The Reserve Bank of New Zealand has cut the official cash rate by 1.25% over the last three monetary policy meetings.

These cuts have reduced the official cash rate to 4.25%, down from a peak of 5.50%.

The latest bond market forecasts have New Zealand’s official cash rate falling to 3.10% by the end of 2025, suggesting significant further easing.

Despite the sharp rate cuts, Kiwi consumers seem reluctant to spend.

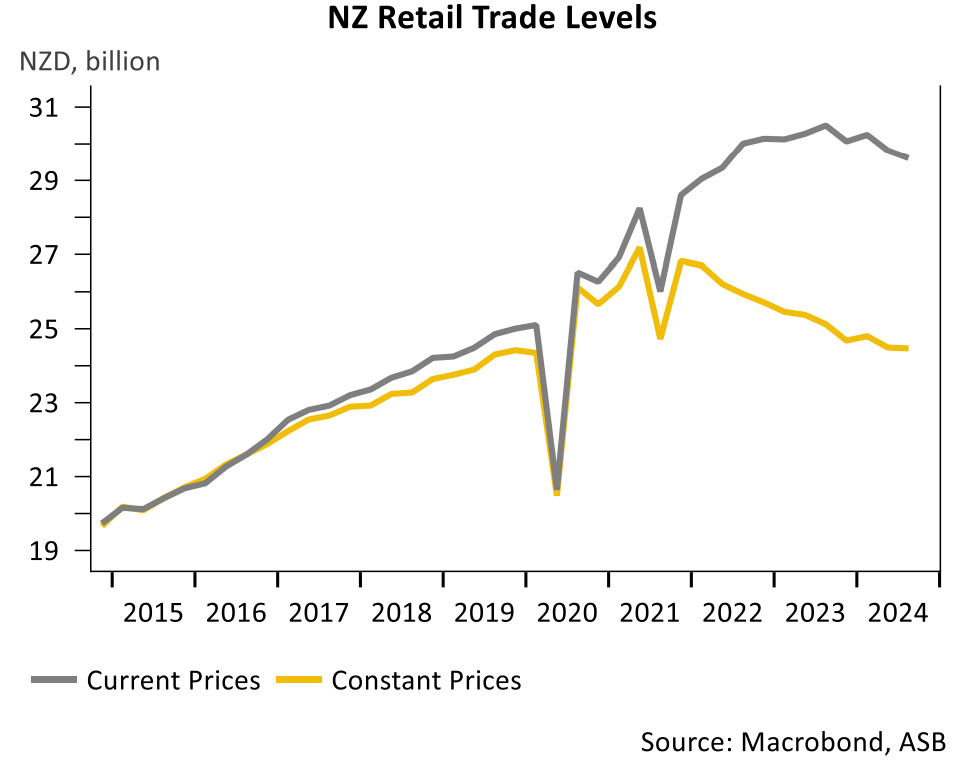

The latest quarterly data shows that retail sales volumes fell by 0.1% in Q3 2024 to be down 2.8% annually.

On Thursday, Statistics New Zealand released data on overall card spending, which declined slightly in November after two consecutive months of gains.

Total electronic card transactions were flat (see table below), after modest rises in the prior two months. Spending was also down 2.3% year on year.

The result was significantly weaker than expected, with most economists tipping a slight lift in card spending in November.

“Despite cooling inflation, further falls in interest rates and income tax cuts, households are still hunkering down and exercising constraint amid rising job insecurity and slowing wage growth”, noted economists at major bank ASB.

“Moreover, population growth, which was a strong boost for card spending last year, is less of a supporting factor”.

“The retail sector showing muted activity and core sectors remaining flat. On an annual basis, card spending decreased further across retail, core sectors, and overall spending”.

“Adjusted for inflation and population growth, the figures present an even grimmer picture”, noted ASB.

Despite the pessimism, ASB is confident that consumer spending will lift in 2025 on the back of falling interest rates and a rebounding housing market.

“Consumers have yet to fully translate improvements in optimism into increased retail spending, but we feel we are getting close to the inflexion point”, ASB noted.

“Further falls in interest rates will provide more support to the retail sector and wider economy. Our base case is a 50bp OCR cut in February, followed by another two 25bp cuts in April and May, making a terminal rate of 3.25%”.

“Our latest Q3 ASB Housing Confidence Survey also indicates a more optimistic outlook for the housing market in 2025, which should underpin recovery in durable retail”.