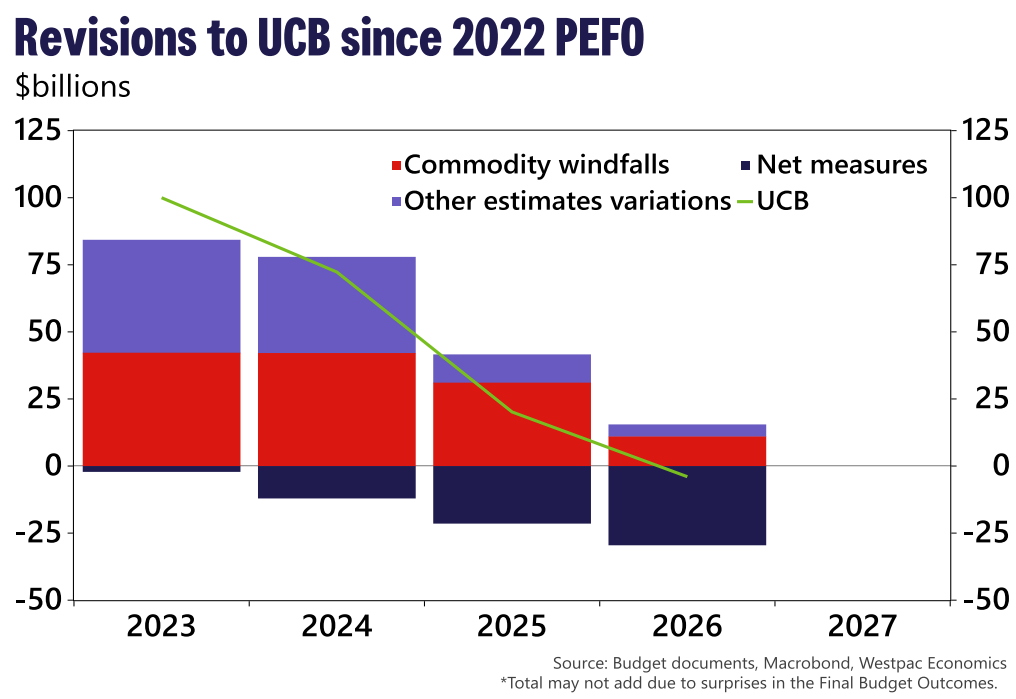

Westpac Senior Economist Pat Bustamante estimates that “high nominal income growth on the back of elevated commodity prices, strong wages growth and high inflation, along with record population growth, have combined to deliver a budget windfall of $252.1 billion over the six years to 2027-28, since the October 2022 budget”.

Bustamante estimates that “elevated commodity prices alone will deliver a windfall of around $121.9bn over the three years to 2024-25, compared with the Treasury estimates in the 2022 Preelection Economic and Fiscal Outlook (PEFO)”.

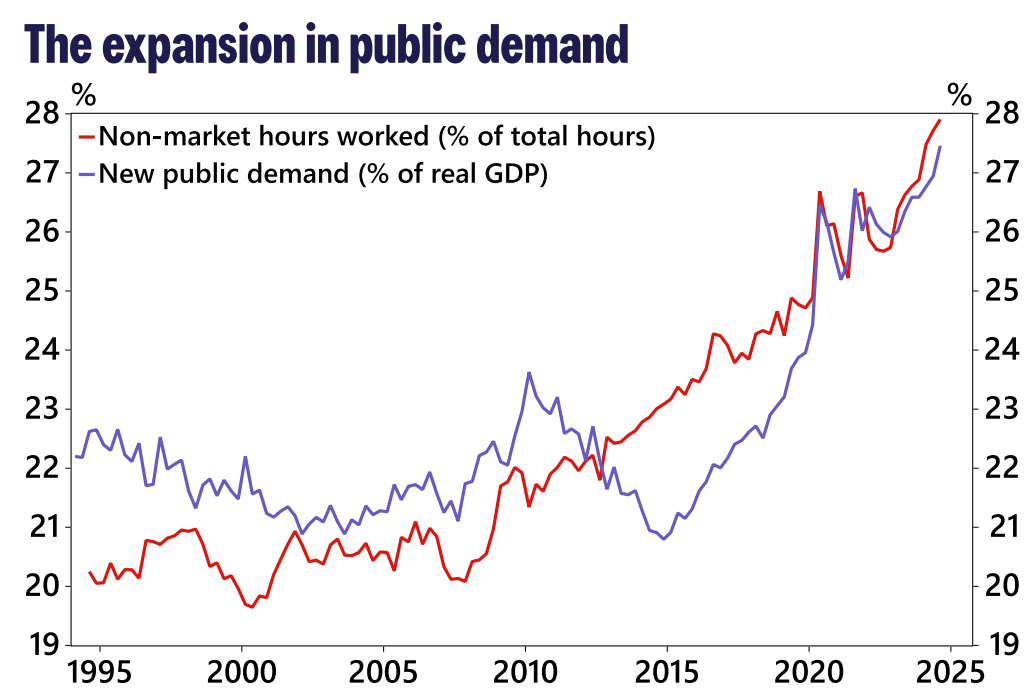

The following chart from Bustamante shows that much of the revenue windfall has been channelled into record public spending.

“Since the October 2022 policy changes have increased spending by $123.6 billion over the six years to 2027-28, with increased discretionary spending amounting to an additional $40.6 billion in 2025-26 alone”, notes Bustamante.

“This includes additional spending on cost-of-living measures, infrastructure projects, and grants to states and local governments under national partnership agreements”.

As a result, new public demand (including federal and state spending) has increased from an average of around 22.5% of real GDP in the decade before the pandemic to a record high of 27.5% of GDP in the September quarter of 2024.

Moreover, the non-market (healthcare, education, and public administration/safety) share of total hours worked across the economy increased to a record high of nearly 28%, as illustrated below.

This blowout in public spending and non-market jobs is powering the economy and labour market, and is the primary reason why the RBA is unable to cut interest rates.

The tide is now receding for the federal budget.

“As commodity prices ease, wages growth moderates and the economic growth remains subdued, these temporary windfalls will become a thing of the past”, notes Bustamante.

“At the same time, the gradual easing in labour market conditions will likely see unemployment benefits and other social assistance payments increase, further weighing on the bottom line”.

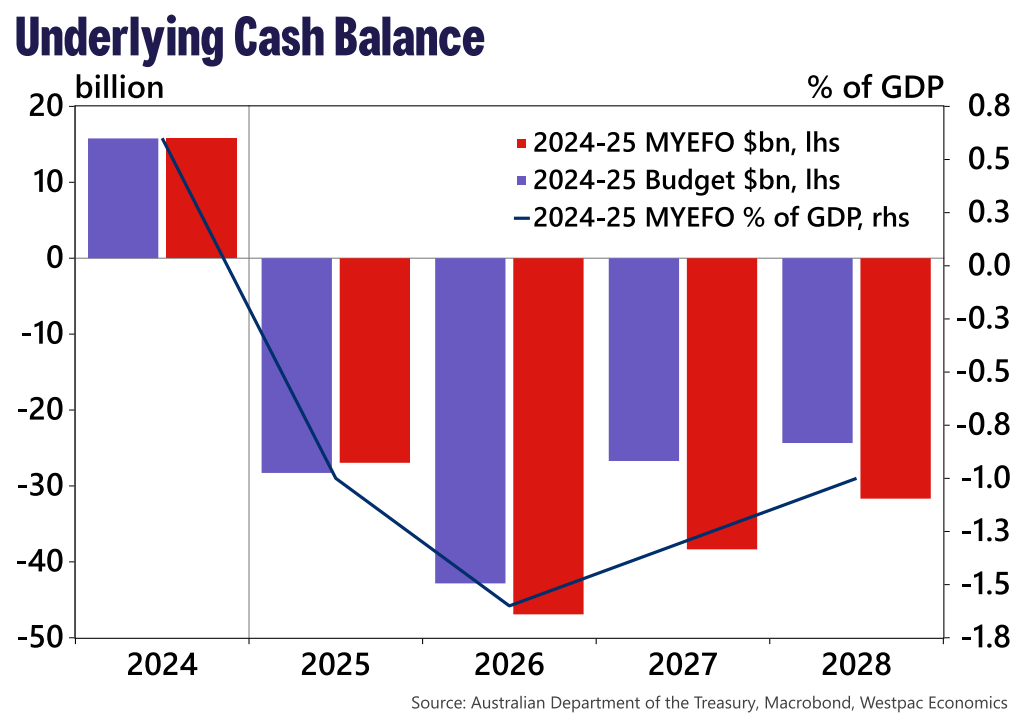

The underlying cash balance is forecast to move from a surplus of $15.8 billion in 2023-24 to a deficit of $26.9 billion in 2024-25 and $46.9 billion in 2025-26, remaining in the red across the forward estimates period.

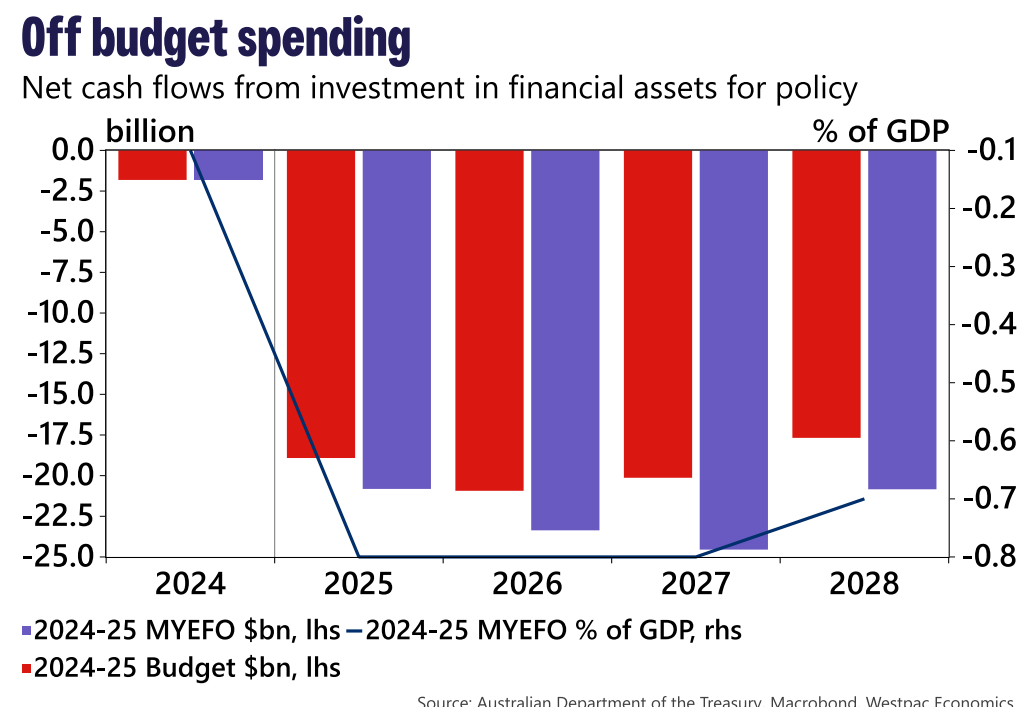

The federal government is also forecasting a substantial lift in off-budget spending, moving from $1.9 billion in 2023-24 to $20.8 billion in 2024-25 and increasing to $24.5 billion in 2026-27.

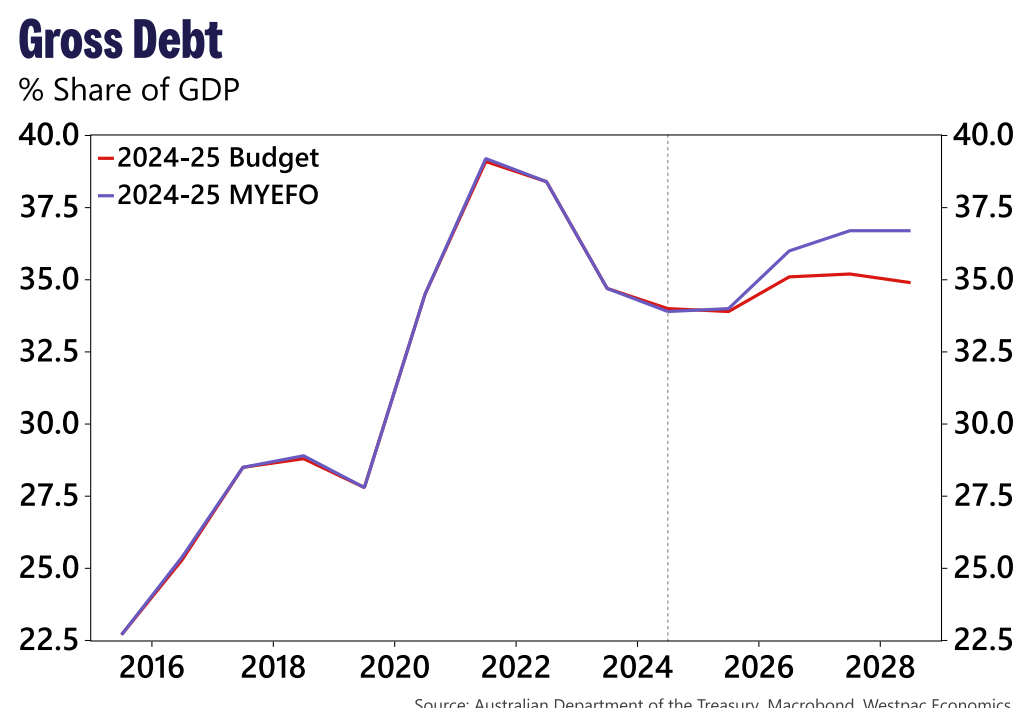

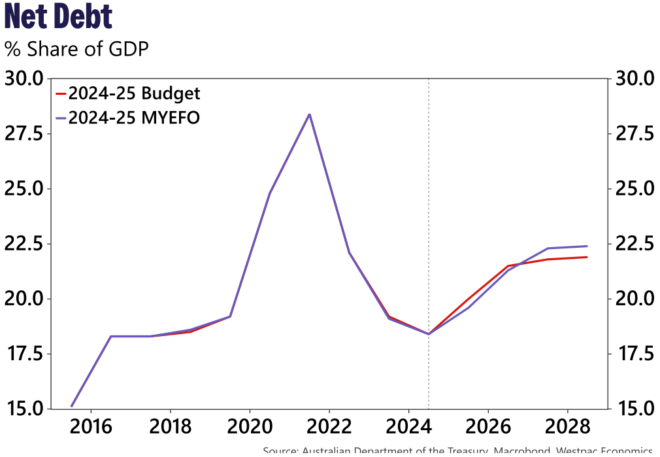

As a result, gross and net debt as a share of the economy has deteriorated compared with the May Budget.