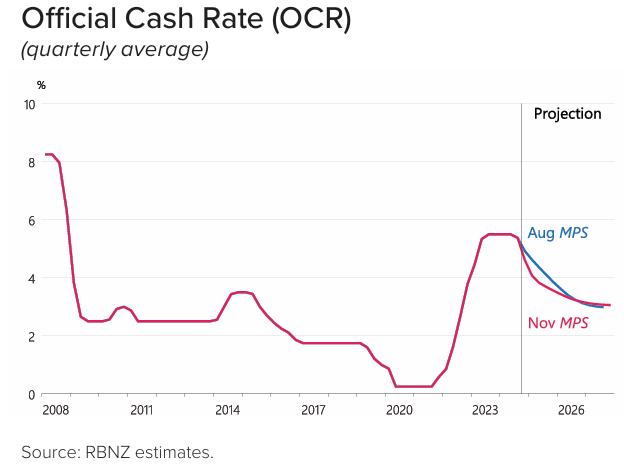

The Reserve Bank of New Zealand’s aggressive monetary policy, which raised the official cash rate to a peak of 5.50%, has successfully deflated the nation’s house price bubble.

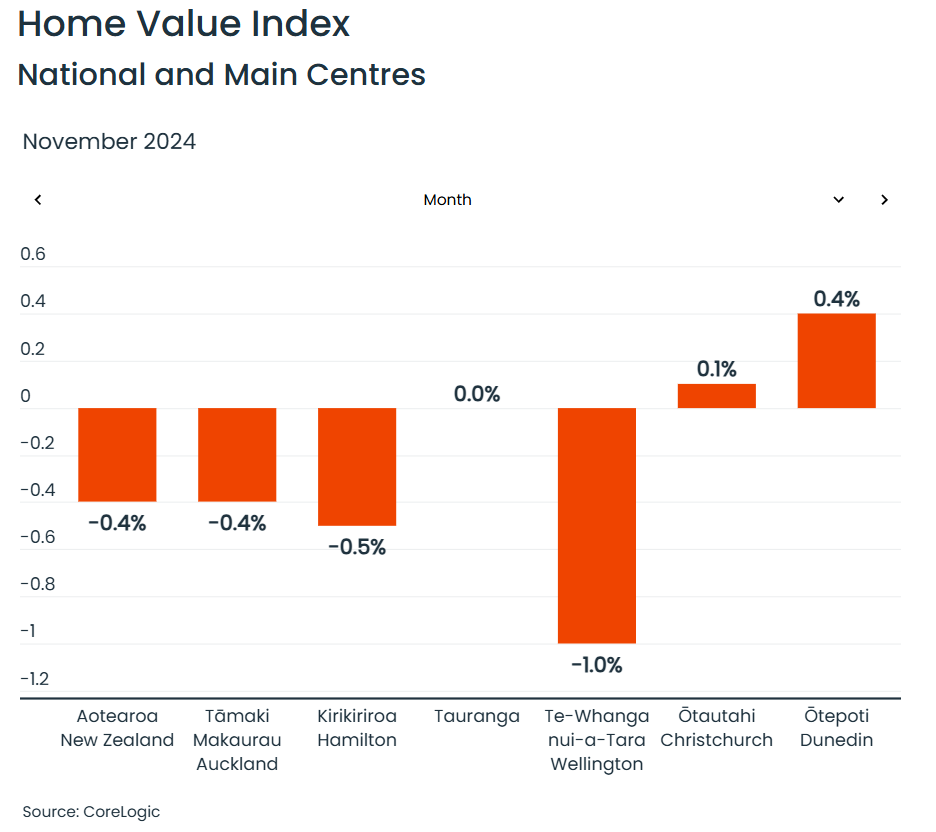

According to CoreLogic, home values across New Zealand declined by 0.4% nationally in November, the ninth consecutive monthly fall.

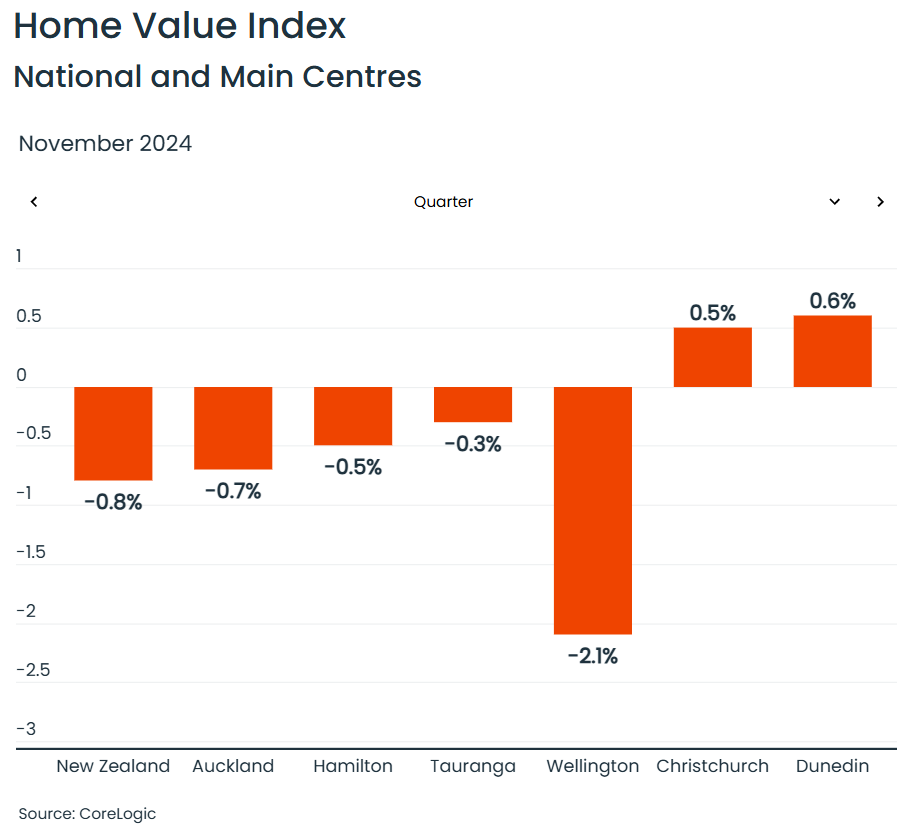

Home values also declined by 0.8% over the quarter, according to CoreLogic.

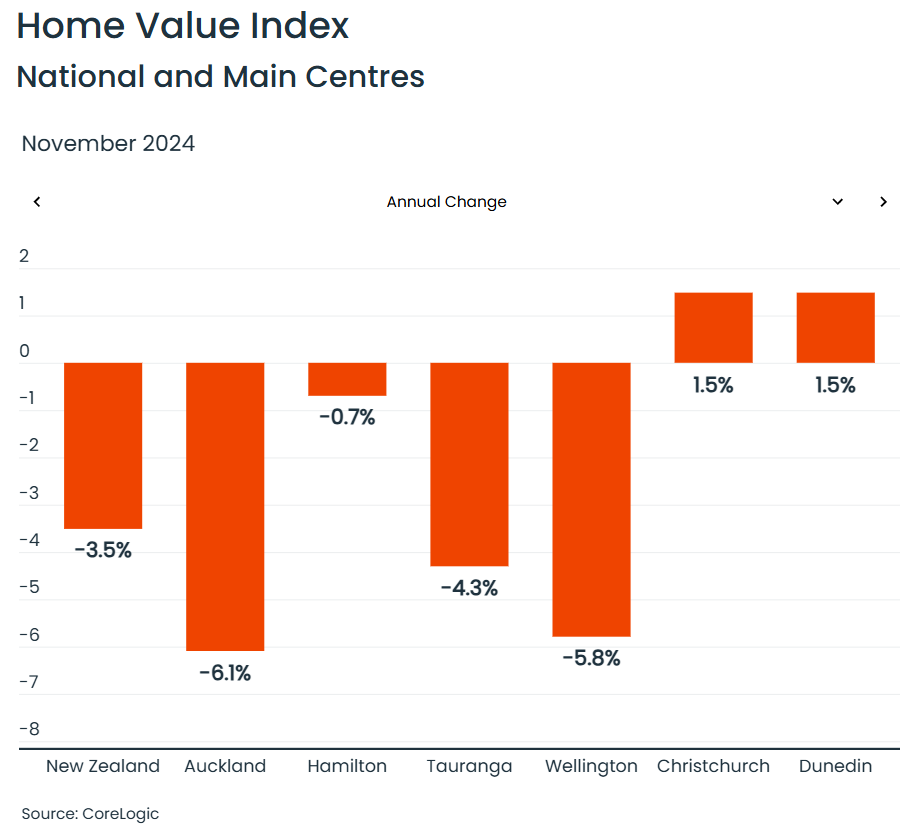

Meanwhile, home values across New Zealand have fallen by 3.5% over the year.

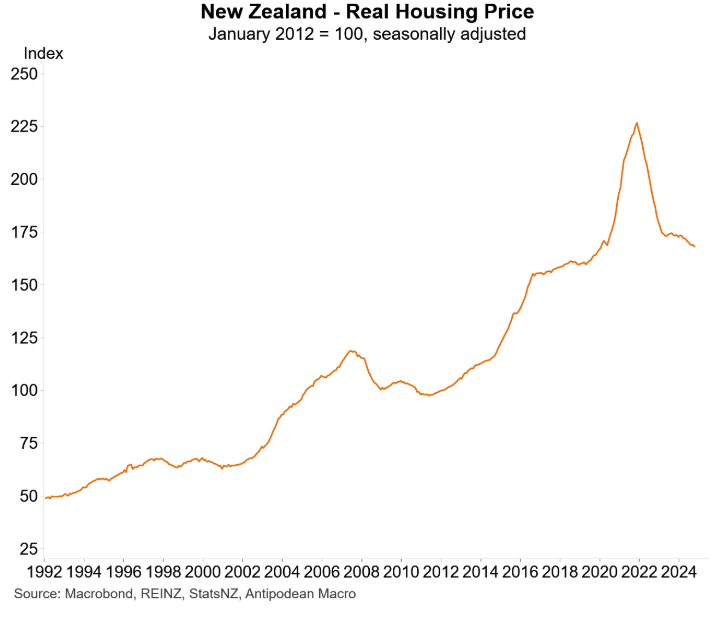

Separate data to October from the Real Estate Institute of New Zealand shows that real inflation-adjusted home values have returned to their pre-pandemic level.

Commenting on the result, CoreLogic NZ Chief Property Economist Kelvin Davidson said the “rate of decline in property values across the country has slowed lately, from an average of 0.8% per month from April to August, back down to an average of 0.3% falls over September to November. That might signal a floor for values is getting closer”.

“Certainly, mortgage rates have fallen further lately, and this pattern looks set to continue into 2025, with the Reserve Bank indicating that the official cash rate will likely be cut again on 19th February, and potentially by another ‘front loaded’ 0.5%”, he said.

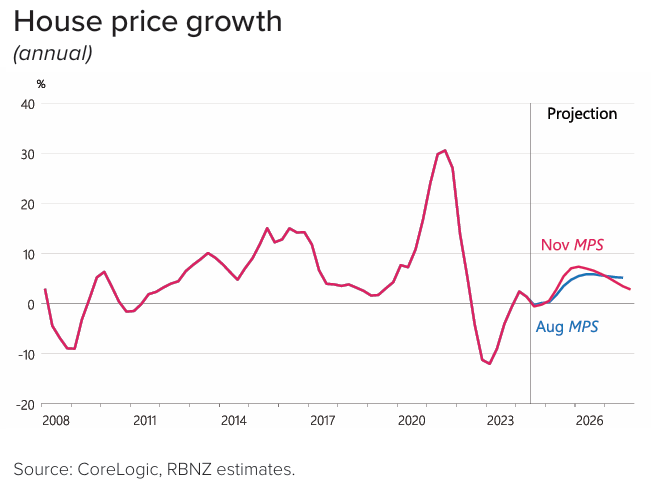

The Reserve Bank of New Zealand seems to hold a similar view. Its latest Statement of Monetary Policy forecasts price growth of -0.2% for 2024 before accelerating in the second half of next year.

Specifically, the Reserve Bank forecasts annual price growth to increase from 2.8% for the year to June 2025 to 5.5% for the year to September 2025 and then 7.1% for the year to December 2025. It then sees house price growth peaking at 7.4% in the year to March 2026 before gradually declining.

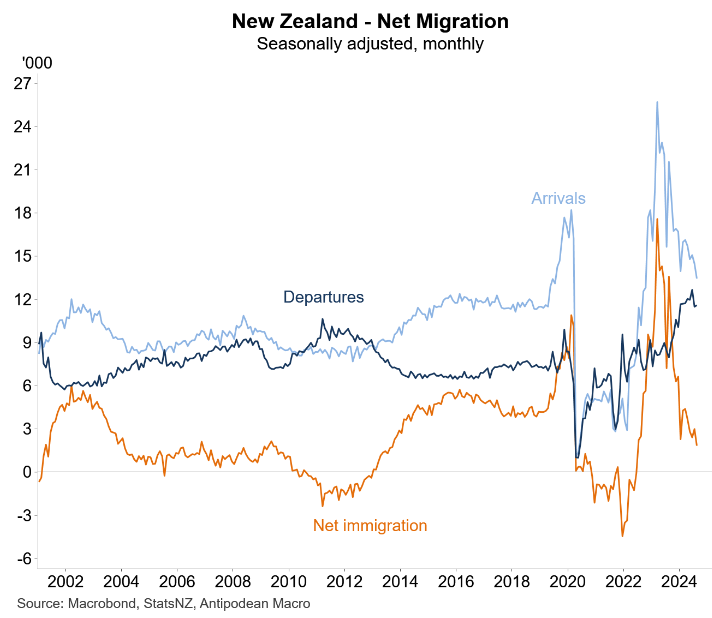

One factor that will dampen the upswing is the sharp slowing of net overseas migration into New Zealand, which will dampen housing demand.