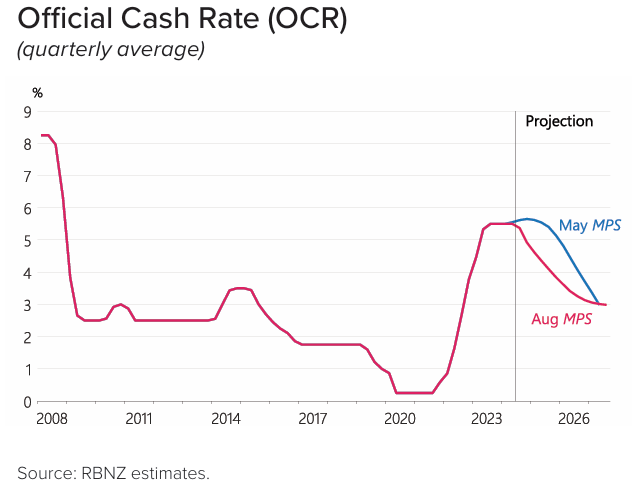

The Reserve Bank of New Zealand cut the official cash rate (OCR) by 0.25% last month to 5.25%. It also forecasts a series of rate cuts over the next 18 months:

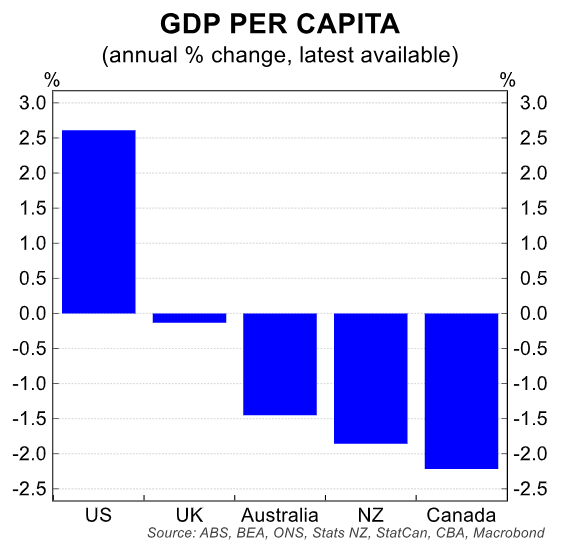

The latest batch of data on the New Zealand economy suggests that the deep per capita recession shows no signs of abating, as illustrated in the below charts from Justin Fabo at Antipodean Macro.

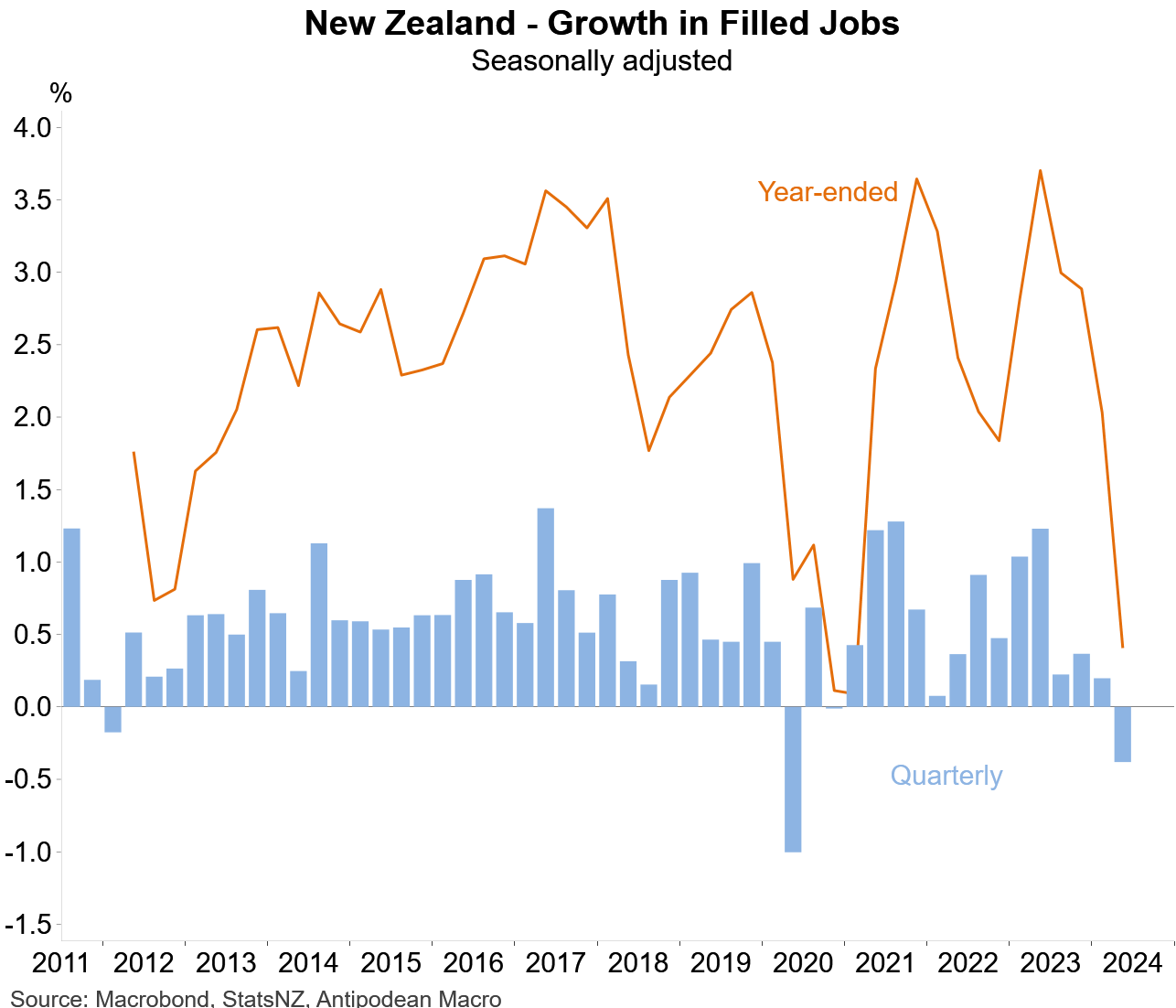

New Zealand filled jobs declined by 0.4% in Q2 and have ground to a halt in annual terms:

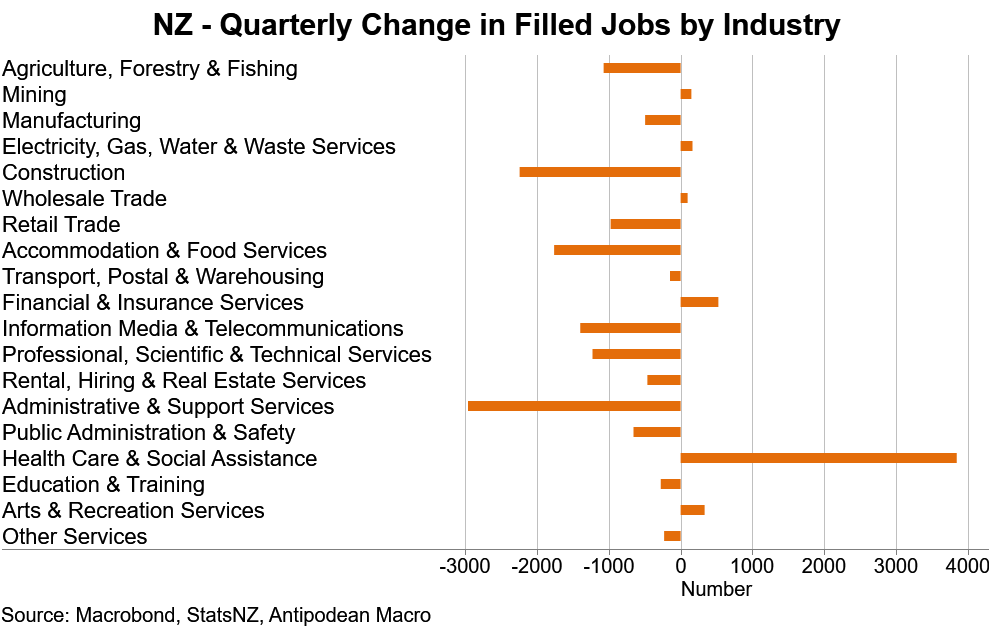

Most industries in New Zealand recorded a decline in filled jobs in the June quarter, with health care the main exception:

The weakness in the labour market has extended into Q3, with the number of job ads in New Zealand declining further in August according to MBIE:

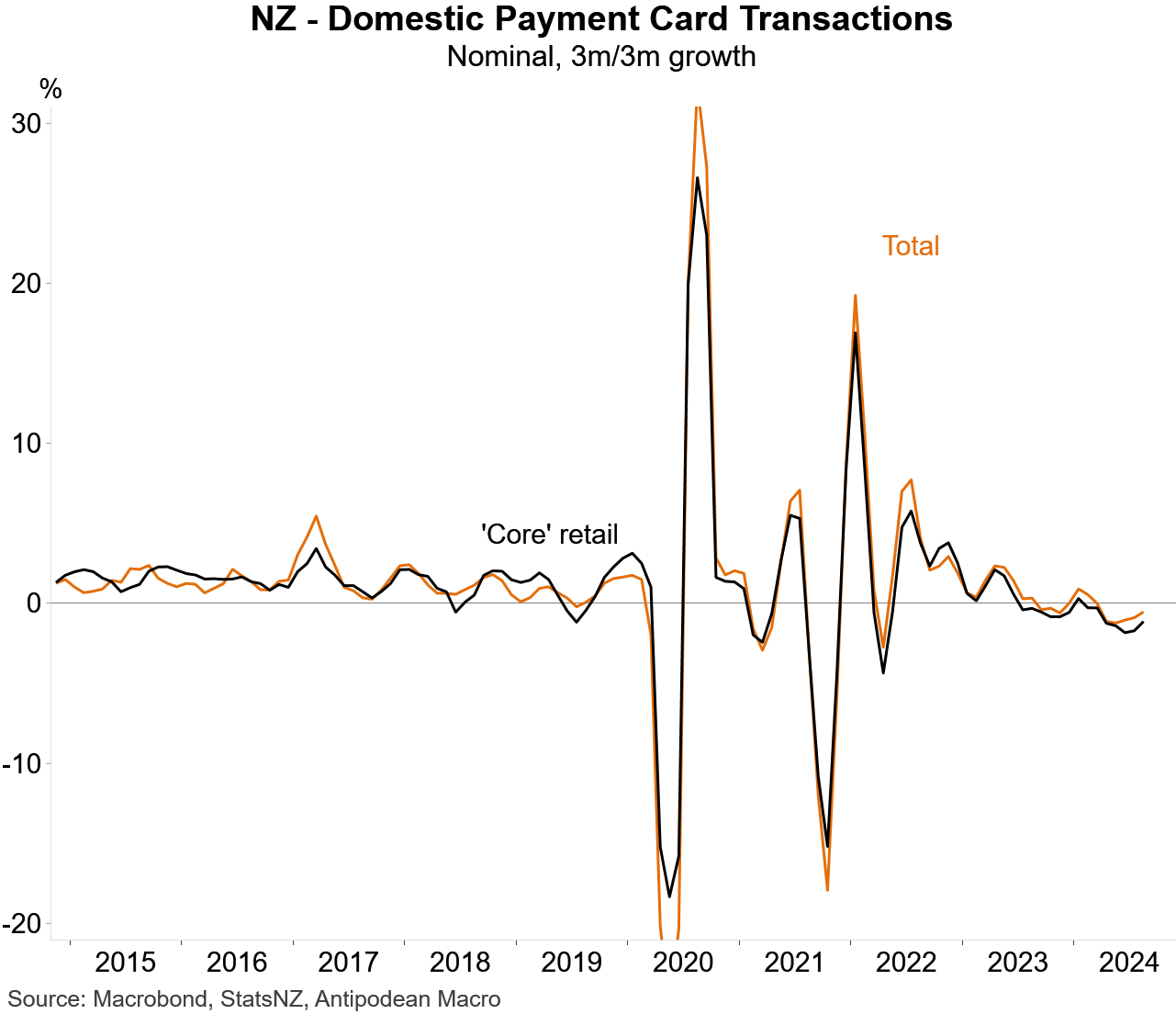

New Zealand domestic card transactions remained negative in the August quarter:

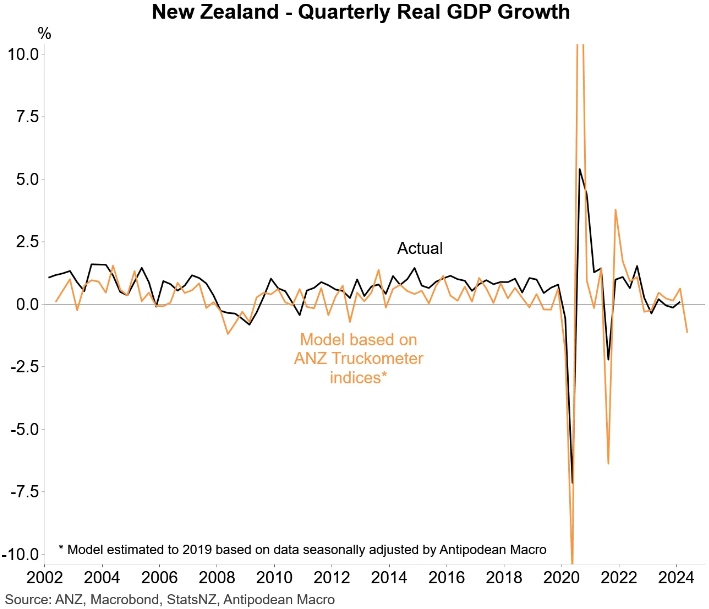

ANZ’s ‘Truckometer’ index, which measures traffic volumes, has also stalled, pointing to lower growth:

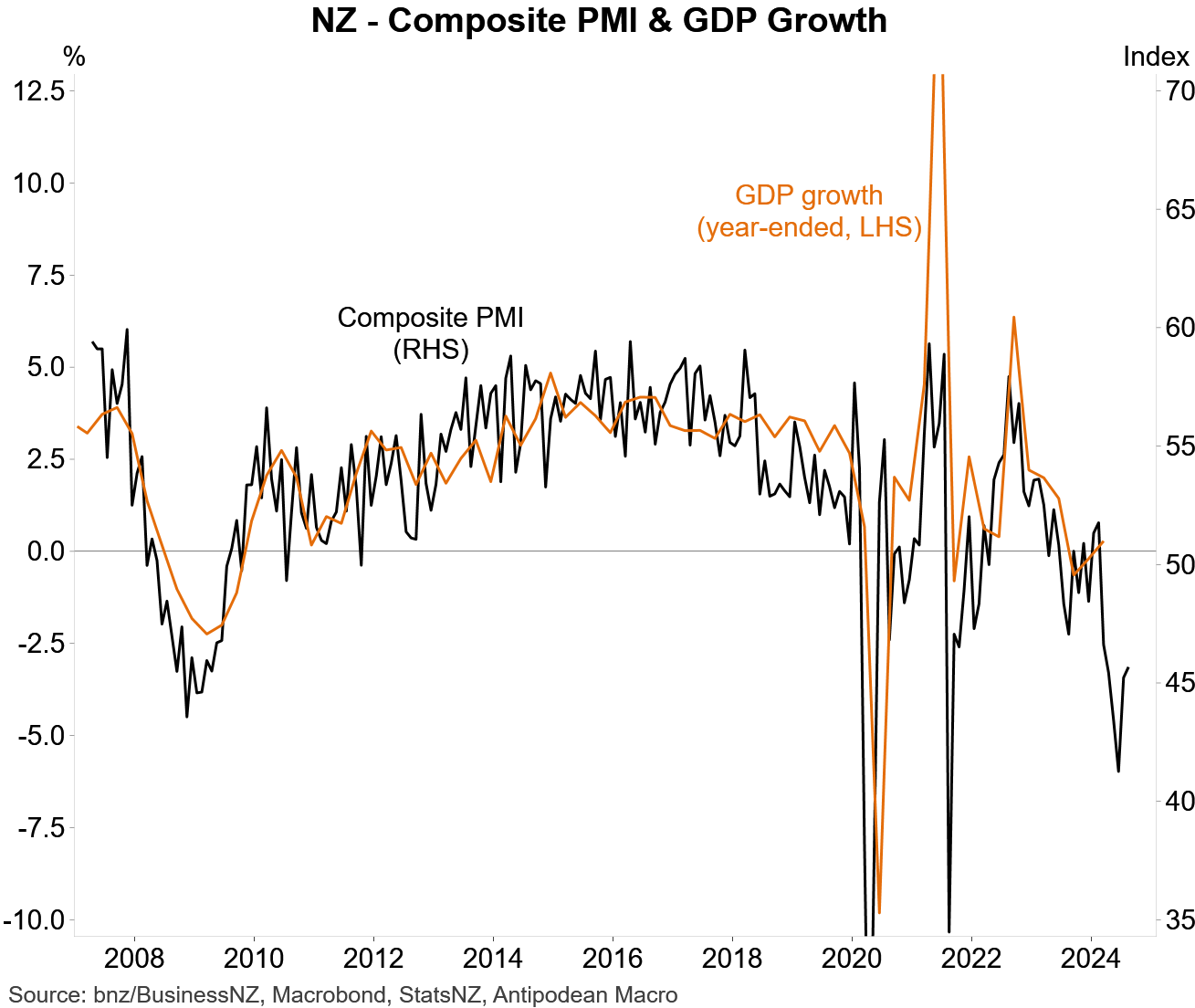

NZ’s composite PMI remained weak in August, despite rebounding, pointing to another weak GDP result:

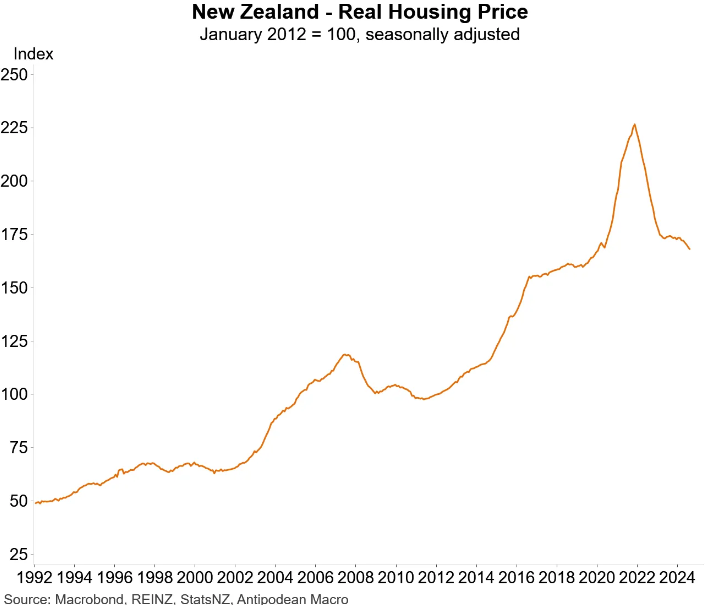

Finally, real house prices in New Zealand have retraced back to early 2020 pre-pandemic’ levels:

Based on the above appalling data, the Reserve Bank of New Zealand will need to cut much harder in the monetary policy meetings ahead.