Last week, Statistics Canada released the Q3 national accounts, revealing that the economy grew at an annualised rate of only 1.0% in the third quarter. This is well below the Bank of Canada’s estimate of potential GDP of 2.4% this year and its October forecast of 1.5%.

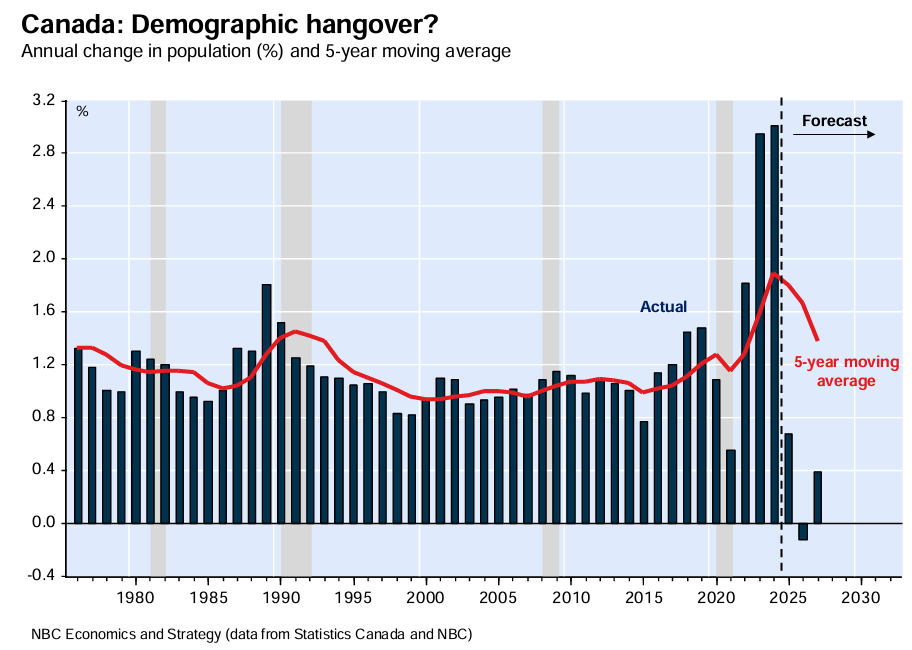

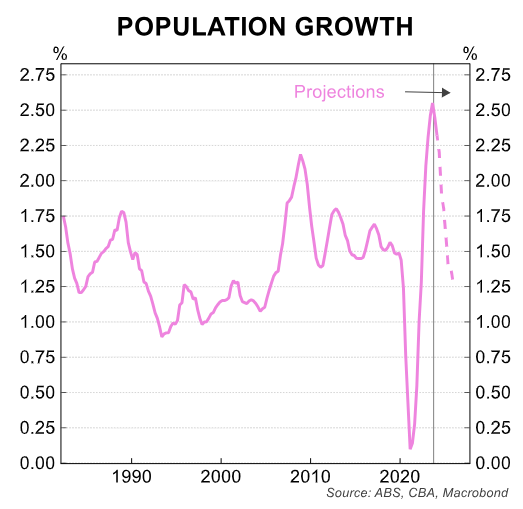

Canada’s population expanded by 3.0% in the year to Q3 2024, meaning that per capita GDP shrank by around 2% year on year.

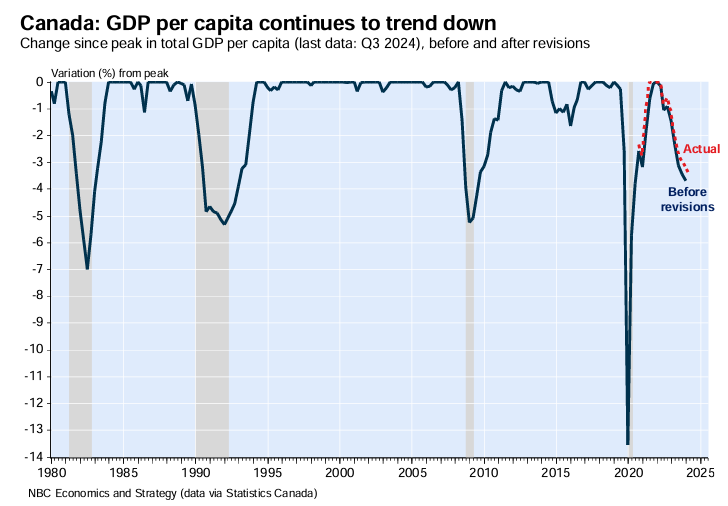

Indeed, the cumulative decline in Canada’s GDP per capita now stands at 3.5%, having fallen for six consecutive quarters.

“Such a decline has never been seen outside a recession”, noted economists at the National Bank of Canada.

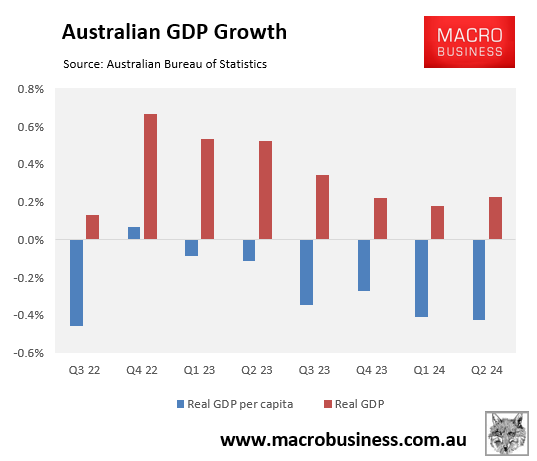

The story is similar in Australia, where per capita GDP has shrunk for six consecutive quarters up to Q2 2024—the longest contraction in recorded history.

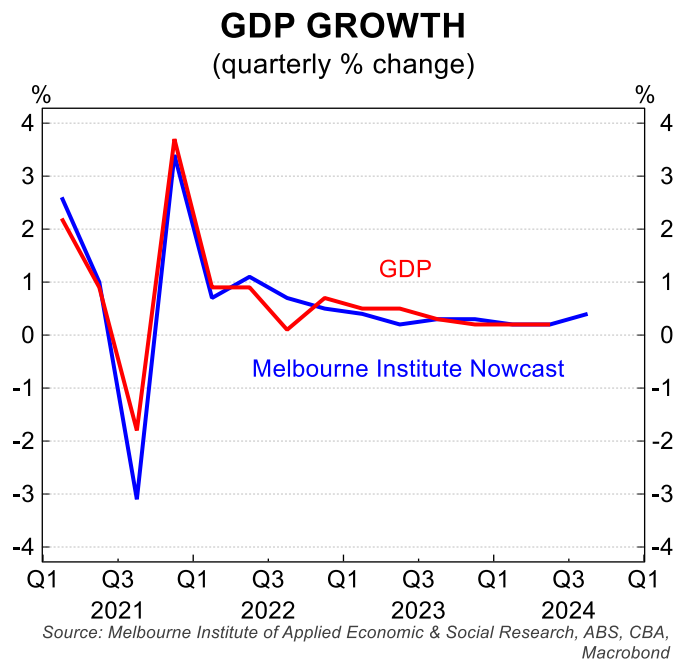

On Wednesday, the Australian Bureau of Statistics (ABS) will release the Q3 national accounts, which are expected to show that Australia’s aggregate GDP grew by 0.4% over the quarter.

The ABS’ quarterly retail trade release implied that Australia’s population grew by 0.6% in Q3. This means Australian GDP per capita is expected to record its seventh consecutive contraction.

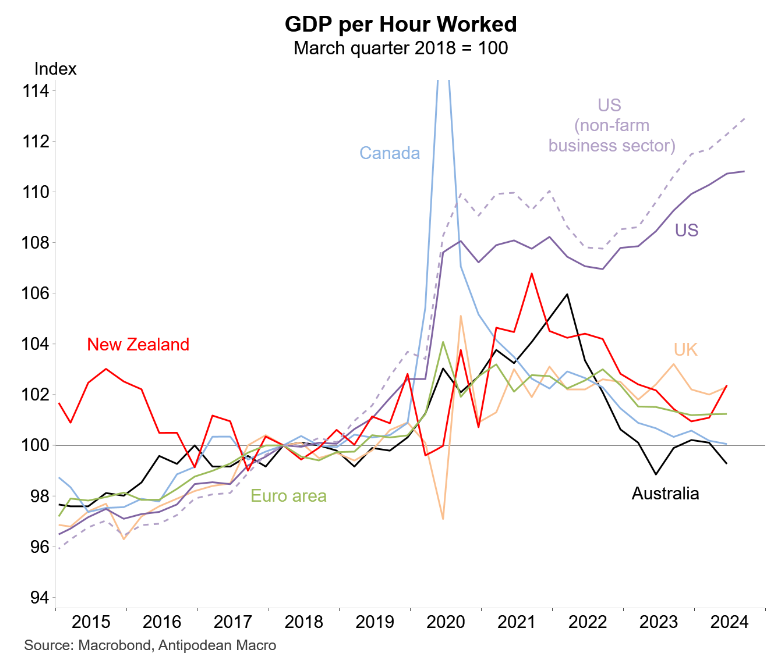

Australian and Canadian productivity growth is among the lowest in the world, suggesting a slow recovery from the recession.

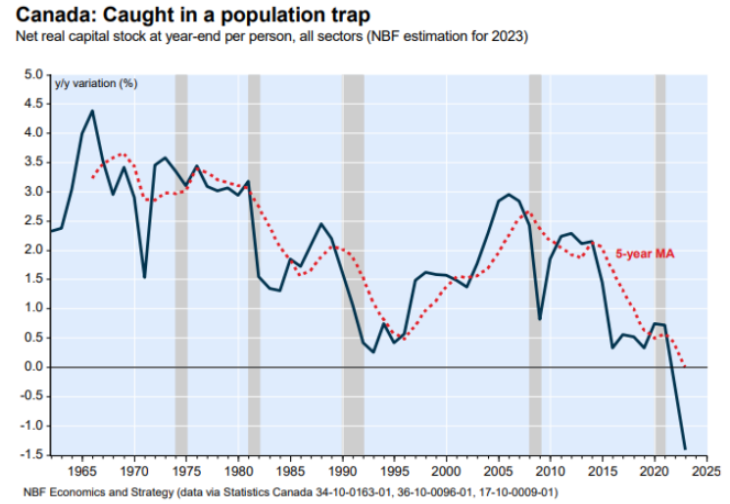

Part of this poor productivity growth reflects the fact that both nations have suffered from chronic “capital shallowing” because their populations, through high immigration, have expanded at a faster pace than business, infrastructure, and housing investment.

Australian capital shallowing

Canadian capital shallowing

As a result, the amount of capital per worker has shrunk (or at least not grown sufficiently), reducing labour productivity, per capita growth, and living standards.