We have repeatedly warned that Victoria’s state debt trajectory is concerning.

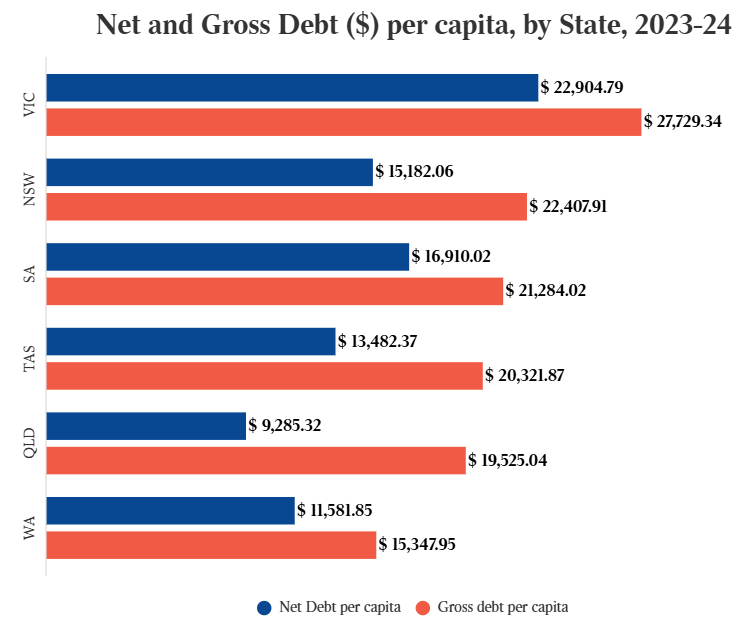

Victoria has the highest per capita debt in the nation and the lowest credit rating.

The world’s two largest credit rating agencies, S&P and Moody’s, recently warned that the state risks further rating downgrades if it does not bring its debt situation under control.

Downgrades seem inevitable given that the Labor government signed the first major tunnelling contracts for the $216 billion Suburban Rail Loop against the explicit advice of experts.

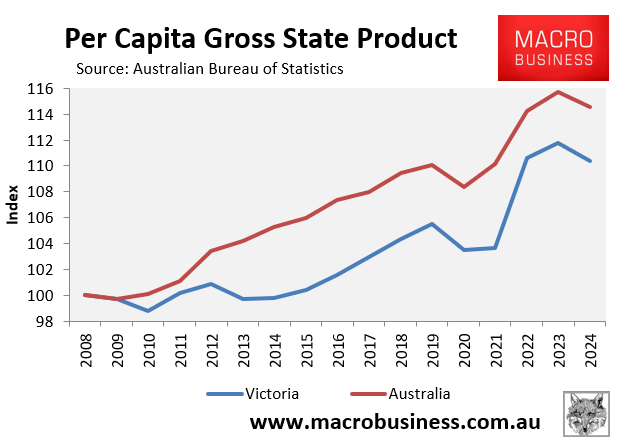

The increase in Victoria’s debt is especially problematic in light of the state’s poor growth, which makes servicing that debt more difficult.

This week, the Australian Bureau of Statistics (ABS) released the annual state accounts, which showed that Victoria’s per capita GDP growth fell by 1.2% in 2023-04 and has only risen by 10.4% since the Global Financial Crisis (GFC) hit in 2008.

This compares to a 1.0% national decline in per capita GDP in 2023-24 and a 14.5% increase since 2008.

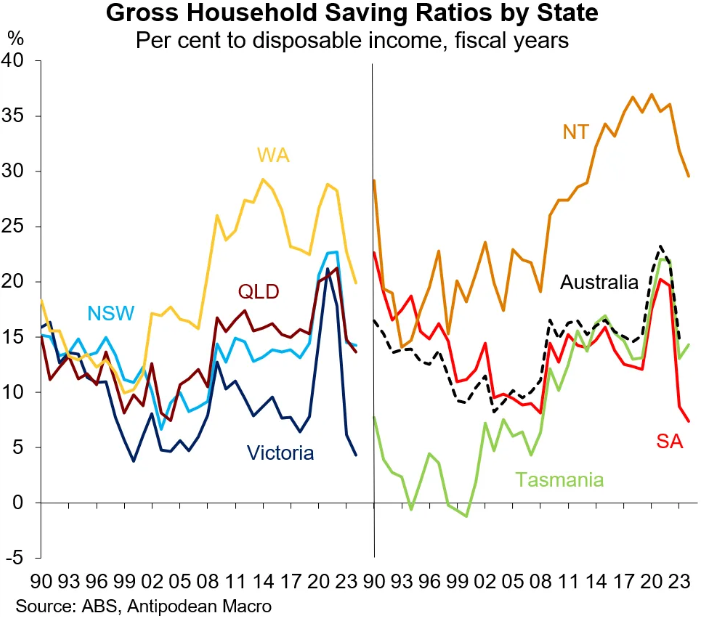

Victoria’s poor GDP growth comes despite its households raiding their savings far more aggressively than households in other jurisdictions:

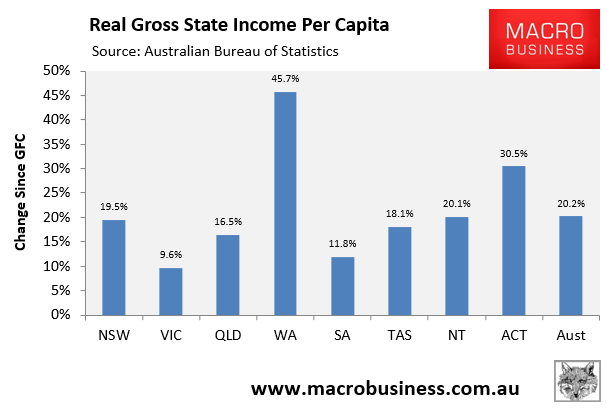

Victoria has also experienced the nation’s weakest growth in gross state income per capita since the GFC:

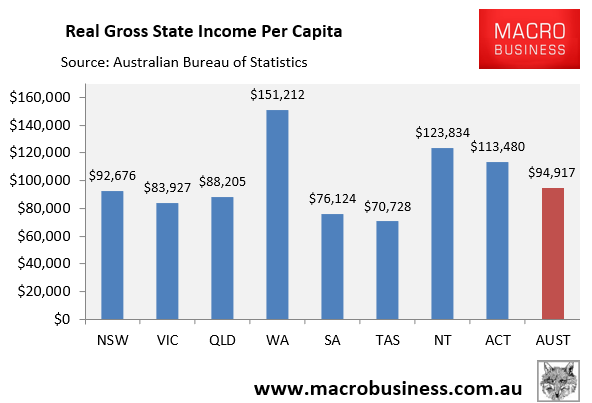

Victoria’s real gross state income was also the third lowest in the nation in 2023-24, behind Tasmania and South Australia:

Victoria’s economic growth model effectively revolves around importing masses of people to build housing and infrastructure for, as well as provide services to.

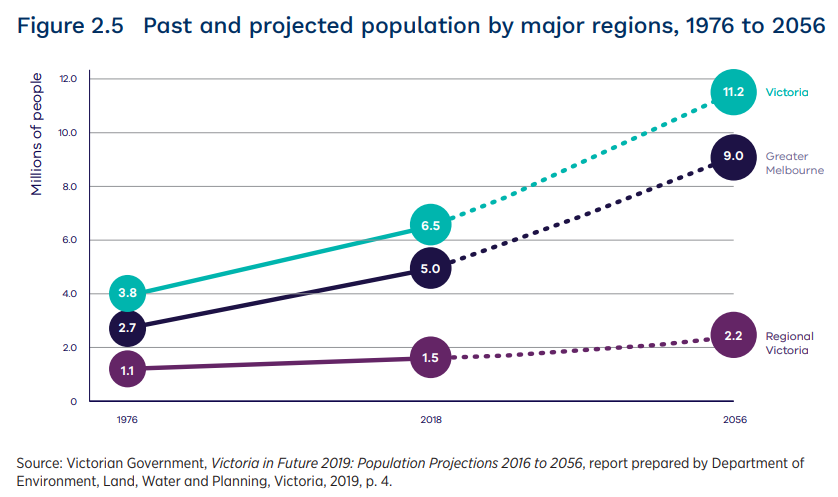

The state’s population has swelled by an insane 2.3 million people this century and is officially projected to add another 4.2 million people over the next 32 years:

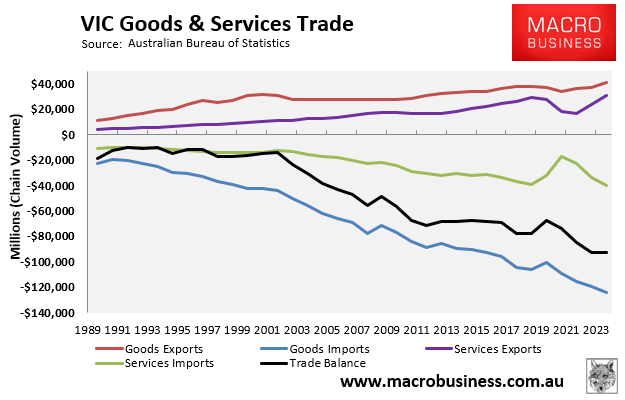

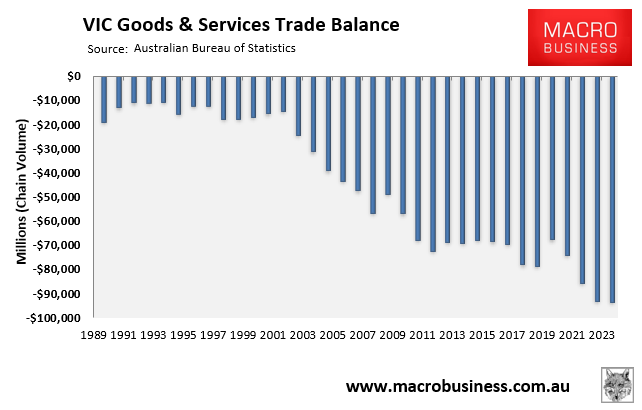

Evidence of this false economy is found in Victoria’s trade performance.

Exports have recorded slow growth over the past 20 years, whereas imports have doubled.

Accordingly, the state’s trade deficit has blown out to a whopping $92.9 billion in the year to June 2024:

Victoria (read Melbourne) is essentially sucking financial resources from mining states in order to fund its population ponzi scheme and growing for the sake of growth through mass immigration and debt accumulation.

This growth model has resulted in perpetual infrastructure bottlenecks and lower living standards for incumbent residents due to rising congestion, reduced amenity, and deteriorating housing affordability.

It has also plunged the state deeper into debt as it frantically tries to build its way out of the never-ending population crush.

How does the Victorian government intend to create an economy based on real and sustainable growth that truly raises the living standards of the current population?