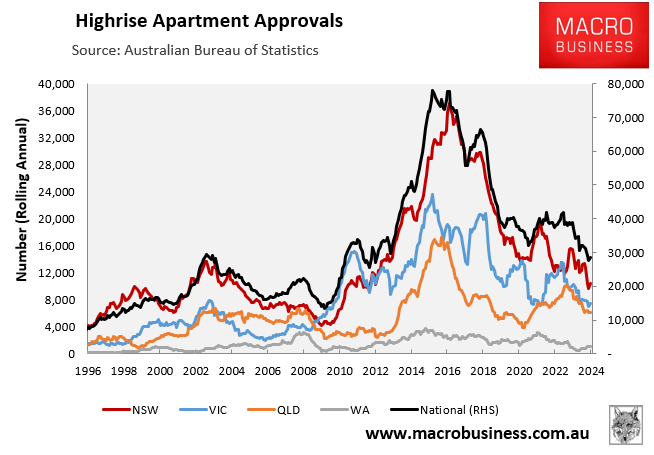

Property advisory firm Charter Keck Cramer released a report entitled State of the Market Report H1 2024, which warned that the volume of new apartments launched across Australia is tracking at its lowest level in 15 years.

The report notes that development conditions in Sydney are problematic, hindered by poor affordability, financial constraints, high land prices, high construction costs, and developer contributions:

“Across metropolitan Sydney, the ability to bring new supply to market is extremely difficult”.

“Affordability considerations coupled with greater / enhanced feasibility challenges for apartment developers are key reasons for a diminishing supply pipeline when demand will only continue to grow”.

“The Sydney apartment development market remained subdued throughout FY2024 featuring only 7.8K completions (in keeping with FY2023) and 4.8K apartments launched (-37% reduction from FY2023)”.

“Future apartment supply across Metropolitan Sydney is anticipated to fall well short of the recently announced NSW State Government five-year dwelling targets”.

Charter Keck Cramer has provided a similar assessment for Melbourne, where development conditions “remain extremely difficult, volatile and uncertain”:

“Apartment launches are at their lowest level in the last 15-years with 2,100 apartments launched in H1-24”.

“Developers and financiers are understandably apprehensive about launching projects given apartment pre-sales are extremely slow and projects remain for the most part financially unfeasible”.

“Many third-party builders are not prepared to take on high density projects at present given the construction risk in the current environment”.

“In summary this will translate into anaemic levels of apartment supply over the next 24-36 months given supply is inelastic and takes time to be delivered”.

“This is a devastating outcome for housing and rental affordability and all but destines the housing targets set out in Victoria’s Housing Statement to failure”.

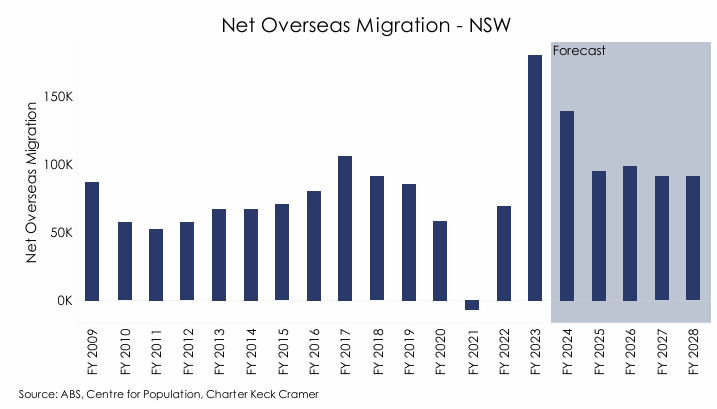

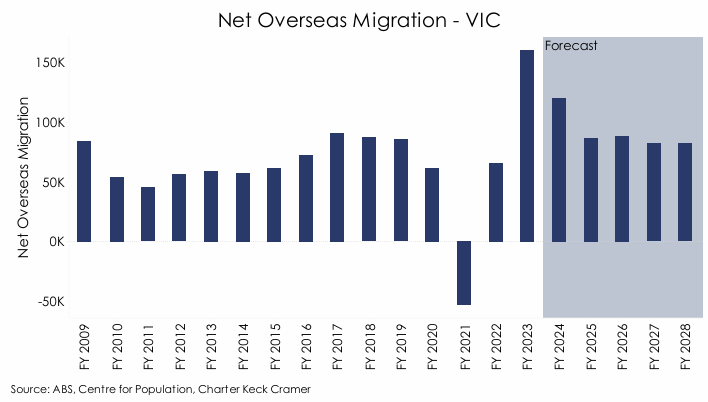

While the situation around supply has deteriorated, Charter Keck Cramer projects historically high net overseas migration (NOM) for both NSW and Victoria.

In FY2024, NOM is projected to have tapered to 139,000 in NSW, down from the record high of 180,000 in FY2023:

NOM is projected to adjust to around +94,000 annually over the course of FY2025 to FY2028, which would be 28% above the levels observed in the decade prior to the pandemic.

In Victoria, NOM is projected to have retraced to around 125,000 in FY 2024, down from the record high of 160,000 in FY2023:

Victoria’s NOM is projected to average 85,000 annually over FY2025 to FY2028, which is significantly higher than the 67,300 average level observed in the decade prior to the pandemic.

However, Charter Check Kramer stresses that its forecasts are “conservative” as NOM arrivals into Sydney, Melbourne and Australia “continue to exceed Government projections”.

“As such, whilst population growth is forecast to slow in the coming years, the actual demand for additional housing is anticipated to be much greater than anticipated by the Government”.

As long as the federal government continues to import high volumes of migrants into a supply-constrained market, the nation’s housing crisis will worsen.

Therefore, the number one solution to Australia’s housing crisis is to lower NOM to a level that is below the nation’s capacity to build housing and infrastructure.