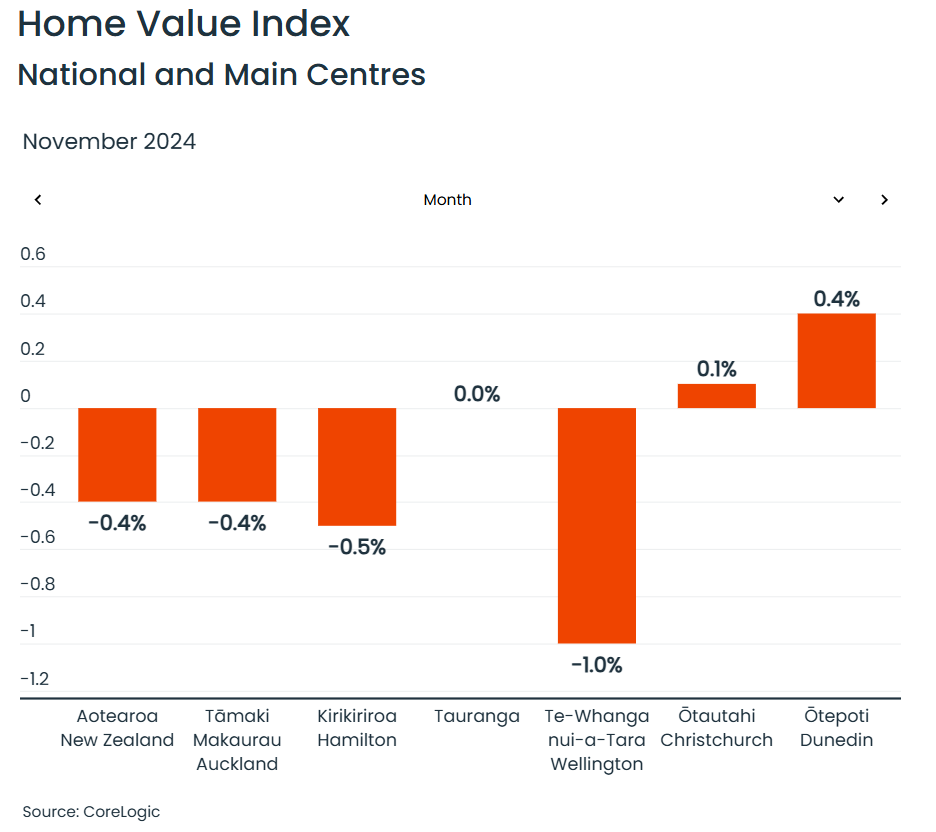

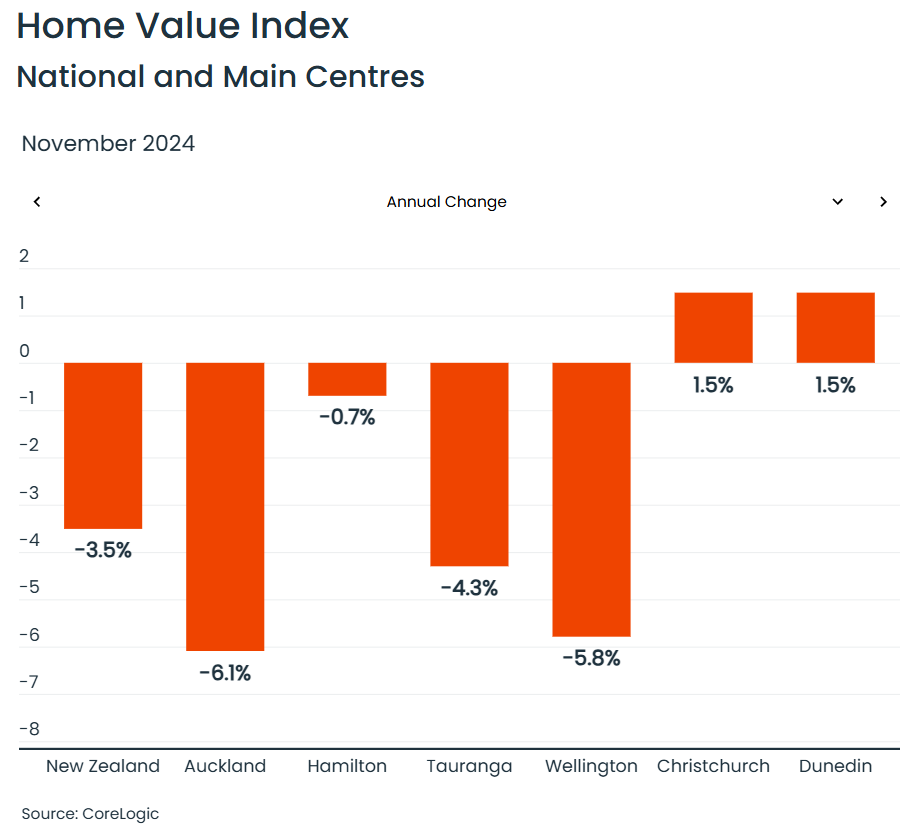

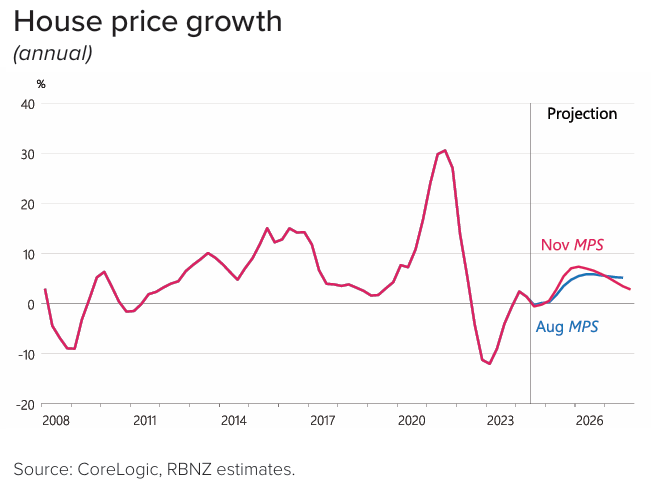

Last week, CoreLogic published its house price results for New Zealand, which showed that prices continued to fall in November despite the Reserve Bank’s 1.25% worth of interest rate cuts.

According to CoreLogic, New Zealand house prices were 3.5% lower year over year.

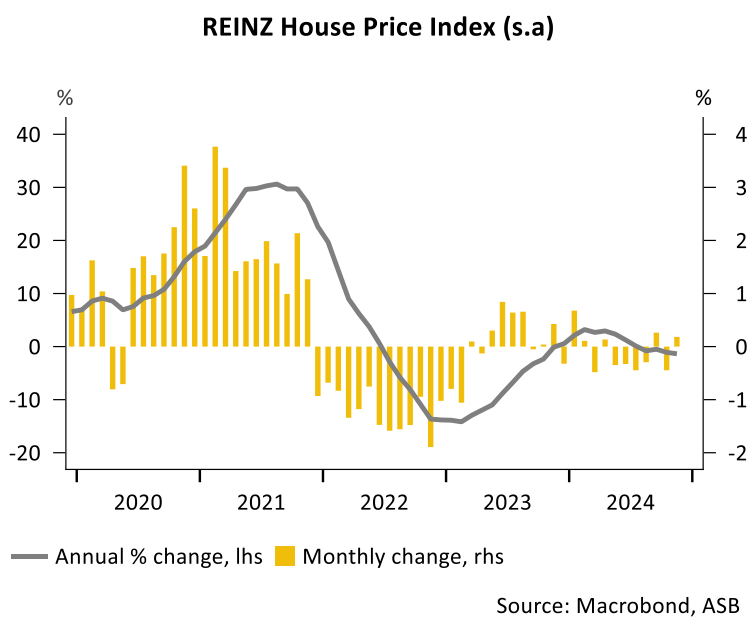

Separate data from the Real Estate Institute of New Zealand (REINZ) shows that New Zealand house prices rose by 0.2% in November following falls in the prior two months. Prices were also down 1.4% year on year.

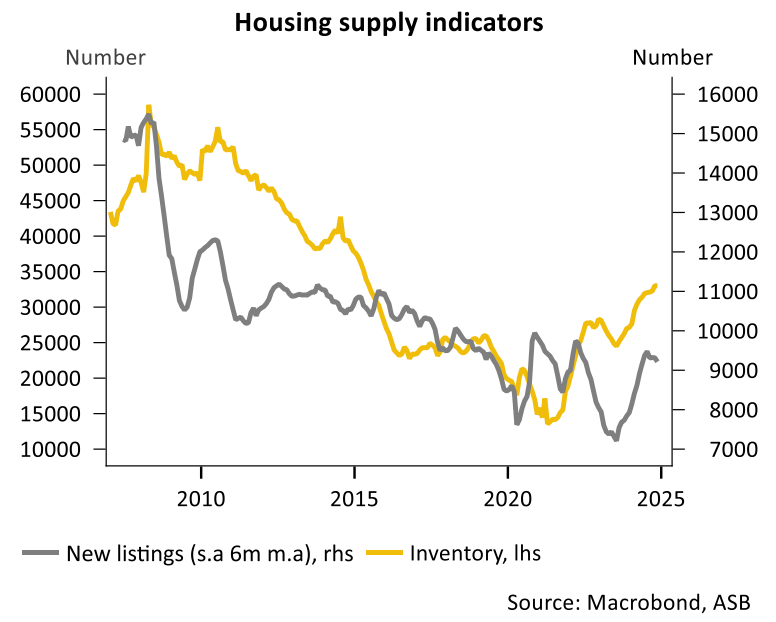

A buildup in for-sale inventory is one of the key factors weighing on prices.

Major bank ASB expects prices to recover in 2025 amid further rate cuts from the Reserve Bank.

“We expect the housing market to shift away from a buyers’ to a sellers’ market in 2025 as the stock overhang is cleared”, ASB noted.

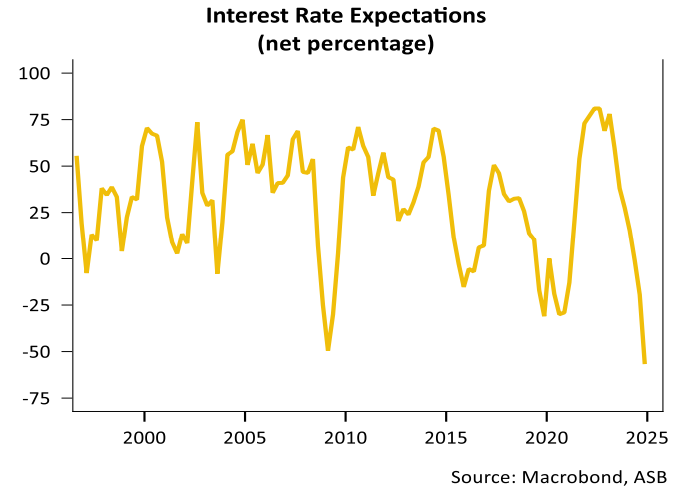

“Lower mortgage interest rates will be a key driver. 2024 has seen 125bps of OCR cuts and we expect a further 100bps of OCR cuts over 2025. Mortgage intertest rates look to head further south over 2025”.

“Further falls in interest rates will provide more support to lift both homebuyer and investor sentiment, though it will take some time to see the full impact on the market”.

“However, there are still headwinds weighing on the housing market recovery in the near term, especially the rising unemployment rate and slowing wage growth”, ASB noted.

Indeed, ASB’s Housing Confidence survey has bounced amid plumetting interest rate expectations.

A net 24% of respondents now expect house price gains, up from a net 13%.

A net 20% of respondents also thought it was a good time to buy in the three months to October, a significant increase to the 8% recorded in the previous quarter.

For what it is worth, the Reserve Bank’s latest Statement of Monetary Policy forecasts annual price growth of -0.2% for 2024 before rising to 2.8% for the year to June 2025, 5.5% for the year to September 2025, and then 7.1% for the year to December 2025.

The Reserve Bank then sees house price growth peaking at 7.4% in the year to March 2026 before gradually declining.

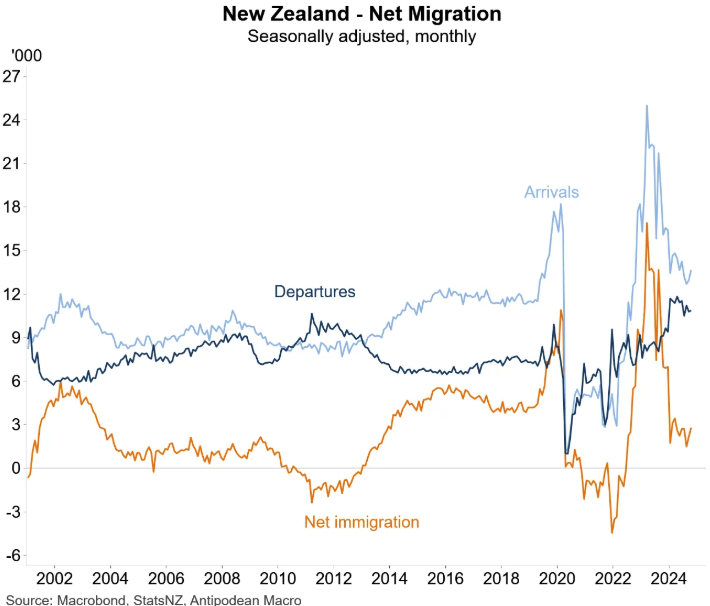

However, the sharp slowing of net overseas migration into New Zealand could dampen housing demand.