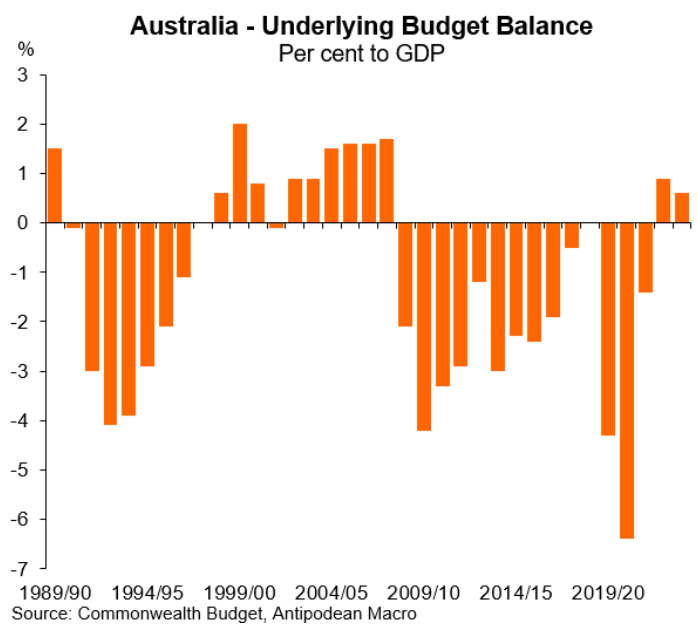

The Albanese government delivered a second consecutive budget surplus, as illustrated below by Justin Fabo at Antipodean Macro:

The underlying cash budget balance recorded a surplus of $15.8 billion (0.6% of GDP) in 2023-24, which was larger than forecast in the May Budget.

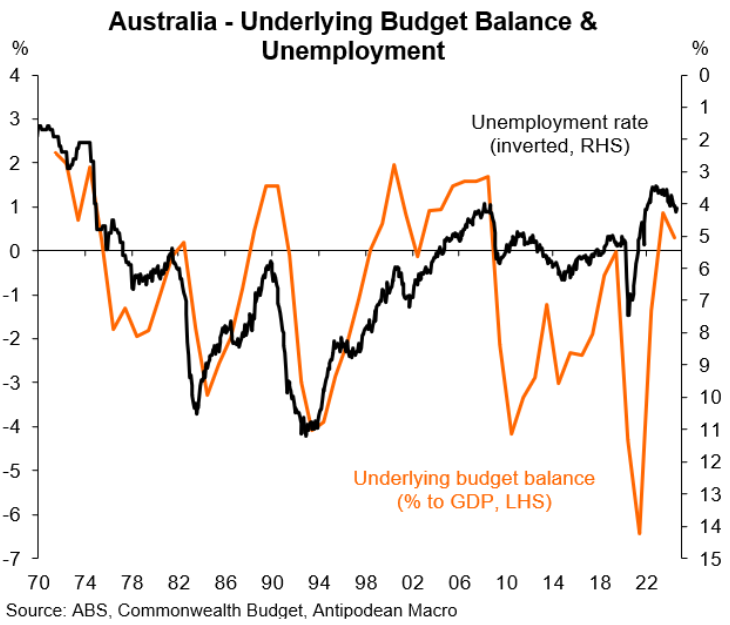

Massive personal tax receipts from the rapidly expanding labour market (read: immigration) and low unemployment have driven the improvement in the budget balance, which has been almost entirely cyclical. The recent strong rise in commodity prices has also played a role.

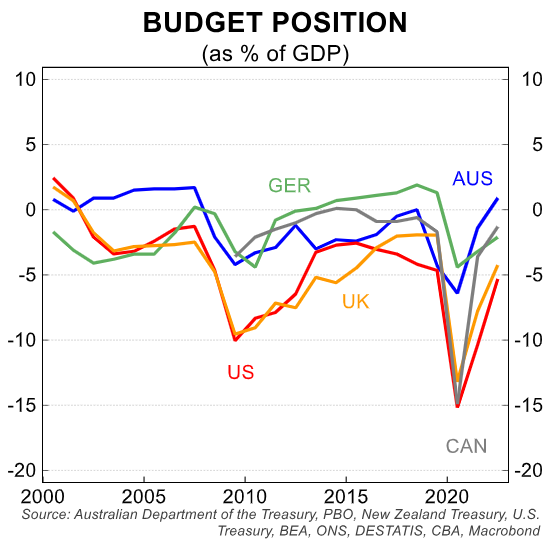

As illustrated below by CBA, the two consecutive surpluses has put Australia in a welcome position globally:

Australia’s net debt as a share of GDP now stands at 18.4%, which continues to be low by global standards and supports Australia’s AAA/Aaa credit rating and global capital inflows.

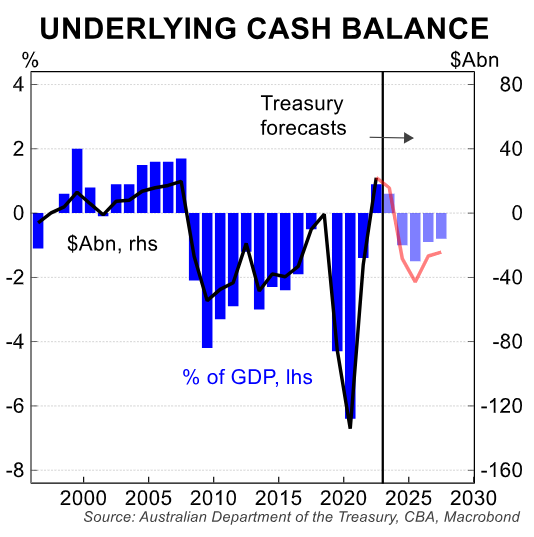

However, the federal budget is projected to deteriorate in the years ahead amid lower commodity prices, higher unemployment, and rising outlays:

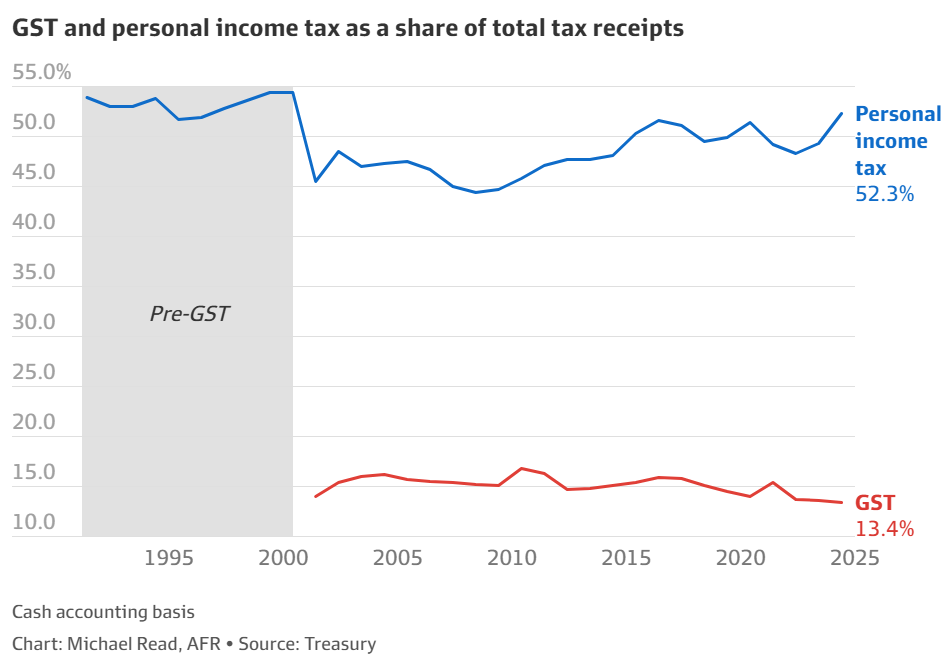

As reported in The AFR, the federal budget surplus has also been underwritten by the highest share of personal income taxes since before the GST was introduced in 2000:

Personal income taxes reached $331 billion in 2023-24, accounting for 52% of the federal government’s total tax revenue.

The average amount of tax paid per person (after inflation), comprising taxes on labour, corporations, and consumers, reached a new high of more than $17,000.

The revised Stage Three income tax cuts are expected to marginally reduce the income tax burden to 51% of the government’s total tax collection in 2024-25, which is still higher than the post-GST average of 48%.

Meanwhile, revenue from GST and indirect taxes like fuel excises continue to shrink as a share of the total tax take.

GST revenue shrank to a record low of 13.4% of total tax, compared to an average of 15.9% in the GST’s first decade of operation. The decline has been driven by growing expenditure on GST-free items like healthcare and education.

Revenue from fuel excise also continues to shrink as motorists shift to hybrid, electric, and more fuel efficient vehicles.

The growing reliance on personal income taxes as the population ages and the share of workers in the economy shrinks is clearly unsustainable.

Former Treasury Secretary, Dr Ken Henry, recently urged comprehensive and broad-based tax reform in a speech to the Australian National University.

Henry remarked that the current overreliance on personal income tax burdens young people while also pricing them out of the housing market. This, Henry warned, will eventually lead to a “existential crisis” unless policy changes are implemented.

“The burden of funding the prospective lift in public spending will have to be shouldered by a declining proportion of the population – principally young workers; the same people who have been priced out of the housing market”, Dr Henry said.

“It puts at risk the social compact. If the people who are expected to pay the tax think that is just fundamentally unjust, at some point they’re going to arc up … and we shouldn’t be surprised that people avoid and evade tax whenever and wherever they can”.

Treasury’s Intergenerational Report likewise warned that personal income tax revenue will increase to 58.4% of total taxes in 2062-63 unless tax reform replaces falling fuel and tobacco levies.

Even worse, as the population ages, a smaller workforce will be responsible for paying this increased personal income tax.

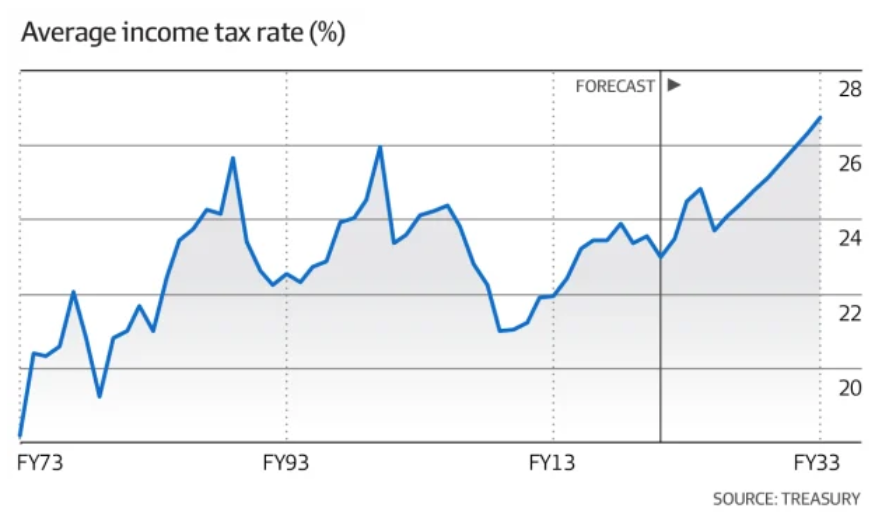

The Treasury also predicted that average tax rates will continue to climb due to bracket creep from inflation:

The rising income tax burden will lead to a greater adoption of tax minimisation measures, such as negative gearing, to reduce taxes.

Australian tax system’s reliance on fewer people paying income taxes is patently unsustainable, inefficient, and unfair.

This is especially true considering that the elderly population is rising and pays less taxes than ever before, despite owning the bulk of the nation’s wealth.

Australia needs comprehensive tax reform that shifts the tax base away from productive activities (taxing persons) and towards more efficient sources like resources, land, and consumption.

Moving the tax base away from personal income taxes would also reduce the need for large-scale immigration to boost federal income tax collections.

The 2010 Henry Tax Review already includes a reform roadmap that just needs to be updated.

Australia cannot afford to delay tax reform for another decade. This would jeopardise workers, intergenerational equity, and the nation’s productivity.