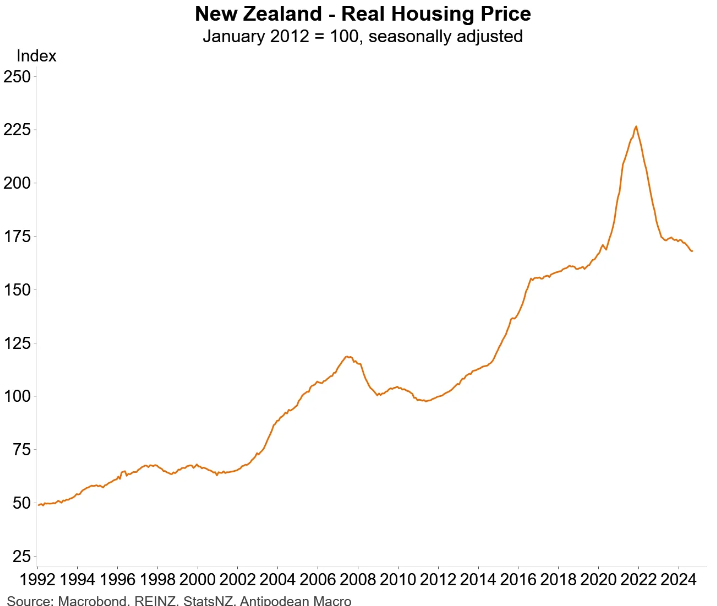

The Reserve Bank of New Zealand’s ultra-aggressive monetary tightening successfully disarmed the nation’s housing bubble, fully unwinding the explosive value gains recorded over the pandemic.

As illustrated in the following charts from Justin Fabo at Antipodean Macro, New Zealand home values have fully retraced back to early 2020 levels in real inflation-adjusted terms after experiencing one of the world’s biggest price booms over the pandemic:

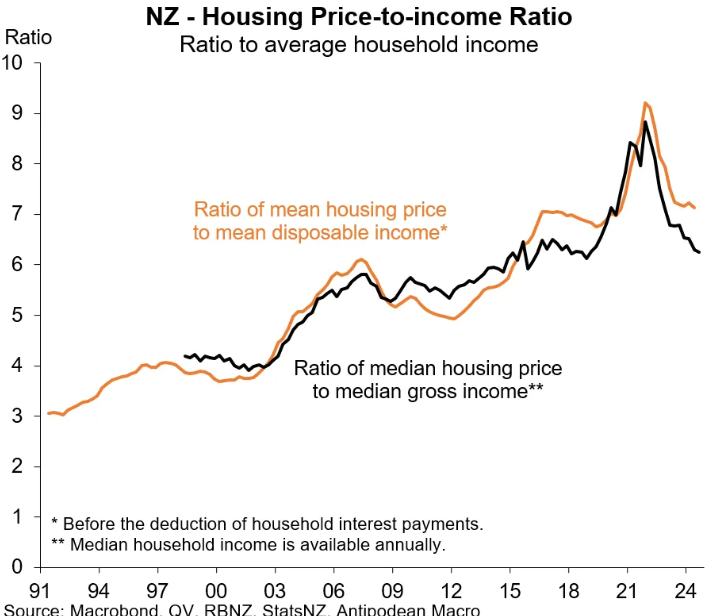

New Zealand’s median house price-to-income ratio has also fallen back to around 2018 levels:

However, mortgage affordability still remains poor thanks to higher interest rates; although it too has markedly improved courtesy of the decline in home values:

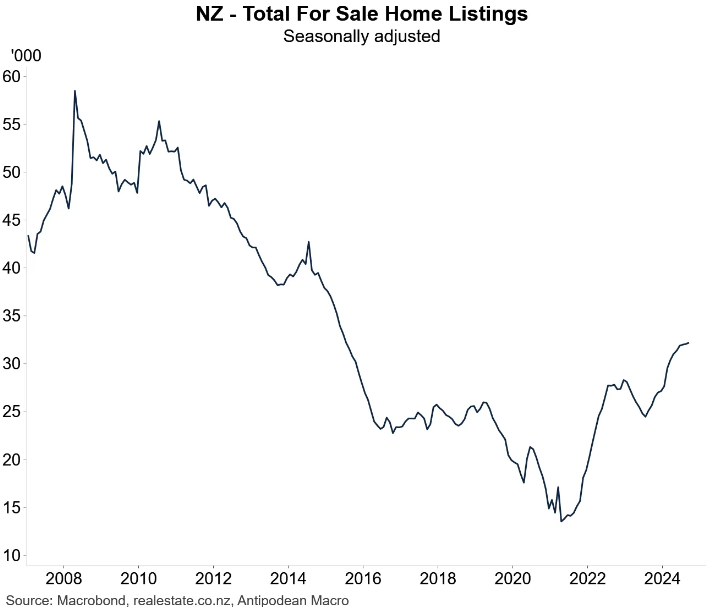

New Zealand housing remains a “buyers market”, with for sale listings tracking at an elevated level:

This should mean that New Zealand housing remains weak for the time being.

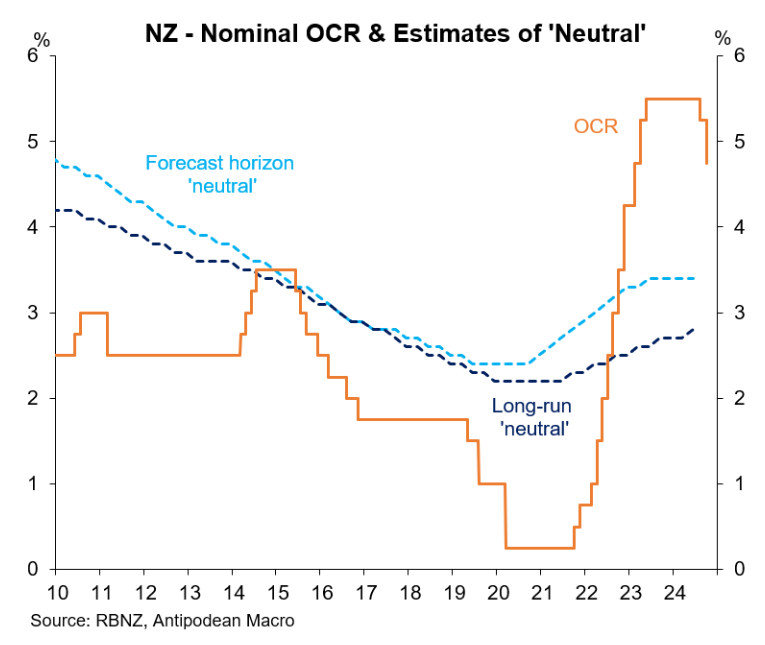

The Reserve Bank is now in an easing cycle and has already cut the official cash rate by 0.75%. But monetary policy remains highly restrictive, with significant further cuts to come in the year ahead:

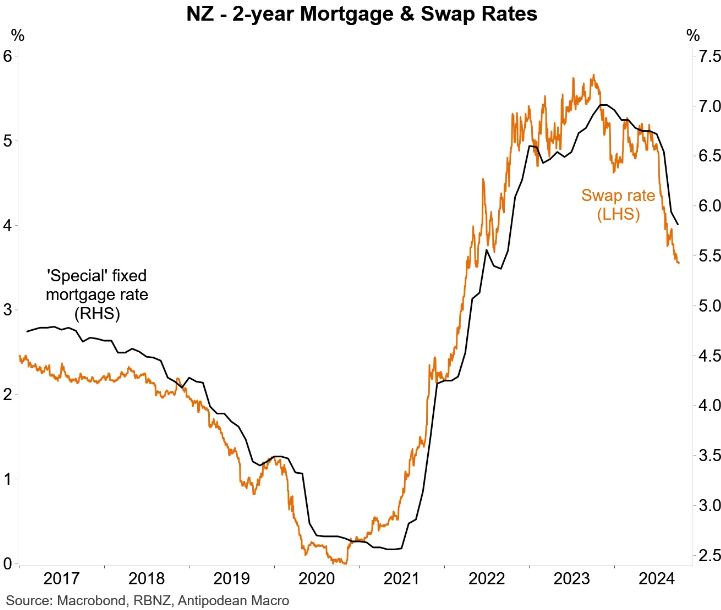

As a result, New Zealand mortgage rates are falling:

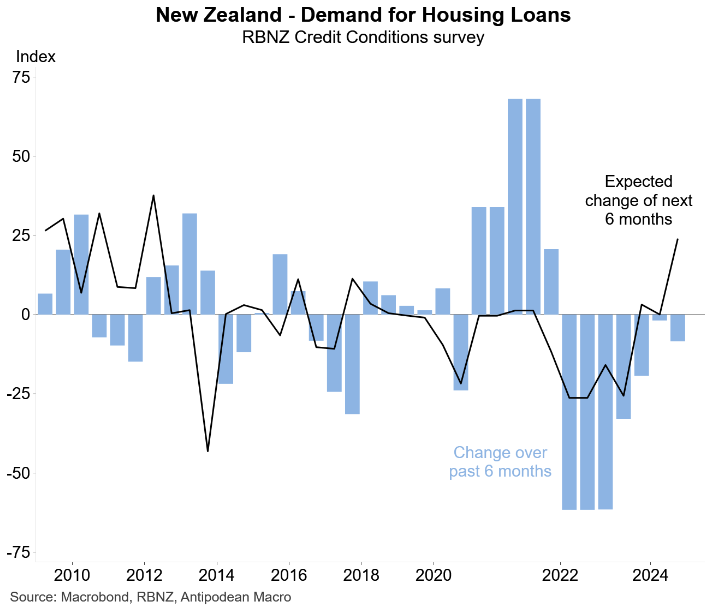

The Reserve Bank’s Survey of Credit Conditions, released this week, also revealed that banks expect to see a surge in demand for mortgages over the next 6 months:

Therefore, after bursting New Zealand’s house price ‘bubble’ via restrictive monetary policy, the market is set to rebound as the Reserve Bank slashes rates.