Australia’s housing market is experiencing a mild correction, led by Sydney and Melbourne.

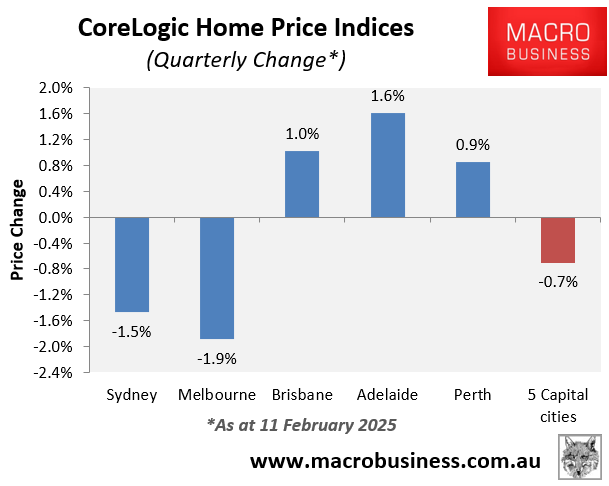

Over the past quarter, dwelling values across Australia’s five major capital cities have declined by 0.7%, driven by Melbourne (-1.9%) and Sydney (-1.5%).

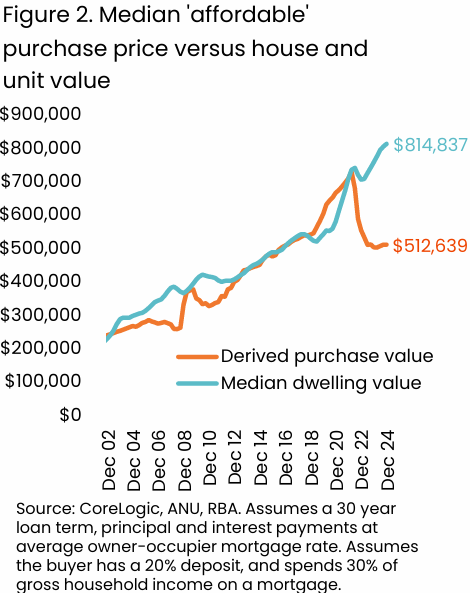

The downturn has been driven by record low affordability, easing net overseas migration and a steady accumulation of for-sale listings.

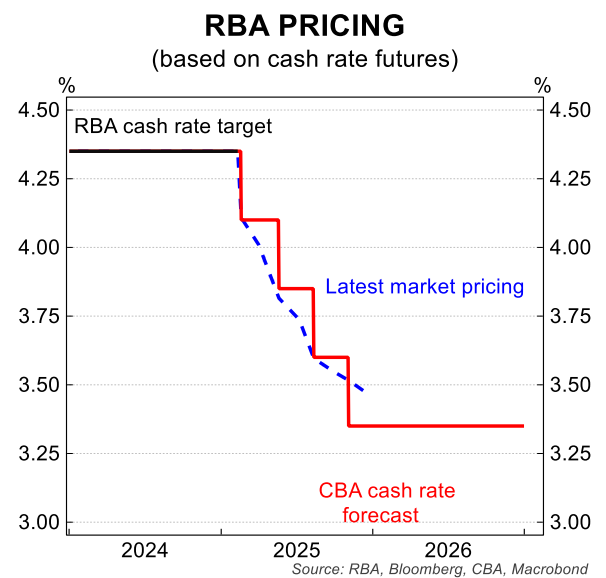

Financial markets expect the Reserve Bank of Australia (RBA) to cut the official cash rate by 0.25% next week, followed by three additional 0.25% cuts over the remainder of the year.

Not surprisingly, CoreLogic reported last week that two-thirds of real estate agents expect national home prices to rise in 2025, with the majority expecting an increase of more than 5%.

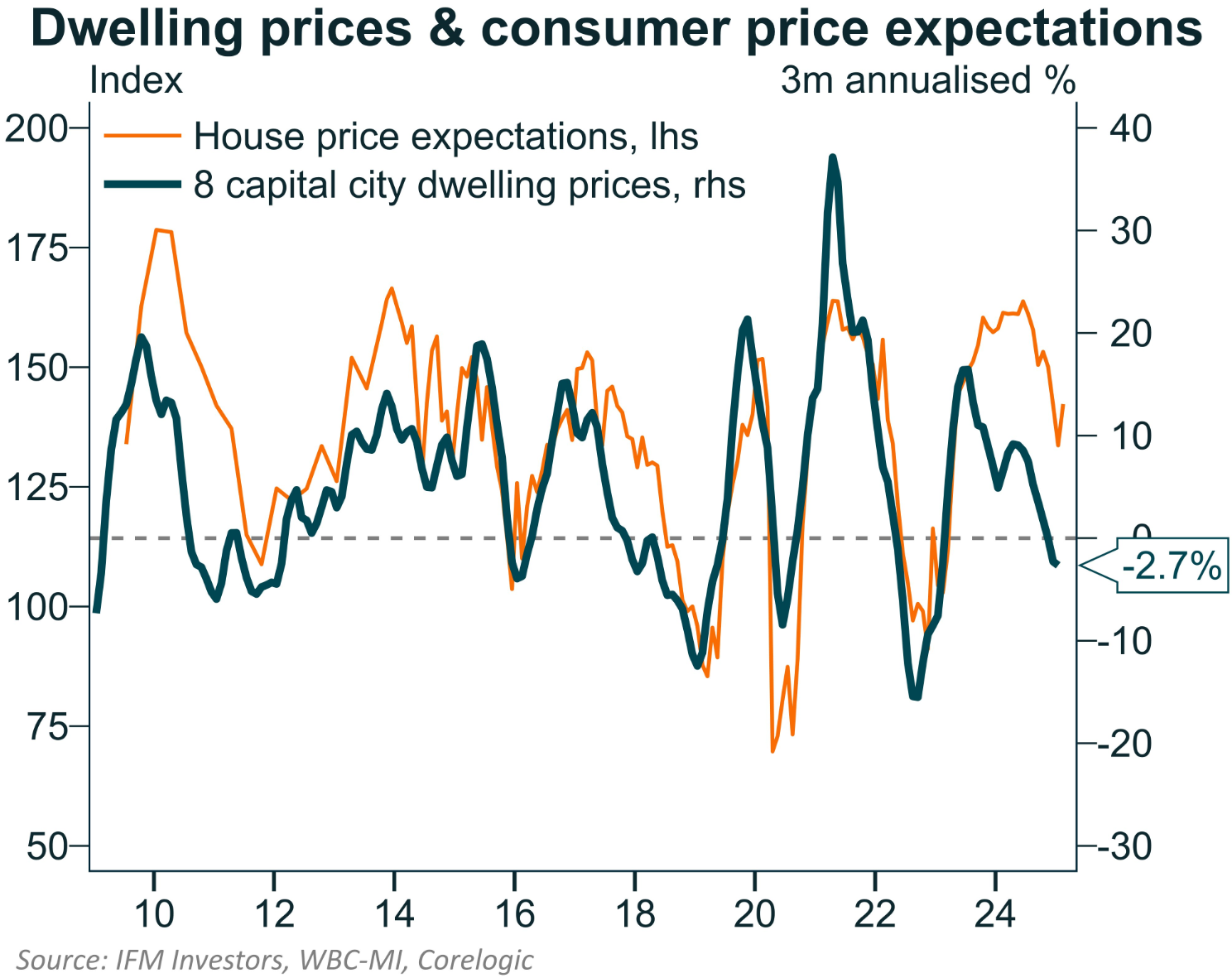

Westpac’s latest consumer sentiment survey noted that “consumers have become much more confident about the prospect of interest rate cuts”.

As a result, “house price expectations rose by 6.5% to 142.3 in February, a solid lift, and the first rise since October”.

While it is still early days, Australian consumers believe that rate cuts will have a positive impact on house prices, as illustrated by Alex Joiner from IFM Investors below.

The current mild price correction could prove to be one of the shallowest on record if the RBA cuts rates next week.