Victorians are facing decades of debt servitude thanks to the incompetence of the state government.

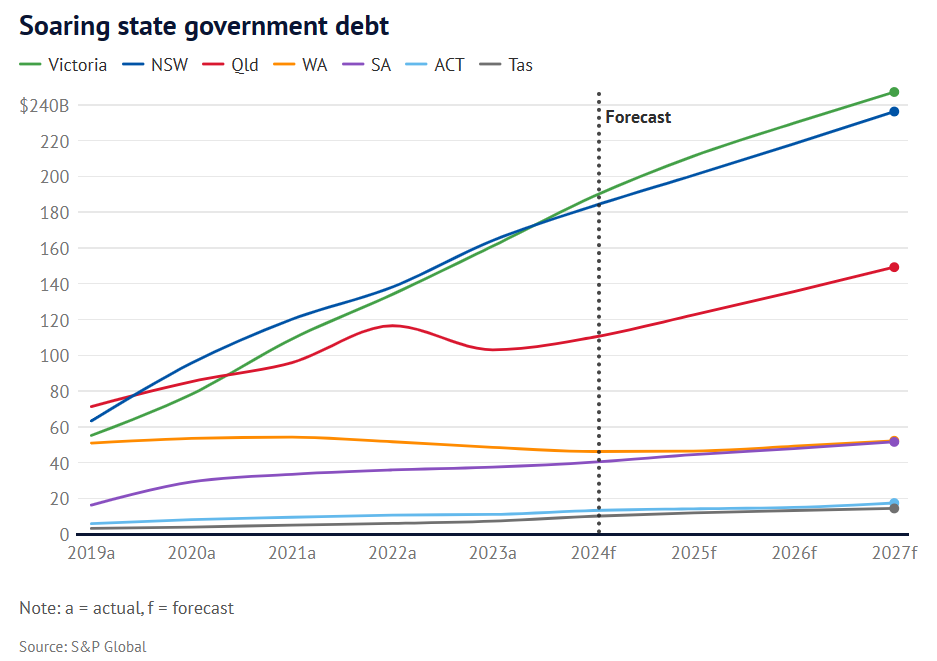

A decade of excessive spending on bureaucrats, tens of billions of dollars in infrastructure cost overruns, and pandemic lockdown expenses have left Victoria with the country’s highest state government debt and the lowest credit rating:

Former Treasury economist Stephen Anthony encapsulated Victoria’s financial dilemma as follows:

“Victoria is on a suicide mission to record borrowing, just as global interest rates are about to hit 5%”.

“Potholes can’t get filled, emergency departments can’t afford clean linen, primary schools can’t fix heaters”.

“Things are about to get very ugly”.

Last month, credit ratings agency Standard & Poor’s told the Victorian government to cancel the $200 billion Suburban Rail Loop (SRL) or risk a credit rating downgrade:

“If Victoria pushes ahead with the Suburban Rail Loop without additional federal government funding, the state’s fiscal outlook may weaken, further eroding its credit standing” [S&P analyst Anthony Walker told the Sunday Herald Sun].

“We believe there’s a real risk the SRL may cost more than the latest government forecasts, given the size and complexities of the undertaking and the state’s recent history of major projects going well over budget,” he said.

Fellow global credit ratings agency Moody’s followed suit last week, warning that Victoria faces a ratings downgrade if the government cannot reverse the state’s dire debt trajectory.

Moody’s also blamed Victoria’s increasing debt burden on major infrastructure spending, including the SRL.

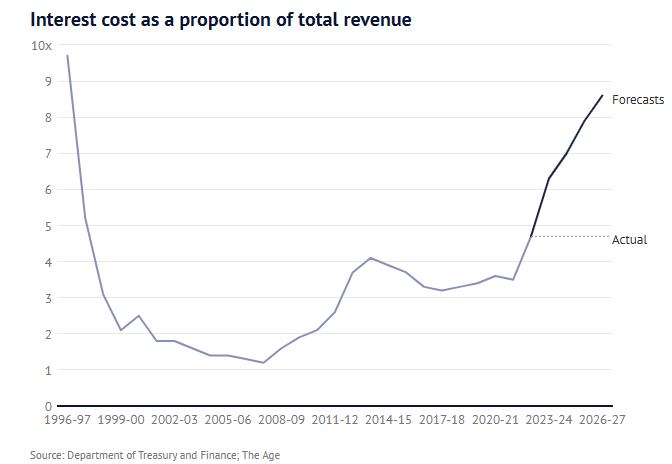

“Based on its fiscal 2025 budget, the state projects interest payments will reach 9.0% of operating revenue across the non-financial public sector (NFPS) by fiscal 2028 from an estimated 6.0% in fiscal 2024”, Moody’s said.

“Downgrade pressure could develop if it became increasingly likely that Victoria will incur a large and persistent increase in its debt burden, with the state evidencing limited capacity to implement countermeasures in the near term to preserve its debt affordability; interest payments in excess of 8.5% of operating revenue on a sustained basis may be inconsistent with a rating at the current level”.

“An inability to contain such fiscal pressures would also denote a more marked erosion of governance strength”, it said.

Victoria’s already hefty interest bill could increase by up to 0.5% if Victoria’s credit rating was cut by one notch.

The Victorian Labor stubbornly ignored expert advice and chose to sign the contracts to build the nation’s most wasteful infrastructure project, the 90-kilometre SRL.

The SRL’s full three stages are projected to cost more than $200 billion, four times the project’s initial cost projection.

There is no escaping the facts. The Victorian government is a financial disaster, with too many bureaucrats and exorbitant cost overruns on doomed infrastructure projects like the SRL.

As a result, Victorians will experience decades of debt slavery.