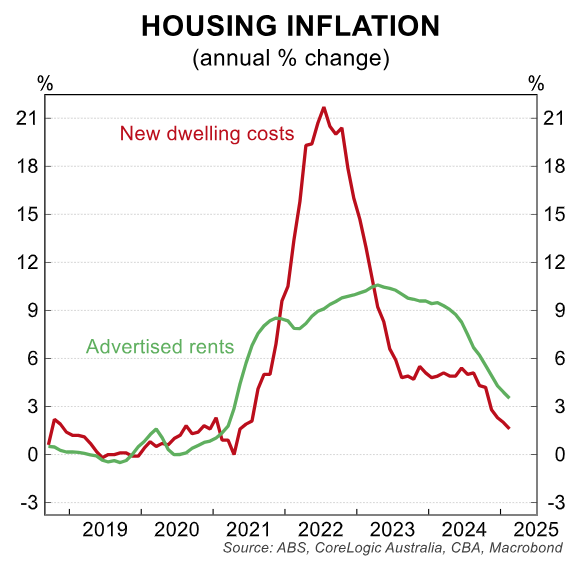

New dwelling costs declined by 0.1% in February, the third monthly decline over the past four months. Annual inflation in new dwelling costs also slowed to 1.6% in February, down from 2.0% previously.

This represented the slowest annual pace since May 2021 and reflected discounts offered by project home builders in response to weak demand.

The ongoing disinflation in asking rents and new dwellings is illustrated in the following chart from CBA:

The disinflation of housing inflation should hearten the interest rate doves.

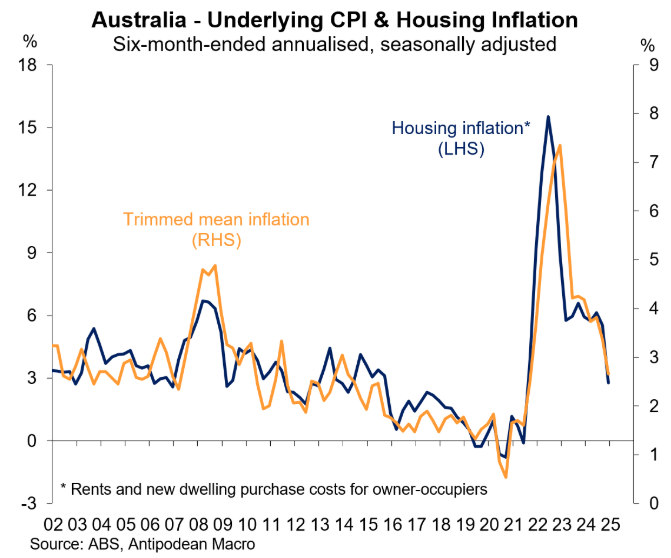

The following chart from Justin Fabo from Antipodean Macro plots housing inflation (CPI rents and new dwelling costs combined) against trimmed mean inflation:

As you can see, there is a very high correlation between housing and trimmed-mean inflation.

Following Wednesday’s better-than-expected monthly inflation gauge, CBA forecasts Q1 2025 trimmed mean inflation of only 0.6%—i.e., below the RBA’s latest forecast.

Westpac is more dovish, forecasting a trimmed mean inflation rate of only 0.5% for Q1 2025.

Both expect the RBA to deliver its next 0.25% rate cut at its May board meeting.