The Victorian government’s budget update shows that the state’s net debt is projected to exceed $188 billion by 2027–28.

The update also reveals that the government’s Covid debt levies are expected to raise $529 million more over four years than had been forecast in the 2023 budget.

The bloating of Victoria’s public service is a key driver of the state’s ballooning debt.

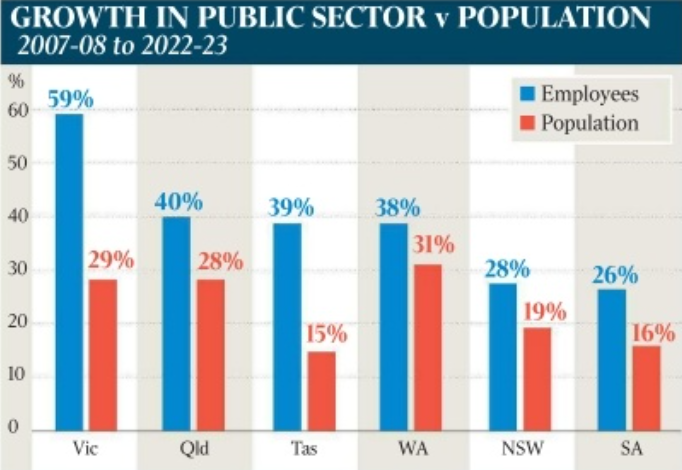

Victoria’s public sector workforce increased by 59% in the 15 years to 2022-23, dwarfing the 29% growth in the state’s population.

Source: The Australian

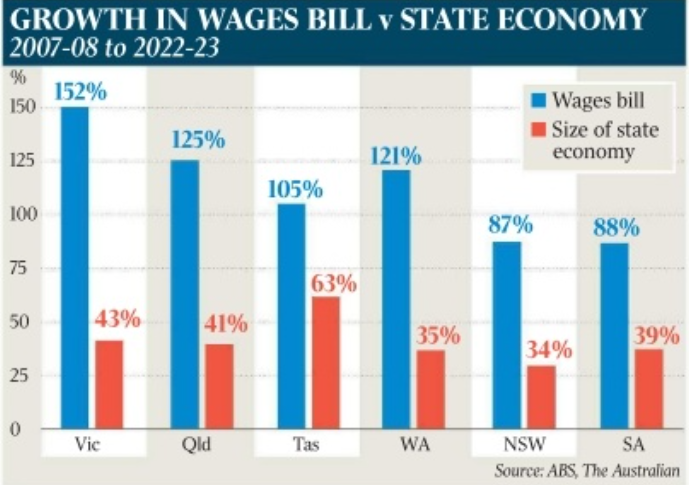

The state’s public servant wage bill also surged by 152% over the same 15-year period, easily outpacing the other Australian states.

Source: The Australian

According to the budget update, Victorian public sector employee expenses grew from $14.35 billion in 2022–23 to $15.48 billion in 2023–24, or 7.94%.

Dozens of senior public servants will receive massive pay rises after Victoria’s Independent Remuneration Tribunal (IRT) approved salaries well above the set regulatory bands.

For example, the incoming chief executives of the Development Victoria agency and government investment arm Breakthrough Victoria have a maximum salary set at $534,000. However, the IRT has approved salaries up to $650,000 and $600,000, respectively.

Other senior public sector positions that will receive large pay increases include the director of the Victorian Infrastructure Delivery Authority, who will be paid $30,000 more, and the head of asset classes at Victorian Funds Management Corporation, who will be paid up to $495,000, $216,000 more than the previous band.

Earlier this month, the annual report of Victoria’s Suburban Rail Loop Authority revealed that it paid more than $32.9 million to 102 executives in 2023-24, with an average salary of $332,000.

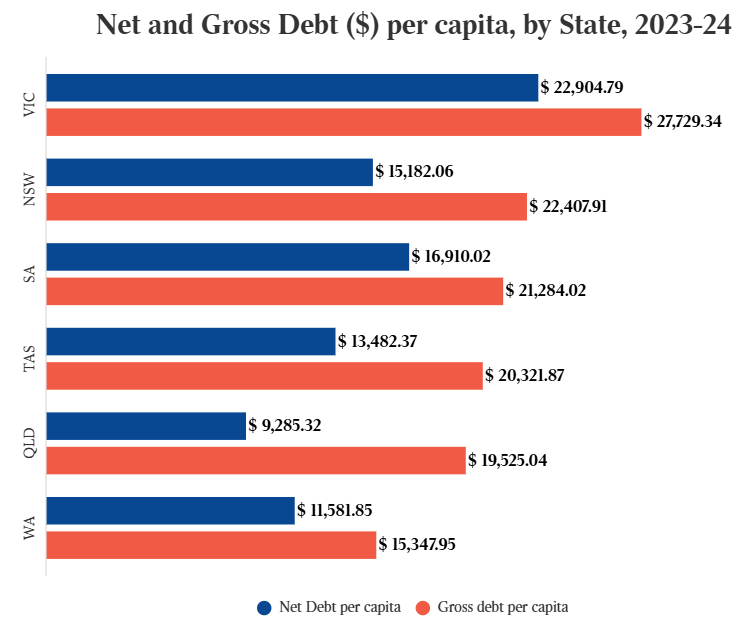

Victoria’s per capita debt is already the largest in the nation relative, with the state also having the lowest credit rating.

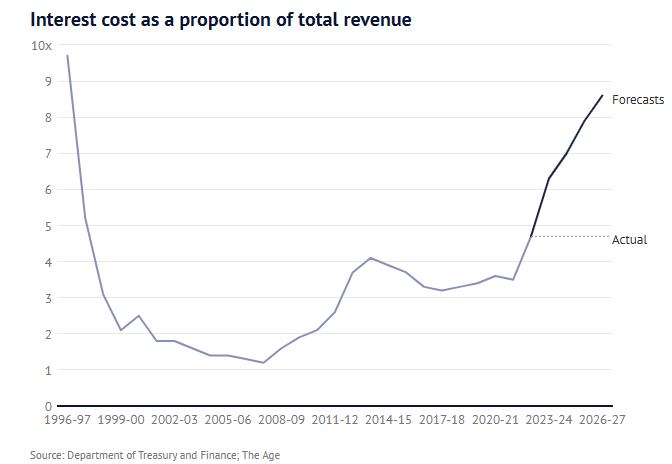

Interest repayments on the state’s debt are also approaching $26 million a day.

The two major credit rating agencies—S&P and Moody’s—warned recently that Victoria faces further credit ratings downgrades if it does not bring its debt under control.

Therefore, the last thing that Victorian taxpayers need is more bloating of the state’s bureaucracy.