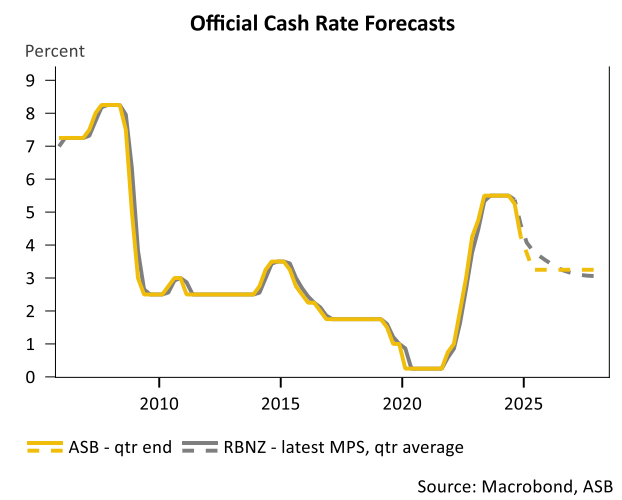

Major bank ABS believes that the Reserve Bank of New Zealand will cut the official cash rate by 0.5% at next week’s monetary policy meeting.

This would lower the official cash rate to 3.75%, down from last year’s peak of 5.5%.

ASB expects two further 0.25% cuts in April and May and a 3.25% endpoint. Further moves will depend on the evolution of data.

The case for additional rate cuts is strong.

GDP over 2024 was weak. The Q3 2024 GDP release showed a 1% decline for the quarter and a revised 1.1% fall over Q2 2024, highlighting the economy nosedived through the middle of the year.

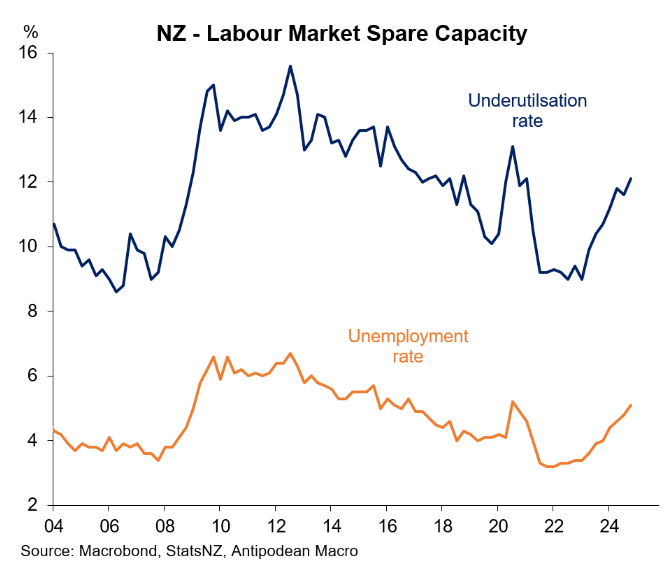

The labour market also softened in line with market expectations. The unemployment and underemployment rates have shot up.

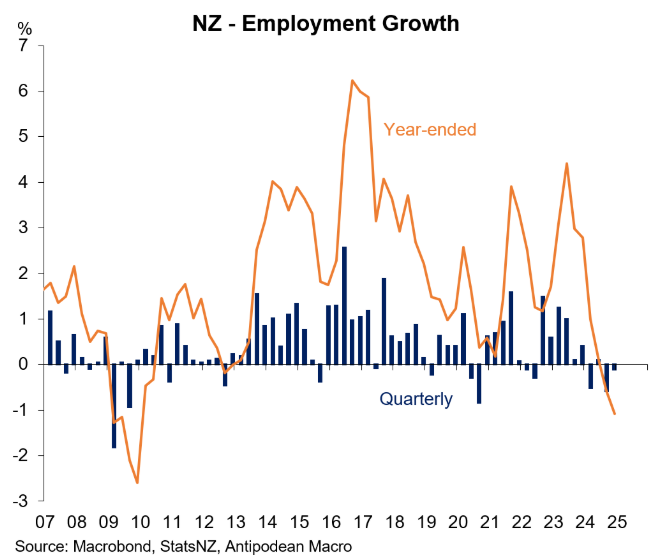

The economy has also shed significant jobs.

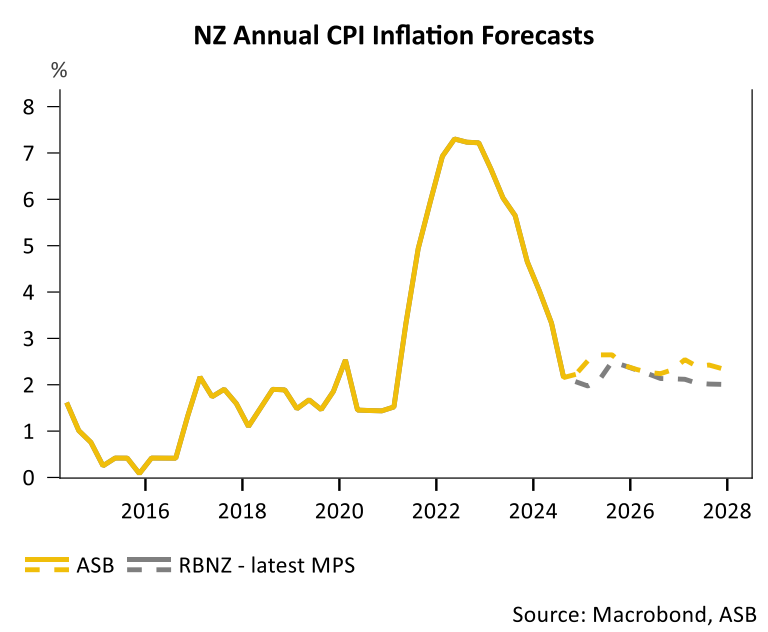

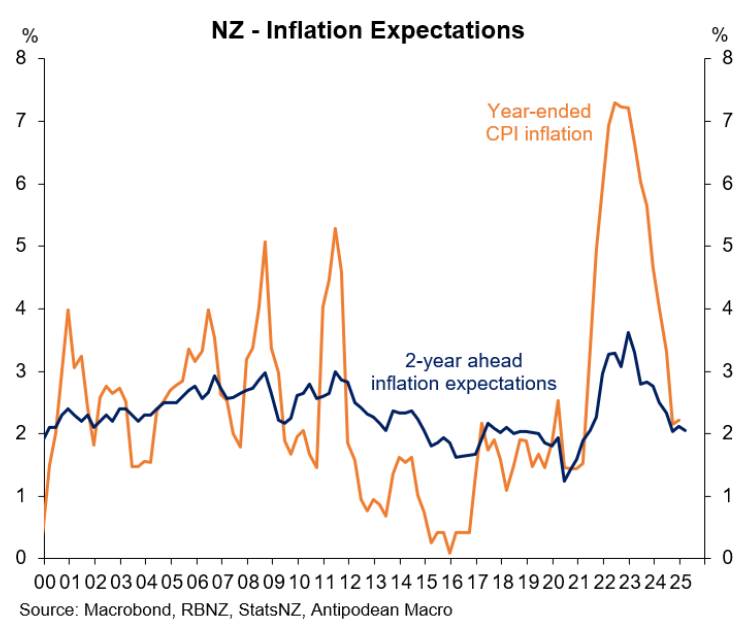

Q4 2024 inflation was close to the Reserve Bank’s expectations and core inflation measures continued to cool.

Inflation expectations are under control.

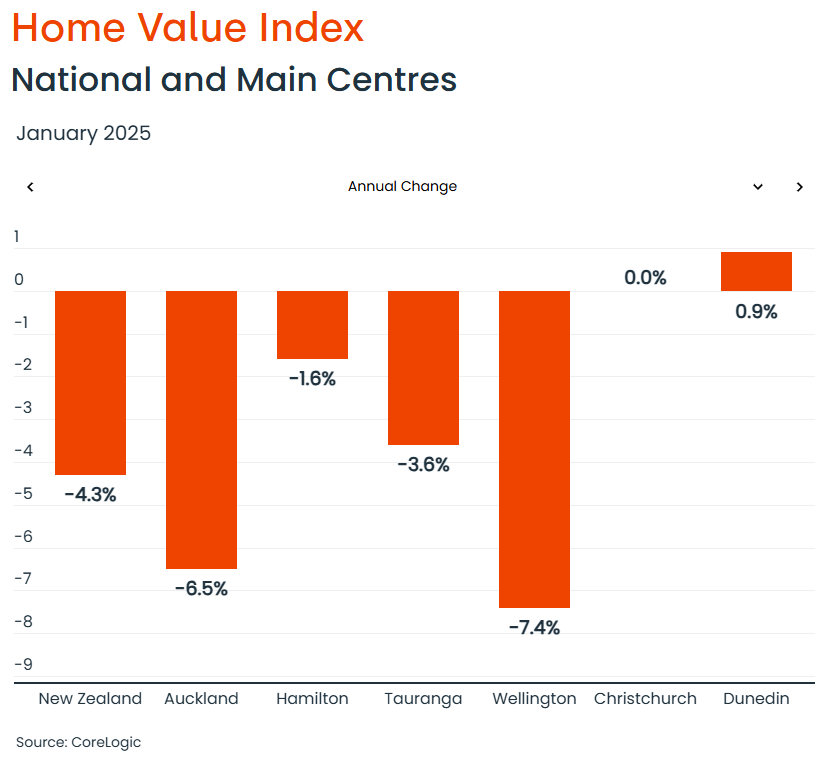

Finally, New Zealand’s housing market poses little inflationary threat.

New Zealand house prices have fallen sharply.

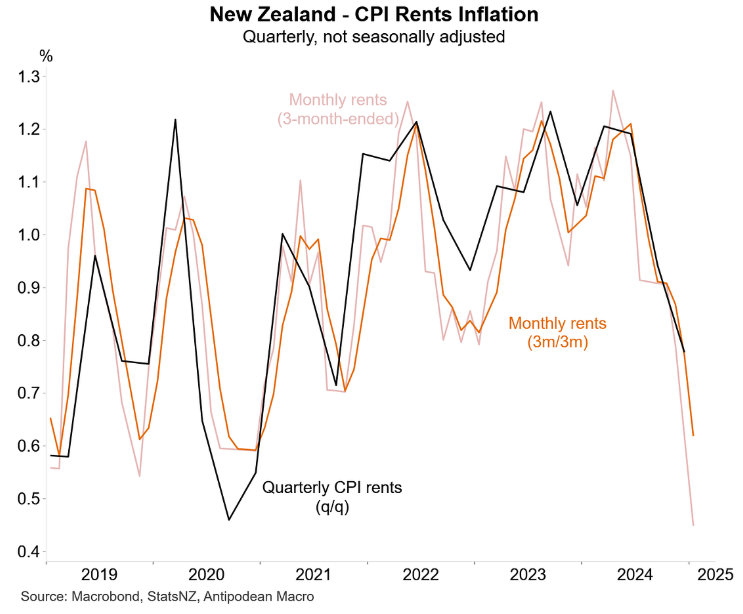

New Zealand rental inflation has crashed.

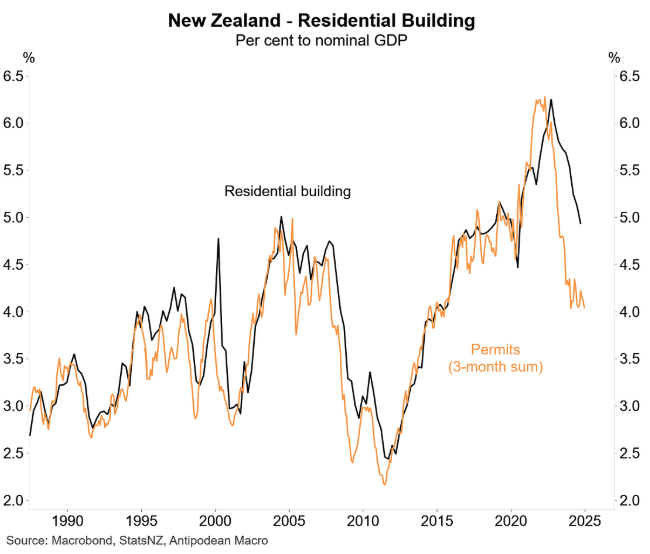

Residential construction activity has also slumped.

Nevertheless, ASB believes that “the finish point” for rate cuts “is getting closer”.

“The RBNZ’s estimates for where the nominal neutral OCR sits over the long term is in a range of 2.5% to 3.5%, which the RBNZ will be knocking on the door of after February (our estimate for the neutral OCR is 3.25%, getting close)”, ASB noted.

“With the neutral OCR now in clear sight, a slower pace of 25bp cuts from April onwards will better balance between the risks of doing too much vs. too little, too late”.