Last week, Coles and Woolworths senior executives were asked by a senate inquiry into the cost of living why a packet of TimTams cost more in Australia than in the United Kingdom despite being made here.

A packet of TimTams cost $6 at both major Australian supermarkets versus $4.86 at Tescos, a popular UK supermarket chain.

Coalition Senator Jane Hume said that it was “strange” that a “product that was manufactured in Western Sydney would cost more at a supermarket in Sydney than it would at a supermarket in London” despite the “rigmarole” over freight costs and import taxes.

Woolworths chief commercial officer Paul Harker told the inquiry that it was “probably a great question for Arnott’s”.

“I don’t know what arrangements they do or don’t have with selling that product into the UK market and what margins they’re expecting to make from that product in that market”, Harker answered.

“In this market, we have negotiated the best standard cost that we can every day with Arnott’s … and we then put all out efforts into negotiating promotions on those products for consumers”.

Coles head of public affairs Adam Fitzgibbons likewise responded that the pricing discrepancy was “a question that would be very best directed toward Arnott’s”.

The very same questions could be asked of the East Coast gas market, which is the only gas exporting region in the world that does not have a domestic reservation system in place.

East Coast Australia exports more than 70% of its gas but charges domestic users more than overseas buyers.

The lunacy of the situation was highlighted in 2022 following the invasion of Ukraine by Russia. As shown in the following Energy Quest chart, East Coast gas prices increased significantly more than those of our export customers:

China buys the bulk of Australia’s East Coast gas, but enjoyed far lower prices than local customers despite the costly “rigmarole” of freezing this gas into liquid and transporting it across the world.

By contrast, Western Australia, where a domestic reservation scheme operates, enjoyed the lowest gas prices in the world, alongside cheap electricity (since gas fired generation is the marginal price setter of electricity).

“With energy prices at eye-watering levels around the world, we believe that Western Australia now has the lowest gas prices in the OECD”, EnergyQuest said in September 2022.

“Western Australia is a low-energy price paradise”…

“WA electricity prices are also much lower than in the National Electricity Market on the east coast, averaging $64 a megawatt-hour, while NEM prices were more than four times higher at an unprecedented $284/MWh”, The AFR reported.

“WA’s electricity market is at the same time less emissions-intensive than the NEM and coal powers only 38% of generation, compared with 59%, EnergyQuest said in an analysis of the June quarter”.

By listening to the rotten advice of the captured Grattan Institute and profit-hungry energy producers, the Rudd/Gillard governments failed to reserve East Coast gas when the Gladstone LNG terminals were set up more than a decade ago.

And every government that followed has failed to take corrective action.

Because of these blunders, East Coast Australia has been left paying some of the highest gas prices in the world, whereas Western Australia enjoyed low and stable prices.

If you don’t want to take my word for it, check out the RBA’s briefing on the issue from 2021:

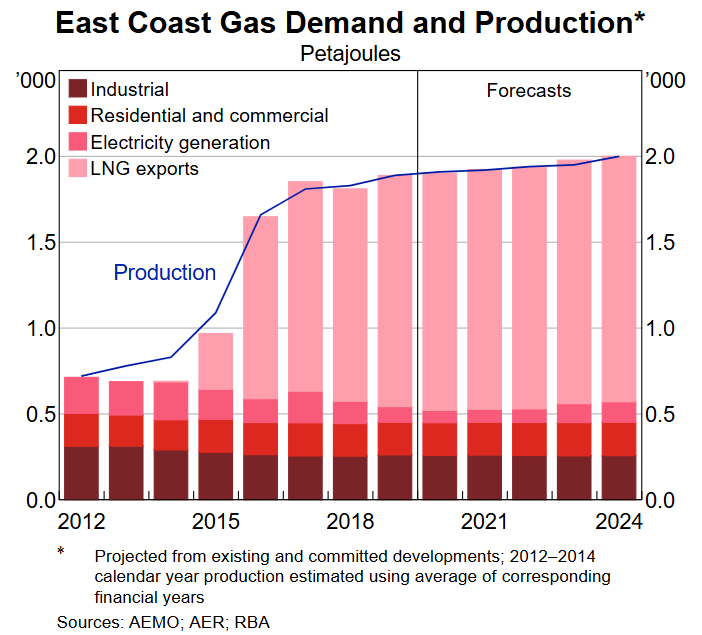

“Prior to 2015, gas demand on the east coast was roughly split 40/30/30 across industrial, residential and commercial, and electricity generation”.

“Since then, the development of Queensland’s LNG export capacity has led to a significant increase in gas demand, with these export projects accounting for almost three-quarters of total demand for gas on the east coast in recent years”.

“Over the same period domestic usage of gas has decreased somewhat; some gas-fired electricity generation has been replaced by renewable energy sources, while higher gas prices have prompted a demand response from some industrial gas users”…

“Despite several large LNG export projects being developed in Western Australia over the past 5 years domestic gas prices in the state have remained low and seemingly uncorrelated with international prices. Liaison and public information indicate that Western Australian gas prices are around half the levels observed on the east coast since 2015”.

“Lower gas prices in Western Australia are widely attributed to the state government’s domestic gas reservation policy. The policy requires LNG project owners to make gas equivalent to 15% of exports available to the domestic market (domestic gas plants must typically be constructed as part of the LNG export project), increasing supply in the WA domestic gas market”.

“The reservation policy also prevents gas from domestic-facing projects from being sold overseas, so international and domestic prices remain unlinked, and only domestic demand and supply determine local prices”.

“With domestic gas demand remaining little changed in recent years many contacts have described the WA domestic market as ‘oversupplied’”.

With access to cheap and reliable gas, Western Australia has also transitioned more quickly away from dirty coal, lowering electricity emissions.

Instead of belatedly reserving East Coast for domestic use, the industry’s brainiac solution is to import our own gas via LNG terminals to overcome artificial shortages caused by failed policy:

“LNG import opportunities … are probably the most prospective ways to meet demand needs”, Woodside CEO Meg O’Neill said.

The obvious solutions to Eastern Australia’s energy woes are to:

- Force domestic reservation

- Cancel a few surplus LNG contracts with China

- Set domestic gas prices using old-fashioned cost plus regulation.

- Build a few storage gas tanks in the south to fill up during the off peak period (e.g., summer) to use during peak periods (winter) when the north-south pipeline runs at capacity.

These solutions are bleedingly obvious and far cheaper than importing energy intensive liquified gas at nosebleed prices, locking domestic gas and electricity prices at permanently high levels.

Sadly, Australia’s captured coward politicians rarely set policy in the national interest.