New Zealand’s economy is a disaster zone.

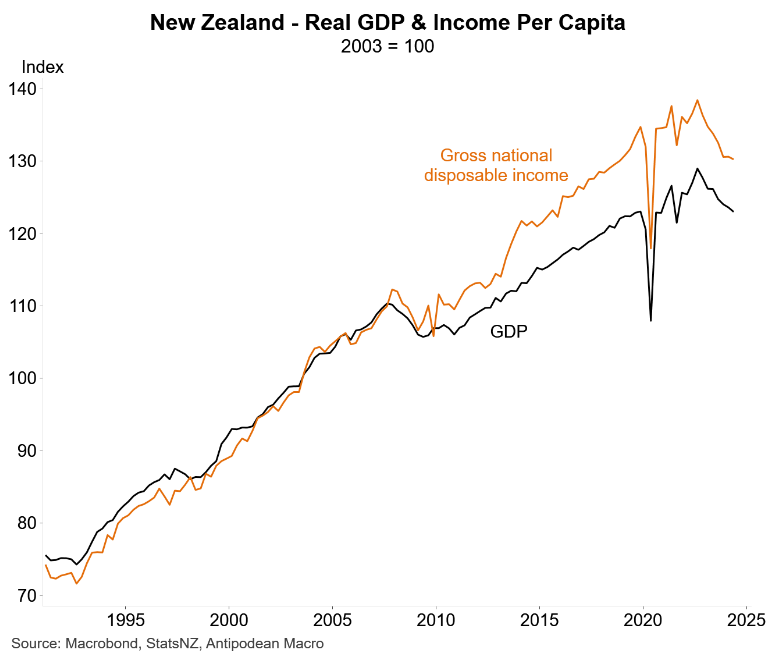

As illustrated in the following chart from Justin Fabo at Antipodean Macro, per capita GDP has fallen for seven straight quarters, with gross national income also down sharply in per capita terms:

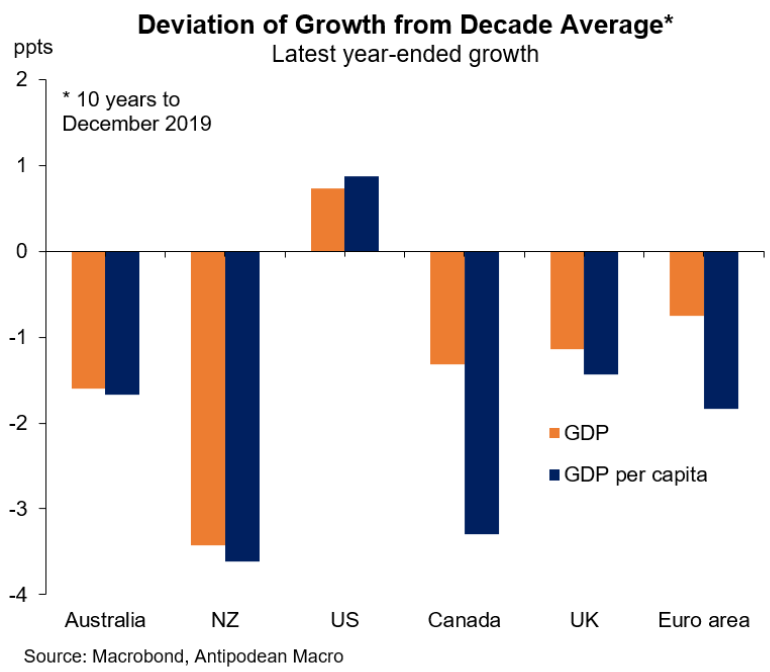

New Zealand has also registered the largest fall in per capita GDP compared with the decade average out of the Anglo nations:

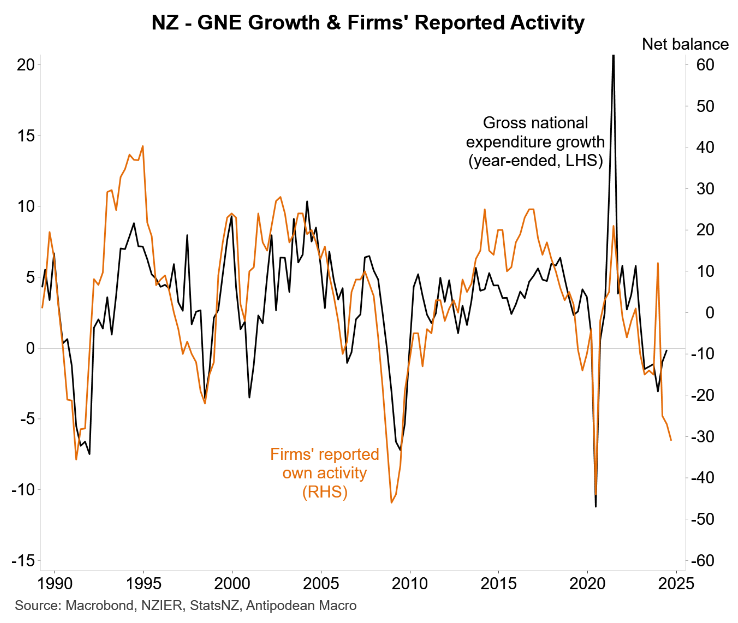

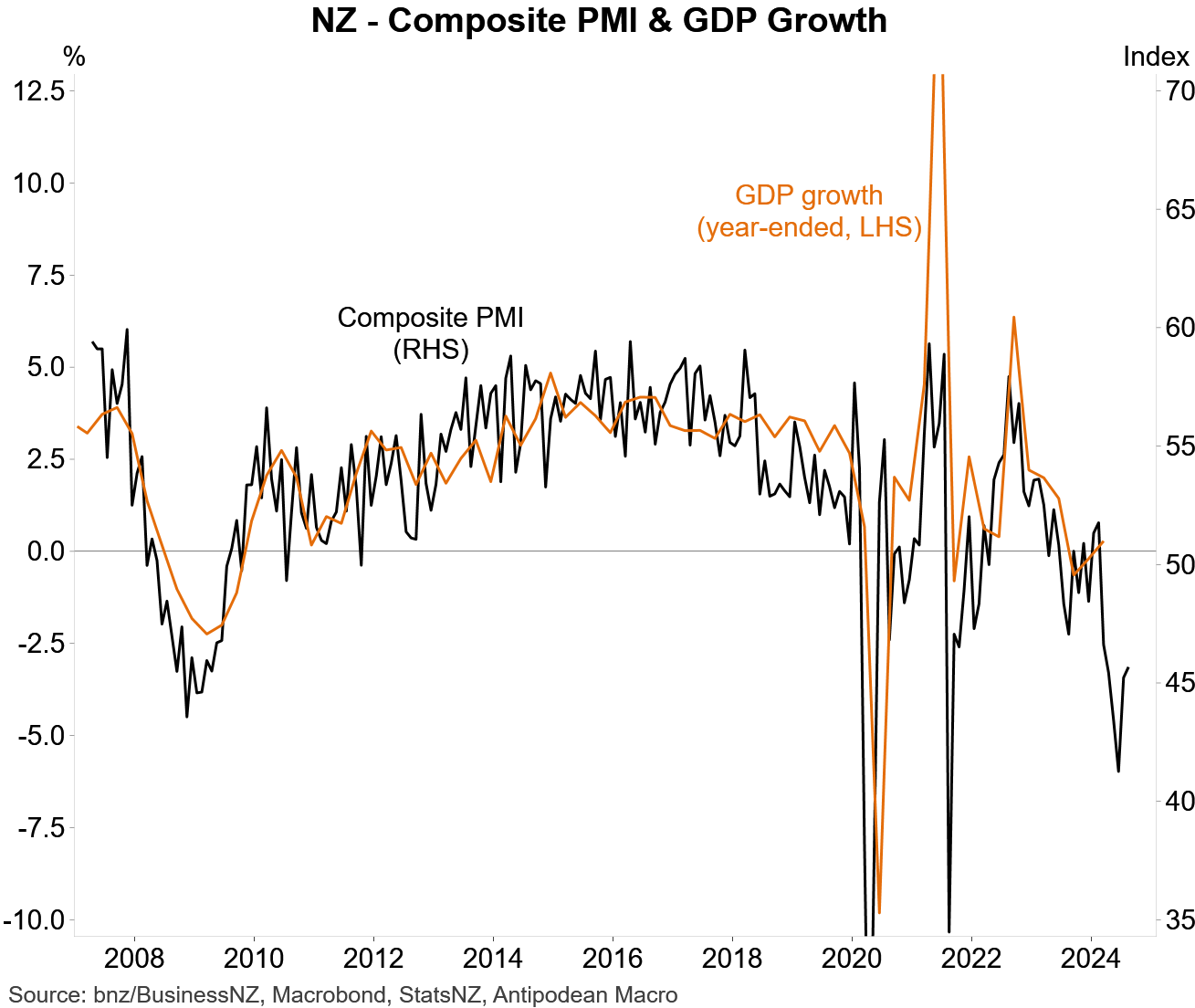

High frequency activity indicators suggest that New Zealand’s recession may have deepened.

Firm activity has collapsed, pointing to weaker gross national expenditure and GDP growth:

New Zealand’s composite PMI also remains very weak:

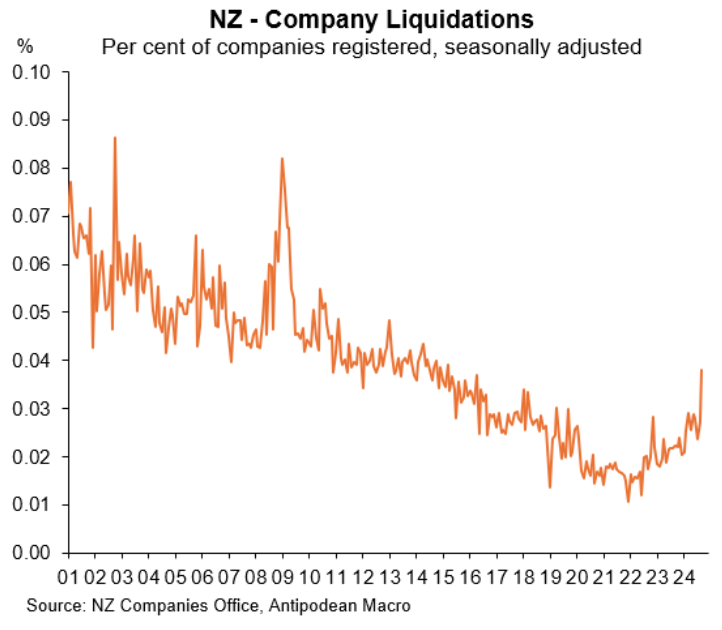

Company liquidations have also jumped:

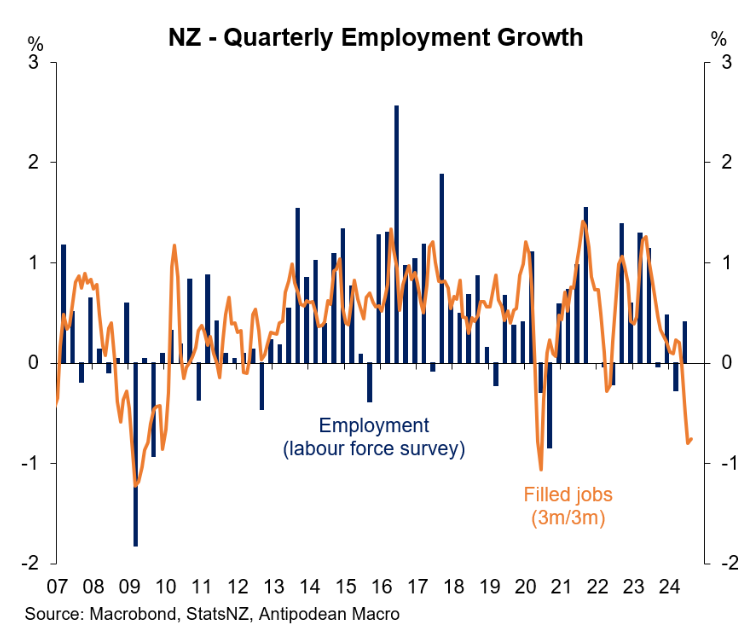

New Zealand’s labour market is also faltering.

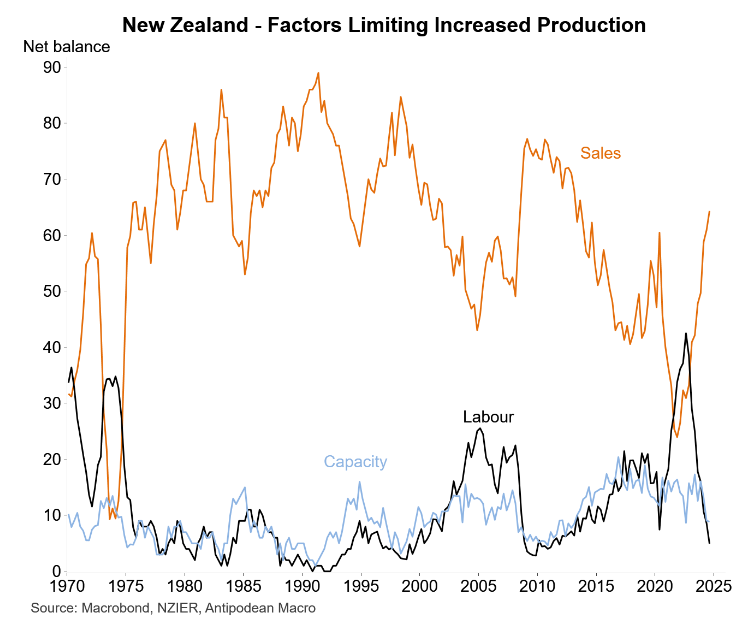

Firms are now oversupplied with workers, and they report that the biggest constraint on activity is a lack of sales:

Not surprisingly, payroll employment, which is a leading indicator for the official quarterly labour market survey, fell sharply over the August quarter:

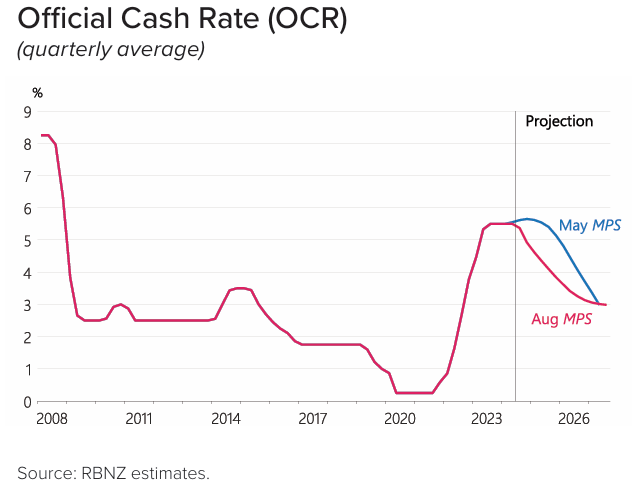

In its August Monetary Policy Statement, the Reserve Bank projected that the official cash rate would be gradually cut by around 2.5% over 2.5 years:

However, amid the depending recession, Greg Smith, head of retail at Devon Funds, has called for the Reserve Bank to slash the cash rate by 1.5% by Christmas.

“There is a strong case for official rates to already be at neutral, which the Reserve Bank estimates to be 3.8% in their short-run horizon”, he said.

“With the official cash rate at 5.25% currently, there is arguably the case that official rates should be below neutral already, with a 0.75% reduction needed not only at the meeting this week, but also at the one in November”.

“We visit many businesses and it is clear that the economy is cratering. Pressures faced by big business are also having knock-on impacts to smaller companies”.

Smith said that the Reserve Bank had the opportunity to “get ahead of things. Why is there even a debate?”.