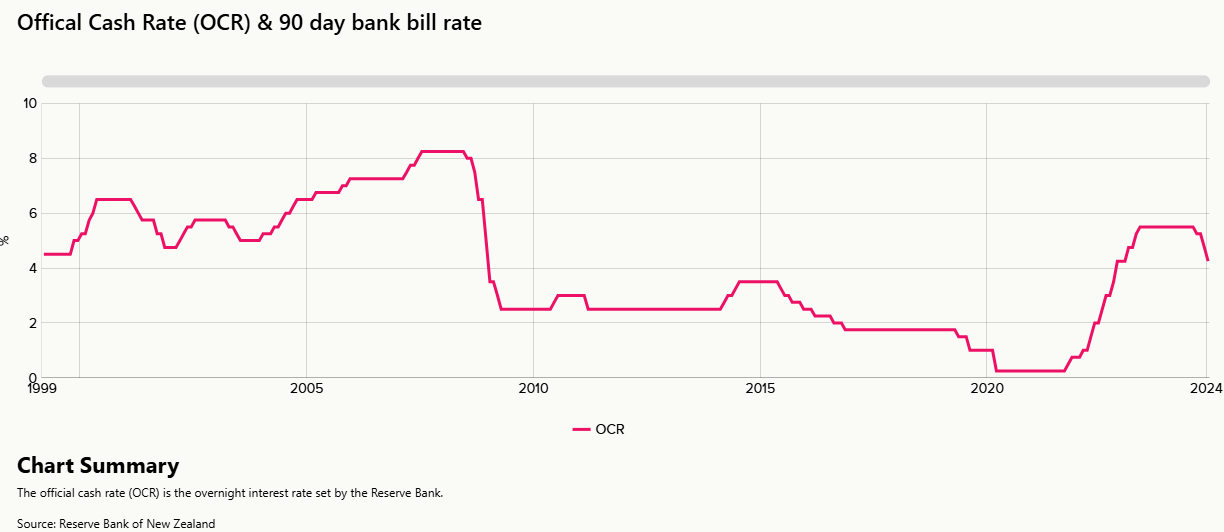

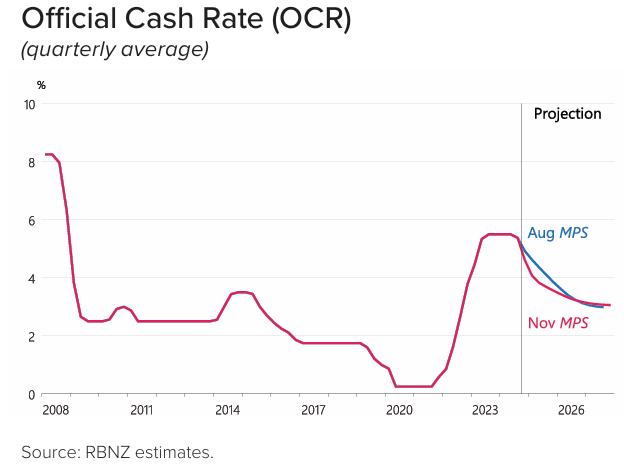

The Reserve Bank of New Zealand has already cut the official cash rate by 1.25% to 4.25%.

Based on the latest economic data, the Reserve Bank will need to cut rates more aggressively to pull the economy out of recession.

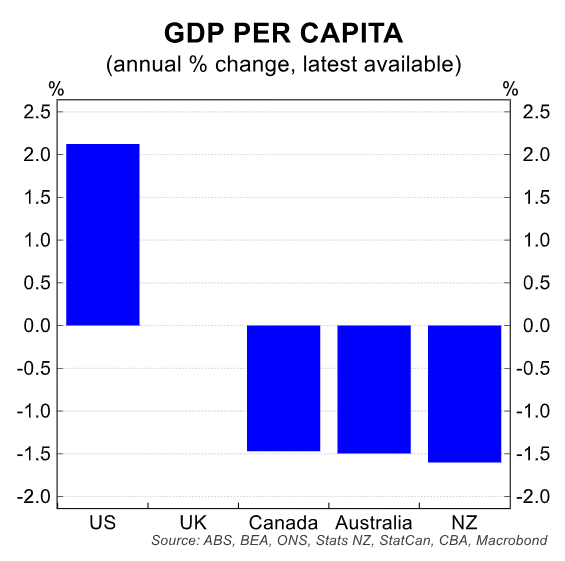

New Zealand has experienced the Anglosphere’s most significant decline in per capita GDP over the past year.

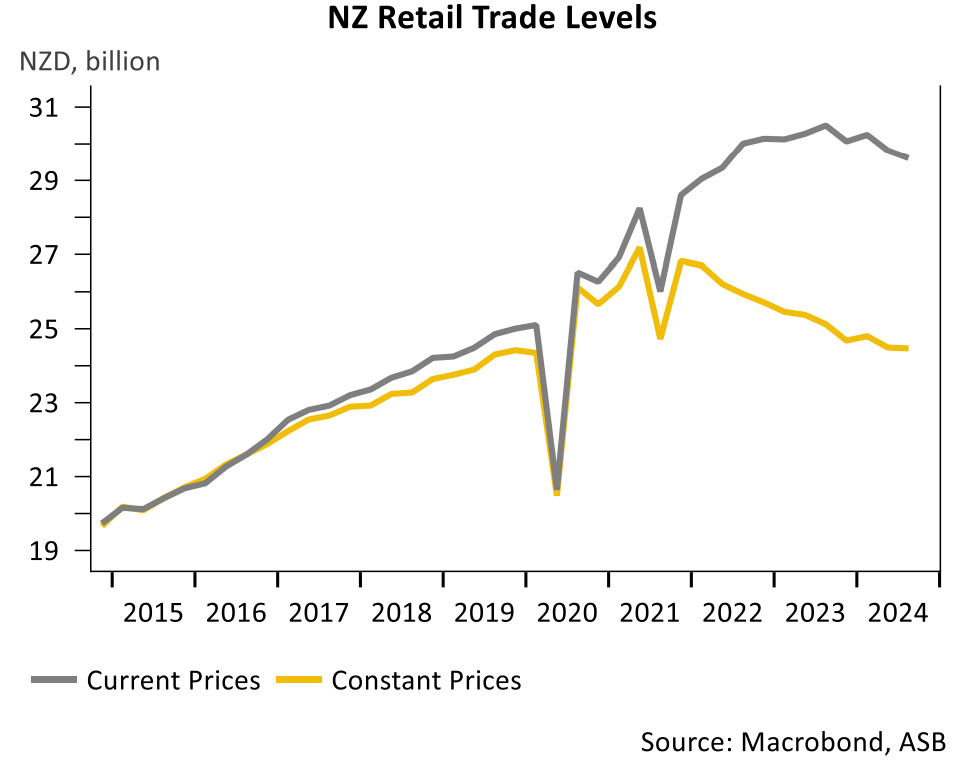

Retail sales volumes fell by 0.1% in Q3 2024 to be down 2.8% annually.

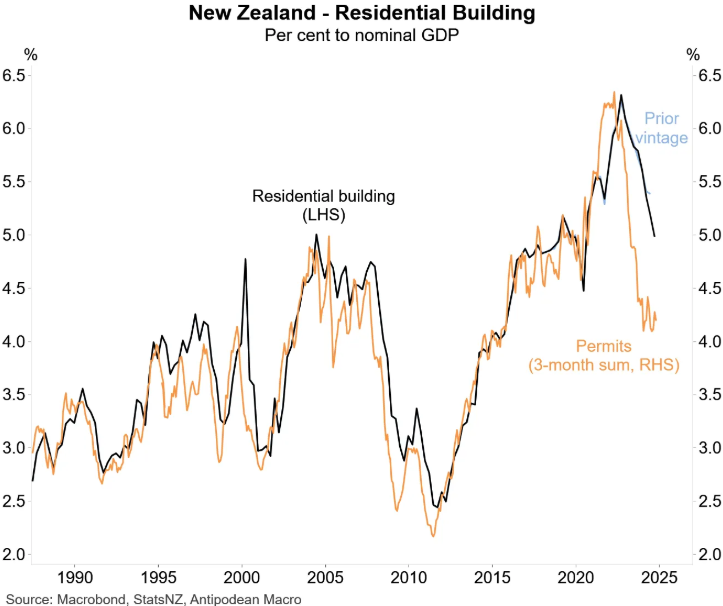

As illustrated below by Justin Fabo at Antipodean Macro, New Zealand residential construction has fallen heavily.

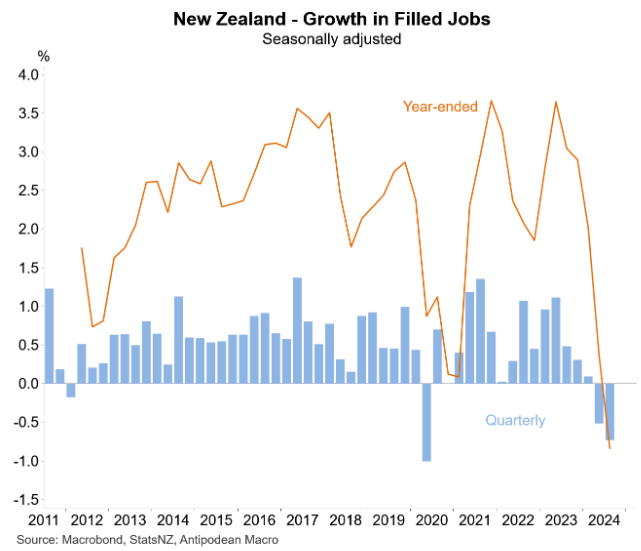

Worst of all, filled jobs declined by 0.7% in Q3, the second consecutive quarterly decline. Filled jobs also recorded their first annual decline in more than a decade.

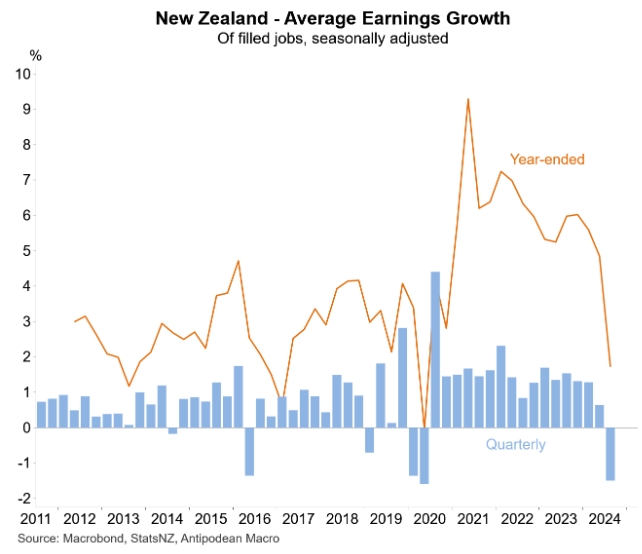

Average earnings growth also fell in Q3, taking annual growth to just under 2%.

The Reserve Bank’s forward guidance suggests a 50% chance that it will deliver another 0.50% cut in February—the first monetary policy meeting of the year.

Major bank ASB has also forecast a 0.50% cut to the cash rate in February.

The official cash rate is also forecast to bottom at around 3.0%, the Reserve Bank’s estimated neutral rate.

Given the overwhelming weakness in the economy, the Reserve Bank would be wise to front-load the cuts over the first half of 2025.