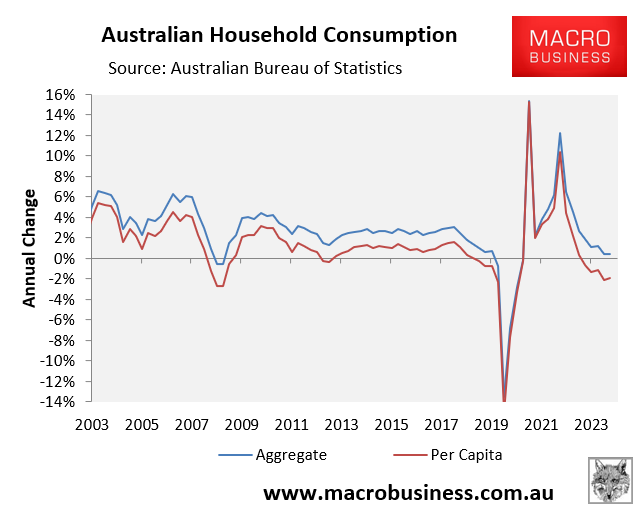

The Australia Institute’s Greg Jericho has called for the Reserve Bank of Australia (RBA) to cut interest rates because real household consumption has fallen.

Chief economist Greg Jericho explains why the RBA must cut interest rates at its meeting this week, showing the decline in household spending pic.twitter.com/5BTKjjwqkb

— Australia Institute (@TheAusInstitute) December 8, 2024

“Households are struggling”, Jericho said. “Before the pandemic, household consumption just grew in a nice straight line”.

But after the pandemic, “it kept raising rates even when household spending went down, and it’s keeping on going down”.

“Households are crying out for relief. This tells us there’s no excess demand. Reserve Bank, cut rates”, Jericho says.

While I understand Jericho’s sentiment, it ignores two fundamental issues.

First, while per capita household consumption has indeed fallen sharply, aggregate consumption has remained positive.

The overall level of demand has grown, which is what matters for interest rate policy.

“A retailer, for example, when deciding prices, is less concerned about per capita spend, when there are more people buying the product, there’s less need to adjust prices. This is what the RBA faces”, noted IFM Investors chief economist Alex Joiner on Twitter (X).

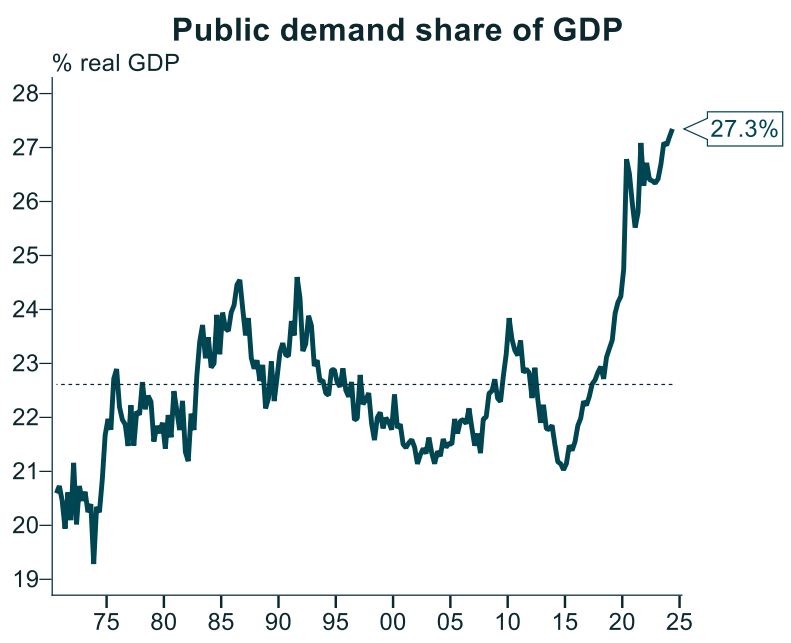

Second, aggregate demand is being pump-primed by record levels of public spending.

Source: Alex joiner (IFM Investors)

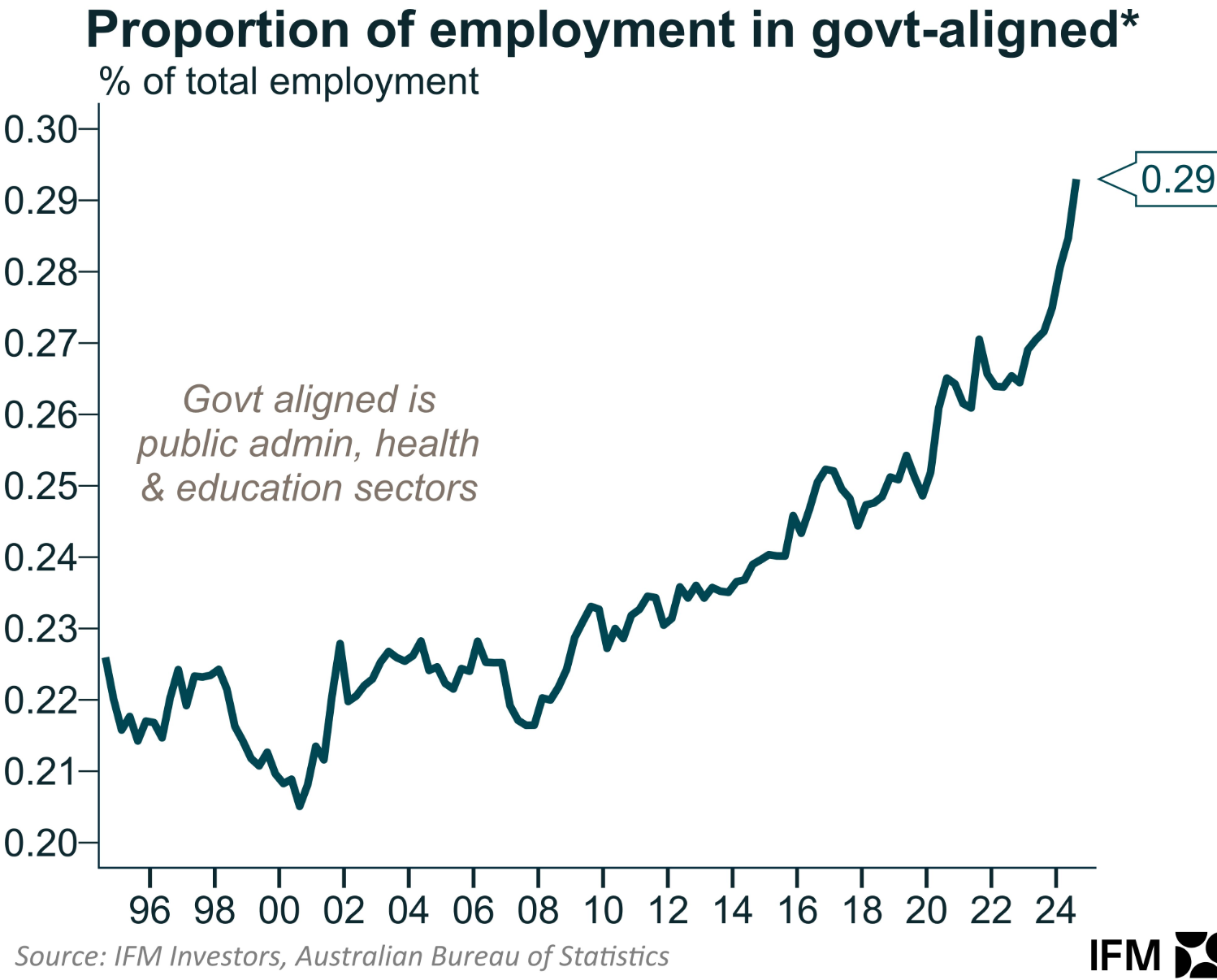

The same applies to the labour market, where job growth is being driven by government spending.

Put simply, record public spending, and immigration is preventing the RBA from cutting rates.

“The RBA has been consistent in its thinking that the level of demand exceeds supply and that creates risks for inflation”, Alex Joiner on Twitter (X).

“Nonetheless, we have added to demand via population growth, public demand and public employment”.