The Reserve Bank of New Zealand has slashed the official cash rate by 0.5% to 4.75%.

In arriving at its decision, the Reserve Bank noted that “business investment and consumer spending have been weak, and employment conditions continue to soften. Low productivity growth is also constraining activity”.

“High-frequency indicators point to continued subdued growth in the near term”, the media release said.

“The New Zealand economy is now in a position of excess capacity, encouraging price-and wage-setting to adjust to a low-inflation economy”.

“Labour market conditions are expected to ease further, with filled jobs and advertised vacancy rates continuing to decline”.

“More generally, weak house price growth, lower levels of net immigration, and ongoing fiscal consolidation from spending restraint, are expected to constrain aggregate demand growth”, the media release said.

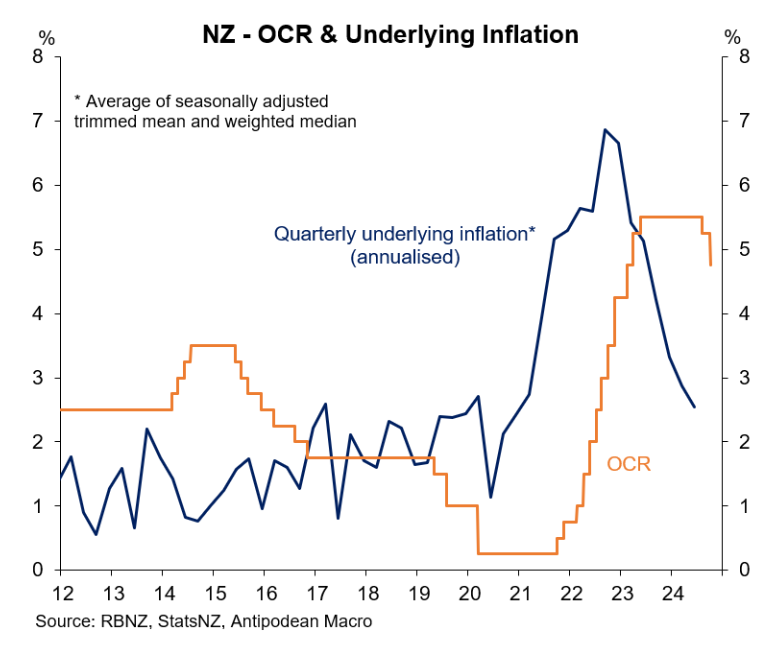

The Reserve Bank also noted that inflation has fallen within the 1% to 3% target and that “the economic environment provided scope to further ease the level of monetary policy restrictiveness”.

This is confirmed by the following chart from Justin Fabo at Antipodean Macro, showing the sharp decline in underlying inflation:

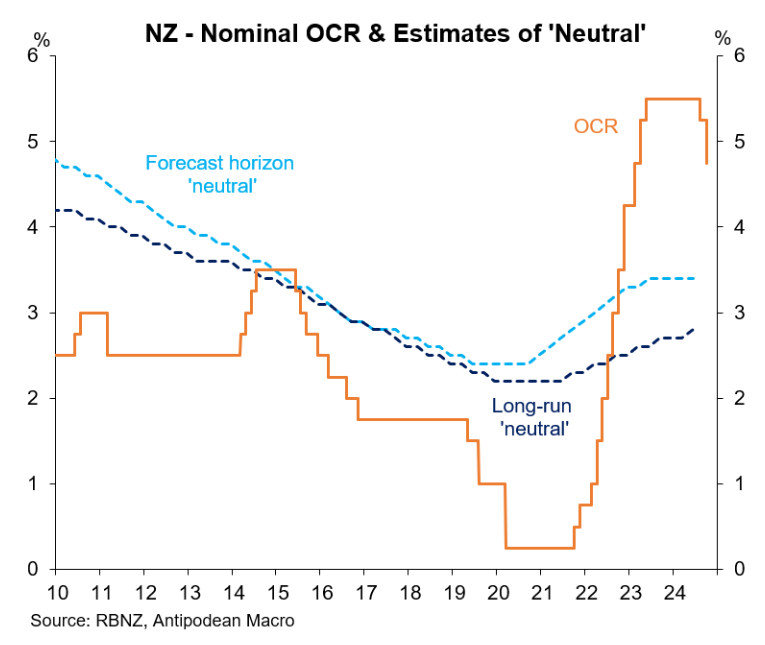

The OCR is still well above the Reserve Bank’s estimates of ‘neutral’, suggesting that another 50bp cut in November is an odds-on bet.

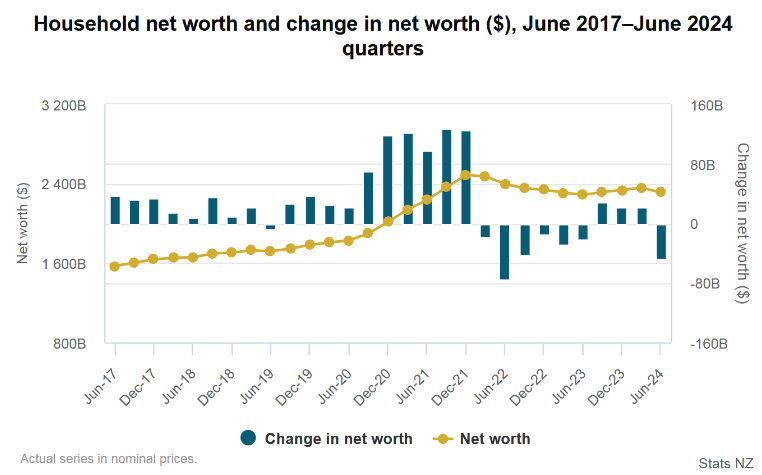

Separate data released by Statistics New Zealand showed that the net worth of households fell sharply in Q2.

Household savings also contracted by $479 million in the June 2024 quarter on the back of a 0.2% decline in total household income—the first decline since the series started in 2016.

“With net disposable income falling in the June quarter, the household sector is funding the increase in spending through borrowing and drawing on existing funds”, Statistics New Zealand said.

New Zealand’s monetary policy is clearly too tight and significant rate cuts are required to fend off recession.