Australia’s federal and state governments hope to meet the National Cabinet’s 1.2 million housing target by demolishing middle-ring suburbs and building high-rise apartments.

The Australian Bureau of Statistics’ (ABS) reported decline in high-density approvals has dealt their ambition a serious blow.

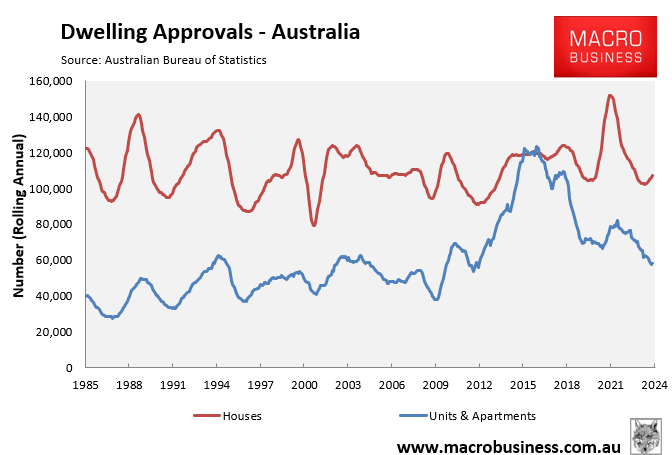

As illustrated in the following chart, annual unit & apartment approvals across Australia crashed to just 58,230 in July—a level last seen in 2012:

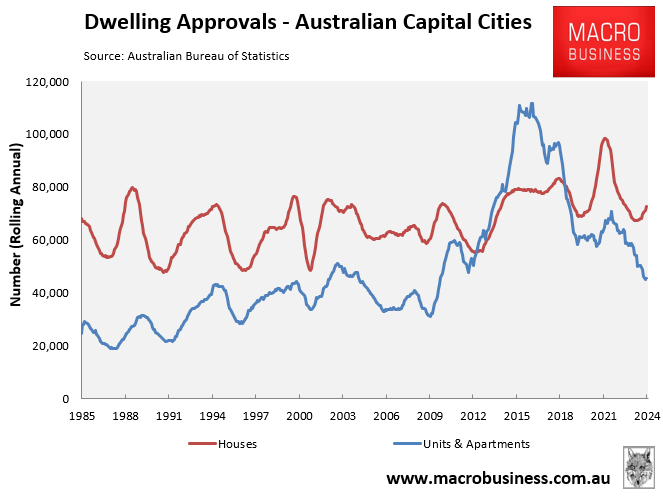

The situation is even worse at the capital city level.

As illustrated below, annual unit & apartment approvals across the combined capital cities fell to only 45,600 in July—a level last seen in 2010:

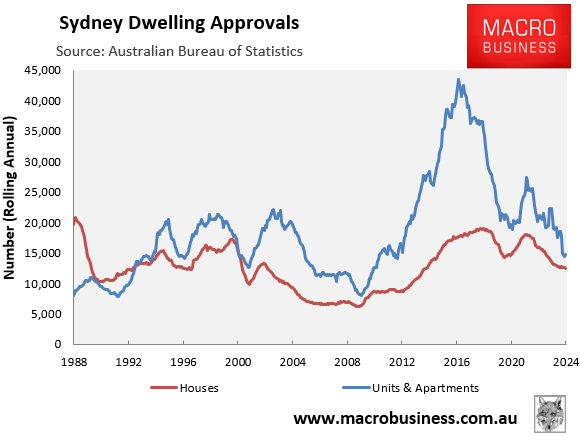

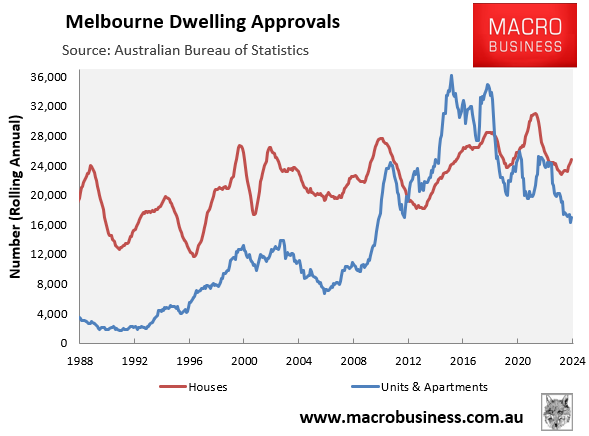

The following charts plot approvals across the three largest capital cities: Sydney, Melbourne, and Brisbane.

Only 14,760 units & apartments were approved for construction across Sydney in the year to July, a level last seen in 2012:

Across Melbourne, only 16,970 units & apartments were approved for construction in the year to July, the lowest level since 2010:

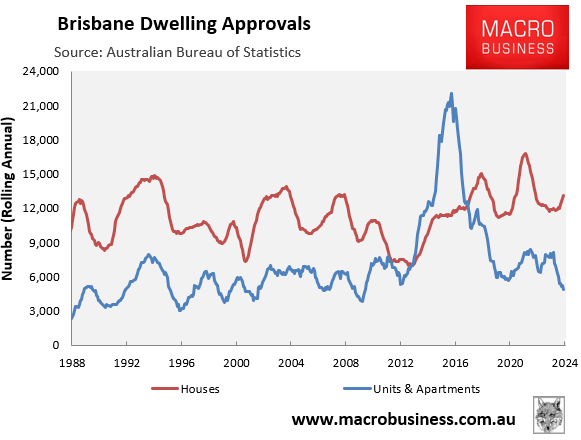

Finally, across Brisbane, only 4882 units & apartments were approved for construction in the year to July, the lowest level since early 2010:

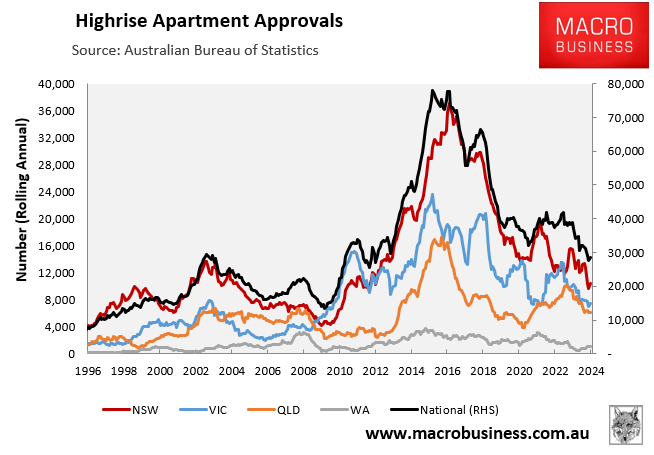

Separate data from the ABS shows that high-rise apartments (i.e., four storeys or above) have led the decline in approvals.

In the year to July 2024, only 28,550 high-rise apartments were approved for construction, close to the lowest volume since 2012:

The three largest states of NSW (-72%), Victoria (-68%), and Queensland (-65%) have experienced the sharpest declines in high-rise approvals.

There are stiff macroeconomic headwinds facing the homebuilding industry, which will continue to limit new home construction. These include:

- The highest official cash rate since 2011.

- The circa 40% rise in construction costs since the start of the pandemic.

- The residential building industry competing for scarce labour and materials with government ‘big build’ infrastructure projects.

- The collapse of around 3000 construction firms over the past year.

The only genuine solution to Australia’s structural housing shortage and the rental crisis is to dramatically reduce demand by slashing net overseas migration.