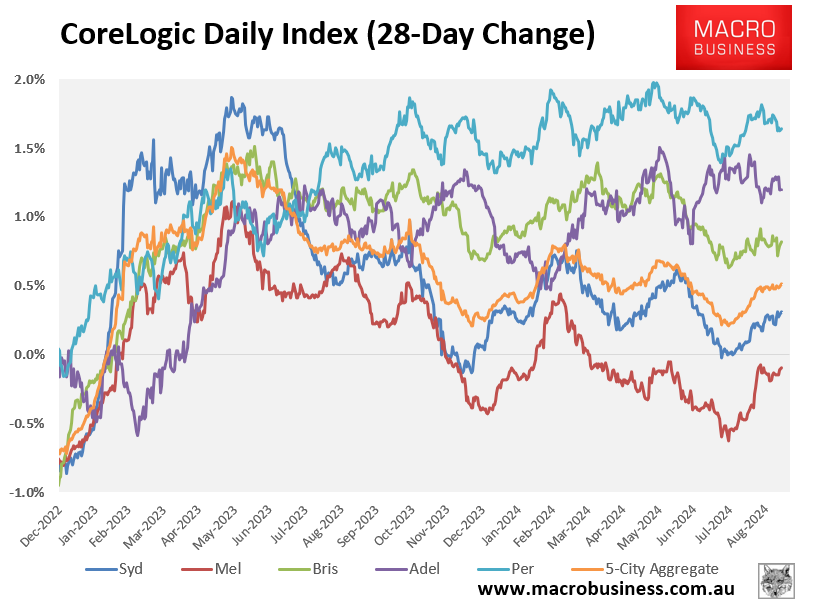

CoreLogic’s daily dwelling values index shows that Melbourne is the only major market where home prices are falling, down 0.1% over the past 28 days:

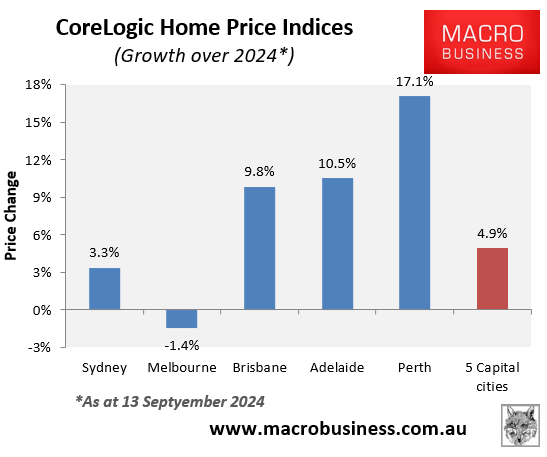

So far in 2024, Melbourne dwelling values have fallen by 1.4% versus a 4.9% increase at the 5-city aggregate level:

The slump in Melbourne’s housing market has prompted property developer mogul Nigel Satterley to declare the city a “dead” market.

“It’s like Victoria has got a financial haze over it. Tobin Brothers have more activity in their North Melbourne mortuary than downtown Melbourne. It’s dead”, Satterley told The AFR.

“All the taxing, the confidence, a lot of people are worried about the direction of what I consider is the best city in Australia, Melbourne. A lot of very good families in Melbourne are concerned about it”.

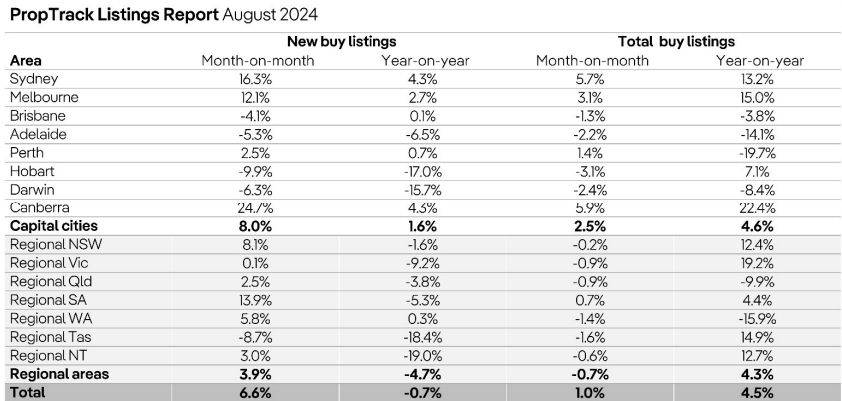

New listings data from PropTrack provides a strong hint as to why Melbourne home values are falling.

Total for sale listings rose by 15.0% across Melbourne in the year to August, the largest increase recorded across Australia’s capital cities.

Sydney listings have also risen by 13.2% year-on-year, which has seen its house price growth slow, albeit remain positive.

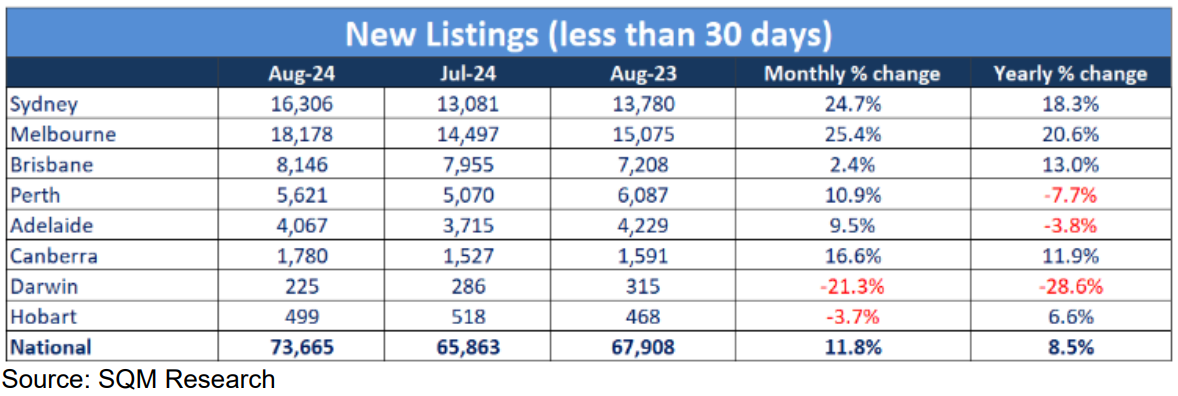

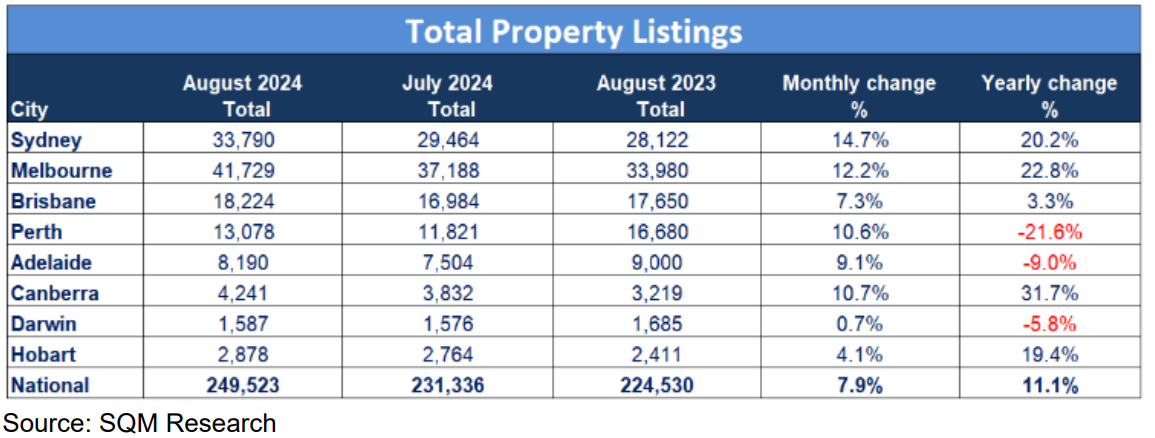

Separate data release by SQM Research likewise showed a strong rise in new listings and total listings across Melbourne, followed by Sydney.

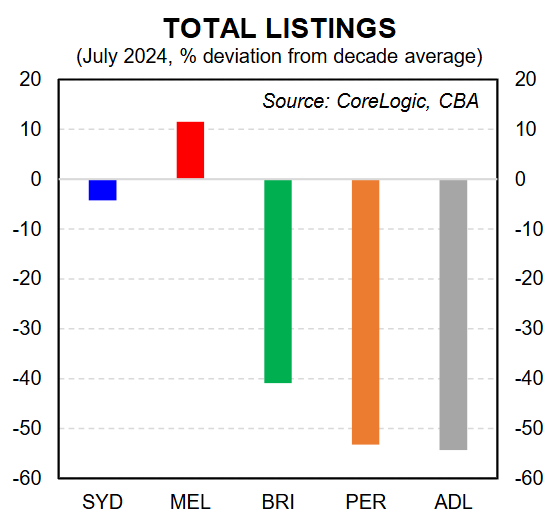

Finally, the following chart from CBA, derived from CoreLogic data, shows that for sale listings across Melbourne are running 11% above the decade average. Melbourne is also the only major capital to have higher listings than the decade average.

The flood of homes listed for sale across Melbourne helps to explain why home prices are falling.

By contrast, the imbalance between market demand and supply in Adelaide, Perth, and Brisbane explains why those markets have experienced strong house price appreciation.