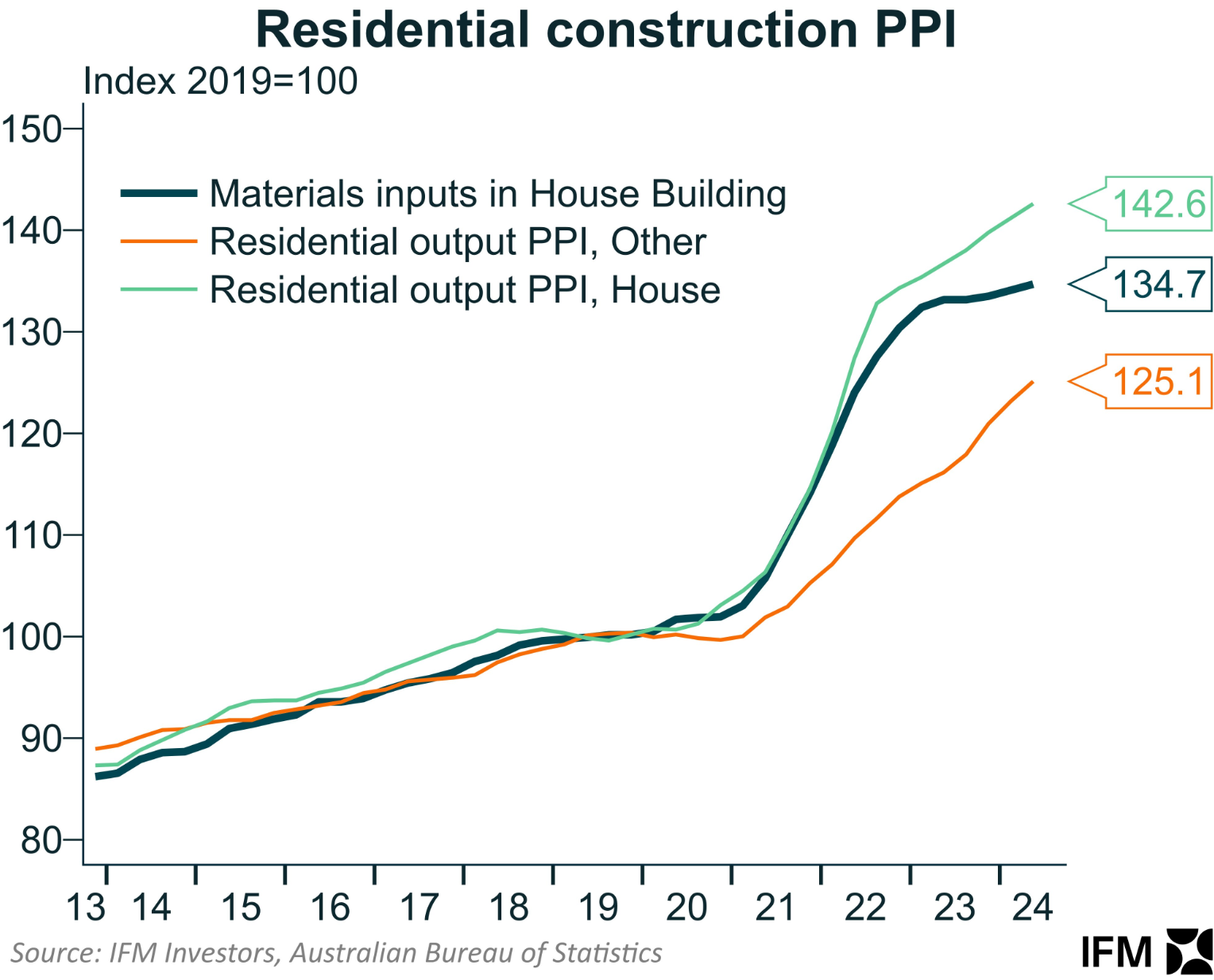

IFM Investors chief economist Alex Joiner posted the following chart on Twitter (X) showing the explosion in residential construction costs as captured by the ABS Producer Price Index (PPI):

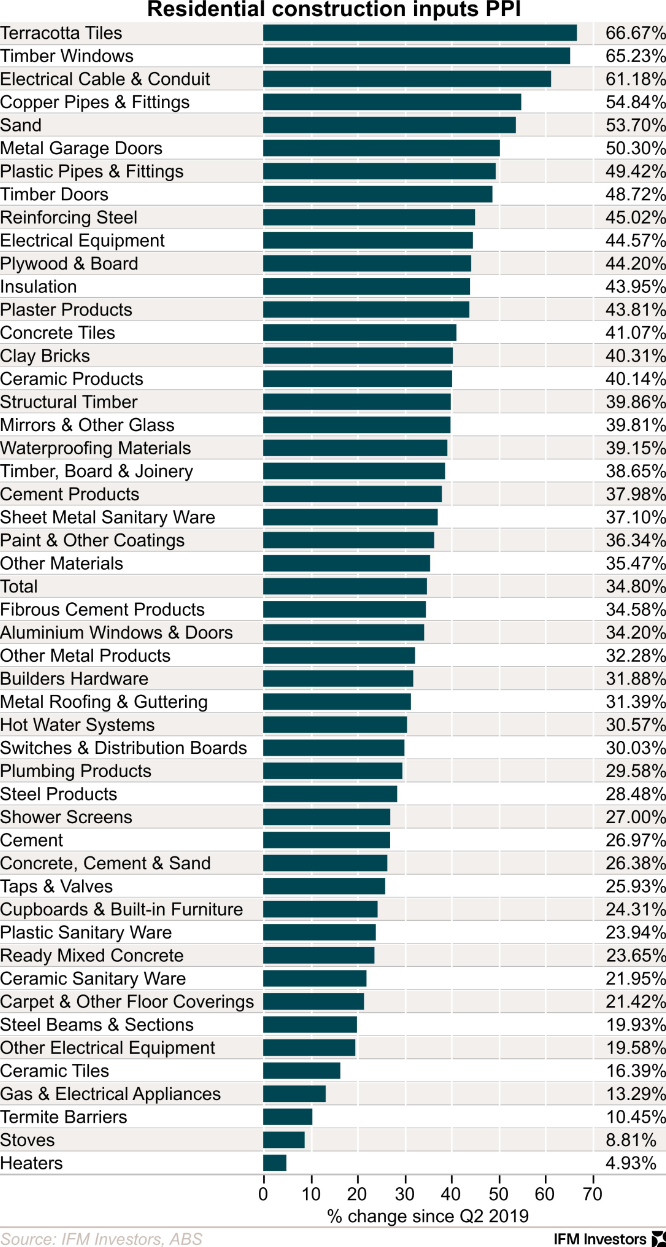

Joiner also provided the below breakdown in costs by sub-component:

A report published this week by The Australian noted the cost escalation across Australia’s states.

Queensland has taken the lead, with the cost of building a new house rising 57% since the beginning of the pandemic in Queensland. This was followed by New South Wales (+46.1%), South Australia (43.1%), Western Australia (+41.6%), and Victoria (38.2%).

“The silver lining for buyers and builders alike is the annual rise in construction costs moderated to single digits in 2024, after rising between 12% and 21% depending on the state in 2022 and 2023”, noted Mackenzie Scott.

Meanwhile, The Daily Telegraph’s Aidan Devine reported that some tradies have lifted their charge out rates by more than 50%, adding to the cost pressures.

Labourers have also lifted their rates by an average of 36%, from $50.67 to $68.75 per hour.

“I don’t think we’ve ever seen such a big increase in costs across so many (trades), just because the supply of skilled professionals doesn’t match the demand”, noted Oliver Pennington, co-founder of ServiceSeeking.

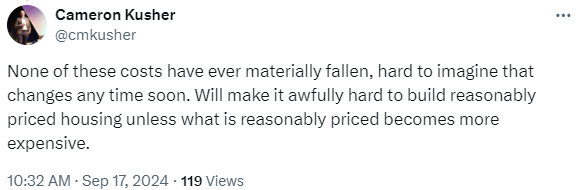

PropTrack Research Director Cameron Kusher commented on Twitter (X) that construction costs are unlikely to fall, which “will make it awfully hard to build reasonably priced housing unless what is reasonably priced becomes more expensive”.

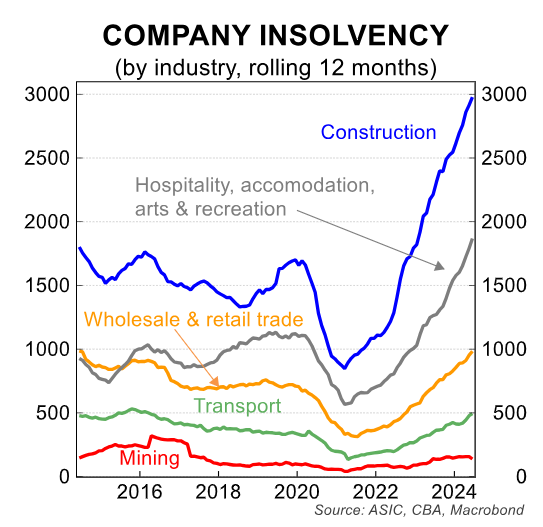

Kusher is right, of course. The cost escalation is a key reason why around 3,000 construction firms went bust in the 2023-24 financial year. It has simply become too expensive to build homes for a profit.

Meanwhile, the Albanese government continues to import housing demand at an unprecedented rate.

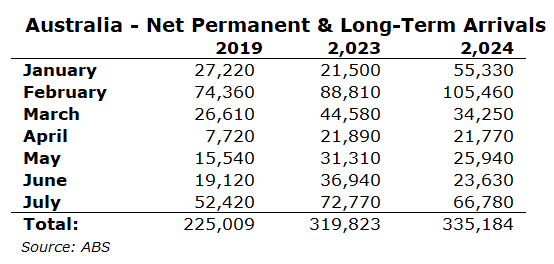

The latest net permanent and long-term arrivals data from the ABS showed that a record 335,184 net migrants landed in Australia over the first seven months of 2024. This was 15,361 higher than last year’s record arrivals and 110,175 higher than the same period in 2019:

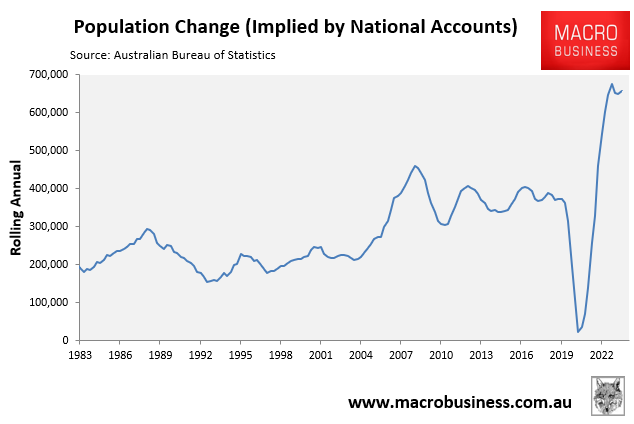

The Q2 national accounts from the ABS also implied that Australia’s population grew by 655,800 in the 2023-24 financial year. This was up from 647,900 in the March quarter and the second highest annual result in history (behind 676,100 recorded in the year to September 2023):

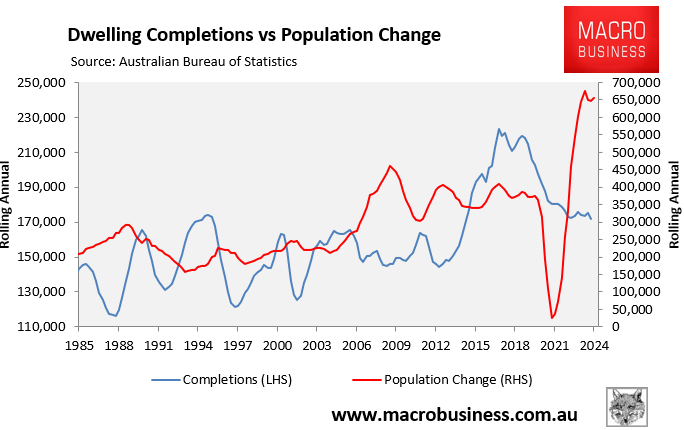

Importing so much demand into a supply-constrained market is a recipe for disaster and will ensure that Australian housing remains chronically undersupplied.

Australians will never again see abundant and affordable housing. Expensive high-rise, shoebox living is the best that future residents of our major cities can hope for.