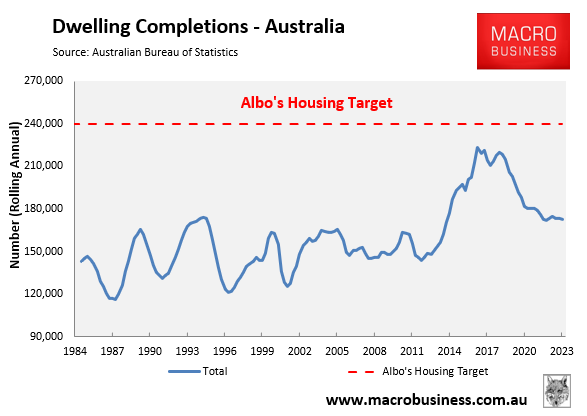

The data surrounding Australia’s housing construction continues to disappoint, mocking the Albanese government’s fantastical target of constructing 1.2 million homes over five years.

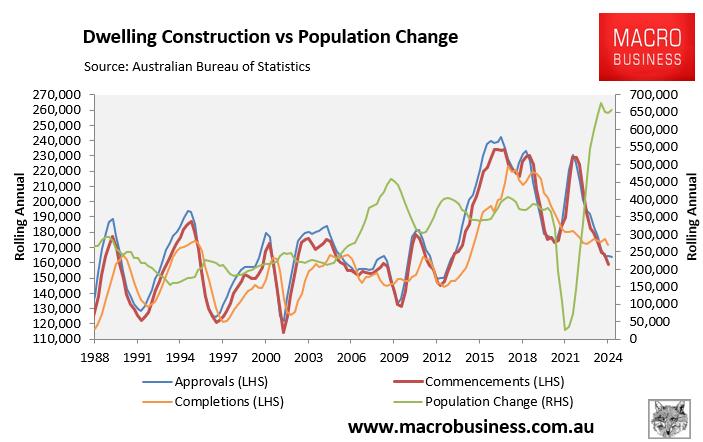

Australian Bureau of Statistics (ABS) data on dwelling approvals, commencements, and completions are tracking at around decade lows, roughly one-third behind the government’s target.

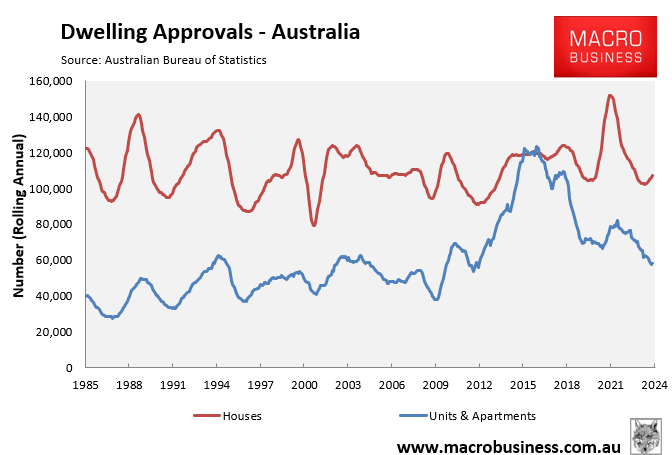

As illustrated in the next chart, the decline has been driven by the unit & apartment segment, where there were only 58,230 approvals in the year to July—a level last seen in 2012:

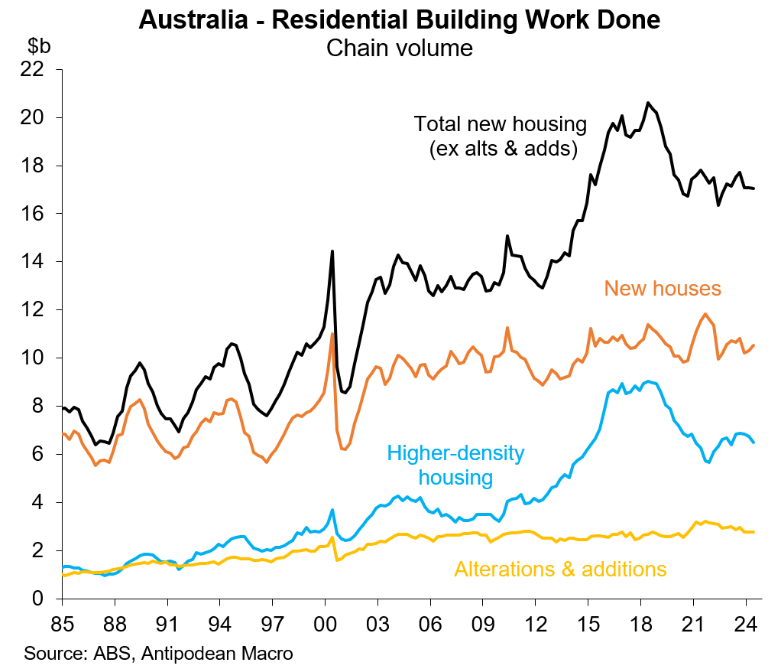

The latest quarterly data on the value of construction work done also fell by 0.1% over Q2 to be 2.9% lower year-on-year:

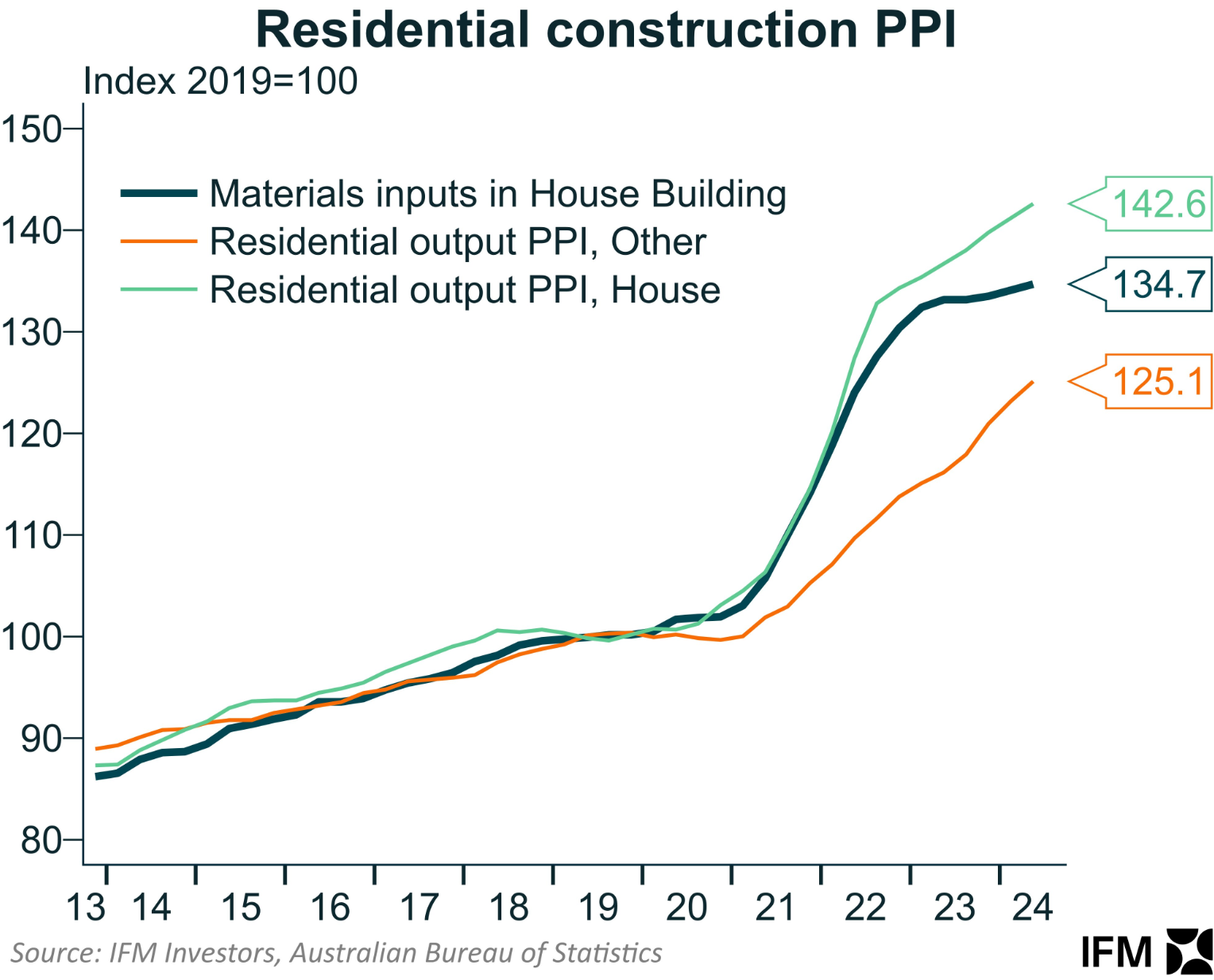

This dollar decline in building work has come despite the sharp rise in building costs since the pandemic:

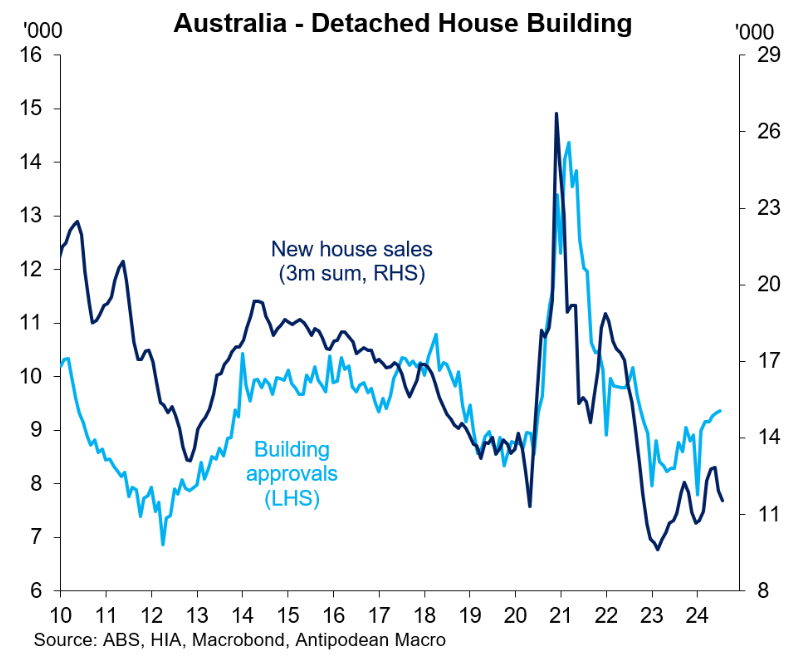

Meanwhile, the Housing Industry Association’s (HIA) latest survey of major homebuilders, released on Tuesday, showed that the number of new home sales across the nation dipped in August, with the three-month run rate also falling. This is illustrated below by Justin Fabo at Antipodean Macro:

Overall, it is a depressing picture for anybody hoping for a bounce in new home construction.

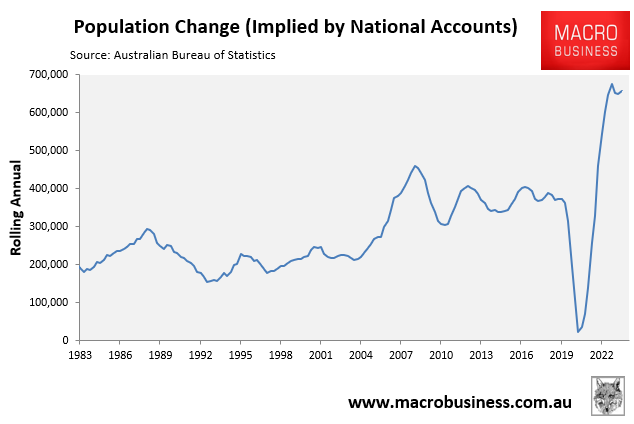

The weakening of new home construction also follows the reacceleration of Australia’s population growth, as inferred from the Q2 national accounts.

Australia’s population ballooned by 655,800 in the 2023-24 financial year. This was up from 647,900 in the year to March and the second highest annual result in history (behind 676,100 recorded in the year to September 2023):

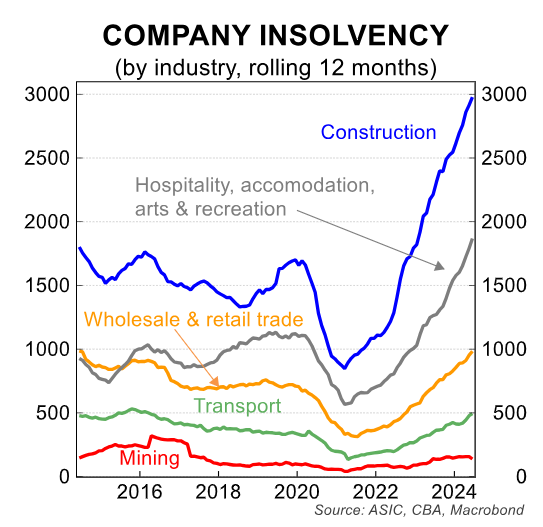

Realistically, Australia’s homebuilders face a perfect storm of headwinds that are precluding a bounce in construction. These include:

- Interest rates at a 12-year high, which has dampened buyer demand and raised developer financing costs.

- The ~40% rise in construction costs since the onset of the pandemic.

- High rates of insolvency among construction firms, many of whom were homebuilders (see below chart).

- Competition for materials and labour with government ‘big build’ infrastructure projects.

Importing record volumes of demand via immigration into a heavily supply-restricted market is the definition of policy idiocy and will ensure that Australia’s housing shortage remains chronic.